加密风险投资基金Dragonfly的一位高管将Hyperliquid的USDH稳定币请求提案(RFP)称为“闹剧”,声称该过程旨在偏袒单一投标者。在X上的一篇帖子中,Dragonfly的管理合伙人Haseeb Qureshi表示,超过一半的其他投标者也认为验证者只对Native Markets感兴趣。

Qureshi的指控是在Hyperliquid评估来自Ethena、Paxos、Agora和Frax的竞争提案,以提供USDH的稳定币基础设施时提出的。正如Bitcoin.com News之前报道的,这些投标者提交了详细说明其监管合规、分发计划以及如何与Hyperliquid生态系统共享储备收益的提案。获胜的投标者将负责发行和管理稳定币。

根据Qureshi的说法,尽管更知名的投标者提出了引人注目的提案,但没有一个验证者对此感兴趣,因为“已经达成了一个幕后交易。”这位Dragonfly的管理合伙人还暗示,Native Markets的投标时机表明他们事先得到了通知。

“Native Markets的提案几乎在USDH RFP宣布后立即发布,这意味着他们提前得到了通知,”Qureshi在9月9日的X帖子中声称。“其他人则在周末匆忙拼凑出一些东西。因此,这整个USDH RFP基本上是为Native Markets量身定制的。”

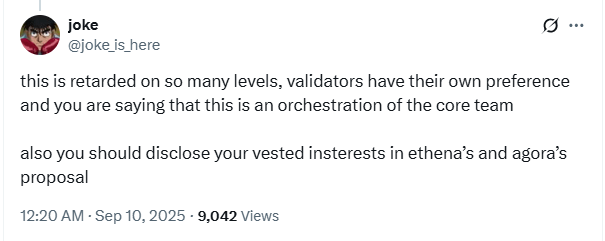

为了支持他的论点,Qureshi在没有提供证据的情况下表示,社区似乎认为Ethena、Paxos、Agora和其他更知名的实体的提案优于Native Markets,他将后者描述为“全新创业公司”。然而,一位社交媒体用户反驳了Qureshi的说法,认为他的指控是出于他在Ethena和Agora的既得利益。

作为回应,Qureshi澄清说,他并不是在指责核心团队,而是指责验证者,他指控他们忽视了委托人和社区。他确认他的公司在几个被验证者忽视的投标实体中拥有股份。

“明确来说,我们在Hype、Ethena、Agora、Sky和Frax中拥有(不同规模的)股份。我们已经投资很长时间了,因此我们有一个非常大的投资组合。这并不是经济影响的问题,而是我所指责的过程,”Qureshi表示。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。