Written by: White55, Mars Finance

El Salvador's Bitcoin story is both a small country's ambitious challenge to the global financial system and a mirror reflecting the complex reality of digital currencies in the real world.

In September 2021, El Salvador's President Nayib Bukele announced to the world that Bitcoin would become the country's legal tender, instantly placing this small Central American nation at the eye of the storm of global financial innovation.

Four years later, this experiment, hailed as a "digital revolution," dramatically came to an end — in early 2025, the El Salvadoran parliament quietly passed a bill to revoke Bitcoin's legal tender status, making its use voluntary.

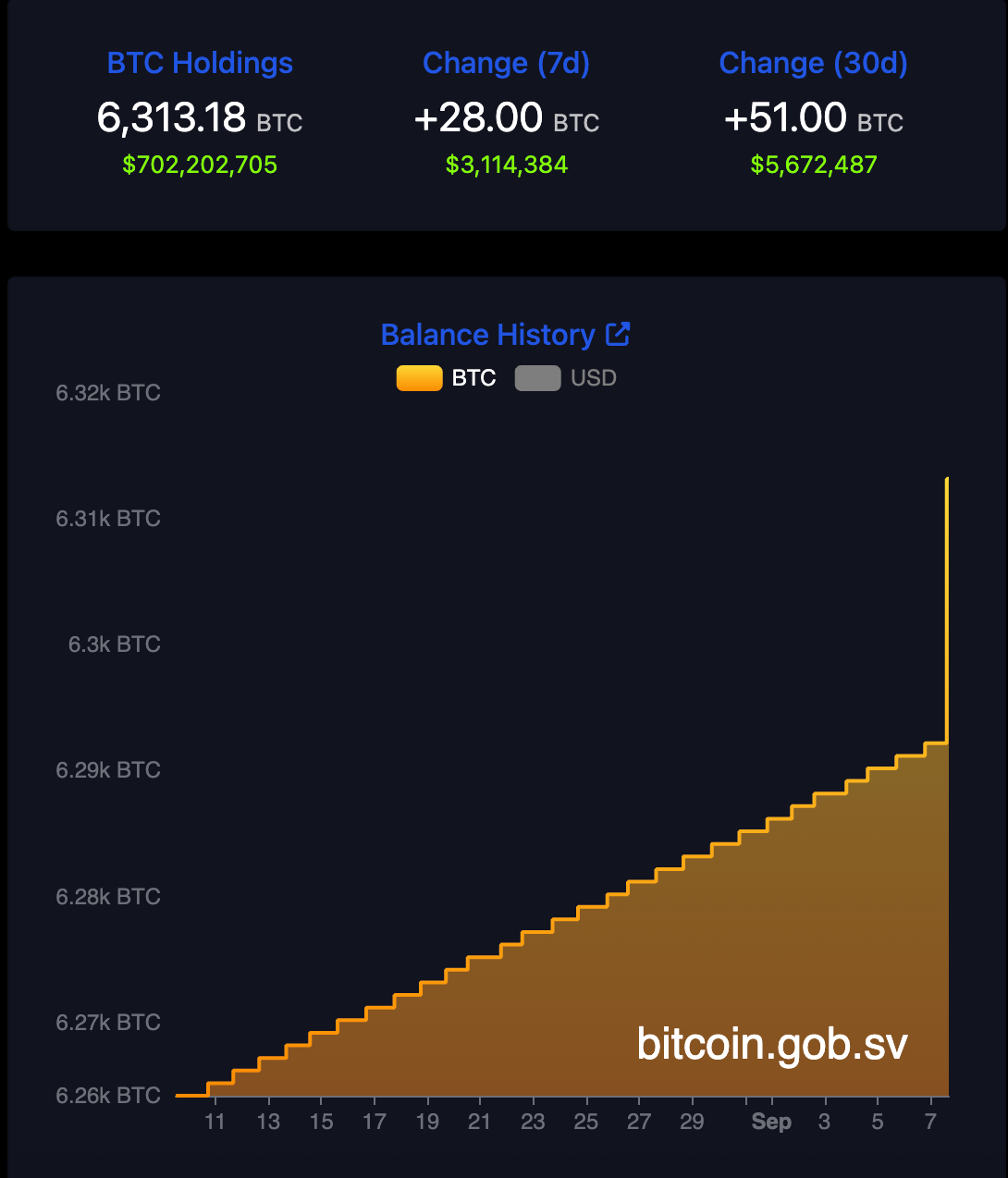

Nevertheless, the El Salvador Bitcoin Office still celebrated "Bitcoin Day" in September 2025, emphasizing on social media that the country still holds a strategic reserve of 6,313 Bitcoins, valued at over $702 million, highlighting the complex legacy of this experiment.

Ambitious Start: A Small Country's Financial Breakthrough Dream

El Salvador is a country located in the northern part of Central America, the only Central American country not bordering the Atlantic Ocean, with a total area of 21,393 square kilometers.

The introduction of the Bitcoin bill in El Salvador was not a spur-of-the-moment decision but was based on its unique economic background. This country, with a population of just over 6 million, has a weak economic foundation, with remittances from abroad accounting for more than one-fifth of the national GDP.

President Bukele pointed to the data with dismay: nearly 70% of adults in the country do not have bank accounts, and the fees paid for cross-border remittances reach up to $400 million annually. In this dollar-cash-dominated economy, Bitcoin was packaged as a "financial savior."

The government launched the Chivo e-wallet, offering $30 in Bitcoin upon registration; installed 200 ATMs with exchange functions nationwide; and even planned to build a "Bitcoin City" powered by volcanic energy. President Bukele promised that Bitcoin could "make the country rich," attract investment, and enhance financial innovation.

Reality Check: The Huge Gap Between Ideal and Reality

However, reality proved to be far more brutal than imagined. The price of Bitcoin plummeted from $69,000 in 2021 to $16,000 in 2022, causing the value of the Bitcoin held by the El Salvadoran government to shrink by nearly half, resulting in a direct loss of over $40 million.

Ordinary citizens quickly discovered the problem: tomatoes that were priced at $3 yesterday could rise to $30 today — the volatility of the currency turned everyday transactions into "gambling." The Chivo wallet was frequently targeted by hackers, with issues like transfer delays and account lockouts occurring often, leading thousands to protest in the capital.

By 2024, 92% of Salvadorans had never used Bitcoin, and only 1.1% of remittances involved cryptocurrency. The government initially believed that using Bitcoin could save $400 million in fees annually, but by 2023, only 1% of remittances used Bitcoin.

Deeper contradictions gradually emerged. The Bitcoin network can only process 7 transactions per second, failing to meet even a fraction of El Salvador's daily transaction demands, and the Lightning Network expansion plan has yet to be realized.

The International Monetary Fund (IMF) made "reducing Bitcoin risks" a condition for disbursing a $1.4 billion loan, directly pressuring El Salvador to abandon its legal tender status. During the parliamentary vote, 71% of the public clearly opposed this policy that had been forcibly implemented.

The European Union also planned to list El Salvador as a high-risk country under the guise of "anti-money laundering." Under both internal and external pressure, El Salvador was ultimately forced to announce the repeal of Bitcoin's legal tender status in January 2025, ending this "financial experiment" with the country's economy on the brink of collapse.

El Salvador's legislative body repealed the Bitcoin legal tender law and agreed to stop using public funds to purchase additional Bitcoins, as part of the $1.4 billion loan agreement reached with the IMF in January.

_ The letter of intent included in the IMF report was signed by El Salvador's finance officials, confirming that the country's Bitcoin balance had not increased. Source: _International Monetary Fund

The letter of intent included in the IMF report was signed by El Salvador's finance officials, confirming that the country's Bitcoin balance had not increased. Source: _International Monetary Fund

The government also agreed to reduce support for the Chivo Bitcoin wallet, which had limited usage among the country's residents.

In July, the IMF released a report revealing that El Salvador had not purchased any new Bitcoins since signing the $1.4 billion loan agreement in December 2024, causing a stir in the crypto community.

Strategic Shift: From Legal Tender to Strategic Reserve

Despite revoking Bitcoin's legal tender status, El Salvador did not completely abandon its Bitcoin strategy. The country continues to accumulate Bitcoin reserves, currently holding 6,313 Bitcoins, valued at over $702 million.

The government also passed a new banking law allowing BTC investment banks to serve accredited investors. As of 2025, 80,000 public servants have received Bitcoin certification, and El Salvador has hosted several public education programs on Bitcoin and artificial intelligence.

In August 2025, El Salvador even conducted a "quantum migration," transferring the country's $680 million Bitcoin reserve from a single address to 14 decentralized, new blockchain addresses to enhance the security and long-term custody of the national strategic Bitcoin reserve.

Economic and Social Costs: The Real Price Behind the Experiment

El Salvador's Bitcoin experiment has placed a heavy burden on this economically weak country. According to World Bank data, in 2023, El Salvador's central government debt accounted for 101.7% of GDP, and the volatility of Bitcoin prices has directly exacerbated the debt crisis.

Moody's downgraded its sovereign credit rating to Caa3, nearing default. This money could have been used to repair roads and build schools, but it has all been sunk into this illusory venture.

The lives of ordinary citizens have not improved; merchants who accept Bitcoin must immediately convert it to dollars, or they risk losing money if prices drop. In February 2025, El Salvador was forced to announce the repeal of Bitcoin's legal tender status, ending this "financial experiment" with the country's economy on the brink of collapse.

Geopolitical Games: The Dilemma of a Small Country in a Big Power Game

Behind El Salvador's Bitcoin experiment lies deeper geopolitical factors. The United States has seen China's financial system grow stronger, with the internationalization of the yuan becoming evident and trade and cross-border payment capabilities increasing, which naturally makes them uncomfortable.

The U.S. has attempted to regulate stablecoins through legislation, creating a closed loop of "dollar - stablecoin - U.S. Treasury bonds," aiming to incorporate Bitcoin into its own system. The "Genius Act" passed by the U.S. House of Representatives in 2025 requires stablecoin issuers to have 100% of their reserves in dollars or U.S. Treasury bonds.

El Salvador initially jumped in, likely thinking it could bypass U.S. dollar control through Bitcoin, but instead became a test subject for U.S. capital. By 2023, El Salvador's external debt accounted for over 80% of GDP, with much of that debt secured by mortgaging Bitcoin; when prices fell, additional collateral was required, straining the national finances.

Future Outlook: Reflections on Digital Currency and National Sovereignty

El Salvador's experiment is not entirely a failure. Over 100 merchants in Berlin still accept Bitcoin, Turkish companies have invested $1.6 billion in ports around "Bitcoin City," and El Salvador has even become the first country to issue tokenized U.S. Treasury bonds.

In an interview, Bukele candidly stated, "It didn't meet expectations, but it brought us branding and investment." Now, while Bitcoin is no longer legal tender, it continues to exist in a more market-oriented way — businesses can choose whether to accept it, and the government is shifting its focus to improving the regulatory framework.

The reflections this experiment leaves for the world are far from over. Can digital currencies truly promote financial inclusion? How can sovereign national currencies coexist with decentralized assets? In the current global regulatory vacuum for cryptocurrencies, is the small country's gamble an innovation or a risk?

The El Salvador Bitcoin Office announced on "Bitcoin Day" in September 2025 that they had increased their holdings by 21 Bitcoins. President Bukele emphasized on social media that the national Bitcoin reserve has reached 6,313.18 Bitcoins, valued at approximately $701 million.

This number seems to tell a story of a small country's stubborn insistence on financial autonomy. On the streets of San Salvador, Bitcoin ATMs still stand, but few people inquire about them.

The four-year Bitcoin experiment has brought this country international reputation and profound lessons, and President Bukele's words highlight the key point: "It didn't meet expectations, but it brought us branding and investment."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。