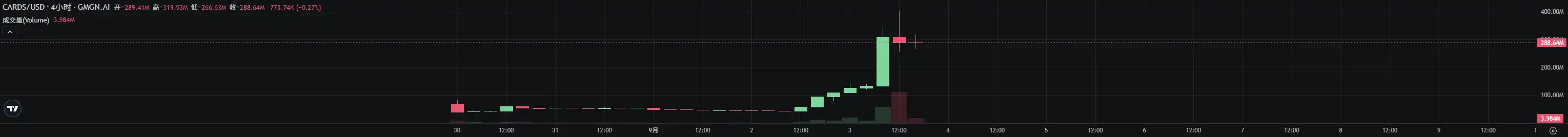

In the cryptocurrency world, while players are focused on the health concerns surrounding Trump and waiting for potential gaming opportunities, a coin called $CARDS has attracted attention with its performance, rising nearly 10 times since September 2, with a market cap that once surpassed $400 million.

$CARDS is the token of Collector Crypt, a trading platform for physical Pokémon cards on Solana. Collector Crypt announced the completion of its seed round financing in February 2023, with the specific amount undisclosed, and was backed by GSR, Big Brain Holdings, FunFair Ventures, Genesis Block Ventures, Master Ventures Investment Management, StarLaunch, and Telos.

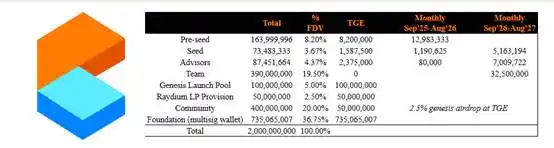

Although the seed round financing was completed two and a half years ago, the presale for $CARDS only opened last week. 5% of the total token supply (100 million $CARDS) was allocated for the presale, ultimately raising 16,500 SOL (approximately $3.5 million), with 718 participants in the presale.

Additionally, 2.5% of the 20% of tokens allocated to the community were opened for claim simultaneously with the presale tokens. According to the tokenomics released by the official team, if the tokens held by the project team are not counted in the initial circulation (the project team claims there are currently no plans to sell), the current circulating supply of $CARDS is approximately 212 million.

Based on market value, the tokens unlocked at TGE before the seed round, during the seed round, and for advisors are currently worth about $1.67 million.

The official team stated that there are currently no plans to sell tokens.

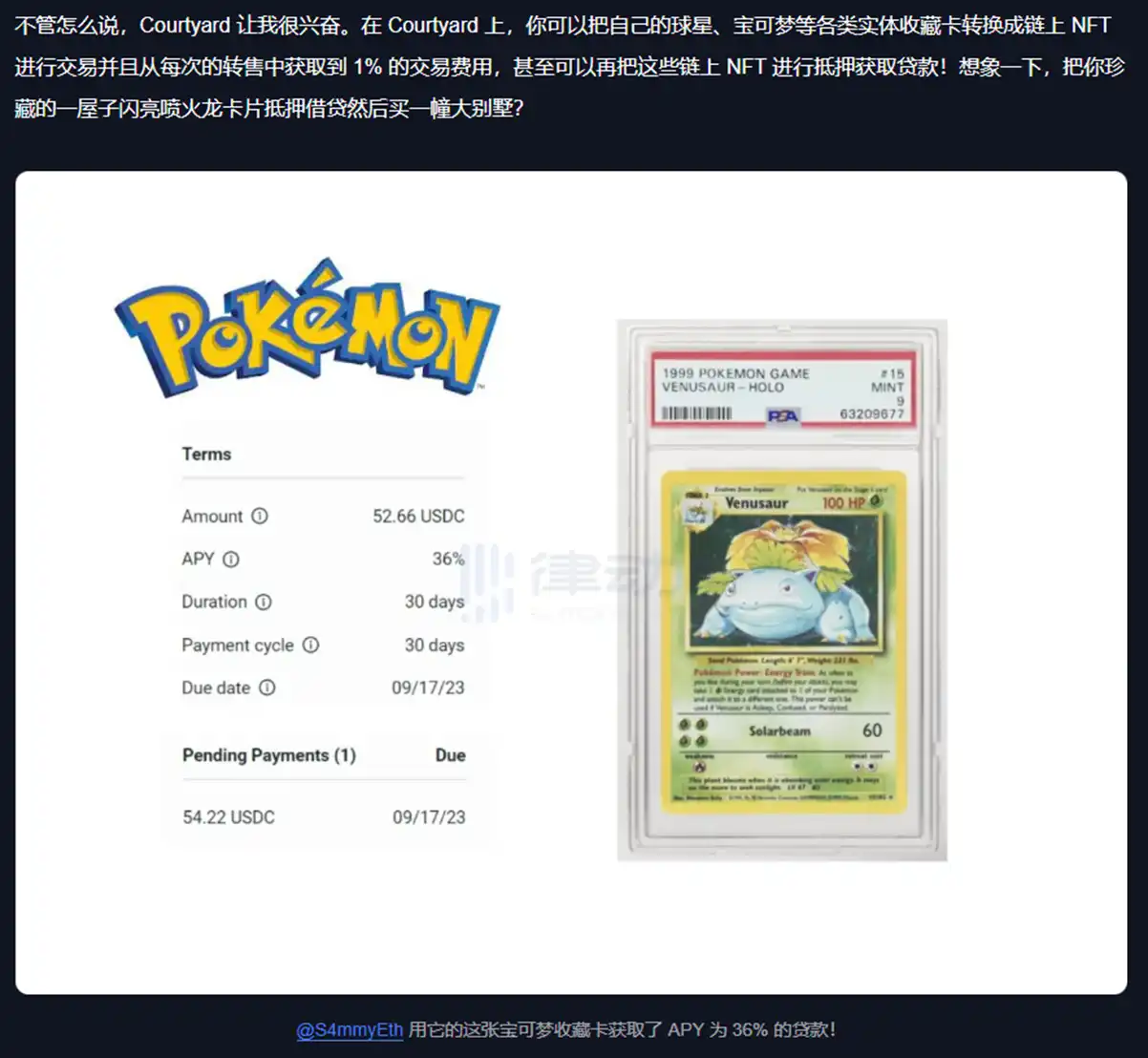

In fact, looking at what the project itself is doing, the on-chain trading of Pokémon cards by Collector Crypt is not that novel.

Courtyard.io on Polygon has also been operating for over two years. Last month, Courtyard's monthly sales just set a new high of approximately $78.43 million. Since February of this year, Courtyard's monthly sales have exceeded $40 million.

The rapid development this year may be the reason Courtyard secured significant financing. On July 28, Fortune reported that Courtyard completed a $30 million Series A financing round, led by Forerunner Ventures, with existing investors like NEA and Y Combinator participating.

In August 2023, when Courtyard had just begun to attract the attention of a few NFT players, we reported on Courtyard. At that time, NFT players were already acquiring Pokémon cards through Courtyard and engaging in on-chain collateralized lending.

Besides Collector Crypt and Courtyard, other crypto projects doing similar business include Beezie, Drip, Emporium, and phygitals.

However, Collector Crypt is the only one among these projects that has issued a token, giving $CARDS a first-mover advantage. Of course, Collector Crypt itself is quite capable, with a monthly trading volume reaching approximately $44 million last month, not too far behind Courtyard.

You might wonder, is there really that much genuine demand for trading Pokémon cards on-chain?

The answer is no. Whether it's Collector Crypt or Courtyard, their actual profitable business is the gambling-style "blind box" sales.

The image above shows Collector Crypt's Pokémon card gacha system. For about $60, there is an 80% chance of drawing a card worth $30 to $60, a 15% chance of drawing a card worth $60 to $110, a 4% chance of drawing a card worth $110 to $250, and a 1% chance of drawing a card worth $250 to $2000.

What if you draw a bad card? No worries, you can sell it back to Collector Crypt at an 85% discount and keep drawing.

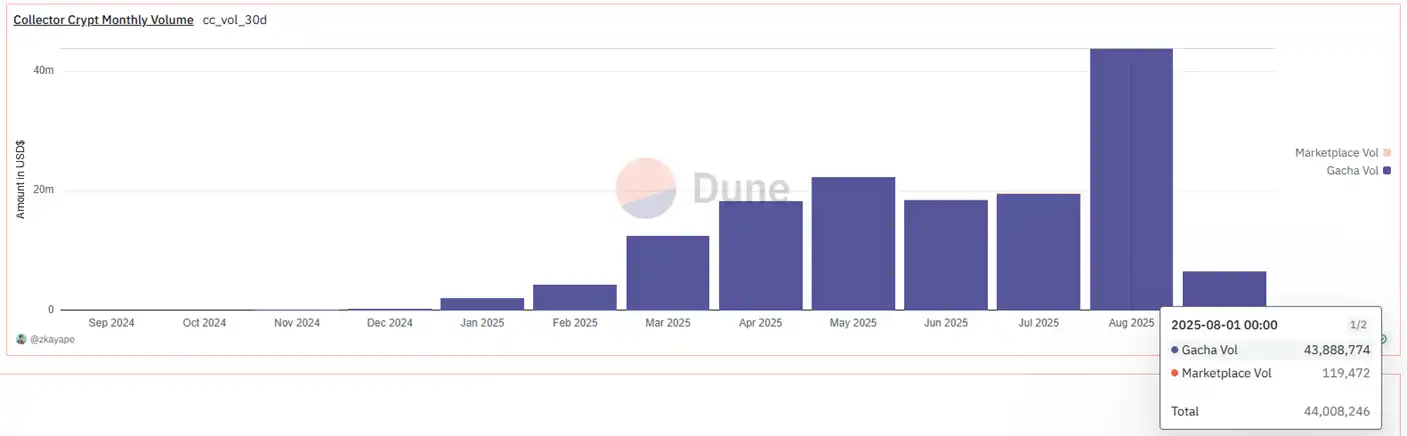

Collector Crypt's lottery system was officially launched in January of this year, achieving approximately $2 million in sales that month, growing to $12.55 million in March, $22.31 million in May, and reaching $43.89 million last month. In contrast, the transaction volume in the Collector Crypt card trading market was only about $120,000 last month.

In the bar chart of Collector Crypt's monthly total sales, the share from the card trading market is almost invisible.

Although there are no direct revenue data from the lottery, we can get a sense of how profitable the lottery business is from Courtyard's previous interviews. Courtyard mentioned in an interview last month that they repurchase lottery cards from customers at 90% of their value and then resell them in new lottery packs to make a profit, with the same card being sold on the platform an average of 8 times per month.

Despite this, it is still difficult to say that the rise of $CARDS is a market-driven "price discovery." Because after the presale ended until two days ago, the price of $CARDS was sluggish, and participants in the presale even felt like they "lost again."

However, the involvement of "head" influencers like pow and gake significantly changed the price trajectory. After they both tweeted support for $CARDS, people began to believe.

Thus, we can summarize $CARDS as follows:

The business narrative is not new, but the revenue is quite strong, making it the absolute leader in this sector on Solana.

The demand is real, but it is not for the trading of Pokémon cards itself, but for the gambling-style demand of "lottery," which is the same for other projects in the sector.

Other projects in the same sector have not yet issued tokens, so there are currently no competing concepts on the market.

The number of token holders is not large, and the current rise is more due to the "head" influencers' endorsements.

There are real assets, but after the emotion-driven rise, whether $CARDS can maintain its momentum still needs time to test.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。