Understanding Hyperliquid USDH Stablecoin and GENIUS Act Compliance

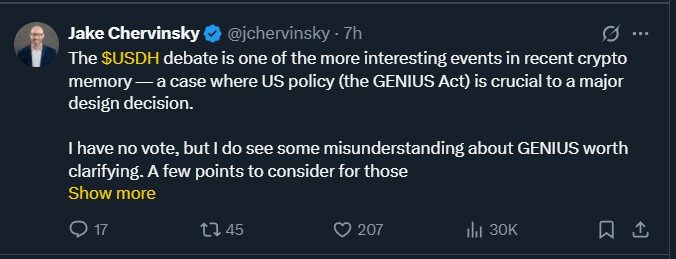

According to Jake Chervinsky, a well-known defi and blockchain enthusiast, pinned a debate and discussion on his X post around the Hyperliquid USDH stablecoin. At the center of this conversation is the GENIUS Act, a U.S. policy framework that could shape the future of stablecoins.

While the law promises to bring regulatory clarity, it leaves behind many questions. As a result, the crypto community, especially those following the proposal, has been debating what compliance really means and how the future may unfold.

Everything About USDH Stablecoin Debate

Hyperliquid USDH is being positioned as a gateway stablecoin for decentralized finance. However, its design and future compliance path have been the subject of intense debate. Supporters believe that USDH could be scalable on a global scale, while critics wonder whether the stablecoin can work with the regulatory framework of the GENIUS Act. The problem is not only a legal one, but a strategic one as well: how does a stablecoins balance compliance with laws today, with preparations for future laws that are not yet finalized?

Source: Jake Chervinsky X

GENIUS Act Regulations

The GENIUS Act (Global and National Establishment of Issuers of US Stablecoins) sets a framework for how stablecoins will be regulated in the United States. However, an important fact often overlooked in debates is that no stablecoin can be “GENIUS-compliant” today.

Here’s why:

-

The Act itself does not provide specific compliance rules.

-

The detailed requirements will only be written later by regulators through a process known as rulemaking.

-

The act won’t take effect until 120 days after these rules are finalized — currently expected on November 15, 2026.

Until then, stablecoins must continue to follow existing laws and regulations. Any claim today is premature because the compliance path has not yet been defined.

USDH Debate and GENIUS Act Compliance

Much of the debate has been about whether the Hyperliquid USDH Stablecoin proposal aligns with GENIUS. However, as legal experts point out, the better question is whether the team behind USDH is capable of adapting to rules when the time comes.

Compliance today simply means adhering to current U.S. laws. Compliance tomorrow will depend on how regulators choose to interpret and implement the Act. Therefore, it’s less about having a GENIUS-compliant model today and more about having a skilled team ready to comply in the future.

GENIUS Act in State vs Federal Rules

One of the most important provisions is the two pathways for stablecoin issuers:

-

State Pathway – available for smaller issuers with a supply under $10 billion.

-

Federal Pathway – mandatory for stablecoins exceeding $10 billion in supply.

If USDH scales as expected in the Hyperliquid ecosystem, it will almost certainly cross the $10 billion threshold. This means it will need to comply with federal regulations, not state ones. In such a case, obtaining state licenses or charters may only serve as a temporary measure but will not help in the long run. Critics argue that focusing on state-level rules could waste valuable time and resources.

Will Hyperliquid's USDH comply with the GENIUS Act Laws?

For now, the key priority is to comply with existing regulations. GENIUS will only matter once its rules are written and enforced. Stablecoin issuers, including Hyperliquid, are expected to have enough time to adapt once rulemaking is complete.

The real question becomes whether Hyperliquid’s team has the legal sophistication, resources, and execution capability to stay compliant under today’s laws and transition smoothly into the GENIUS framework once it takes effect.

What Austin Campbell Concluded?

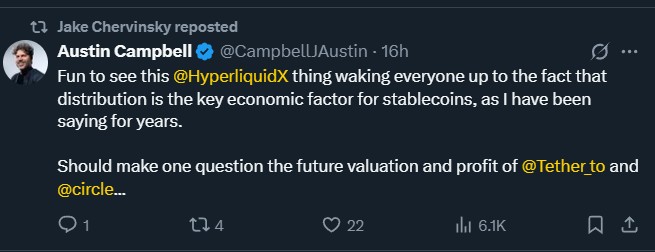

Crypto expert Austin Campbell addressed a key point in this debate: distribution is the key economic factor for stablecoins. He argued that the spread and adoption of a stablecoin is even more important than legal structures. Campbell said this realization may cause investors to reconsider Tether and Circle two largest stablecoin issuers, future valuations in the market today.

Source: Austin Campbell X

Conc lusion

The debate highlights a bigger truth about the crypto industry: regulation is evolving, and uncertainty is part of the process. Regulatory compliance is not something that can be claimed today — it is a future challenge that issuers will need to prepare for.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。