The nonprofit behind Avalanche is reportedly in advanced discussions with investors to launch one digital-asset treasury company and convert another into a similar vehicle, the FT report noted. The deals could be finalized in the coming weeks. Both deals target U.S. institutional investors. Avalanche Foundation declined to comment, FT’s reporters added in the report.

One transaction allegedly seeks up to $500 million via a private investment led by Hivemind Capital into an existing Nasdaq-listed company, with Anthony Scaramucci advising. Hivemind confirmed it was working on a deal; Scaramucci did not comment. FT says a second plan, sponsored by Dragonfly Capital through a special-purpose acquisition vehicle, is also seeking up to $500 million and may close in October.

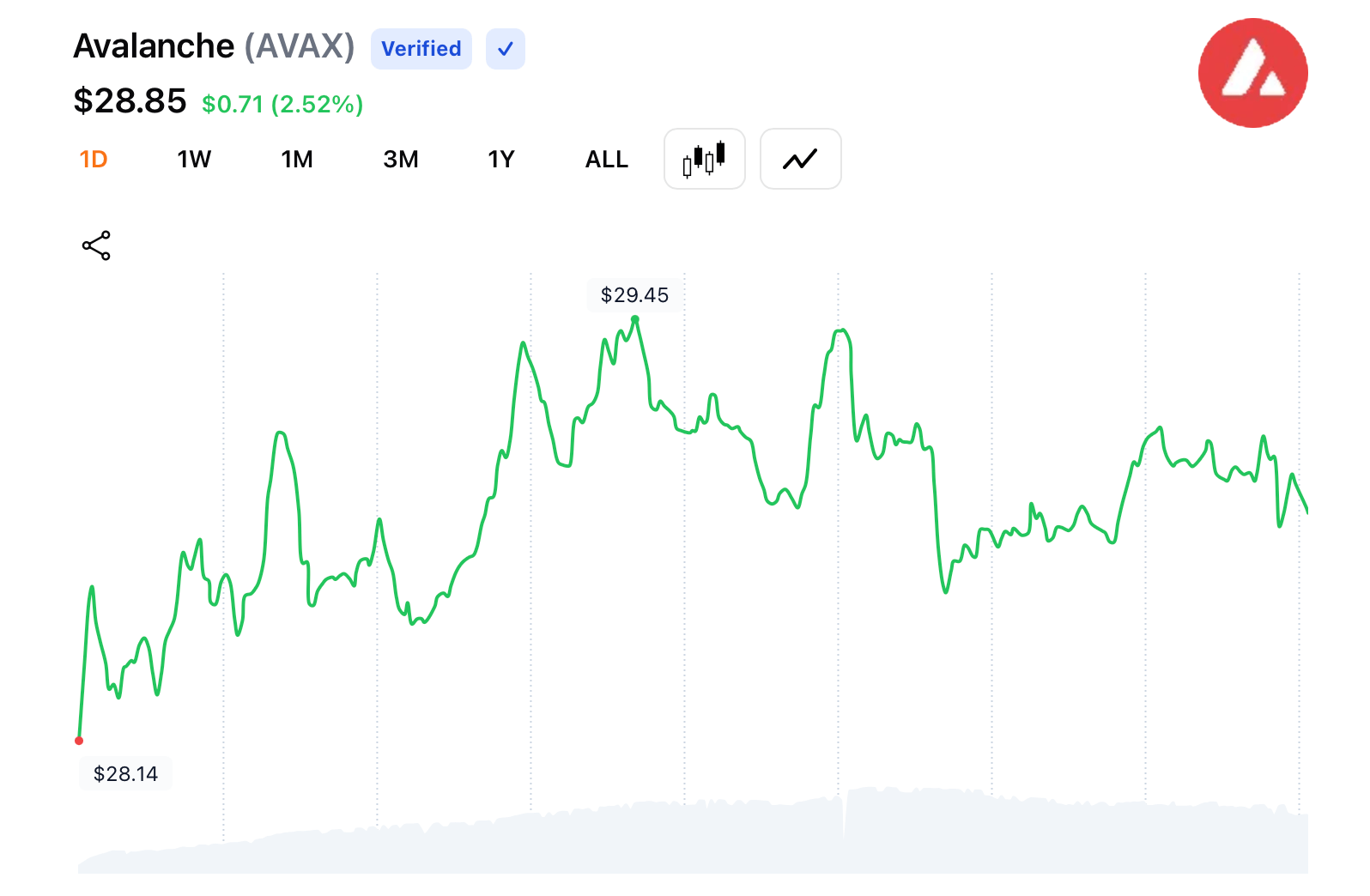

Proceeds would purchase millions of AVAX at a discounted price from the foundation, FT sources say. Avalanche has a maximum supply of 720 million AVAX, with roughly 422 million currently in circulation. The coin rose 2.5% on the news on Thursday, and AVAX is up 17% higher on the week. Despite the rise, it is still down 80% below its 2021 all-time high of $144 per coin, with AVAX prices exchanging for $28.85 at press time.

The reported effort comes as shares of several crypto-treasury companies have fallen, even as tokens tied to bitcoin ( BTC), ethereum ( ETH), and solana ( SOL) climbed in recent months. Avalanche has been tested by Wall Street names including Blackrock, Apollo, and Wellington Asset Management for tokenized fund pilots, the FT article reported on Thursday, while AVAX has lagged rivals during the broader rally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。