Socializing Predictive Trading with Leverage

Written by: ChandlerZ, Foresight News

From the end of June to late August this year, Flipr's price performance has been remarkable. Two months ago, its market capitalization was less than $2 million, and it was hardly noticed. As of August 27, the project's market cap has soared to a peak of $21 million, an increase of over a hundred times, with a 16-fold rise just in August.

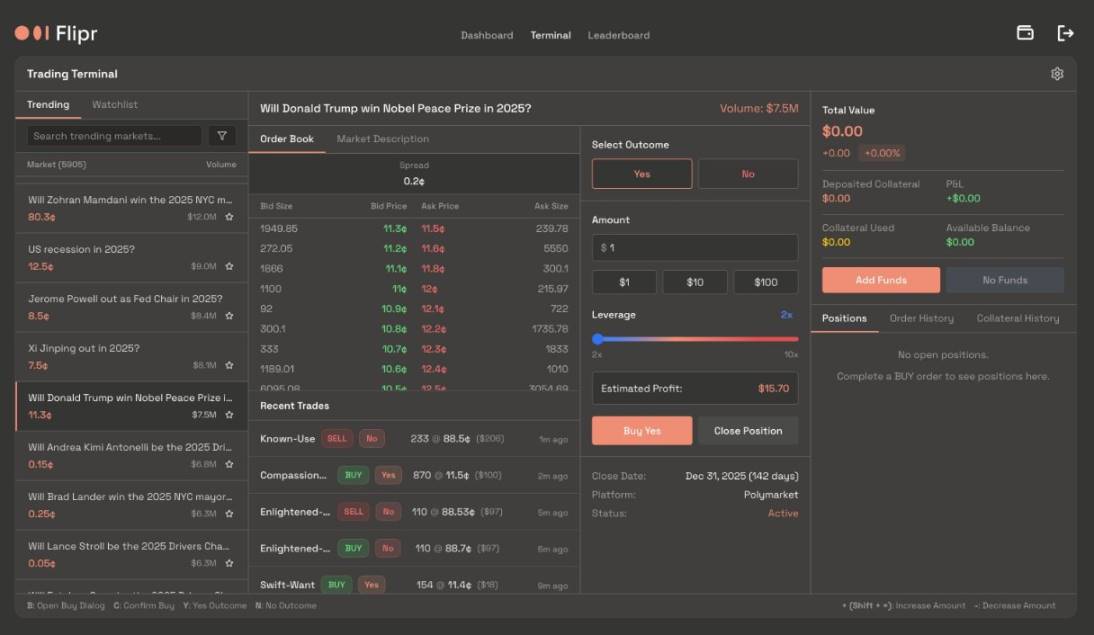

So, what exactly is Flipr? In simple terms, it is not a new prediction market but a social entry point for prediction markets. Unlike Polymarket or Kalshi, which require independent platforms and interfaces, Flipr has chosen a more lightweight approach: directly embedding into the social platform X.

What is Flipr: The "Social Layer" of Prediction Markets

Flipr officially launched in July 2025, with its core entry point being the trading bot Fliprbot operating on the X platform. Unlike traditional prediction markets that require users to navigate to independent websites, browse market lists, connect wallets, and then place bets, Flipr compresses the entire process into a social conversation.

Users simply need to tag @fliprbot on X or enter a natural language command in a private message, such as "Will Donald Trump win the Nobel Peace Prize in 2025?" along with the betting direction and amount, to complete the transaction directly. The betting information then appears on the timeline as content, becoming a social event that can be copied, forwarded, and questioned by others. Essentially, Flipr integrates trading and posting, making each bet publicly visible.

To lower the entry barrier, Flipr has integrated Privy's account system at its core and introduced derivative features such as leveraged trading and stop-loss orders. Betting is no longer an isolated action that requires redirection but a natural extension within the conversational context. Flipr even supports group chats and community embedding, allowing group administrators to create markets instantly within conversations, enabling users to discuss and bet simultaneously, making the prediction function a part of social interaction like chat stickers.

The logic behind this design is clear. Traditional prediction markets are more like tools for professional speculators, while Flipr aims to make trading a part of social interaction. However, it does not compete directly with Polymarket or Kalshi but chooses to reach users at the front end. Polymarket and Kalshi provide trading depth and compliance, while Flipr offers visibility and shareability. For prediction markets, this is a complementary relationship. Flipr acts as an amplifier, bringing specialized trading behavior into a more mainstream social context.

This product logic determines its dissemination advantage. Betting becomes a dynamic that can be forwarded, commented on, and challenged. The expression of opinions and the act of betting overlap in the same space, amplifying the visibility of trading across the entire social network. Flipr transforms the prediction market from a tool into content, and the content's diffusibility is key to its rapid rise in popularity.

On July 7, Flipr launched the Mindshare Mining event, lasting six weeks, distributing a total of 10 million FLIPR tokens as rewards.

Unlike common trading mining, it does not solely reward trading volume but has designed a more complex scoring system aimed at combining betting and social interaction. The scoring calculation covers five dimensions: the larger the trading scale, the higher the score users receive, which is the most intuitive part; the timing of posts is also considered, with content published earliest in the week carrying more weight, encouraging users to participate promptly; continuous posting is rewarded with additional points; at the same time, the project has built-in constraints against spam content, where excessively frequent posting will incur point deductions to avoid meaningless information flooding the community; user post interactions are also counted, with likes, comments, and shares directly affecting the final score.

The Landscape of Prediction Markets and Flipr's Future

Flipr's rapid rise makes sense within the development context of the prediction market sector. Over the past year, Polymarket and Kalshi have proven the scale and potential of prediction markets, but neither has launched a token, leading to a lack of direct narrative-bearing assets. Consequently, hot money has naturally flowed to Flipr, which has a small market cap and is labeled as a prediction market.

Meanwhile, the popularity of prediction markets continues to accumulate. Polymarket's trading volume exceeded $9 billion in 2024, reaching $2.6 billion in a single month during the U.S. elections, firmly establishing its position as a leading crypto-native prediction platform. Kalshi, with CFTC approval, has rapidly expanded in the compliance sector, approaching $2 billion in trading volume in 2024, with a post-funding valuation of $2 billion in 2025. Over the past two years, prediction markets have grown from marginal experiments to a rapidly growing niche sector.

According to official information, Flipr has now integrated with Polymarket and will soon integrate with Kalshi. Flipr does not attempt to compete with giants in liquidity or compliance but focuses on front-end experience. The X platform has 150 million active users daily, who are already in an environment driven by events and emotional expression. Flipr embeds the prediction market into this scenario, allowing betting and posting to overlap, thus lowering the entry barrier for users. For Polymarket and Kalshi, this "social layer" may be the missing link they currently lack.

More importantly, Ethereum co-founder Vitalik Buterin has publicly expressed support for prediction markets on multiple occasions. Over the past two years, Vitalik has become a leading advocate for prediction markets, repeatedly emphasizing their role in "information accuracy" and "cognitive correction." He pointed out that in token voting mechanisms, there is almost no penalty for choosing the wrong outcome, while in prediction markets, incorrect judgments lead to real economic losses, compelling participants to be more rational and often providing market prices that are more accurate than media sentiment. For him personally, prediction markets help him remain calm and not let social media amplify the importance of events, while also providing alerts when significant events actually occur. Vitalik thus views prediction markets as a social technology that can enhance rationality at the group level, aligning closely with the open governance goals of blockchain.

At the same time, he frequently discusses the application potential and improvement directions for prediction markets. Vitalik noted that most prediction markets currently lack interest compensation, limiting their attractiveness as hedging tools, but if this issue can be resolved in the future, related markets will generate a large number of hedging applications, significantly increasing trading volume. He also considers the combination of prediction markets and artificial intelligence, believing that AI-driven prediction markets could provide new pathways for community fact-checking, DAO adjudication, and even automated market-making. For example, he envisions embedding prediction markets in the "community notes" feature on X, using AI and small betting incentives to accelerate the confirmation of factual truths. Vitalik even ranks prediction markets alongside community notes as two flagship social cognitive technologies of the 2020s, asserting that they are built on public participation rather than elite control, serving as important tools for promoting decentralized social governance.

The key question for the future is whether Flipr can transform this short-term explosion into long-term stable growth. After the Mindshare Mining incentive program ends, if there are no new mechanisms to maintain the momentum, user activity may decline. If the collaboration with Kalshi can be further realized, Flipr has the opportunity to become the social front end for compliant predictive trading in the U.S. market, which would bring new growth opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。