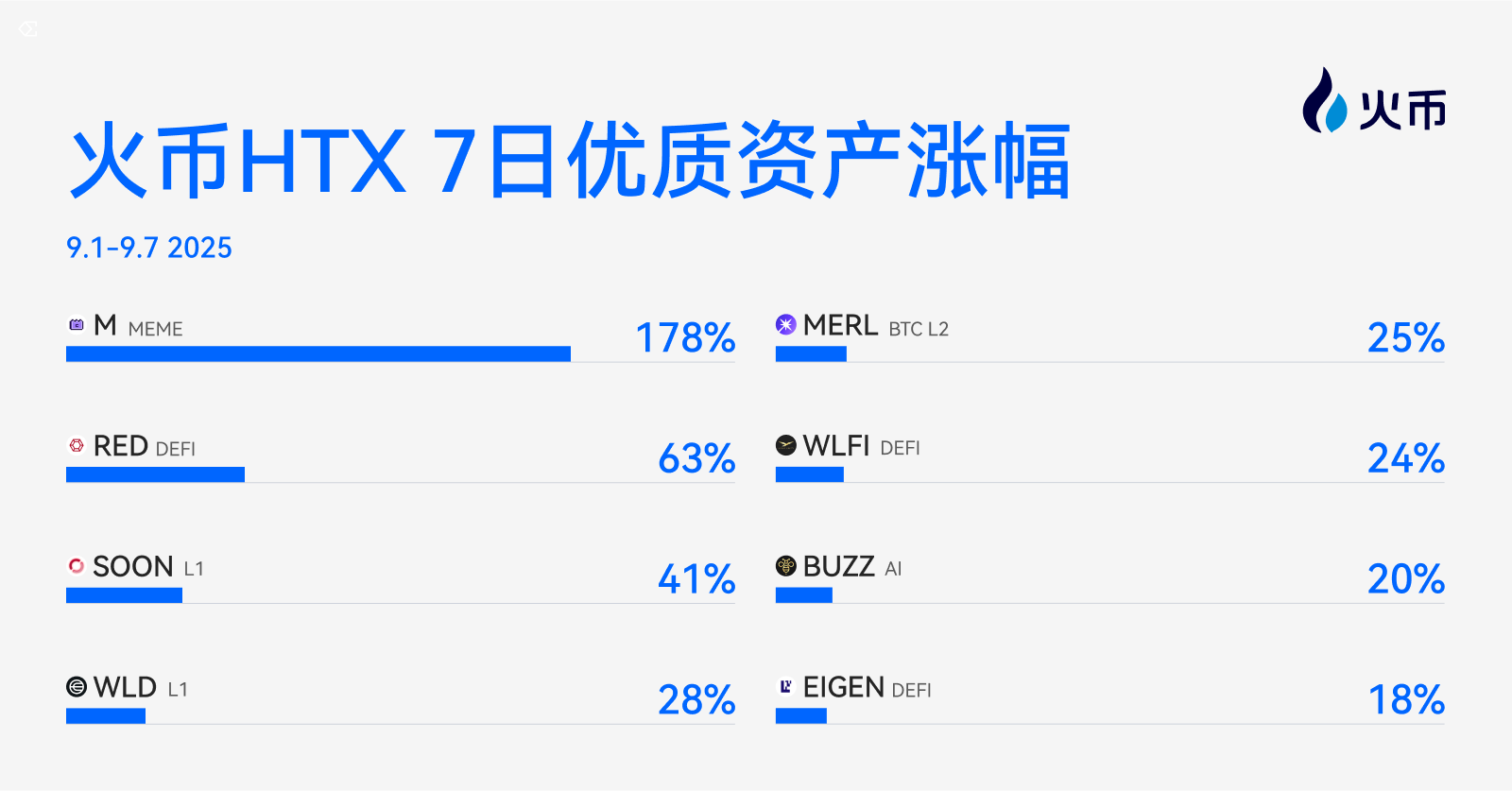

过去一周(9月1日-9月7日),加密市场整体延续震荡格局,BTC与ETH等主流资产维持整理态势,市场情绪处于观望,但部分细分赛道逆势走强,带动了资金短期集中流入。火币HTX数据显示,DEFI、AI及L1相关板块多个代币录得显著涨幅,成为过去七天的主要亮点。

L1赛道:新兴公链崛起

L1 公链表现稳健,成为市场关注的核心之一。其上涨不仅反映出市场对底层基础设施的持续需求,也显示出新应用落地与用户增长的潜力正在被重新定价。

● M(MEME、L1):周涨幅 178% ,表现最为亮眼。MemeCore(M)是首个专为 “Meme 2.0” 打造的 Layer 1 公链。它打破了 Meme 项目长期依附于主流公链的旧格局,以“原生公链 + 文化共识”的架构,推动 Meme 从单纯的投机符号跃迁为结构化资产。

● SOON:本周上涨41% ,表明资金对新兴公链叙事的兴趣明显提升。SOON 是基于 Solana Virtual Machine(SVM)的 Rollup 堆栈,专注于高性能区块链解决方案。相较于传统公链,SOON 致力于提供更高效、更低成本的基础设施,以支持Web3应用的大规模落地。

DeFi回暖:资金回流,叙事延续

DeFi 市场的集体上涨并非偶然。其背后,一方面是机构资金的加速进场——无论是 RWA、合规化借贷,还是 401(k) 配置加密资产,都为市场注入长期动能;另一方面,随着牛市预期升温,散户对链上收益的需求回暖,加之技术迭代不断催生新的应用场景,推动了资金的再次聚集。

值得一提的事,这波反弹中不少老牌项目回归,映射出市场信心的修复,也预示着新一轮DeFi 竞争即将拉开帷幕。

● RED:本周涨幅63%。部分涨幅来自于其上线Upbit 交易所的利好,而从项目本身来看,RedStone(RED)已成为增长最快的 DeFi 预言机之一。其独特的模块化架构使之能够为上千种加密资产 部署价格喂价,并已适配 100 多条公链,展现出极强的可扩展性和灵活性。

● EIGEN:本周上涨18%。受ETH 储备公司质押行为推动,EigenLayer (EIGEN)TVL八月突破220亿美元,创历史新高。

AI 赛道:热点稳步推进

AI 与区块链结合受到技术创新和市场关注的双重驱动,资金对具备实际应用场景和生态建设潜力的项目保持青睐。

● WLD:本周涨幅28%,在 AI 与身份认证赛道的双重加持下,Worldcoin(WLD)延续了良好的上涨势头。数据显示, WLD 已成为加密资产金融服务平台Amber Group 在链上公开地址持仓中的 Top 3 资产。

● BUZZ:本周涨幅20%。Hive AI(Buzz) 上涨的主要驱动力在于其作为DeFi Agent ,吸引了大量投资者与用户关注。尤其在当前对 DeFi 便捷性需求快速增加的背景下,BUZZ 的价值正被市场迅速认可。

BTC L2异军突起

综合来看,BTC L2生态正在逐步兑现应用价值。板块上涨不仅反映了短期市场情绪,也凸显了长期基础设施和生态潜力的投资逻辑。

● MERL:本周涨幅25%。作为Merlin Chain的原生代币,MERL 利用二层网络提升了比特币的交易速度与可扩展性,增强了 BTC 在支付、质押和智能合约等应用场景中的实用性。消息层面上,美股上市公司 CIMG Inc. 接受比特币作为股票支付,并计划与Merlin Chain展开合作,进一步吸引市场资金入场。

市场前瞻:震荡中孕育新一轮潜力

回顾过去十年的比特币市场,9月通常表现相对疲软,回报率多为负数,这反映了投资者对该月份波动和风险的谨慎态度。然而,当前市场面临的利好因素正逐渐累积:401(k)养老金的加密资产准入为长期资金流入提供支撑,美联储降息预期也可能改善整体风险偏好。这两股力量有望在一定程度上对市场形成积极推动,或为加密资产在震荡整理之余,开启新一轮结构性机会和向上行情提供条件。

火币HTX致力于为用户提供安全、透明的交易平台和多元化的资产选择。目前,火币HTX 已开启第二期随机空投活动。自9月10日18时至9月20日18时,交易指定活动币种(APEPE、BONK、FARTCOIN、FLZ、M、PEPE、WLD、XMR),即可随机获得空投奖励,每日最高可得1,888 USDT等值 HTX代币空投。另外,累计交易量排名前3的用户,还将获得Blockchain Life 2025入场门票。

火币HTX希望能够持续助力加密用户在机遇与挑战并存的市场环境中,精准捕捉下一个财富增值周期。

关于火币HTX

火币HTX成立于2013年,经过12年的发展,已从加密货币交易所成为一个全面的区块链业务生态系统,涵盖数字资产交易、金融衍生品、研究、投资、孵化和其他业务。

火币HTX作为全球领先的Web3门户,秉承全球扩张、生态繁荣、财富效应、安全合规的发展战略,为世界虚拟货币爱好者提供全面、安全、可靠的价值与服务。

如需了解更多火币HTX信息,请访问https://www.htx.com/或HTX Square,并关注X、Telegram和Discord。如有进一步的疑问,请联系glo-media@htx-inc.com。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。