撰文:@MiyaHedge

编译:AididiaoJP,Foresight News

Launchcoin 创始人 Ben Pasternak,只要提到这个名字,整个加密推特都会患上创伤后应激障碍。一个市值 4000 万美元的代币却能占据如此高的心智份额,这告诉我一件事:代币化初创企业已经站稳脚跟,而且加密推特的每个人都非常希望这个概念能成功。

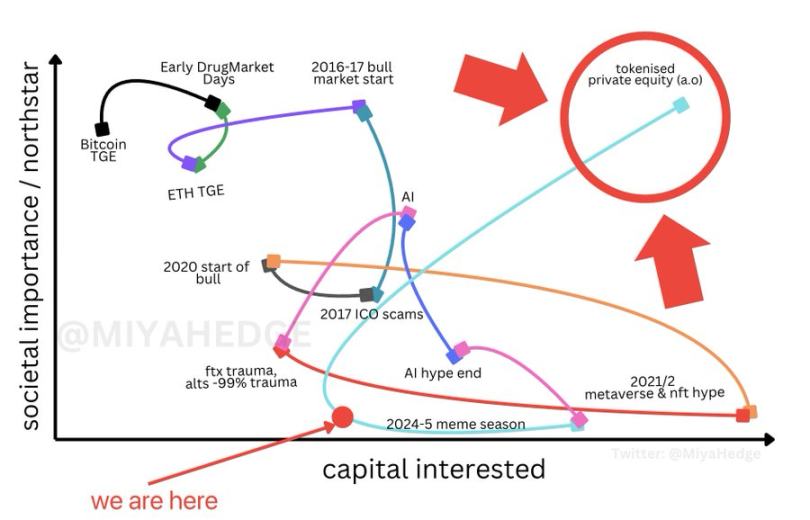

我曾概述了模因币是如何慢慢消亡的,自那以后,发生了很多事情;我们来快速回顾一下:

BonkFun 迅速消亡,正如预测的那样

PumpFun 重新赢得了市场份额,正如预测的那样

Heaven 出现,占据了模因币市场 14% 的份额

模因币市场的整体活动?在 8 月 17 日创下新低,每日活跃地址数仅为 12.4 万。你或许与我的观点不同,但数字不会说谎:模因币市场正在消亡。

但不会消亡的是代际之间向赌博、向金融虚无主义、向承担重大风险以获取不对称回报的转移。我们正处于超级赌博的时代。这正是为什么代币化在加密推特上从未真正兴起。如果你可以赌 CHILLHOUSE(预计 5 天内涨 10 倍),谁还会想去赌 Solana 上的苹果公司呢?代币化仍然是本轮周期中最大的传统金融主题,并且一年来一直如此。

RWA 虽然对社会很重要,但在加密领域内部从未引起过巨大的资本兴趣,但这一切在 Ben Pasternak 出现后开始改变。

我们正处于模因币时代的尾声和 ICM(Initial Coin Offerings,指代币化初创企业或相关概念)时代开端的某个阶段

尽管我们都喜欢嘲讽 Ben Pasternak,但我认为他在某种程度上是一位有远见的人。

初创企业 + 加密 Degen 文化是天作之合。

你第一次能够赌上真正的、由 T1 级硅谷风投支持创始人,而 Believe 为其创建了数字版的创业投资真人秀。大多数都是前提和愿景,实际的执行在节奏和框架上都存在不足。现在 LAUNCHCOIN 从高点下跌了 -87%,Ben Pasternak 成了整个加密推特的笑柄。

那么 ICM 现在死了吗?数字创业投资真人秀一直是个笑话,一个坏主意吗?

我认为不是。

投机总是流向任何能够维持叙事速度的东西。

-

在 1980 年代,是低价股。

-

在 2000 年代,是小盘股 IPO。

-

在 2020 年代,是狗狗币。

现在?是代币化初创企业。

为什么?因为它们正好处于每个利益相关者都想要的交汇点:

-

初创企业需要资金 + 分发渠道(distribution)。

-

投资者希望获得对早期创新的流动性敞口。

-

加密领域需要持续的新代币流入以维持周期。

私募股权的背景

2025 年全球私募股权是一个 13 万亿美元的市场,预计到 2030 年将达到 12-19 万亿美元。

目前它是封闭的:最低投资额 100 万美元,5-10 年的锁定期,不透明的报告,数万亿美元集中在 Blackstone、KKR、Apollo 等巨头手中。

因此,我们有数万亿美元的私人资产被锁住,而加密市场的零售端则渴望获得非空壳的新资产。这种不匹配就是套利机会。

我们还有年轻且渴望脱颖而出的创始人。下一代的创始人是长期在线、精通吸引注意力的高手。当 AGI 越来越近时,唯一能产生收入的就是以最有效的方式将你的“外壳”货币化的能力。技术将不再重要,这将变成一场游戏,看谁能以最好的方式推广他们的产品来聚集大量客户群。

这些 Z 世代的创始人精通模因语法,从青春期起就受训于驾驭算法推荐流。他们不仅仅是“创始人”,他们是文化运营者。实际的代码库可以被分叉、外包、由 AI 自动生成,但将其包装成一个病毒式叙事,迫使数百万人点击、分享并最终付费,这才是稀缺的技能。他们通过创建一个代币来武器化网络效应和注意力最大化,这个代币会自动吸引数百万用户使用他们的产品。这就是为什么代币化初创企业比未代币化的更具优势。

看看 Murad 的 SPX 游戏计划。“每天向一个人推广这个币以增加持有者数量”。对于 Believe 来说,你应该被激励去推广初创公司以增加其用户数量,如果开发团队围绕其代币做了正确的设计,也应该使代币持有者共同受益。这种用户飞轮对于代币化初创企业至关重要。

这完全符合当下的时代精神:他们推销的不是产品,而是一个附带着股票代码的实时叙事。创始人可以从第一天起就将他们注意力最大化的技能引导到一个可交易的对象上。每一条推文、每一次病毒式营销、每一个市场周期都直接转化为流动性。

代币化初创企业是不可避免的,因为它们满足了等式每一方的需求。

现在请不要误会:这不是为 LAUNCHCOIN 做推广,我认为 Believe 搞砸了,他们推出了一个只完成了 1/10 的产品,框架糟糕,并且像推广模因币一样推广这些代币,而你真正应该做的是将它们设计得尽可能接近证券。

ICM 如此火爆,但没人愿意持有一个代币超过 30 秒,这两者是相互排斥的。

我不知道这种叙事转变需要两个月还是两年才能展开。我这个月投入了六位数的资金,用于创建一个法律框架,允许初创企业进行代币化,同时不被认定为证券 。据我所知,至少有其他 5 个团队在做同样的事情。有一些人在暗处,在大型律师事务所的支持下,已经构建代币化股权法律框架近一年了。

我不知道这何时会发生,但过程会如下:

-

通过非证券模式进行代币化初创企业

-

中小市值估值公司通过证券模式在 IPO 前进行代币化

-

大型(10 亿美元以上)私营公司通过证券模式进行代币化

而你需要参与其中。

私募股权是加密领域尚未敢触及的最大未开发市场。

它简直完美契合加密文化。

类赌博性质,没有过度金融化,大量新公司涌入。

代币化初创企业将标志着代币化私募股权的开始,并将成为堕落者超级赌博、输光积蓄的新赌场。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。