撰文:Ben Strack

编译:AididiaoJP,Foresight News

在美联储主席杰罗姆·鲍威尔鸽派发言之后,现在似乎是一个进行换仓策略的好时机,尤其是随着时间的推移,宏观因素对加密货币市场的影响不断增大。

我们仍然不知道美联储在 9 月 17 日的会议上会做什么。但对许多人来说,鲍威尔的评论带有鸽派倾向,为下个月降息打开了想象空间。

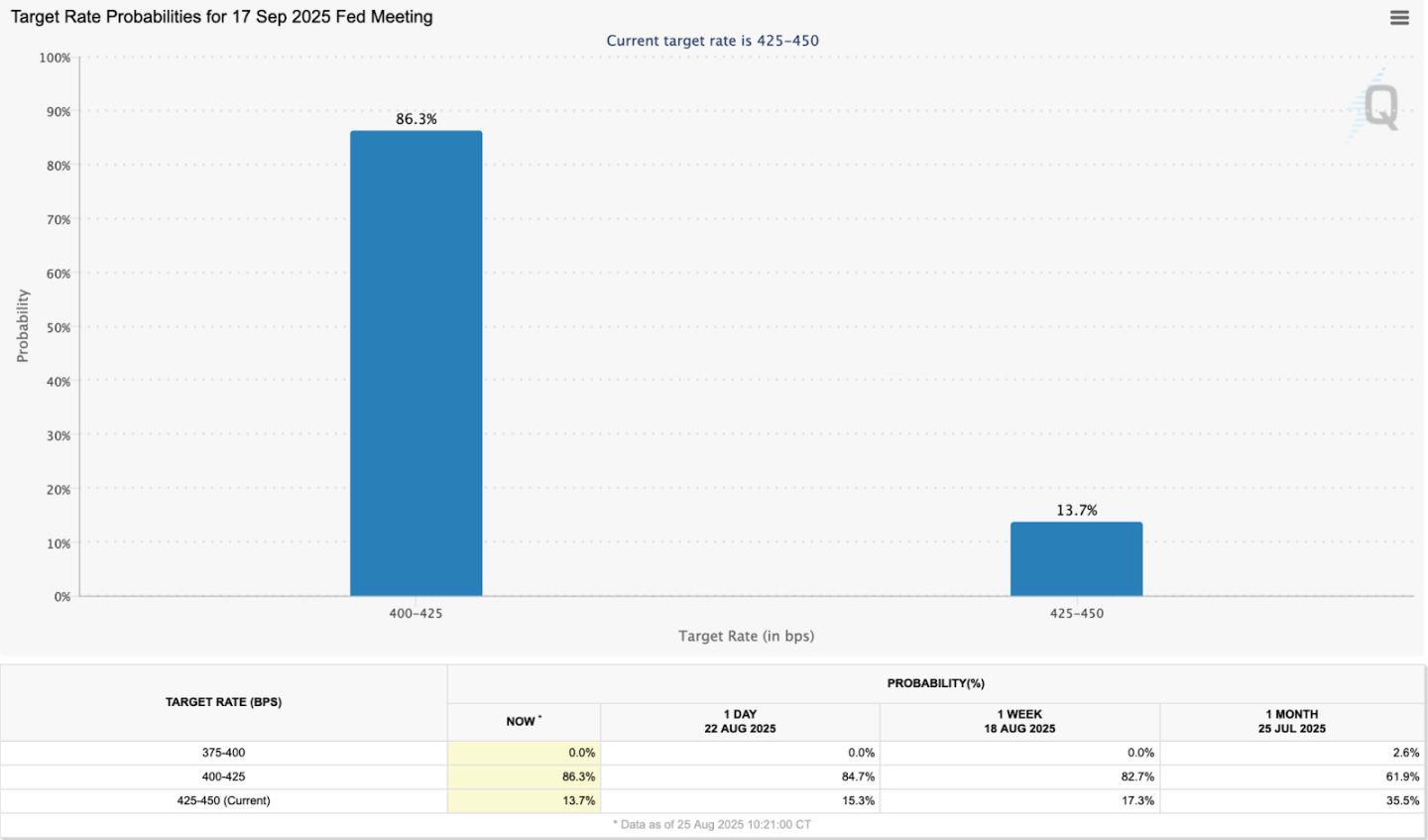

如果我们查看 CME Group 的 FedWatch 工具,基于 30 日期联邦基金期货价格,截至周一中午,许多人认为 25 个基点的降息是有可能的,这一预期远高于一个月前:

虽然降息通常对比特币等风险资产有利,但实际情况比这更微妙。比特币周五飙升至 117,000 美元以上,随后回落至 111,000 美元以下。该资产在东部时间下午 1:30 的交易价格约为 112,600 美元,目前已经跌破 110000 美元。

YouHodler 市场主管 Ruslan Lienkha 认为,加密货币市场走向的更广泛轨迹仍将取决于宏观背景。

「如果通胀压力持续存在,美联储可能被迫再次延长暂停期,限制单次降息的持续影响,」他告诉我。「此外,如果降息被视为对衰退的紧急应对措施,它可能会拖累加密货币以及其他风险资产。」

最佳情景?降息是美联储成功实现软着陆努力的一部分。

「在这种环境下,鉴于比特币作为最成熟数字资产的地位,它可能会吸引大部分机构资金流入,」Lienkha 说。「一些山寨币可能会表现更佳,因为它们具有更高的波动性和更低的流动性,当资金流动扩大到比特币之外时,会放大山寨币上涨倍数。」

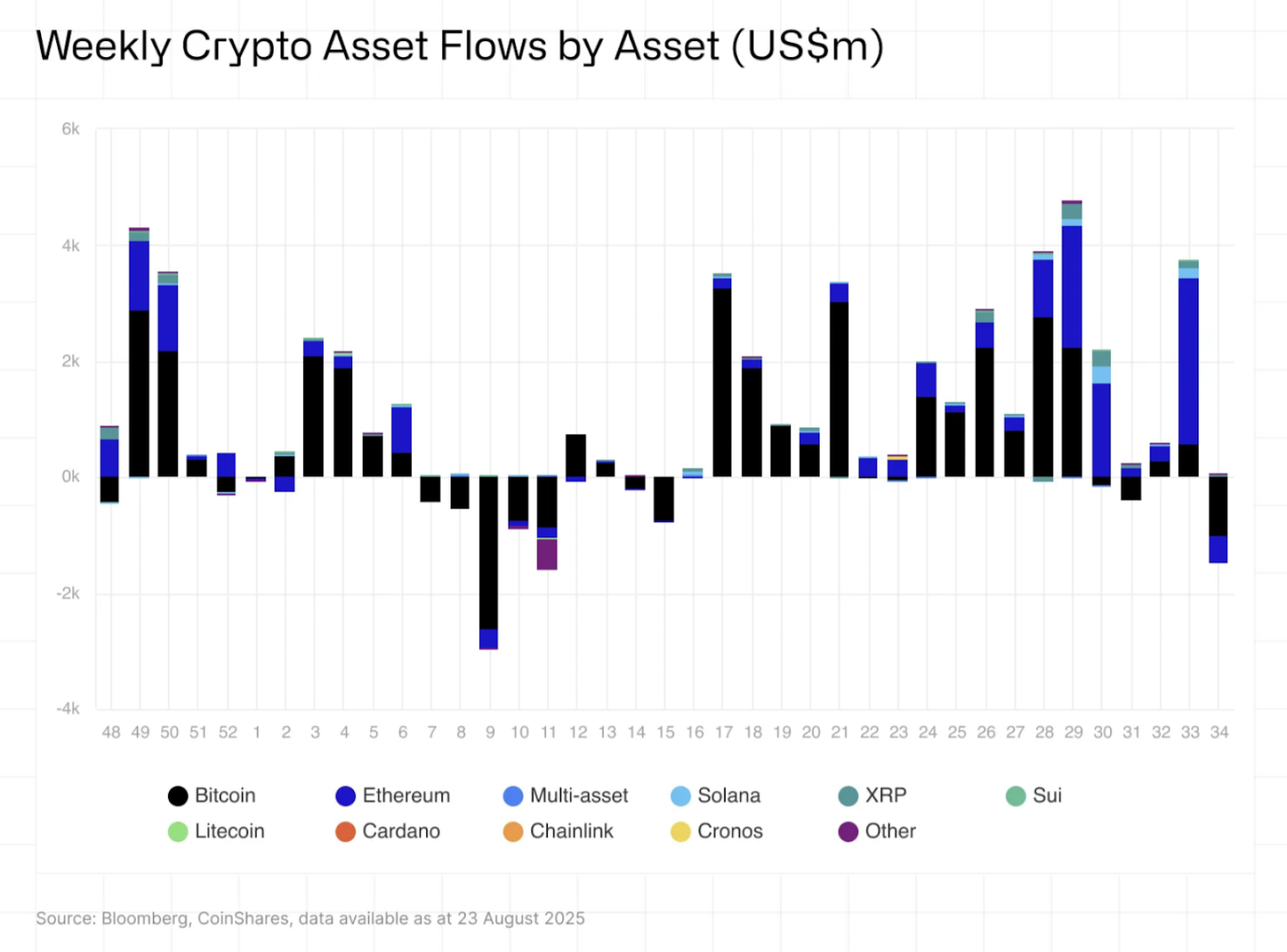

谈到机构资金流动,根据 CoinShares 的数据,加密货币投资产品上周流出超过 14 亿美元,这是自 3 月以来最高的单周流出总额。在这些数据中,我们看到周初对美联储立场的悲观情绪似乎推动了资金流出,随后在鲍威尔的言论后出现复苏(主要是以太坊产品)。

尽管周四和周五美国 ETH ETF 合计流入 6.25 亿美元,但这两天 BTC 基金流出 2.17 亿美元。本月至今,ETH 和 BTC ETF 的净流入分别为 +25 亿美元和 -10 亿美元,「标志着投资者对这两种资产的情绪发生了显著变化,」CoinShares 的 James Butterfill 指出。

投资者从周五得到了什么信号?

加密货币对冲基金 ZX Squared Capital 的联合创始人 CK Zheng 称,鲍威尔转向可能开始降息对风险资产类别「意义重大」。

他对比特币的年终目标在 125,000 美元至 150,000 美元之间。他预计 ETH 年终将在 6,000 美元至 7,000 美元之间。(周一下午徘徊在 4,600 美元左右)。

Globe 3 Capital 首席投资官 Matt Lason 表示,任何降息信号都证实了该对冲基金的多头持仓,因为更多流动性对加密货币至关重要。他预计当前加密货币牛市的强度将在第四季度达到最强。

预期的降息促使 Globe 3 Capital 将其更多持仓转向小市值代币,「因为我们看到了期待已久的山寨币季节的早期迹象,」Lason 补充道。

第四季度之后我们应该期待什么?50T Funds 创始人 Dan Tapiero 周末在 X 上引用摩根士丹利的研究发表了看法:

Zheng 表示,他预计在《GENIUS 法案》签署后,比特币的主导地位将继续下降,并估计稳定币市场将在未来几年增长 10 倍(从约 2,700 亿美元)。Coinbase 的最新模拟表明,稳定币市值可能在 2028 年底达到 1.2 万亿美元。

我们知道加密货币市场变化很快,但我认为这些「我们当前处境」的思考是值得的。即使一切在几周、几天或几小时内发生变化。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。