随着特朗普重新入主白宫,预测市场正在迎来史无前例的主流化浪潮。最新的一个大消息是:全球最大的预测市场 Polymarket 收到了特朗普长子 Donald Trump Jr. 风险投资基金的数千万美元投资,这位总统之子不仅以 1789 Capital 的身份参与投资,还将加入 Polymarket 的顾问委员会。

Polymarket 的这笔投资或许也意味着,其 IPO 的可能性远大于发币的可能性。1789 Capital 也是 Anduril 和 SpaceX 等明星公司的投资方,据知情人士透露,1789 Capital 创始人 Omeed Malik 与 Polymarket CEO Shayne Coplan 早在 18 个月前就开始接触,但直到公司在美国市场有了明确的合法路径后才正式投资。

而另一个有趣的现象是:预测市场的大多数项目大多数仍处于未发币状态,留给二级市场投资者的标的选择相对有限。即便是 Polymarket 这样的预测市场巨头,其最直接的投资标的也只是为其提供预言机服务的 UMA 协议。

在这样的背景下,律动 BlockBeats 精选了六个预测市场赛道项目标的。从 2 个月一百倍、将交易嵌入社交媒体实现病毒式传播的 Flipr,到构建基础设施层服务整个行业的 UMA 和 Azuro,再到通过 AI 算法实现完全自主交易决策的新兴协议,这些项目不仅在技术架构上各具特色,更在商业模式和用户体验上展现出截然不同的发展路径。需要特别提醒的是,本文内容仅为行业分析和信息整理,不构成任何投资建议。

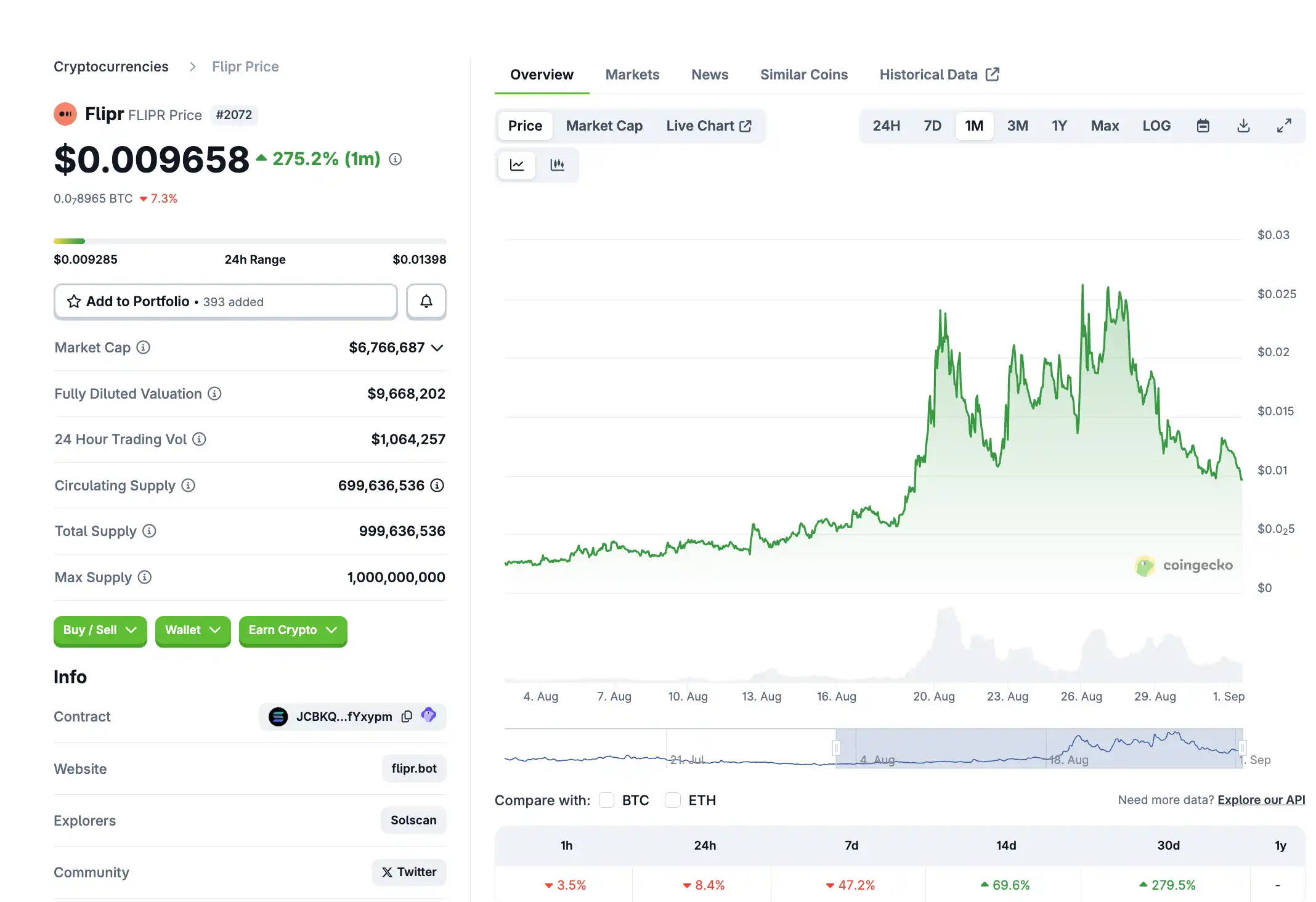

Flipr:2 个月百倍的社交预测市场

Flipr 定位为"预测市场的社交层",其核心创新在于将预测市场交易嵌入到 X(Twitter) 平台中,用户无需离开社交时间线即可完成下注。

用户只需在推文中标记 @fliprbot 并说明方向和金额,机器人即可解析指令并立即执行交易,执行后的订单会自动发布为引用推文,在 Polymarket 和 Kalshi 上下注,其他人也可以一键复制、反向下注或分享。这种设计将传统预测市场从孤立的网站界面转变为病毒式传播的社交体验,每笔交易都自然成为可分享的内容,从而大幅降低了用户获取成本。此外,Flipr 还推出了高达 5 倍杠杆、止损止盈和高级订单类型等功能。

在团队和融资层面,截至 2025 年 8 月,该项目团队成员身份仍未公开披露,保持匿名运营状态,迄今也未宣布任何股权融资轮次或风险投资者。

关于代币经济数据,据 CoinGecko 显示,截至 2025 年 9 月 1 日,$FLIPR 当前价格为 0.009951 美元,市值约为 696 万美元。值得注意的是,该代币在两个月内实现了从不到 200 万美元到峰值 2100 万美元的百倍增长,显示出强劲的市场动能。不过该代币于 8 月 25 日创下 0.02804 美元的历史高点后,当前价格较峰值下跌 64.5%,显示出从峰值的显著回调。

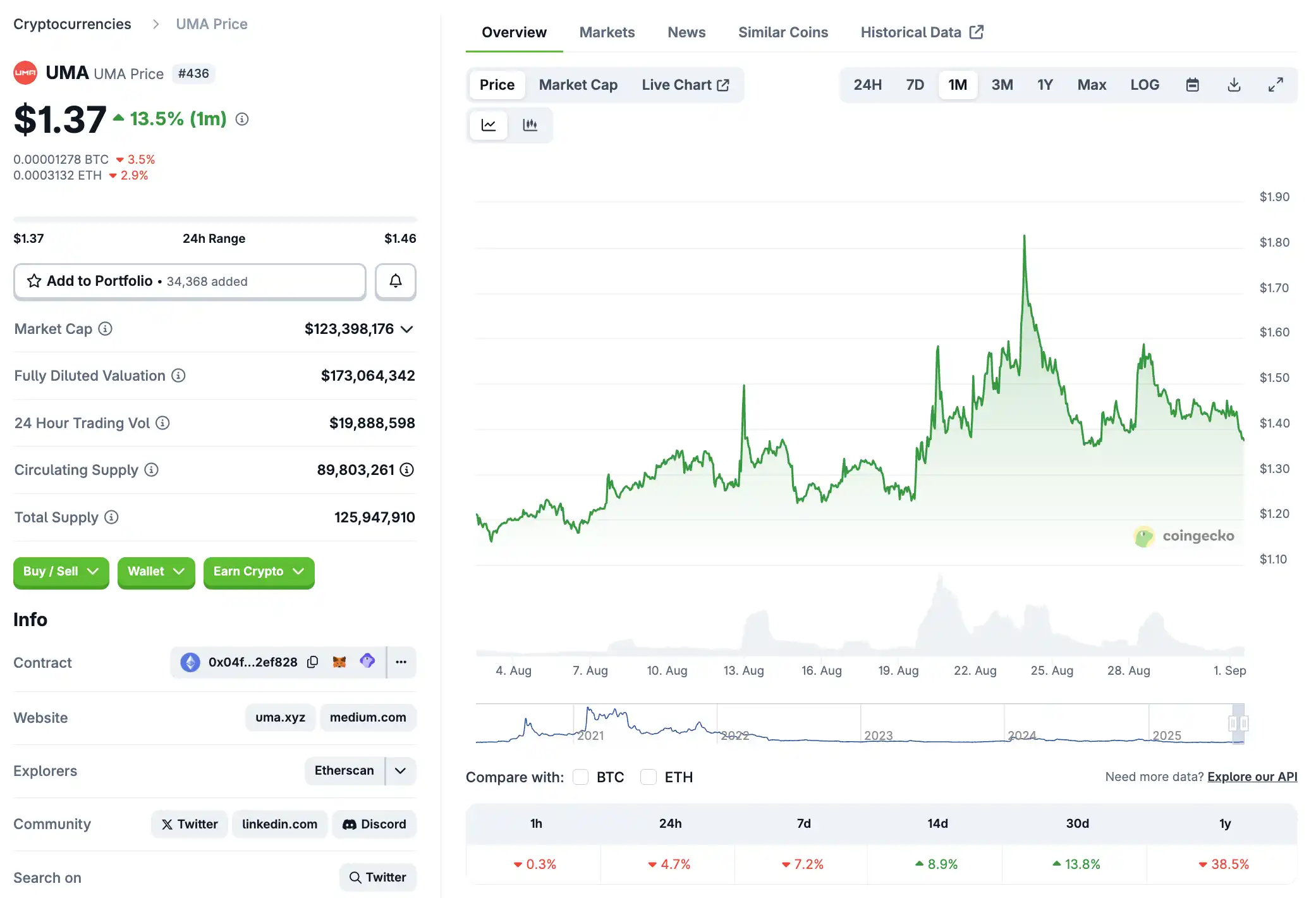

UMA:预测市场的基础设施之王

UMA 在预测市场中的地位不必多说,Polymarket、Across 等知名协议均采用 UMA 作为争议解决方案。

UMA(Universal Market Access)定位为"乐观预言机"协议,其核心创新在于构建了 Optimistic Oracle 与数据验证机制(DVM)的双层架构。据 UMA 官方文档,该协议采用"先假定正确,后争议验证"的工作机制,任何人可以向链上断言一条外部真值并抵押保证金,在预设的活跃期内若无人质疑即视为正确。这种设计使得绝大多数情况下无需投票即可给出结果,速度可达秒级且链上成本极低,同时通过 UMA 代币持有人在 48-96 小时内进行链下投票来解决争议。

融资层面,据 RootData 统计,UMA 自 2018 年启动以来累计完成 660 万美元融资,主要集中在早期阶段。2018 年 12 月的 400 万美元种子轮由 Placeholder 领投,Coinbase Ventures、Dragonfly、Blockchain Capital、Bain Capital Ventures 等知名机构参与。值得注意的是,项目在 2021 年 7 月通过创新性的 Range Token 结构完成 260 万美元融资,为 DAO 财库提供无抛压的流动性改善方案,参与方包括 Amber Group、Wintermute、BitDAO 等专业机构。相比动辄数千万美元融资的新兴 DeFi 项目,UMA 的融资规模相对保守,体现了团队对产品驱动增长而非资本驱动扩张的重视。

UMA 采用质押机制保障网络安全,据官方文档,质押者将 UMA 锁定在 DVM 2.0 合约中对预言机争议进行投票,可获得约 30% 的目标年化收益率以及错误投票者被罚没资金的重新分配。UMA 于 8 月 12 日激活针对 Polymarket 的"管理乐观预言机 V2"合约,将市场解决提案限制为白名单成员提交。

随着 Binance 于 8 月 26 日新增 UMA 交易对,市场预期流动性将进一步提升,但中长期表现仍取决于能否在保持去中心化理念的同时有效防范代币持有者捕获风险。

截至 2025 年 9 月 1 日,$UMA 价格为 1.38 美元,市值约 1.238 亿美元,14 日涨幅 8.9%,30 日内涨幅 13.8%,显示出积极的短期表现。该代币于 2021 年 2 月 4 日创下 41.56 美元的历史高点,当前价格较峰值下跌 96.7%,但近期走势相对稳定。

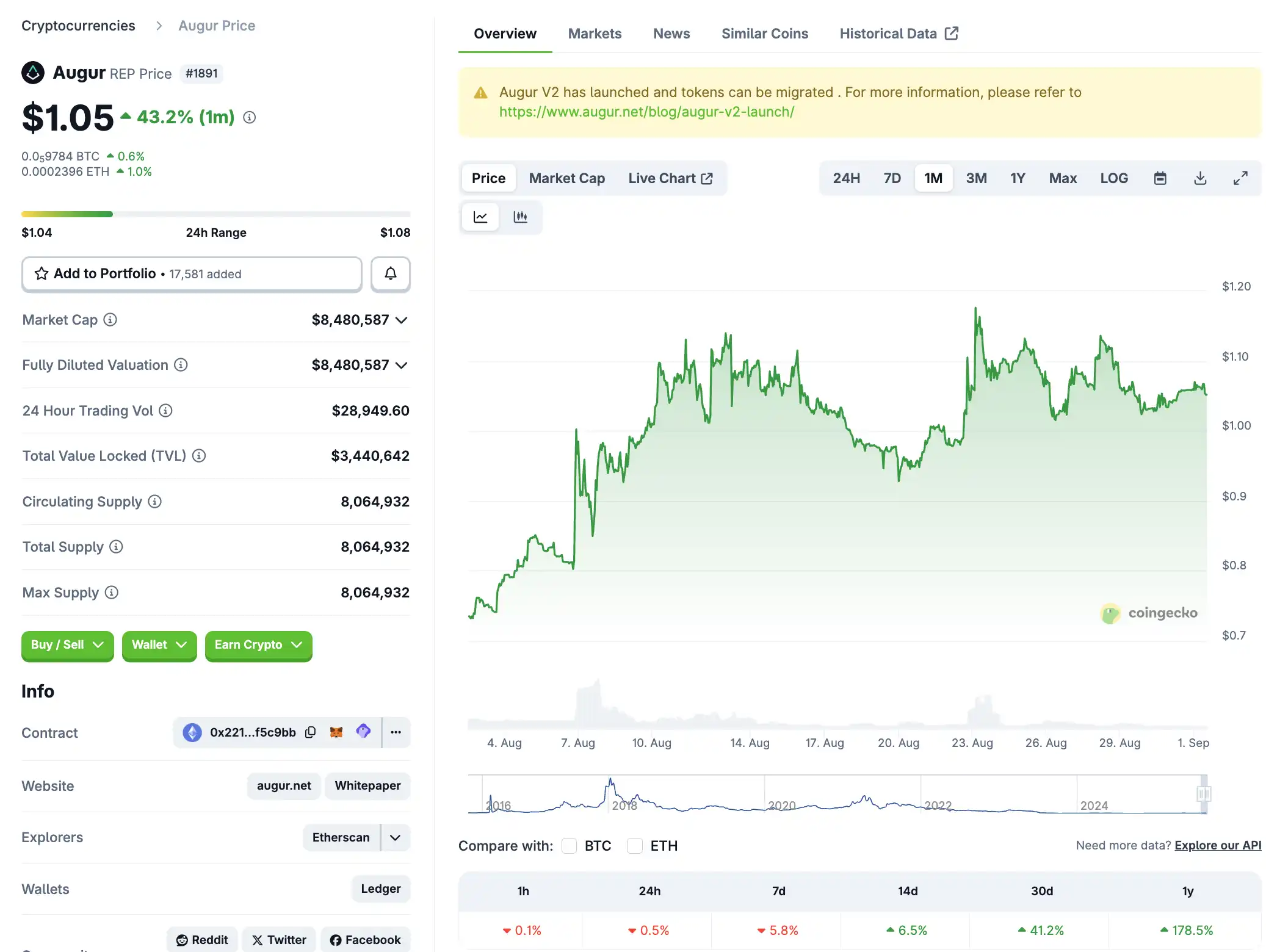

Augur:去中心化预测市场的开拓者

Augur 是以太坊上首个开源去中心化预测市场协议,可以说是去中心化预测市场的开拓者。

Vitalik Buterin 去年 11 月一篇关于预测市场的文章中,也提到了 Augur:「早在 2015 年,我就成为 Augur 的活跃用户和支持者(我的名字出现在维基百科文章中)。在 2020 年美国大选期间,我通过投注获得了 5.8 万美元。」

Augur 协议通过 REP 代币持有者对现实世界事件结果进行众包报告,不准确的报告将面临代币被罚没的风险,而与共识一致的报告者则可获得平台手续费分成。更为独特的是,Augur 设计了"分叉防共识失败"机制,当争议无法解决时,REP 持有者可以迁移到新的平行宇宙,这使得攻击预言机的经济成本极其高昂。可以视为是 UMA 的另一种替代方案。

团队构成方面,Augur 由三位具备深厚技术和金融背景的创始人共同创立。据 Forbes 报道,联合创始人 Joey Krug 目前担任 Pantera Capital 联合首席投资官,早期因开发马匹竞赛分析电子表格而对预测市场产生兴趣,最终设计出 Augur 的博弈论机制并主导了以太坊历史上的首次 ICO。另外两位创始人 Jeremy Gardner 和 Jack Peterson 同样活跃于区块链生态,项目顾问团队包括以太坊创始人 Vitalik Buterin 和 Intrade 创始人 Ron Bernstein 等行业重量级人物。

融资历史上,项目于 2015 年 8 月至 10 月期间进行 ICO,以每枚 0.602 美元的价格出售 880 万枚 REP 代币,总计募资约 530 万美元,主要投资方包括 Pantera Capital、Multicoin Capital、1confirmation 等知名机构。

市场反馈层面,$Augur 正经历一轮社区主导的复苏。正在推进流动性激励计划和新研究方向,面临流动性不足的挑战,相比早期预测市场平台表现较弱。截至 2025 年 9 月 1 日,REP 价格为 1.05 美元,总供应量约 806 万枚,已完全释放,市值达 850 万美元。30 日涨幅 41.2%,一年涨幅 178%。

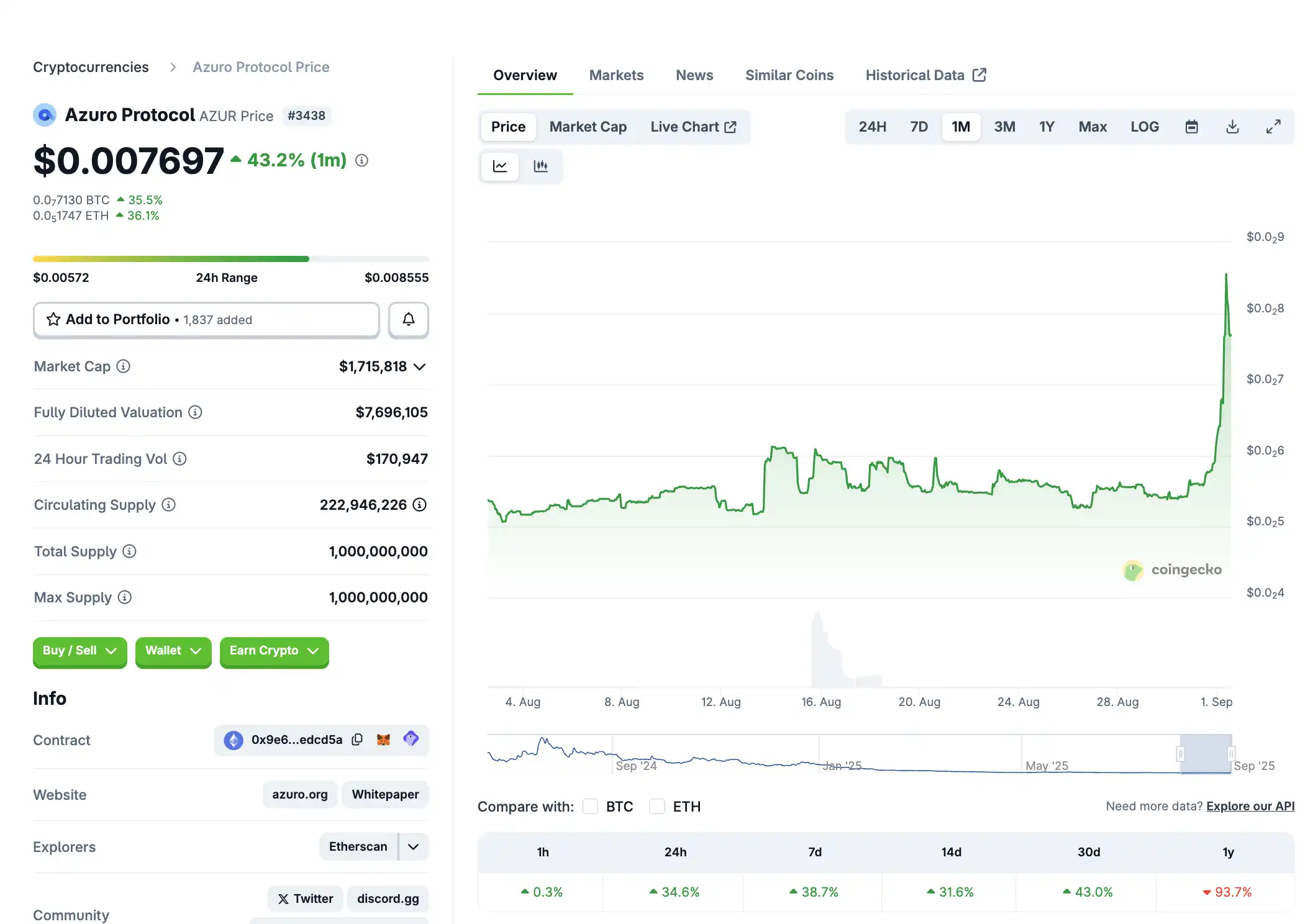

Azuro:传统博彩市场出身的团队

Azuro 定位为开放式白标基础设施层,让任何人都能在几分钟内启动链上体育和事件预测应用。据官方技术文档,该协议通过三个即插即用模块构建了完整的预测市场技术栈:单例流动性池(让应用接入共同资金池并支付费用,LP 赚取浮动收益并分享庄家盈亏)、数据提供商/预言机层(经批准的数据提供商创建"条件"市场并设置初始增强资本和保证金)以及前端钩子(现成的 React 组件,让品牌体育博彩或预测游戏无需后端即可启动)。这种设计将 Azuro 打造为"体育博彩界的 Shopify",前端应用保留自己的 UI/UX 并向协议支付投注盈亏分成,同时避免了许可证和资金池要求。

该协议的技术优势体现在其 LiquidityTree 虚拟自动做市商(vAMM)和共享单例 LP 架构上,这套系统处理赔率制定、流动性管理、预言机数据和结算流程,使前端无需构建自己的交易引擎。据官网统计,截至 2025 年 8 月,Azuro 支持 30 多个实时应用,累计投注量超过 5.3 亿美元,约 31000 个独特钱包参与,相比传统体育博彩,其无需许可的流动性和透明的链上结算为前端开发者提供了竞争性固定赔率的同时大幅降低了准入门槛。该协议目前运行在 Polygon、Base、Chiliz 和 Gnosis 四条链上,其中 Polygon 占据主导地位,可见 Azuro 在 Polygon 生态圈获得了显著的正面关注和战略定位。

团队构成方面,Azuro 由具备深厚传统博彩行业背景的创始人领导。创始人兼 CEO Paruyr Shahbazyan 曾是 Bookmaker Ratings 的创始人,在 iGaming 行业拥有 10 年以上经验。融资历史显示,Azuro 通过三轮融资累计筹集 1100 万美元,投资者阵容包括 Gnosis、Flow Ventures、Arrington XRP、AllianceDAO、Delphi Digital、Fenbushi 等知名机构。

截至 2025 年 9 月 1 日,$AZUR 总供应量 10 亿枚,流通量 222.95 百万枚(22%),价格 0.007894 美元,市值约 181 万美元。该代币于 2024 年 7 月 20 日创下 0.2396 美元的历史高点,当前价格较峰值下跌 96.6%,但近期表现出强劲的反弹势头,24 小时涨幅 41.5%,7 日涨幅 41.8%。

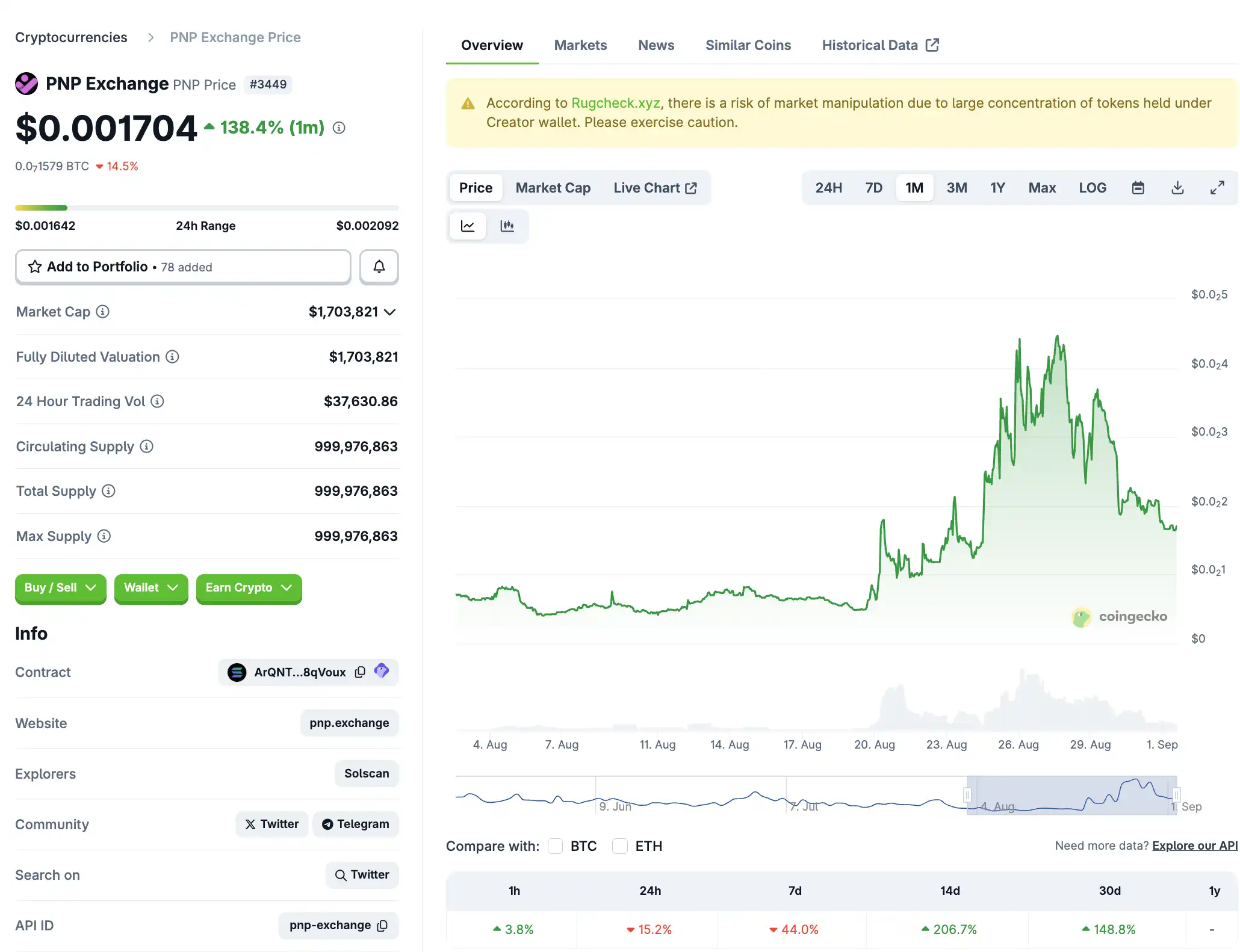

PNP Exchange:Solana 上的无许可预测 DEX

PNP Exchange 定位为 Solana 链上的无需许可预测市场 DEX,其核心创新在于任何用户都可以就"任何可以想象的话题"创建是/否市场,并从其联合曲线池中赚取 50% 的交易手续费。据项目官网介绍,该平台采用自动化联合曲线定价机制,实现即时链上结算。创新的是,PNP 集成了 LLM 预言机系统,通过 Perplexity 和 Grok 的共识加上链上数据源来自动解决市场结果,已成功在无人工干预情况下完成首个代币市场的结算。

该协议近期推出的"Coin MCP"模块展现了其技术迭代速度,用户可以针对任何代币的价格、流动性或市值创建 1 小时结算的预测市场。据项目创始人 8 月 28 日的社交媒体公告,即将发布的 SDK 将允许 AI 代理程序化创建和交易市场,同时 Gas 成本将在未来 2-3 天内下降 90%。这种"Pump.fun 式预测市场"的定位,通过移除上币门槛来区别于 Kalshi 和 Polymarket 等传统平台,使其成为用户生成内容驱动的 meme 化预测交易场所。

$PNP 代币采用完全流通设计,总供应量约 9.65 亿枚。据 Birdeye 数据,截至 2025 年 9 月 1 日,代币价格为 0.001665 美元,市值约 160 万美元。30 日涨幅 148.8%,24 小时交易量达 17.6 万美元,全部在 Meteora DEX 上完成。

Hedgemony:AI 驱动的自主交易算法

Hedgemony 定位为"完全自主的 AI 交易算法",专门针对全球新闻和政治情绪进行实时预测交易。据 DexScreener 信息,该算法每秒抓取约 2500 个实时新闻和政治信息源,包括特朗普的 X 账号推文、彭博社、路透社以及国家媒体渠道。

Hedgemony 通过毫秒级延迟的 Transformer 语言模型检测全球宏观新闻标题的方向性偏见,在信息公开传播前最多 60 秒的时间窗口内执行高频杠杆期货交易。

该协议的创新还体现在"意图导向执行层"的设计理念上,据官方介绍,Hedgemony 为用户提供了一个 AI 代理,能够通过提示式输入组装交换路由、美元成本平均计划、收益委托和基于叙事的投资组合策略。该系统目前在 Arbitrum 上运行 MVP 版本,计划扩展至 Base、HyperEVM 和 Monad 网络。

融资情况上,Hedgemony 完成种子轮延伸融资,自报估值约 10 亿美元,但具体融资金额并未披露。需要注意的是,这一估值声明尚未得到独立媒体报道或区块链既得权益披露的证实,投资者应对此类估值数据保持谨慎态度,特别是考虑到项目仍处于早期发展阶段。

代币经济数据方面,$HEDGEMONY 代币总供应量和流通量均为 10 亿枚,采用完全流通设计。截至 2025 年 9 月 1 日,代币价格为 0.005306 美元,市值 530 万美元,完全稀释估值与市值相等。7 日涨幅 64%,显示出积极的短期表现。

链上数据显示 557 个持币地址,流动性池总流动性 37.1 万美元,24 小时内 251 笔交易,78 个独立交易地址参与。值得注意的是,前 10 大持仓占比高达 66.57%,其中最大持仓地址独占约 50%,存在较高的集中度风险。项目仍处于非常初期的投机性采用阶段,存在极高的风险收益动态特征。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。