文章编译:Block unicorn

1979 年,共和国民银行向客户提供了一个选择。只需存入 1,475 美元,期限为 3.5 年,即可获赠一台 17 英寸彩色电视机;或者存入相同金额,期限为 5.5 年,即可获得一台 25 英寸的电视机。想要更优惠的价格?只需存入 950 美元,期限为 5.5 年,即可获得一套内置迪斯科灯光的音响系统。

大萧条时期,银行监管法规禁止银行支付有竞争力的利率,而银行正是通过这种方式争夺存款。1933 年颁布的《银行法》中的 Q 条例禁止银行对活期存款支付利息,并对储蓄账户的利率设置了上限。尽管货币市场基金提供了更高的收益率,但银行却只能赠送烤面包机和电视机,而不是实际回报。

银行业将货币市场基金的投资者称为“聪明钱”,而将自己的储户称为“傻钱”,认为他们不明白可以在其他地方获得更高的回报。

华尔街热情地采用了这种语言,用它来描述那些似乎高买低卖、追逐趋势、做出情绪化决策的投资者。

五十年后,这些“傻钱”正在笑到最后。

“傻钱”的概念在华尔街心理学中根深蒂固。专业投资者、对冲基金经理和机构交易员将自己的身份建立在“聪明钱”之上——他们是能够看透市场噪音、做出理性决策的精明玩家,而散户投资者则在恐慌中做出错误决策。

当散户投资者确实表现出这样的行为时,这种叙述效果很好。在互联网泡沫期间,日内交易者抵押房屋在高点购买科技股。2008 年金融危机期间,个人投资者在市场触底时逃离,错过了整个复苏期。

其模式是:专业人士低买高卖,而散户投资者则相反。学术研究证实了这种偏见。专业基金经理将这些模式作为其卓越技能和收费合理性的证据。

是什么发生改变?是信息获取渠道、教育和工具。

新的零售现实

今天的数据讲述了一个截然不同的故事。2025 年 4 月,美国总统特朗普宣布关税,引发两天内 6 万亿美元的市场抛售,专业投资者抛售股票,而散户交易者则看到了买入的机会。

在市场动荡期间,个人投资者以创纪录的速度抢购股票,自 4 月 8 日起净投入 500 亿美元到美国股市,获得约 15% 的回报。在此期间,美国银行的散户客户连续 22 周买入股票,这是该公司自 2008 年以来最长的连续买入记录。

与此同时,对冲基金和系统性交易策略的股票敞口位于后12个百分点,错过了整个反弹。

2024 年的市场波动中也出现了同样的模式。摩根大通的数据显示,散户投资者在 4 月末推动了主要涨幅,个人投资者在 4 月 28 到 29 日的市场份额达到 36%——这是有记录以来的最高水平。

Robinhood 的史蒂夫·奎克(Steve Quirk)捕捉到了这种转变:“我们参与的每一次 IPO 都超额认购。需求总是强于供给。发行人喜欢这样,并希望那些支持他们公司的粉丝能够获得分配。”

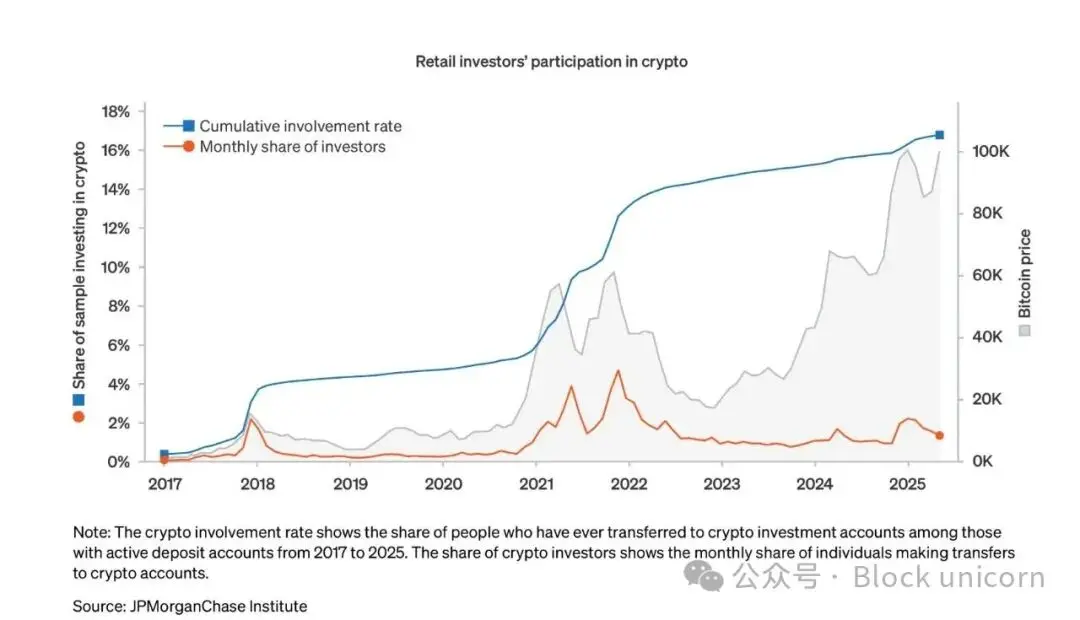

在加密货币领域,散户行为已从典型的“高买低卖”模式演变为复杂的市场时机选择。根据摩根大通的数据,2017 年至 2025 年 5 月间,17% 的活跃支票账户持有人将资金转入加密货币账户,参与度在战略时刻而非情绪高峰期激增。数据显示,散户投资者越来越表现出“逢低买入”的行为,2024 年 3 月和 11 月比特币创历史新高时,参与度显著上升——但值得注意的是,当比特币在 2025 年 5 月达到更高峰时,散户参与保持了克制,而不是疯狂。这表明了学习和克制,而非传统上与散户加密货币投资者相关的“害怕错过”(FOMO)驱动的行为。加密货币投资的中位数仍然保持在低位,不到一周的收入,这表明投资者采取了审慎的风险管理,而非过度投机。

像赌博、体育博彩和模因币这样的行业证明,仍然有“稳定的傻钱钱供应”。但数据表明并非如此。

赌场和体育博彩平台确实产生了数十亿美元的交易量,在线赌博市场在 2024 年估值为 786.6 亿美元,预计到 2030 年将达到 1535.7 亿美元。

在加密模因币领域,定期掀起投机热潮,导致后来者持有毫无价值的代币。

即使在这些所谓的“傻钱”领域,行为也变得越来越精明。Pump.fun 尽管通过模因币创造获得了 7.5 亿美元的收入,但当竞争对手提供更好的沟通和透明度时,其市场份额从 88% 暴跌至 12%。散户用户并没有盲目地继续支持原有平台——他们转向了提供更好价值主张的平台。

模因币现象并非证明散户投资者的愚蠢,反而显示了散户投资者对那些由风险投资(VC)支持的代币发行的拒绝,因为这些发行剥夺了公平的准入。正如一位加密货币分析师所指出的:“模因币赋予代币持有者一种归属感,并促进基于共同价值观和文化的联系”——它们是社交和财务报表,而不仅仅是投机。

IPO 革命

散户投资者日益增长的影响力在 IPO 市场中最为明显。公司正在放弃传统上仅服务机构投资者和高净值个人的模式。

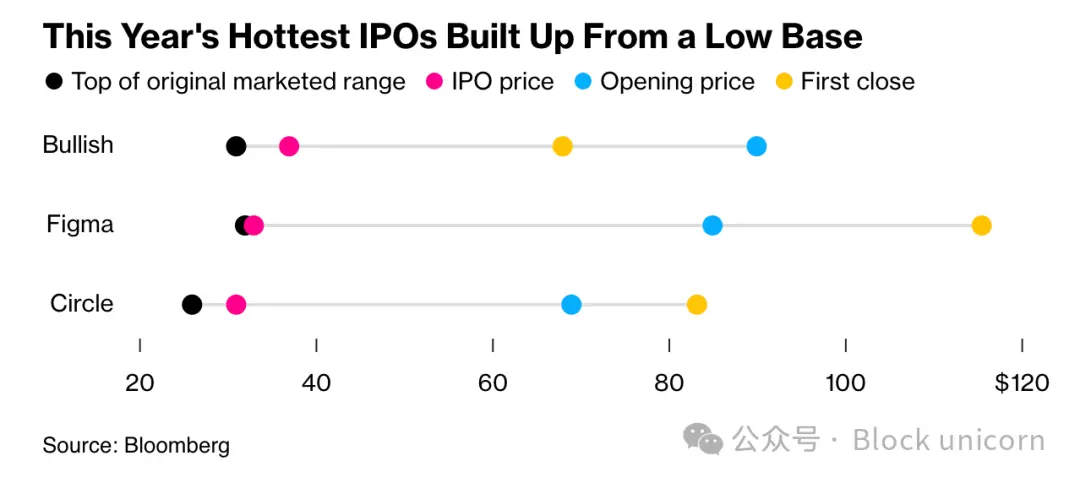

Bullish 代表了公司如何处理 IPO 分配的分水岭时刻。Bullish 由 Block.one 创立,并得到包括彼得·泰尔的创始人基金在内的大型投资者的支持,兼具加密货币交易所和机构交易平台功能。这家加密公司在以 11 亿美元的估值上市时,通过 Robinhood 和 SoFi 等平台直接向散户投资者开放认购。散户的需求极为强劲,Bullish 的定价为每股 37 美元,比其初始价格区间顶部高出近 20%。该股在上市首日飙升 143%。

Bullish 将其五分之一的股份出售给了个人投资者——价值约 2.2 亿美元,大约是业内资深人士认为的正常水平的四倍。仅 Moomoo 的客户就下了超过 2.25 亿美元的订单。

这并非孤立事件。文克莱沃斯兄弟的 Gemini Space Station 明确分配了 10% 的股份给散户投资者。Figure Technology Solutions 和 Via Transportation 也通过零售平台进行了 IPO。

这一转变反映了公司对散户投资者看法的根本变化。正如 Jefferies 的贝基·斯坦塔尔(Becky Steinthal)解释:

“发行人可以选择让散户在 IPO 过程中占据比以往更大的份额。这一切都是由技术驱动的。”

Robinhood 的数据显示,2024 年其平台上的 IPO 需求是 2023 年的五倍。该平台现在有禁止在 IPO 后 30 天内抛售股票的政策,创造了更稳定的买入并持有行为,这对公司和长期股东都有利。

这种转变不仅体现在个人投资的决策上,也体现在结构性的市场变化上。散户投资者目前约占美国股票交易量的 19.5% ,高于一年前的 17%,也远高于疫情前约 10% 的水平。

更重要的是,散户行为发生了根本性变化。2024年,仅 5% 的 Vanguard 401k 计划投资者调整了其投资组合。现在目标日期基金的规模已超过 4 万亿美元。

这意味着投资者更信任系统化、专业管理的投资解决方案,而不是频繁买卖。这种转变通过避免代价高昂的、情绪驱动的交易错误,从而实现更理想的退休生活。

eToro 的数据显示,2024 年其 74% 的用户实现了盈利,高级会员的盈利率上升至 80%。这一表现与散户投资者始终输给专业经理人的基本假设相矛盾。

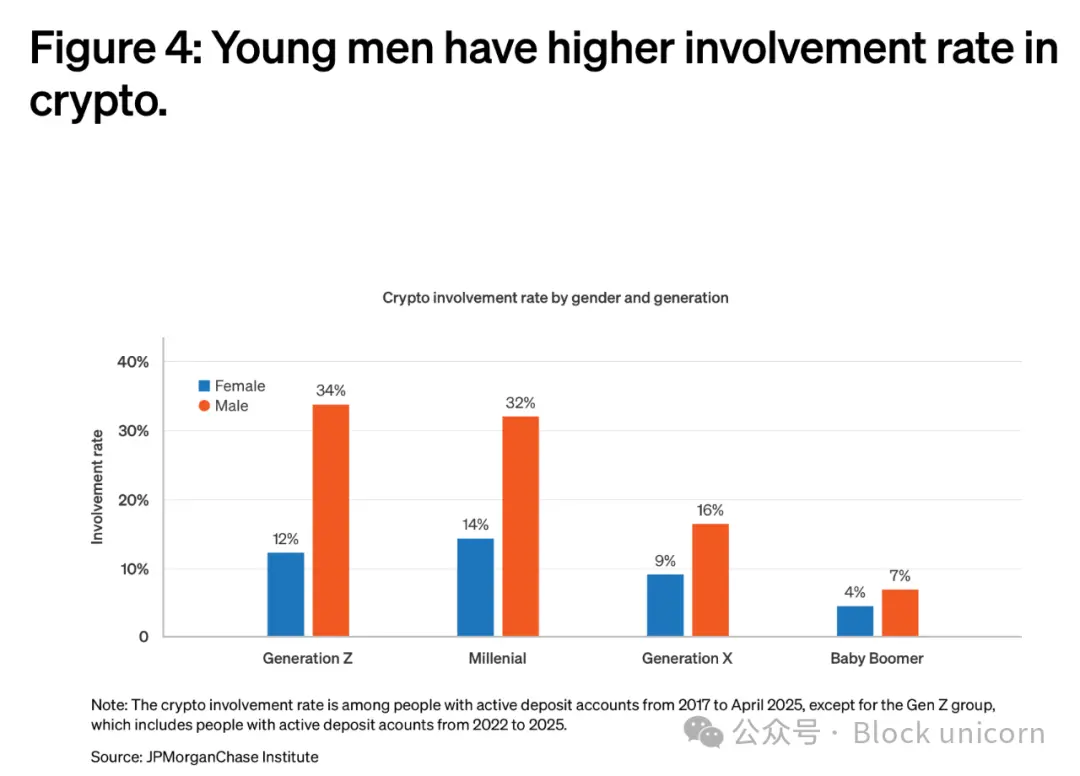

人口统计数据支持了这种转变。年轻投资者更早进入市场——Z 世代平均在 19 岁开始投资,而 X 世代为 32 岁,婴儿潮一代为 35 岁。他们拥有前几代人没有的教育资源:播客、时事通讯、社交媒体名人和零佣金交易平台。

加密货币的普及最能体现散户日益成熟的趋势。尽管机构投资者对比特币 ETF 和企业债券的关注度不高,但实际加密货币的使用主要还是由散户投资者推动。

根据 Chainalysis 的数据,印度在全球加密货币采用率领先,其次是美国和巴基斯坦。这些排名反映的是中心化和去中心化服务中的基层使用情况,而非机构积累。

稳定币市场以散户支付和汇款为主,2024 年,仅 USDT 每月处理的交易就超过 1 万亿美元。USDC 的月交易量在 1.24 万亿美元至 3.29 万亿美元之间。这些并非机构资金管理的资金流——它们代表着数百万笔支付、储蓄和跨境转账的个人交易。

当我们按世界银行收入等级划分加密货币采用时,高收入、中上收入和中下收入群体的采用率同时达到峰值。这表明当前的采用浪潮是广泛的,而不是集中在富裕的早期采用者中。

比特币仍然是主要的法定货币入口,在 2024 年 7 月至 2025 年 6 月间,交易所购买量超过 4.6 万亿美元。然而,散户投资者在多元化投资方面越来越精明,一层代币、稳定币和山寨币都出现了大量资金流入。

审视近期机构投资者的行为,就能最清楚地体会到“聪明钱”与“傻钱”之争的讽刺意味。专业投资者总是误判市场的主要走势,而散户投资者则表现出纪律性和耐心。

在加密货币的机构采用阶段,对冲基金和家族办公室因在周期高点附近增加比特币投资而成为头条新闻。与此同时,散户投资者在熊市中积累并在波动中持有。

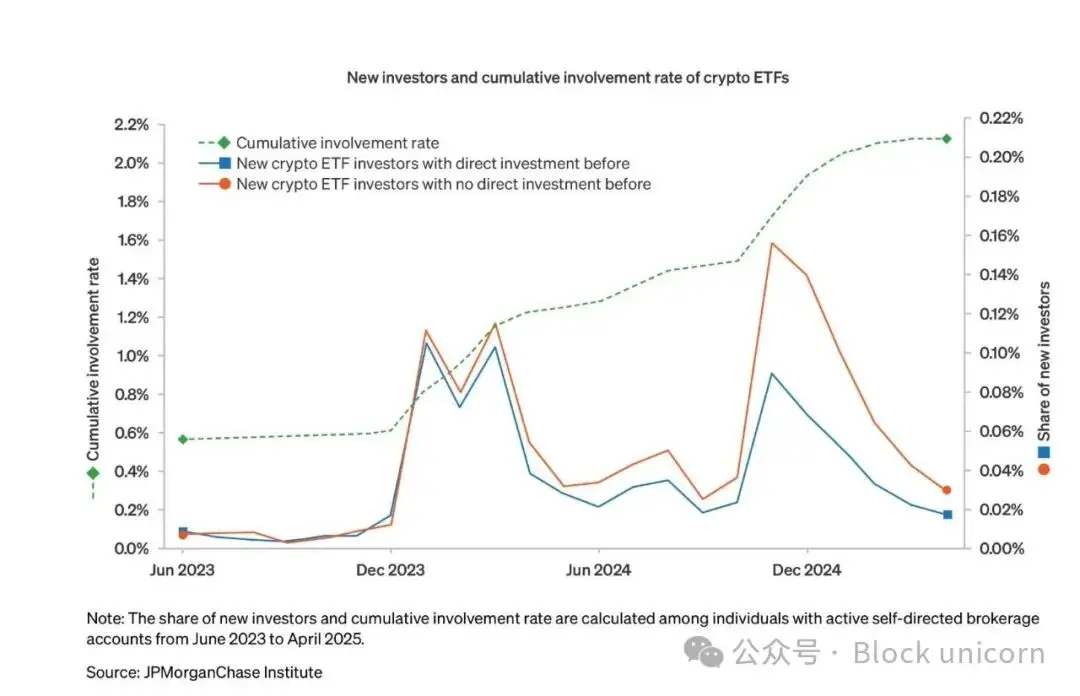

加密 ETF 的兴起完美地说明了这一点。超过一半的加密 ETF 投资者之前没有直接持有加密货币,这表明传统渠道正在扩张,而不是蚕食投资者群体。在 ETF 持有者中,中位数配置保持在投资组合的 3-5% 左右——表明是谨慎的风险管理,而非过度投机。

专业投资者近期的行为反映了他们长期以来批评的典型散户错误。当市场动荡时,机构投资者往往会逃离市场以保住季度业绩指标,而散户投资者则会逢低买入以建立长期账户。

技术是伟大的均衡器

散户投资者行为的转变并非偶然。技术使信息、工具和市场的获取民主化,这些原本是专业人士的专属领域。

Robinhood 的创新不仅限于零佣金交易。他们为欧洲用户推出了代币化的美国股票和 ETF,在美国启用了以太坊和 Solana 的质押,并正在构建复制交易平台,让散户用户可以跟随经过验证的顶级交易者。

Coinbase 通过改进的移动钱包、预测市场和简化的质押扩展了消费者加密产品。Stripe、Mastercard 和 Visa 都推出了稳定币支付功能,使加密货币在数千家零售商处可以消费。

华尔街对散户影响力的认可形成了一个反馈循环,进一步赋能个人投资者。当像 Bullish 这样的公司凭借专注于散户的 IPO 策略取得成功时,其他公司也会纷纷效仿。

Jefferies 的研究指出,散户交易额高而机构兴趣低的股票可能是潜在机会,包括 Reddit、SoFi Technologies、特斯拉、Palantir 等。研究表明,“当散户在交易中占比更大时,传统指标中的质量变得不重要”——但这可能反映了散户不同的评估标准,而非决策能力低下。

加密行业向散户可访问性的演变展示了这种动态。如今,各大平台的竞争不再仅限于机构关系,而是用户体验。便捷的永续交易、代币化股票和集成支付等功能都瞄准了大众散户参与。

“傻钱”叙事之所以持续存在,部分原因是它服务于专业投资者的经济利益。基金经理通过声称卓越技能来证明收费合理。投资银行通过限制高利润交易的准入来维持定价权。

数据表明这些优势正在侵蚀。散户投资者越来越展现出专业人士声称独有的纪律性、耐心和对市场时机的敏锐。与此同时,机构投资者往往表现出他们长期以来认为散户特有的情绪化、趋势跟随行为。

这并不意味着每个散户投资者都做出了最优决策。投机、滥用杠杆和追逐趋势仍然常见。不同的是,这些行为不再是“散户”独有的问题——它们存在于所有投资者类型中。

这种转变具有结构性影响。随着散户投资者在 IPO 中获得更大影响力,他们可能会要求更好的条款、更多透明度和更公平的准入。拥抱这一转变的公司将受益于更低的客户获取成本和更忠诚的股东基础。

在加密领域,散户的主导地位意味着产品和协议必须优先考虑可用性而非机构功能。成功的平台将是那些使复杂金融服务对普通用户可访问的平台。

散户投资者近年成功的背后有一个令人不安的真相值得承认:在过去五年中,几乎所有资产都在上涨。标普 500 指数在 2020 年上涨了 18.40%,2021 年上涨了 28.71%,2023 年上涨了 26.29%,2024 年上涨了 25.02%,只有 2022 年出现了显著的下跌,跌幅为 -18.11%。即便是 2025 年,今年迄今也上涨了 11.74%。

比特币从 2020 年初的约 5000 美元涨至 2021 年接近 7 万美元的峰值,尽管波动持续,但总体呈上升趋势。即使是像国债和房地产这样的传统资产,在此期间也出现了大幅上涨。在“逢低买入”策略始终有效、几乎任何资产持有一年以上都能产生正收益的环境下,很难区分技巧和运气。

这引出了一个重要的问题:散户投资者看似老练的本领能否在真正的熊市中幸存下来。大多数 Z 世代和千禧一代投资者经历过的最长的一次重大下跌是仅持续 33 天的新冠疫情冲击。2022 年的通胀恐慌虽然令人痛苦,但随后却迅速复苏。沃伦·巴菲特那句名言“只有当潮水退去时,你才知道谁在裸泳”在这里同样适用。散户投资者或许确实比前几代人更聪明、更自律、更了解情况。又或许,他们只是几乎所有资产类别前所未有的牛市的受益者。真正的考验将在宽松货币环境结束、投资者面临投资组合持续亏损时到来。只有到那时,我们才能知道“傻钱”的转变是永久性的,还是仅仅是有利市场环境的产物。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。