撰文:Naruto11.eth

编译:AididiaoJP,Foresight News

如果你在加密领域待了哪怕只有 3 个月,那么到现在你应该已经知道什么是 Hyperliquid。如果你还不知道,简而言之就是:它是加密货币领域最成功的项目之一,创收最多,拥有忠诚的社区,并且是去中心化金融的未来。

目前,所有人的目光都集中在 Hyperliquid 和 USDH 的提案上。

什么是 USDH?

本质上,它是「Hyperliquid 优先的原生稳定币」。

到目前为止已经有多个提案,甚至 WLFI 也想参与进来。为简洁起见,我们将跳过那些较弱的提案。

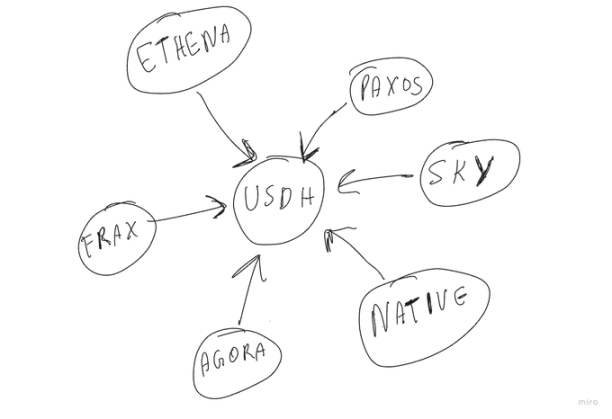

以下是主要的竞争者:

以及最新的 Polymarket 数据:

Native Markets

Native Markets:由 @fiege_max 和他的团队共同创立,在 Polymarket 上获得了最多的投票。

Native Markets 提出的一些有趣想法:

-

USDH 的构建具备 GENIUS 法案合规性,并通过托管进行机构储备金管理,且在设计上对跟发行方无关。

-

Hyperliquid 基金会:50% 的储备金收益直接且不可变地流向 Hyperliquid 基金会,而另外 50% 再投资于 USDH 的增长。这效仿了过去 Hyperliquid 的费用分享先例(HIP-3,部署者费用)、社区所有权和长期的 Hyperliquid 对齐。

-

开发了 CoreRouter 智能合约,这是一种首创的智能合约,用于在 HyperEVM 上原子化铸造并将 USDH 跨链至 HyperCore。

总的来说,现在很多人支持 Native 的提案。

Ethena

Ethena:今天早上刚通过 @gdog97_ 了解到这实际上是一个非常强有力的提案,许多社区成员和外部各方都在为其担保。Ethena 还拥有如此强大的团队和处理稳定币发行的丰富经验。以下是一些简要说明:

-

USDH 最初 100% 由 USDtb 支持(通过 Anchorage Digital Bank 托管符合 GENIUS 法案要求),间接由 BlackRock BUIDL 支持。强调机构 + 合规 + 充足早期流动性。

-

我个人在提案中喜欢的一点:目前 USDtb 的供应量比迄今为止提交申请的所有其他纯国债支持的稳定币发行方的总累计供应量都要大。包括 USDe 在内,Ethena 的产品规模约是其他所有此类发行方总和的 10 倍,不包括 Sky。迄今为止,Ethena 已铸造和赎回了超过 230 亿美元的代币化美元资产,且从未出现安全问题或停机。

-

对社区的收益:承诺将不低于 USDH 储备金净收入的 95% 分配给 Hyperliquid(基金会 + HYPE 回购;后期可通过投票选择分享给质押的 HYPE 和验证者)。

-

Ethena 将承担所有从 USDC 迁移到 USDH 的交易成本。

-

通过一个选举产生的 Hyperliquid 团体提供安全性,该团体有权冻结和重新发行,以避免任何类型的严重损害或故障。

-

流动性和微观结构优势:通过 Ethena 做市商关系和费用层级,实现即时的 USDH、 USDC 和 USDT 流动性兑换;目标是在 CEX 上与 USDT 交易对相比没有流动性劣势。

-

GENIUS 法案优势:目前通过 ADB 获得完全 GENIUS 合规性的唯一定义明确的路径;NYDFS 和 MTL 路径可能更慢且具有不确定性。

-

强大的生态系统展示,我认为:130 亿美元的 USDe 资产负债表,是永续合约最大的自然对手方;承诺为 HIP-3 前端提供 7.5 亿至 1.5 亿美元的激励

真正赢得大家芳心的是什么?每一积分价值 800 美元的预言或将通过 Ethena 实现。

Agora

Agora:我个人支持 @withAUSD 和 @Nick_van_Eck 的提案。Agora 为 USDH 提供的稳定币基础设施实际上非常棒,以下是一些要点:

-

储备金由道富银行(49 万亿美元 AUM)和 VanEck(1300 亿美元 AUM)管理;流动性管理银行(Cross River, Customers Bank),得到了机构级的配置和早期可信度。

-

100% 净收益回归 Hyperliquid:所有储备金收益和回购基金。简单,价值累积最大化。

-

Hyperliquid 优先且中立的发行方:USDH 原生发行于 Hyperliquid;Agora 没有竞争链、经纪业务或交易所(无摩擦对齐)。

-

符合 GENIUS 法案要求

-

强大的分销网络:Rain + LayerZero + EtherFi。这为 Hyperliquid 带来新用户和更多流动性。特别是加密卡的使用。

-

首日 1000 万美元的前期流动性。

我的想法:@Nick_van_Eck 和团队其他成员将带来大量来自传统金融世界和 @vaneck_us 本身的经验,这就是为什么我相信他们能赢得投票并使 USDH 变得伟大。我也是 @withAUSD 团队的忠实粉丝。

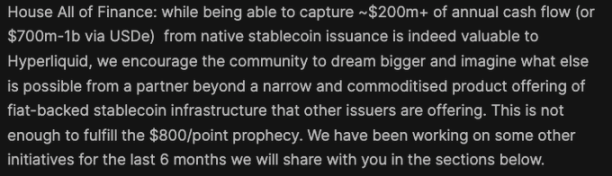

Sky

Sky(前身为 MakerDAO):@SkyEcosystem 和 @RuneKek 也提出了一个很棒的提案。每个人都知道 MakerDAO 以及他们作为生态系统对加密货币的重要性。以下是我了解到的一些事情:

-

Sky 是第四大稳定币项目:80 亿 + USDS,130 亿美元抵押品,7 年 + 的正常运行时间,无安全事件发生。

-

但 Sky 也有流动性优势:通过锚定稳定模块 (PSM) 实现 22 亿 USDC 即时赎回 + 无缝切换至 USDH 保证金永续合约和现货交易对。Sky 将其 80 亿 + 的资产负债表部署到 Hyperliquid 中。

-

使用 LayerZero。

-

Hyperliquid 上所有 USDH 的 4.85% 回报全部用于回购基金的 HYPE 回购。可选的 sUSDS 集成和即时访问 Sky 储蓄率(目前为 4.75%)。

-

承诺投入 2500 万美元建立「Hyperliquid Genesis Star」 代币挖矿的 DeFi 孵化器,类似于 Spark(其 TVL 为 12 亿美元)。Sky 每年 2.5 亿 + 美元的利润回购可能会迁移到 Hyperliquid。这增加了流动性并为协议回购树立了标准。

-

其余大部分内容相同。符合 GENIUS 要求,风险管理和透明度,实时监控和长期计划:USDH 成为其自己的「Sky 生成资产」。

这里有一条推文确实引起了我的共鸣,我认为 Sky 的定位也相当不错。

Frax Finance

Frax Finance:以下是 @fraxfinance 团队的一些简要说明。

-

Frax 承诺将 100% 的国库收益分配给 Hyperliquid。不抽取分成,或代币或任何形式的收入分享。

-

在他们更新的提案中,他们表示拥有一家联邦监管的美国银行(尚未公布名称)+ 符合 GENIUS 法案要求

-

通过 Blackrock、superstate、wisdomtree 等持有美国国债。

-

Frax 分销:20+ 条链的连接性,但 USDH 保持原生于 Hyperliquid。奖励以编程方式 + 透明地在链上流转;治理选择接收方。

-

社区优先。

预计经济效应:55B 美元存款 +4% 美国国债年利率 = 2.2 亿美元年收入。全部重新回流至 Hyperliquid:

-

提升 HYPE 质押收益

-

回购基金回购

-

交易者返利或 USDH 持有奖励

Paxos

Paxos:最后一个优秀的竞争者是 @paxos。他们提交了 V2 版本用于 USDH 提案,类似 $PYUSD。

以下是 Paxos 及其提案的一些简要点:

-

Paxos 在全球范围内推广 Hyperliquid。

-

分销工作:HYPE 将上线 PayPal 和 Venmo,并且 USDH 提供免费的法币出入金通道。

-

承诺投入 2000 万美元激励,并由 Paypal 在 Hype 生态中承诺投入 2000 万美元激励。

-

结账集成:PayPal Checkout、Braintree、Venmo P2P、Hyperwallet 大规模支付、Xoom 汇款(100+ 国家)

修订后的援助基金收入结构:

-

起始于 20% 分配给回购基金(TVL 10 亿美元),逐步增加,一旦 USDH > 50 亿美元时达到 70% 分配给援助基金

-

axos 在 10 亿美元之前收取 0%,50 亿美元后封顶于 5%,费用以 HYPE 形式持有

-

在每个重大事件进行治理投票,由社区监督

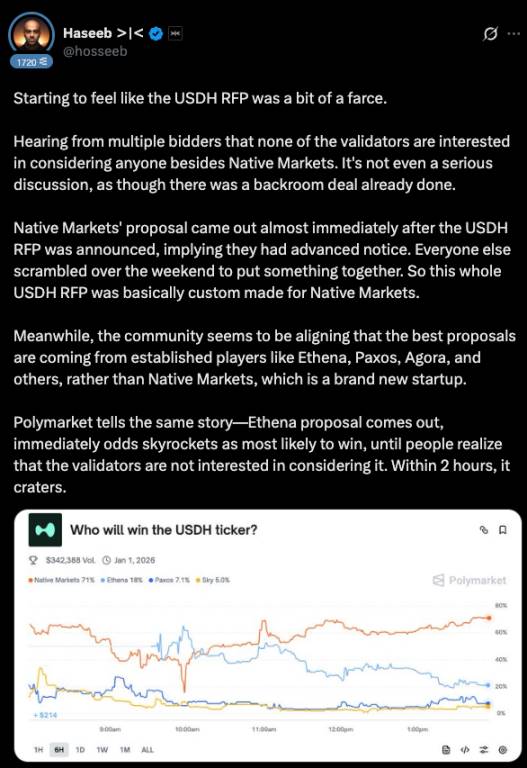

更重要的事情:

-

用户甚至可以在不知情的情况下交易 Hyperliquid 流动性。

-

Paxos 作为资产发行方将 RWA 引入 HIP-3 永续合约。

-

Paxos 将构建 HyperEVM 「Earn」产品 + 面向零售和机构规模的代币化 HLP 结构化产品

这些就是 6 个主要提案。虽然我很喜欢这些提案,但我会更倾向于 Ethena,因为他们有一个强大、严肃的提案,或者是 Agora,因为他们拥有那些传统金融关系,可以将 Hyperliquid 提升到更高水平水平。

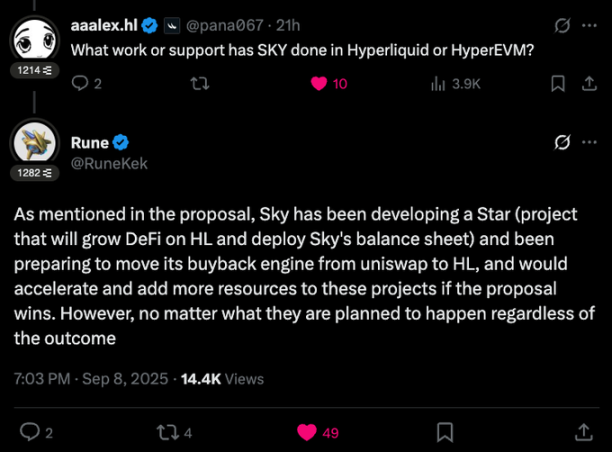

很多人把钱押在 Native 上,并且不断有消息传出,获胜者甚至在竞标开始前就已经决定了,如果你将 Native 成立的速度之快以及其提案与 agora 或 ethena 相比缺乏真正分量这些点联系起来,这确实有点道理。

在过去 4 天里,我与多位 Hyperliquid 成员交谈过,并在推特上阅读了很多他们的观点,几乎所有人都表示情况并非如此。验证者尚未对任何提案做出决定,任何提案的获胜者都不可能在此之前被选定。

然而我个人认为,并同意 @hosseeb 的观点,即这其中有一些真实性,或者至少这是最初的期望,并且获胜者在某种程度上已经内定了。无论如何,这对 Hyperliquid 和所有参与的公司来说实际上是一次很好的营销。

现在会发生什么?没有人知道,我们将很快看到谁获胜。我的钱押在 Ethena 上。你呢?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。