Written by: Glendon, Techub News

On September 3, Japanese listed company Metaplanet announced that it had received shareholder approval to raise up to 555 billion yen (approximately 3.727 billion USD) through preferred shares for investment in Bitcoin. Not long ago, the company's CEO Simon Gerovich stated at a special shareholders' meeting that they plan to accumulate 210,000 Bitcoins by 2027.

At the same time, another U.S. listed company, CIMG, announced today that it has increased its Bitcoin holdings by 55 million USD, officially entering the "Bitcoin Treasury" space. To date, as more and more listed companies "add fuel to the fire," the concept of Digital Asset Treasury (DAT) has been gaining traction and becoming a focal point in the industry. Against this backdrop, this article will discuss the current state of Bitcoin and Ethereum treasury companies and explore their future development trends.

Bitcoin and Ethereum Treasury Companies

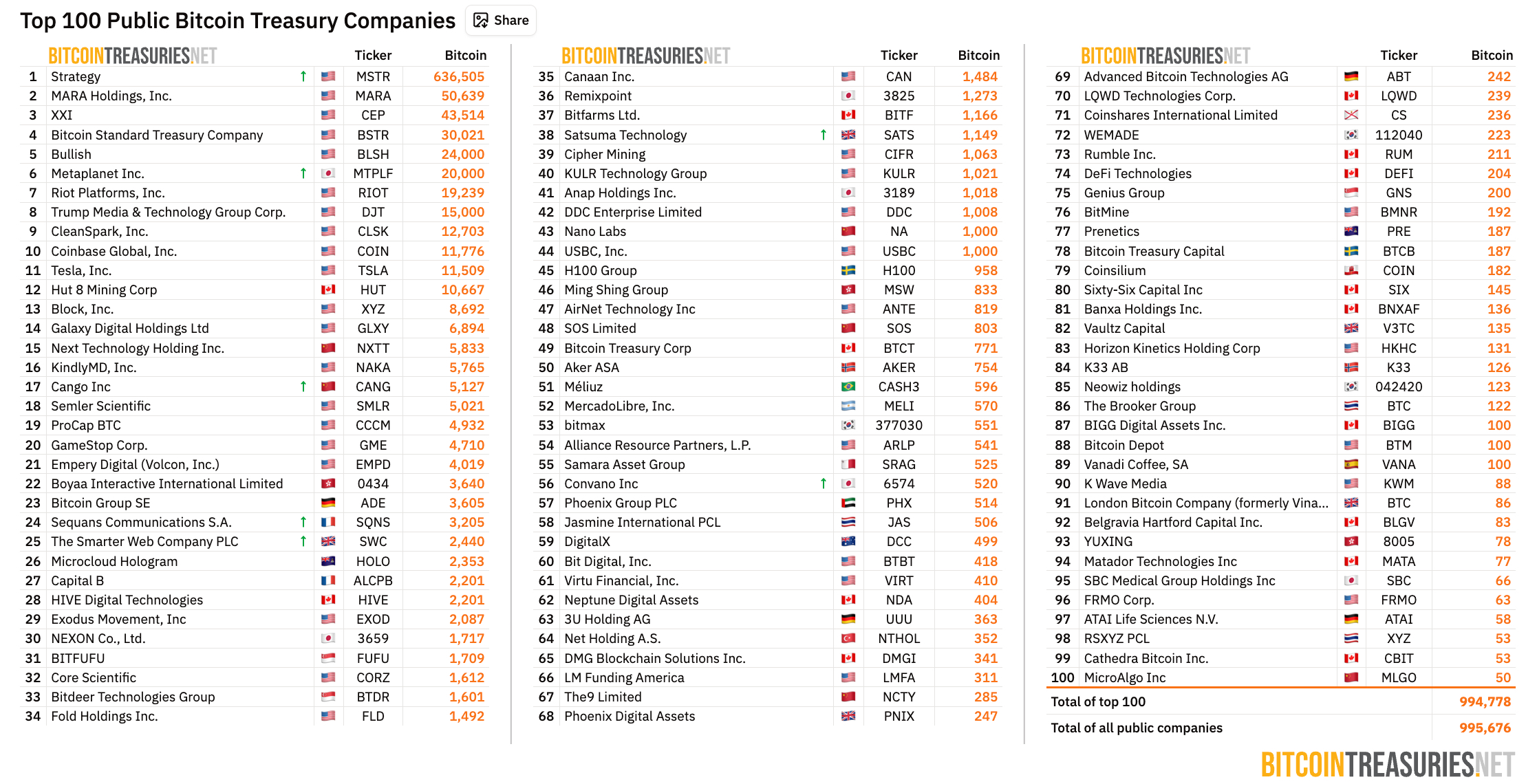

According to data from BitcoinTreasuries.net, as of the time of writing, the number of listed companies holding or publicly trading Bitcoin has reached 179, with a total of 995,676 Bitcoins held, valued at over 11 billion USD.

Among them, the largest Bitcoin treasury company remains Strategy, which last week increased its holdings by 4048 Bitcoins for an additional 449.3 million USD. Throughout August, Strategy accumulated approximately 6364 Bitcoins. As of September 1, 2025, the company has held a total of 636,505 Bitcoins, with a total investment cost of about 46.95 billion USD.

As a pioneer in Bitcoin reserve strategies, Strategy continues to increase its Bitcoin holdings at a relatively stable rate each week. Notably, the proportion of Strategy's Bitcoin holdings in total holdings has decreased from 70% in early July to 63%, indicating that new entrants are diversifying the market share of this established giant, reflecting the intensifying competition in the field.

However, in the past month, among the top ten Bitcoin treasury companies (excluding native cryptocurrency companies like Coinbase and Bullish), aside from Strategy and Metaplanet, the other companies seem to be in a "standstill," making little progress in advancing their Bitcoin treasury strategies. The increase in Bitcoin holdings has largely come from some listed companies making tentative purchases. For example, the U.S. listed company LiveOne increased its Bitcoin holdings by 2 million USD, Hong Kong listed company Boyaa Interactive purchased 290 Bitcoins, and Japanese fashion brand ANAP increased its holdings by 11.68 Bitcoins.

From a data perspective, this "slump" is even more apparent. In the past month, the growth rate of Bitcoin treasury holdings has only increased by about 16%, whereas previously, the monthly growth rate of Bitcoin holdings had exceeded 90%.

In contrast, Ethereum treasury companies have seen the DAT market witness a rise to increasing prosperity in August. Data from the Strategic ETH Reserve website shows that as of the time of writing, the number of Ethereum treasury companies has exceeded 70, with a total holding of approximately 4.71 million Ethereum, valued at over 20 billion USD.

Among the top ten Ethereum treasury companies, BitMine, SharpLink Gaming, and The Ether Machine are like three horses running neck and neck. Currently, BitMine leads in Ethereum reserves, holding approximately 1.87 million Ethereum, with a monthly increase exceeding 124%, showcasing impressive expansion speed. SharpLink Gaming's Ethereum holdings have reached 837,200, with a monthly increase of over 91%. These two largest Ethereum treasury companies alone purchased approximately 1.7 million Ethereum in August, estimated to be worth about 7.3 billion USD at current market prices.

As a rising star, The Ether Machine has quickly entered the market, with holdings nearing 500,000 Ethereum and a monthly increase exceeding 43%.

It is worth mentioning that The Ether Machine has completed a private financing round of 654 million USD (approximately 150,000 Ethereum) today, which will continue to be used to increase its Ethereum holdings and further expand its reserves. The company was formed by the merger of Ether Reserve and Dynamix Corporation and is expected to be listed on NASDAQ in the fourth quarter of this year. Additionally, Andrew Keys, co-founder and chairman of The Ether Machine, revealed that a third round of financing led by Citibank will kick off this Wednesday, targeting at least 500 million USD.

In addition to the aforementioned "three giants," NASDAQ-listed Fundamental Global Inc. (FG Nexus) has seen its Ethereum holdings exceed 48,000 since launching its Ethereum treasury strategy, with a monthly increase of over 650%. Furthermore, today, Hong Kong listed company Yunfeng Financial disclosed that it has accumulated 10,000 Ethereum in the public market, also sparking industry discussions.

From the active layouts and market performances of these companies, it is evident that although both Bitcoin and Ethereum prices reached historical highs in August, their development trends in DAT are not entirely the same. The increase in Ethereum DAT is significant, with high market enthusiasm; meanwhile, the pace of Bitcoin DAT accumulation has slowed down in August, trending towards stability. So, has the DAT market reached a "boiling point," or is it still in a "growth phase"?

DAT Market Development

Multiple market data indicate that the Bitcoin market is currently in a "cooling" phase, and Bitcoin DAT has not been spared.

Taking Metaplanet as an example, its Bitcoin flywheel effect has significantly diminished, with its stock price dropping from over 15 USD on May 18 to 5.87 USD. Although Metaplanet recently plans to raise more funds through preferred shares to invest in Bitcoin and aims to accumulate 210,000 Bitcoins by 2027, this plan has not had a noticeable positive effect on its stock price.

As mentioned earlier, the Bitcoin DAT market has formed a competitive landscape of "one strong and many strong," and as more listed companies enter this market, the cost of purchasing Bitcoin will continue to rise, which on one hand suppresses some companies' willingness to buy. At the same time, the market exhibits characteristics of "head concentration and ecological differentiation," where large transactions by institutional investors can easily trigger significant price fluctuations in the short term, undoubtedly increasing the difficulty for companies to time their Bitcoin allocations.

On the other hand, in the context of intensifying competition, the Bitcoin flywheel effect is dispersed among various listed companies, and its impact on their stock prices is far less than that of early entrants, leading to the current situation of slowed growth.

Meanwhile, the allocation of market resources is changing, with much of the attention gradually shifting from Bitcoin to Ethereum or other cryptocurrency DAT.

For instance, at the end of August, Trump Media announced an agreement with Crypto.com to focus on building a digital asset treasury for the native token CRO of Cronos, planning to raise 6.42 billion USD, including 1 billion USD in CRO; the listed real estate asset management company Caliber will establish a digital asset strategic treasury to support the Chainlink protocol's LINK token, using part of the funds to purchase cryptocurrencies, with a focus on supporting LINK tokens and earning through staking; additionally, several companies are preparing to establish Solana treasuries, including Galaxy Digital, Multicoin Capital, and Jump Crypto, which are collaborating to raise about 1 billion USD to build Solana treasuries through public company vehicles.

In other words, unlike the Bitcoin DAT market, the current Ethereum DAT market is in a "growth phase."

The positive attitude of listed companies towards Ethereum serves as the most direct and strong market trend indicator. In addition to the previously mentioned The Ether Machine completing a 654 million USD private financing for Ethereum, many companies are also planning to purchase Ethereum: biopharmaceutical listed company Propanc Biopharma plans to acquire 100 million USD worth of Ethereum within the next 12 months, and NASDAQ-listed ETHZilla (formerly 180 Life Sciences Corp.) intends to raise its fundraising scale to 10 billion USD to enhance its Ethereum reserves.

At the same time, a report released by on-chain options exchange Derive.xyz indicates that Ethereum is attracting increasing institutional demand from exchange-traded funds (ETFs) and corporations. Even though there may still be some volatility in capital flows in the short term, Ethereum has the potential for "explosive growth" in the fourth quarter.

Derive founder Nick Forster cited specific data, stating that last week, listed companies increased their holdings by approximately 330,000 Ethereum, surpassing the 250,000 Ethereum held by U.S. Ethereum spot ETFs. Currently, treasury companies hold about 4% of the total Ethereum supply, while ETFs hold 5.5%. Derive expects that by the end of the year, institutions may cumulatively hold 6-10% of the Ethereum supply.

Additionally, Geoff Kendrick, global head of digital asset research at Standard Chartered Bank, expressed a similar view. Kendrick believes that at current price levels, the valuations of Ethereum and its related treasury companies are significantly undervalued, indicating that there are undervalued investment opportunities in the market. He also predicts that Ethereum treasury companies will ultimately hold 10% of the circulating Ethereum supply. Despite the recent sharp decline in Ethereum prices, he still maintains his prediction that it will rise to 7,500 USD by the end of the year.

So, compared to Ethereum, is the Bitcoin DAT market about to peak? The author believes not necessarily.

In fact, Bitcoin as an asset class is gradually maturing, with its annualized volatility decreasing from nearly 200% over a decade ago to 38%. This "blue-chip" characteristic will prompt listed companies to shift from short-term speculation to long-term holding strategies, leading to a transition from explosive growth in purchasing behavior to stable allocation. At the same time, purchasing strategies among listed companies will also diverge, with large institutions turning to strategic allocations while small and medium-sized enterprises focus more on short-term price fluctuations.

However, the volatility and cyclical risks of the cryptocurrency market remain the biggest potential risks facing the DAT market. Binance founder Changpeng Zhao stated at the Bitcoin Asia 2025 conference that some companies may only use "Bitcoin Treasuries" as a tool for speculation, lacking real management capabilities. Market cyclicality is also a risk that cannot be ignored, as "most DAT companies must experience a complete bear market to truly prove their resilience."

It is important to note that the short-term volatility of cryptocurrencies is significant, which not only increases the difficulty for companies to allocate but also raises the financial risks of DAT. Additionally, DAT generally employs leverage strategies to amplify returns, acquiring funds through issuing convertible bonds or additional stock offerings to purchase digital assets. This strategy can magnify returns during market upswings but exposes vulnerabilities during market downturns. For example, when the cryptocurrency market enters a correction phase, DAT may fall into a negative feedback loop between stock prices and asset values.

Of course, as the number of DATs continues to grow, these companies may also begin to establish strict risk management frameworks to control leverage ratios. From the current situation, the DAT market is naturally transitioning from the early explosive growth phase to a mature and stable phase. In the future, with the improvement of regulatory frameworks and technological advancements, the DAT model may become a regular option for corporate asset allocation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。