In ancient times, there was the demon sword Muramasa, and now there is the waist knife coin stock DAT—why has coin stock DAT evolved into "official announcement means halving"? (Halving? Or demon slashing?) Is it early investors dumping? Is the market not buying it anymore? This is not a market failure or a random panic, but a predictable and rational market repricing process. It marks a shift in market sentiment from a fervent pursuit of a novel story to a calm examination of the company's financing mechanism, equity dilution, and the real per-share value.

Part One: Deconstructing the "Coin Stock" DAT Model

1.1. Definition and Core Logic: A Bridge Connecting Traditional Finance and the Crypto World

In recent years, a new type of listed company has quietly emerged at the intersection of cryptocurrency and traditional finance, commonly referred to by investors as "coin stocks" or "digital asset treasury concept stocks." In the professional financial field, these companies are defined as "Digital Asset Treasury Companies" (DAT). Their core business model lies in strategically accumulating cryptocurrency assets (usually mainstream ones like BTC/ETH/BNB/SOL) on their balance sheets as one of their core business functions.

Unlike traditional companies that hold cryptocurrencies, the operational purpose of DATs is to actively and explicitly increase their holdings of crypto (digital) assets. In this way, they provide a regulated, equity-based tool for traditional capital market investors to gain exposure to crypto assets. This model serves a specific market demand: many large institutional investors, such as pension funds, sovereign wealth funds, and endowment funds, are unable to directly purchase and hold cryptocurrencies due to internal compliance, custody complexities, or regulatory restrictions. The stocks of DATs are traded on mainstream exchanges like the NYSE or NASDAQ, providing a compliant bridge for these restricted capitals to enter the crypto space.

The pioneer of this model is Strategy Inc. (formerly MicroStrategy) under the leadership of Michael Saylor. Since 2020, the company has begun converting a large portion of its cash reserves into BTC, pioneering the transformation of listed companies into BTC holding tools. This move not only reshaped the market's perception of how companies view BTC—from a purely speculative asset to a strategic reserve asset capable of resisting fiat currency depreciation—but also provided a replicable template for subsequent companies.

Subsequently, this trend gradually spread globally. For example, the Japanese listed company Metaplanet has also adopted a similar strategy, reflecting that there is demand for such investment tools in capital markets across different regions. The emergence of these companies signifies that crypto assets are moving from the margins to the mainstream, increasingly integrating into the global macro-financial system.

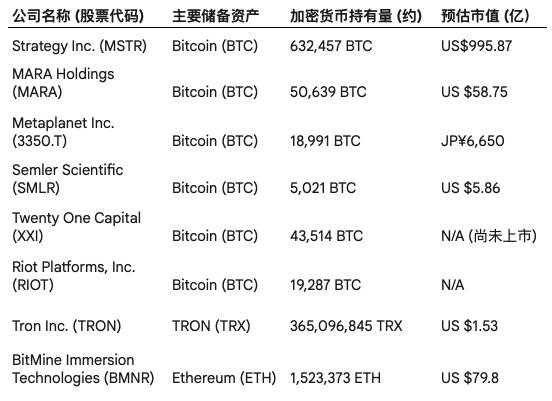

Table 1: Overview of Major Digital Asset Treasury Companies

Note: Data as of August 2025; market capitalization and crypto asset holdings will fluctuate with market conditions.

1.2. Key Concepts and Value Propositions: A Professional Dictionary for Investors

To accurately assess "coin stocks," investors must go beyond traditional metrics like price-to-earnings or price-to-book ratios and master a set of analytical vocabulary specifically designed for this model. These concepts are key to understanding its value propositions and inherent risks.

Net Asset Value (NAV): This is the cornerstone for evaluating DATs, referring to the total value of the digital assets held by the company calculated at current market prices. It represents the "real" intrinsic value of the crypto assets on the company's balance sheet.

Equity Premium to NAV (or mNAV): This is the core concept for understanding "coin stock" valuation. It quantifies the premium of the company's stock market value relative to the net asset value per share of digital assets. This metric is typically expressed as a multiple (mNAV, or multiple of NAV). For example, if a company's mNAV is 2.0x, it means its stock price is twice the value of the BTC contained in each share. A high mNAV reflects market optimism, expectations for the company's future asset accumulation, stock scarcity, and the convenience premium of being a compliant investment tool. Conversely, a contraction in mNAV indicates a weakening of market confidence.

Bitcoin Yield (or Crypto Yield): This is a key performance indicator (KPI) actively promoted by the management of DATs. It measures the growth rate of the amount of BTC (or other crypto assets) represented by each share (fully diluted) over a specific period. A positive "Bitcoin Yield" means the company is acquiring new assets through financing at a faster rate than equity dilution, resulting in an increase in the nominal BTC share owned by each shareholder. However, this metric requires critical examination. If the stock price significantly declines during the same period, even with a positive "Bitcoin Yield," shareholders' actual wealth may suffer losses. Therefore, this metric must be analyzed in conjunction with stock price performance and mNAV trends to fully assess its real value to shareholders.

1.3. A Leveraged Proxy Tool: Comparison with BTC ETFs

With the approval of the US spot BTC ETF in 2024, investors gained access to a direct, low-cost tool for tracking BTC prices. This makes the differences between DATs and ETFs particularly important, as they offer investors distinctly different risk-return experiences.

Active Management vs. Passive Tracking: The design purpose of ETFs is to replicate the price performance of their underlying asset (i.e., BTC) as accurately as possible, making them a passive investment tool. In contrast, DATs are actively managed entities. Their management teams must make key decisions regarding capital allocation, timing of financing, choice of financing tools (equity or debt), and asset purchase strategies. Investing in DATs is not only an investment in BTC but also an investment in the capital operation capabilities of their management teams.

Embedded Leverage Effect: Investing in DAT stocks is essentially a leveraged bet on BTC. This leverage arises from two aspects: first, the company may finance the purchase of BTC through debt instruments like bonds, constituting financial leverage. Second, the mNAV premium itself has a leverage effect. When market sentiment is high, a 1% increase in BTC price may drive DAT stock prices up by 2% or more, and vice versa.

Unique Risk Exposure: The risk of ETFs is primarily concentrated on the price volatility of BTC itself. In contrast, DATs add specific company-level risks on top of this, including execution risks, specific regulatory challenges faced by listed companies, and most critically—financing risks, namely the risks of equity dilution and debt refinancing.

In summary, DATs should not be viewed simply as "cryptocurrency holding companies," but rather as complex financial instruments. They provide investors with leveraged exposure to cryptocurrencies like BTC through active capital market operations, but this also introduces multiple risks inherent in traditional equity investments and financial engineering.

Part Two: The Capital Flywheel—Financing, Reflexivity, and Market Impact

The core driving force of the DAT model lies in its unique financing mechanism, which can create a powerful, self-reinforcing positive feedback loop, known as the "capital flywheel," in favorable market conditions. However, this flywheel also has a bidirectional nature, and its direction of operation entirely depends on market sentiment and the liquidity of capital markets.

2.1. Financing Engine: How Capital is Created

DATs primarily raise funds for purchasing digital assets through two complex financial instruments. The brilliance of these tools lies in their ability to maximize the company's high stock price and market expectations for its future growth.

At-the-Market Equity Programs (ATM): This is the most commonly used and efficient financing method for DATs. ATM programs (which vividly allow companies to "withdraw" directly from the market) enable companies to sell newly issued shares in small batches at current market prices based on market conditions. This method is extremely flexible, avoiding the roadshows and discounted offerings required for traditional large-scale issuances, but it is also the main reason for the dilution of existing shareholders' ownership.

Convertible Notes: This is a hybrid financing tool, essentially low-interest or zero-interest bonds issued by the company, but with an attached option: under certain conditions, bondholders have the right to convert the bonds into company stock. For companies, this is an attractive financing method because it allows them to borrow large amounts of money at rates far below market levels. For example, MicroStrategy has issued convertible bonds with interest rates as low as 0% or 0.625%, raising billions of dollars. For investors, these bonds offer asymmetric returns with "downside protection (at least the principal can be recovered) and upside potential (profit from converting to stock when the stock price rises)." However, this tool also buries future "dilution landmines" for the company: once the stock price rises significantly and exceeds the conversion price, a large number of bonds being converted into stock will lead to a sharp expansion of the total share capital.

2.2. "Flywheel Effect": Amplifier of Gains and Losses

The operation of the DAT model perfectly illustrates the theory of "reflexivity," which posits that there is a dynamic feedback loop between market participants' expectations and market fundamentals that mutually influence and reinforce each other.

Upward Spiral (Positive Feedback in Bull Markets): In a bull market, the flywheel generates a strong positive driving force. Its operational logic is as follows:

BTC price rises, triggering optimistic expectations for DAT.

Optimistic expectations drive DAT stock prices to rise with a higher beta coefficient (i.e., larger increases), thereby expanding its mNAV premium.

A high mNAV premium makes the company's financing activities "value-accretive." For example, the company can raise $1.5 in cash from the market using $1.5 worth of stock, then use that money to purchase $1 worth of BTC, and retain the remaining $0.5 as the company's value addition.

The large amounts of funds raised through ATM or new debt issuance are used to purchase more BTC, further increasing the company's net asset value (NAV).

The growth of the company's assets and the ongoing purchasing actions, in turn, reinforce its market narrative as a "BTC growth engine," attracting more investors and further driving up stock prices and mNAV premiums, thus completing a round of positive feedback loop.

Downward Spiral (Negative Feedback in Bear Markets): The vulnerability of this flywheel lies in its high dependence on market sentiment. Once the market turns bearish, the flywheel will quickly reverse direction, forming a "death spiral":

The price of BTC falls, triggering pessimistic market sentiment.

The stock price of DAT declines even more due to its high beta and leverage effect, leading to a rapid contraction of the mNAV premium, even turning into a discount.

At this point, any financing behavior through issuing new shares will be "dilutive," meaning the cash obtained from selling shares is insufficient to compensate for the dilution of existing shareholders, making financing through ATM impractical or highly destructive.

The exhaustion of financing channels breaks the narrative of the company continuously increasing its BTC holdings, leading to a collapse of investor confidence and a sell-off of stocks.

Further declines in stock prices cause the company's market value to fall far below the value of its BTC holdings, resulting in severe discounts, which triggers even more intense sell-offs, creating a vicious cycle.

Part Three: The Mystery of DAT's "Official Announcement Means Halving": A Multi-Factor Risk Analysis

The phenomenon of most "coin stocks" experiencing a sharp decline in stock prices after official announcements is not a random fluctuation of market sentiment, but a concentrated manifestation of the inherent risks in their business models. Behind this phenomenon are multiple intertwined factors such as equity dilution, market psychology, leverage mechanisms, and valuation logic. The collapse of stock prices can be understood as a dramatic shift in the market from "narrative-driven valuation" to a more stringent "fundamentals-driven valuation."

3.1. Dilution Engine: Quantitative Analysis of MicroStrategy

Equity dilution is the original sin inherent in the DAT model and is key to understanding its long-term stock performance. While the company's management tends to promote the growth of its total assets, the only meaningful metric for stock investors is the asset value per share.

Taking the pioneer and largest practitioner of this model, Strategy (MSTR), as an example, since implementing its BTC strategy in 2020, the company's total share capital has experienced explosive growth. Data shows that its fully diluted circulating share count surged from about 97 million shares in mid-2020 to over 300 million shares in mid-2025, an increase of over 200%. This means that to raise funds to purchase BTC, the company's equity pie has been cut into three times more pieces than before.

At the same time, the company's BTC holdings have grown from zero to over 630,000 coins. So, what impact has this "increase" and "dilution" race ultimately had on shareholders' per-share BTC exposure? Through the data analysis in the table below, we can clearly see the answer.

Table 2: Analysis of Equity Dilution and Per-Share BTC Holdings of Strategy Inc. (MSTR) (2020–2025)

The above table clearly reveals a key trend: although Strategy Inc.'s total BTC holdings continue to grow, its "per-share BTC holdings" have experienced significant fluctuations and have shown a clear downward trend recently. In the early stages of the strategy, the company's pace of BTC accumulation exceeded the pace of equity dilution, leading to an increase in per-share BTC content. However, as the scale of financing expanded and stock prices fluctuated, especially after entering 2025, large-scale equity financing caused the growth rate of the denominator (number of circulating shares) to exceed the growth rate of the numerator (BTC holdings), leading to the actual content of per-share BTC being diluted.

This quantitative result shows that continuous equity financing, even for the purpose of purchasing well-regarded assets, can cause actual value dilution for existing shareholders. When the market shifts from a fervent worship of "total holdings" to a rational examination of "per-share value," downward corrections in stock prices become inevitable.

3.2. The Psychology of Collapse: Crowded Trades and Narrative Bankruptcy

The sharp decline of "coin stocks" is also a typical case of market psychology, centered around "crowded trades" and the ensuing "narrative bankruptcy."

Crowded trades refer to a situation where a large number of investors hold the same asset based on similar logic and strategies, creating endogenous risks—risks that do not stem from the asset's fundamentals but from the market structure itself. DATs perfectly fit the characteristics of crowded trades: a simple, enticing narrative ("the next MicroStrategy," "leveraged BTC stocks") attracts a large influx of speculative capital with converging views.

This crowded structure lays the groundwork for severe price volatility. Another speculation from users—"early investments are about to cash out"—points to the trigger for the collapse of crowded trades. Early investors, especially institutions that entered at lower valuations through private investments (PIPE), have a strong incentive to sell stocks to lock in profits when the company announces its strategy and market sentiment peaks. Their selling behavior constitutes the first wave of selling pressure.

When the initial hype subsides, market participants' attention shifts from grand narratives to the mundane financial statements and SEC filings. At this point, investors will find that with each "successful" financing and BTC accumulation announcement comes a continuously growing number of circulating shares and a constantly diluted per-share value. This cognitive shift from "story" to "numbers" constitutes the core of "narrative bankruptcy." Once the market realizes that the growth story supporting high premiums has flaws, the crowded trades will quickly reverse, leading to a "stampede" exit and causing stock prices to plummet.

3.3. The Mechanics of Volatility: Leverage and Forced Liquidation

The inherent structure of the DAT model and the trading behavior of investors together amplify the volatility of stock prices.

First, the financial leverage at the company level is a major source of volatility. By issuing bonds to purchase BTC, the company's balance sheet becomes leveraged, meaning its equity is more sensitive to changes in the price of the underlying assets.

Second, although DATs do not face "liquidation" like cryptocurrency derivatives, a similar risk of "forced deleveraging" still exists. When stock prices plummet and the mNAV premium contracts significantly, the company's ability to issue new shares through ATM programs will be severely weakened or even completely lost. Because at this point, issuing new shares would be highly dilutive, akin to "drinking poison to quench thirst." The interruption of financing channels means the capital flywheel comes to a halt, which is a fatal blow for a company that relies on continuous financing to maintain its growth narrative. The market interprets this as a significant negative signal, triggering even more intense sell-offs, creating a self-reinforcing negative feedback loop.

Additionally, investors holding DAT stocks may also use leverage (for example, through margin accounts with brokers). When stock prices fall, these investors may face margin calls, and if they cannot meet them, their positions will be forcibly liquidated, adding extra downward pressure on stock prices.

3.4. The Evaporation of Premiums: Competition and Market Maturity

The early high mNAV premiums enjoyed by DAT stocks primarily stemmed from their scarcity. Before the advent of spot BTC ETFs, companies like MicroStrategy were among the few channels that allowed a large amount of regulated capital to hold BTC exposure compliantly. This unique market position brought them significant "scarcity premiums."

However, this premium is unsustainable. In addition to the emergence of ETFs providing a lower-cost, simpler, and purer risk way to invest in digital currencies, market maturity will also lead investors to move beyond the superficial narrative of "increasing digital currency holdings" to deeply analyze their financing mechanisms, dilution effects, and leverage risks.

In summary, we can conclude that coin stock DATs are highly innovative but extremely risky financial instruments. They successfully bridge traditional capital markets and the emerging crypto world, but the structure of this bridge is fraught with inherent contradictions and instability.

Assuming the earlier collapse is inevitable, how should investors respond? What strategies should be adopted? What algorithms and standards exist? Are there successful cases in the market? What are their core competitive advantages?

To know what happens next, please stay tuned for the next installment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。