作者:0xWeilan

受美国经济及就业数据影响,重启降息预期变化不定,主定价资金进出变化不定,叠加跨周期长手抛售及场内资金轮动,8月加密市场整体呈现“先弱-转强-再转弱”走势,价格呈“拱形”形态。

BTC全月下跌6.49%,收于108247.95美元。Altcoin代表ETH则劲升18.75%,收于4391.83美元。

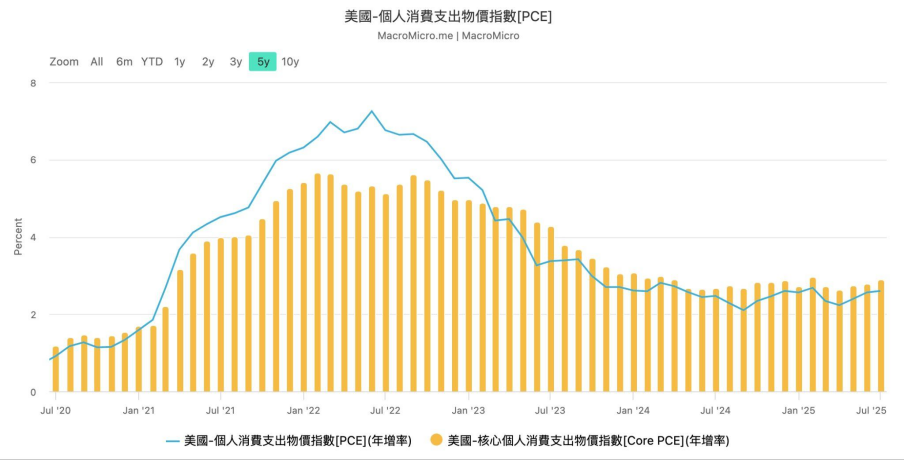

据eMerge Engine,目前BTC处于牛市上升期后期。在6月报告中,我们判断BTC在第三季度将启动第四波上涨并创出历史新高。这一判断在7月即获得印证,进入8月份,“对等关税战”影响开始在美国经济数据中体现,CPI和PCE均再现反弹势头。这使得市场对于9月重启降息的预期不断受到打击,使得对于降息重启定价过高的美股市场不断震荡。这一震荡通过Crypto Spot ETF传导至加密市场,使得月中创出历史新高的BTC最终向下定价,属于典型的风险偏好再平衡现象。

在波动过程中,资金并非持续流出,显得举棋不定。整体BTC本月仍然获得3.29亿美元资金流入。导致价格下跌的根本原因是加密市场内部的跨周期长手的抛售和板块轮动。

远古巨鲸的大幅抛售锁定了利润,榨取了并不充裕的流动性,同时在场内场外,亦有数十亿美元规模的资金从BTC流入ETH。EMC Labs认为,这共同构成了BTC价格创历史新高后再次跌返“特朗普底”(90000~110000美元)的根本原因。

目前市场基本完成了降息预期再定价,隐含定价为“9月降息,年内降息2次,计50基点”。后市在9月17日前,仍有多项经济就业及通胀数据待公布,市场仍将波折。

但降息重启,美国经济在AI资本支出及技术驱动的带动下“软着陆”,且就业数据下跌但不至恶化程度,仍是大概率事件。EMC Labs对9月行情持谨慎乐观态度,我们认为在经历短期必要震荡后,BTC将继续第四波上涨。

宏观金融:“通胀反弹”与“就业遇冷”拉扯降息预期

8月,美国资本市场主要受控于“经济及通胀数据表现、美联储何时重启降息预期、美联储独立性隐忧”三大变量的博弈。市场整体呈现先冷,再热,再冷的走势。

8月1日,就业数据率先登场。7月美国失业率环比上升,非农就业岗位增加7.3万个,远低于此前预期的10万个。与此同时,美国劳工统计局对5月和6月数据进行大幅下修,6月修正值竟超90%。

这一爆冷数据发布后,纳指当日大跌2.24%,BTC跟随下跌2.17%。受数据影响,FedWatch显示,美联储9月降息25个基点的概率从前一日的37.7%大幅升至75.5%。

当日美元指数大跌1.23%,此后持续下行。这一数据令市场9月降息的预期死而复燃,之后美股及BTC持续上行,BTC在8月14日创下历史新高124533.00美元。

8月12日,美国发布CPI数据符合市场预期,并未对市场形成明显影响。然而,已经完成降息充分定价的市场仍然对通胀数据保持着高度敏感。

8月14日,PPI数据发布,年化增长3.3%大幅高于市场预期的2.5%。因为忧虑生产端成本上涨最终会传导至消费者端,PPI数据初步挫伤了市场降息预期。BTC在创出历史新高后,启动下跌,一直跌到月底。同期,科技股主导的纳指开始走弱,资金从处于估值高位的科技股转入周期股和消费股,道琼斯开始走强。这意味着,降息预期并未破坏,但预期值出现了下调,资金开始寻求估值更安全的标的。

8月20日,Jackson Hole全球央行会议上,美联储主席鲍威尔今年来首次释放“最鸽”论调,暗示此后将更关注就业市场冷却情况,并可能降息促进就业市场回升。市场吃下定心丸,交易员将9月降息概率定价到70%以上,直至月底。

8月29日发布的核心PCE虽然基本符合预期,但录得年化2.9%增长,为2025年2月以来最高,显示潜在通胀压力略有增强。美三大股指均以下跌回应,但道琼斯指数跌幅明显小于纳指。

美国 PCE 指数年率

截止月底,市场对“9月重启降息,年内两次,共计50基点”完成充分定价。

为降息,美总统特朗普向美联储施压升级,月底直接在社交媒体上宣布因其“房贷文件作假”解雇主张不降息的美联储理事莉萨·库克。这一事件进一步提升了市场对于美联储独立性的忧虑。

加密资产:BTC重返“特朗普底”,ETH流入资金创历史记录

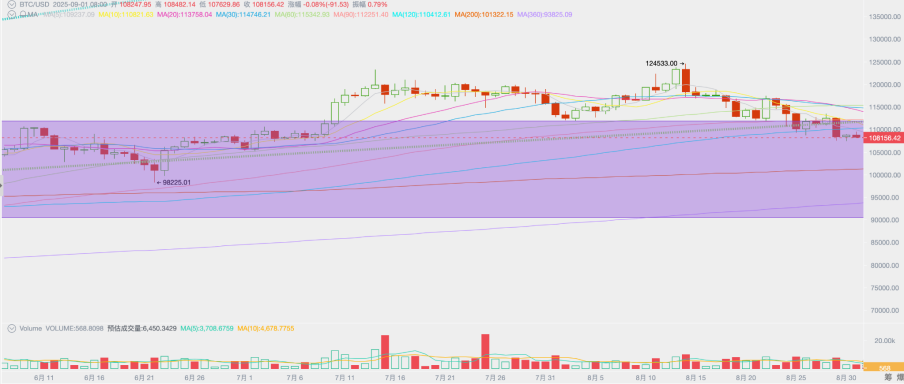

8月,BTC呈“拱形”走势。月初被大幅下修的就业数据打压,但很快被高达80%以上的降息概率推动重拾升势,并在8月14日创下历史新高。14日PPI数据发布后,在后半月走出持续下跌走势。

技术上,BTC受挫重返“特朗普底”(90000~110000美元),并且暂时破本轮牛市的“第一上升趋势线”和重要的120日线。

BTC价格日线

月度来看,在持续反弹4个月后,BTC单月回撤6.49%,成交量略有萎缩。本月BTC的价格下跌,可以视作“过高定价被修订叠加资金有所转向”双重作用下的技术回调。我们相信,随降息周期重启,市场风险偏好变化,主流资金将回流BTC,推动其继续本轮周期的第四波上涨。

BTC下跌基本与纳指联动,与降息预期有关。一般认为,市场进入降息周期之后,风险资产会持续走强。虽然BTC亦是高波动资产,但在加密市场内部,与Altcoin相比,BTC却被视作更具“蓝筹”属性的资产。

随降息临近和公链资产共识增强,场内场外资金加速流入ETH。

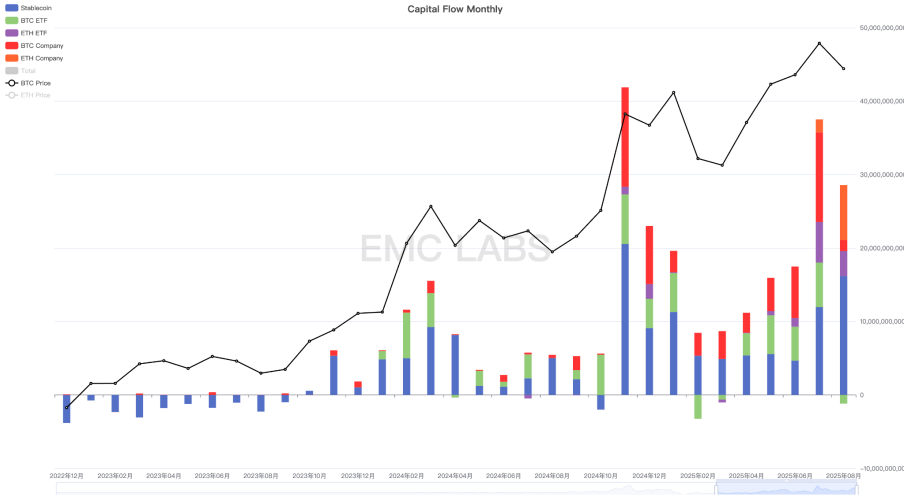

资金流向:ETH流入资金超BTC百亿以上

本月加密市场流入资金合计达到277.78亿美元,其中稳定币164.14美元,ETH Spot ETF 34.20亿、ETH 企业购买74.85亿、SOL ETF 2.26亿、BTC 企业购买15.05亿,但BTC Spot ETF流出11.76亿。

加密市场资金流入统计(月)

统计BTC目前主购买力,BTC Spot ETF与企业购买两个通道仅3.29亿美元流入,大幅低于上月。这是BTC本月表现疲弱的根本原因。

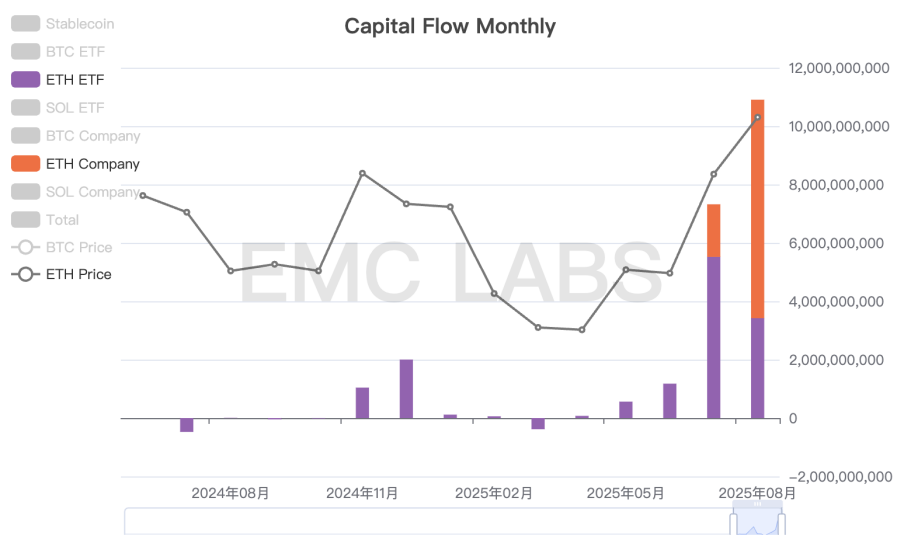

反观ETH Spot ETF及ETH企业购买则合计达到108.05亿美元,创下历史记录。EMC Labs认为,无论场内还是场外资金都明显出现从BTC流入ETH的趋势。

ETH资金流入统计(月)

其中原因有三。首先,过去数年BTC在美国等主要国家的共识已经基本完成扩散,更多资金开始将注意力投注到第二大加密资产ETH。其次,伴随美国进入加密友好时期,运用区块链技术改造传统金融产业的趋势开始出现,作为第一大智能合约平台的原生货币,ETH开始得到产业资本越来越多地的关注与配置。最后,本周期内BTC早已创出历史新高,而ETH仍未越过上轮牛市高点,叠加低利率环境Altseason终将爆发的历史经验,使得投机资金大举进入ETH,推动其价格快速上涨。

基于降息周期重启,风险在产再定价及Altseason的历史率,我们在上月报告提出Altseason正在打开,现在我们认为ETH处于本轮周期内价格再发现的中期阶段,后继仍有较大上行空间。而伴随降息重启,风险偏好提升,更大范围的Altcoin的价格才可能迎来基于投机买入而带来的价格快速攀升。

筹码结构:第三波抛售继续

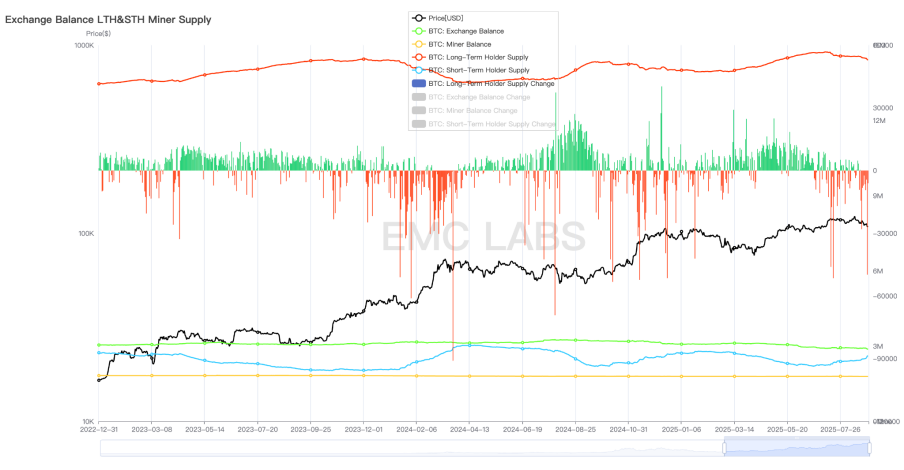

除了资金轮动,导致8月BTC与ETH价格分野的另一个重要原因是跨周期和周期内长手已经启动BTC本轮周期的第三波抛售(以往牛市只有两波抛售)。

在8月份,长手加速减持,减持规模超过15万枚,其中包括中本聪时期盈利规模庞大的远古账户。这些减持榨干了并不充裕的流入资金,推动价格向下再平衡。因单一实体规模巨大,远古巨鲸的抛售使得大幅卖出数据具有一定偶然性。目前长手持仓规模仍然高于2月,后继流动性增强,料抛售将持续进行。

长手、短手、矿工及中心化交易所持仓统计

以交易所视角来看,本月流出BTC为38620枚,略少于上月,符合牛市上升期特征。

结语

eMerge Engine显示,BTC Metric 为0.375,BTC处于上升中继期。

我们认为,在财库公司、Spot ETF和产业资本大举进入的今天,加密市场已经进入新的“主流化”的发展阶段。对于BTC来说,波动率将逐步下降,与美股尤其纳指关联度将日益加强。而对于ETH、SOL等智能合约平台资产来说,主流资本的进入只是刚刚开始,共识扩散必然带来重新定价的发生。

进入即将启动降息的9月,市场并不会一帆风顺,美股市场的高估值、美联储独立性等仍困扰着市场。

但周期仍将继续。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。