Author: 0xResearcher

The decentralized derivatives market has experienced rapid growth over the past two years. From initial experiments with on-chain perpetual contracts to multiple protocols now achieving daily trading volumes exceeding billions of dollars, this niche has become one of the most explosive directions for DeFi growth. Different projects have shown significant divergence in their model choices, as they prioritize and address key challenges differently.

We will discuss two of the largest perpetual contract DEXs as examples: Hyperliquid prioritizes extreme performance to attract users seeking a trading experience comparable to centralized exchanges, focusing on speed and efficiency; Orderly positions itself as "liquidity infrastructure," aiming to provide the necessary foundational liquidity for the burgeoning decentralized derivatives ecosystem, addressing the historical issue of liquidity fragmentation in DeFi.

These different path choices are responses to several key market challenges. One major issue is the need to replicate the performance and user experience of centralized exchanges (CEXs) while maintaining decentralization. CEXs offer superior speed and order execution, which many DeFi users expect.

Another challenge is the fragmentation of liquidity among different DeFi protocols, making it difficult for traders to execute large orders without experiencing significant slippage. Additionally, many users seek a more comprehensive and user-friendly DeFi experience rather than having to navigate multiple specialized platforms. The different approaches of Hyperliquid and Orderly reflect their attempts to address these challenges and capture different segments of the growing decentralized derivatives market.

Hyperliquid: Performance-Driven C-End Platform

Hyperliquid's concept is straightforward—create an on-chain version of Binance. Hyperliquid's success lies in its understanding of traders' core needs: depth and speed. For professional traders accustomed to centralized platforms, liquidity depth and low latency are essential, and Hyperliquid provides an experience close to that of a CEX. The transparency of its on-chain settlement further ensures the security of funds. It can be said that Hyperliquid is more like an extreme C-end product, capturing users' minds through performance and experience. Hyperliquid's architecture features a fully on-chain order book, which is rare in decentralized exchanges (DEXs).

Hyperliquid leads the decentralized perpetual contract DEX market, holding over 70% market share. Hyperliquid operates a native liquidity engine, offering tighter spreads and superior market depth, rather than relying on external liquidity providers.

Hyperliquid's Technical Parameters

Orderly: The Supporter of Liquidity and Infrastructure

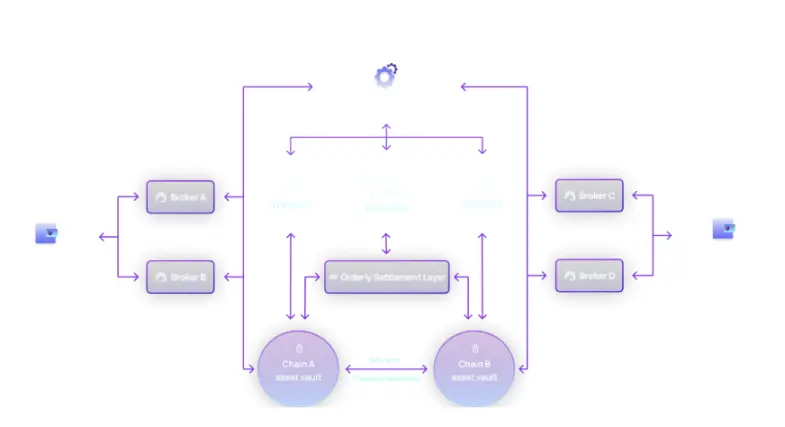

In contrast to Hyperliquid, Orderly does not position itself as a single C-end trading platform but chooses to take the infrastructure route. It provides order books, matching engines, and liquidity support to help other front-end projects quickly launch derivatives trading, thereby forming an open ecosystem. Orderly Network implements the asset trading process through a three-layer structure: Asset Layer, Engine Layer, and Settlement Layer.

In simple terms, Orderly acts like a "trading intermediary platform." When you place an order to buy or sell on an app, this app (let's call it the agent) sends your order to Orderly; Orderly's system automatically finds suitable buyers or sellers for matching; once the trade is successful, the system automatically updates your account's funds and positions.

How Orderly Achieves Asset Trading Process

Among them, the Settlement Layer Orderly Chain is the core product of Orderly Network's full-chain infrastructure, responsible for cross-chain data transmission, trade settlement, and ledger data recording.

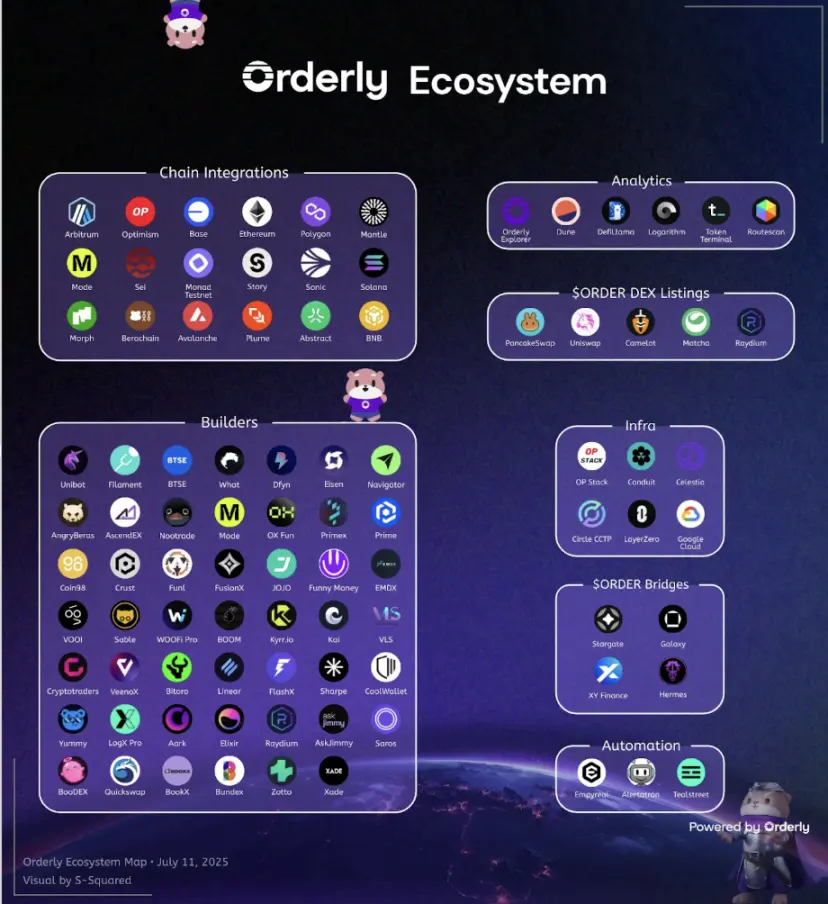

The value of this model lies in that Orderly does not rely on a single application but forms economies of scale by serving more partners. Every front-end that connects to Orderly can share its underlying liquidity and matching capabilities, thus avoiding the problem of "liquidity fragmentation." In the long run, Orderly resembles the "infrastructure layer" of the derivatives market, empowering different projects.

Orderly Ecosystem Summary

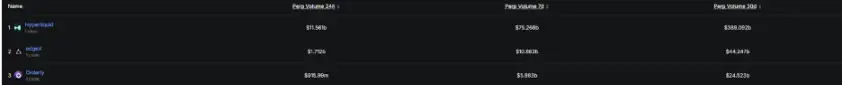

At this stage, Orderly has built a large ecological network by integrating multiple projects, and the release of this infrastructure advantage is a key reason for its recent impressive performance— as a foundational protocol, Orderly ranks among the top three in trading volume and revenue in Perp Dex, fully validating the commercial value of its ecological model.

Orderly as Perp Dex Infrastructure Trading Volume Ranks Top Three

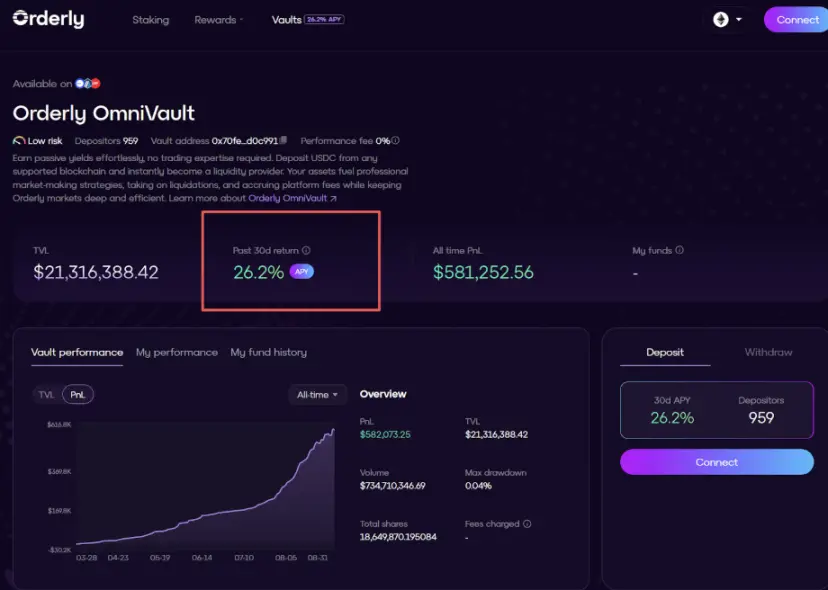

In addition, based on its multi-chain advantage, it recently integrated with Ceffu (Binance's institutional custody partner) to establish its own Omnivault, allowing users to deposit multi-chain assets into this OmniVault, with Ceffu ensuring asset security and professional quantitative institution Kronos Research guaranteeing returns. Recently, as the TVL of OmniVault continues to rise, returns have also increased, with the annualized return over the past 30 days reaching 26%, which is quite an impressive figure.

Competitive Advantages and Moats of Two Models

Hyperliquid's strategy is straightforward—create a platform that traders "cannot live without." Just as it is difficult to switch to another mobile operating system once you are accustomed to one, professional traders incur high costs when adapting to a new platform's trading interface and speed.

The moat of this model is "user stickiness." What do traders value most? Speed, no lag, and sufficient liquidity (simply put, being able to buy when they want and sell when they want). Once Hyperliquid achieves these to the extreme, a snowball effect will occur: the more people trade, the better the liquidity; the better the liquidity, the more people will be attracted to trade.

Orderly's chosen route is entirely different—it does not directly face users but provides underlying technical support to companies wanting to create trading platforms. Just as an electricity company does not sell appliances directly, but all appliances need its electricity. This "selling water to gold miners" model has a unique advantage: network effects. As more platforms connect, the liquidity of the entire network will deepen, benefiting all partners.

Hyperliquid's user-facing model advantage lies in its ability to directly control user experience, quickly respond to market demands, and establish strong brand recognition. However, it requires continuous resource investment to maintain user relationships in a highly competitive market. Orderly's infrastructure model is characterized by diversified revenue sources, not relying on the success or failure of a single application, and achieving stable growth by serving the entire ecosystem. However, it has a high dependency on ecological partners and needs to continuously expand its network scale to maintain competitiveness. Both models have their own development logic and market positioning, representing different business ideas in the DeFi space.

Looking Ahead

These two models are likely to continue evolving along their respective tracks and may exhibit interesting trends of convergence. Hyperliquid needs to continuously innovate in fierce competition and may expand into areas such as AI-assisted trading and diversified financial products, while facing challenges of rising user expectations and customer acquisition costs. Orderly, on the other hand, will benefit from the scale effects of its infrastructure model, by consolidating multi-chain liquidity and expanding service boundaries (such as innovative products like OmniVault), evolving from a purely trading infrastructure to a comprehensive financial services platform, but it also needs to maintain service quality and technological leadership amid rapid expansion.

From an industry-wide perspective, the boundaries of these two models may gradually blur— infrastructure providers may launch their own applications, while application platforms may also open up their technical capabilities, ultimately forming a more diversified and interconnected DeFi ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。