Institutional entry changes the game, and traditional cycles may be broken.

Author: Aylo

Translation: Deep Tide TechFlow

First of all, it is nearly impossible to sell at the peak of a cycle. I can't do it, and I won't try to do it.

Cycle peaks usually appear in short-term trading charts (LTFs) and happen very quickly, often only becoming apparent when they manifest in long-term trading charts (HTFs).

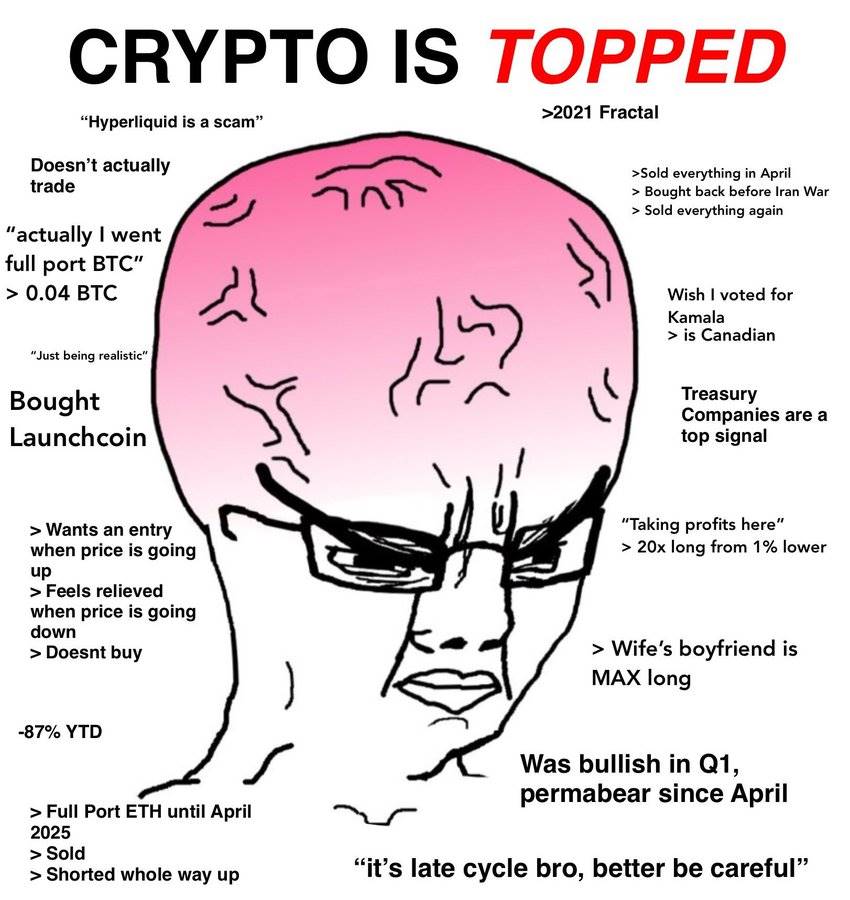

Day traders focused on short-term trading may catch cycle peaks, but they have predicted and been convinced of the arrival of cycle peaks so many times that such predictions become meaningless. They are not paying attention to the broader market context.

I am still exploring the market and learning continuously. I have not experienced enough market cycles to feel like an expert, so I am just sharing my genuine thoughts and observations here.

Please draw your own conclusions and make your own financial decisions. I do not know more than anyone else, and I will regularly change my views based on new data.

Arguments Supporting the Four-Year Cycle Peak

Perspective of Pattern Recognition:

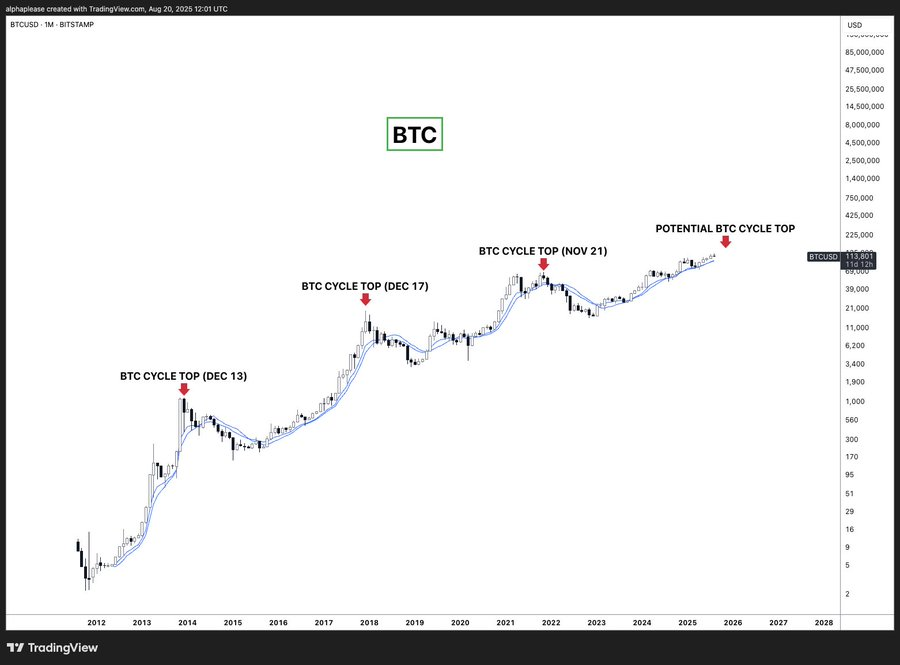

Looking back at historical charts, there is an undeniable clear pattern: December 2013, December 2017, November 2021. The four-year cycle has behaved remarkably consistently, and patterns in the market tend to persist until fundamentally broken.

Reasons This Pattern May Continue:

Deeply Rooted Psychology: The four-year cycle is deeply embedded in the collective consciousness of the crypto market.

Self-Fulfilling Prophecy: This widespread recognition may trigger coordinated selling pressure, combined with latent leverage in the system (possibly DATs?).

Halving Effect Correlation: Bitcoin halving causes supply shocks, typically occurring 12 to 18 months before peaks (though in this cycle, it seems more narrative-driven than actual impact).

Occam's Razor Principle: The simplest explanation is often the correct one—why complicate a pattern that has succeeded three times?

We have clearly entered the later stages of this cycle—Bitcoin has achieved significant gains since the bottom. The pattern suggests we may be approaching a peak time window.

Arguments Against the Four-Year Cycle Peak (2026 Theory):

Perspective of Fundamental Change:

I pose a simple question: Can a cycle driven by institutions really be exactly the same as the previous two cycles driven by retail?

I generally believe in the existence of market cycles, so I won't discuss the so-called "super cycle" here, but I think cycles may be shortened or extended due to other factors.

Reasons This Time May Really Be Different:

- Institutional Behavior Patterns vs. Retail Behavior Patterns

Spot ETF fund flows and traditional exchange fund flows have created a whole new liquidity pattern.

Institutional systematic profit-taking is smoother and less prone to panic-driven actions, whereas retail behavior is more volatile.

- Traditional Indicators May Fail

We have a plethora of cycle analysis tools (like NVT, MVRV, etc.), but their historical scope is based on retail-driven markets.

Institutional participation fundamentally changes the definition of "overextension."

Currently, Bitcoin has not even surpassed the previous cycle's peak when priced in gold—hardly a bubble state.

- Revolution in Regulatory Environment

The market environment of this cycle is completely different, with the U.S. and SEC's acceptance clarifying the institutional framework.

Previous cycles ended partly due to regulatory shocks (like the ICO crackdown in 2018).

The risk of a systemic shock ending the cycle has significantly decreased.

- Macroeconomic and Federal Reserve Dynamics

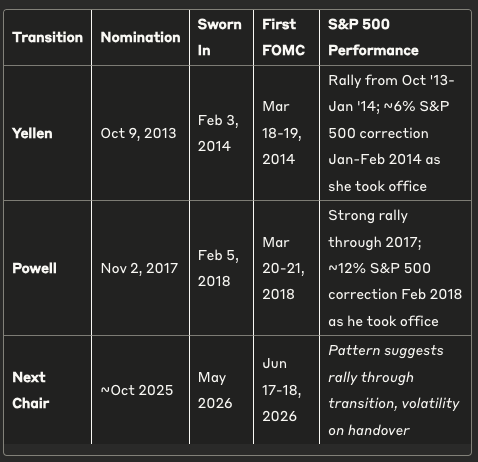

Federal Reserve Chairman Powell's term will end in May 2026, and Trump is expected to announce a new chairman candidate by the end of 2025.

The "shadow Fed chair" dynamic undermines the effectiveness of current policies, while market expectations of a moderate chair nominated by Trump may create early buying pressure.

The first FOMC meeting of the new Fed chair is scheduled for June 17-18, 2026—potentially a cycle catalyst.

The transition period may extend the "Goldilocks environment" (referring to economic stability and moderate interest rates).

Historical Patterns of Fed Chair Transitions: Reviewing past transitions can provide a compelling market cycle template.

Stable Patterns:

Both transitions exhibited similar sequences: nomination announcements triggered market rallies, continuing into the transition period, but the S&P 500 adjustments occurred precisely when the new chair took office.

During Yellen's transition, the S&P 500 experienced about a 6% decline from January to February 2014.

When Powell took over, the S&P 500 saw about a 12% adjustment in February 2018.

This pattern suggests that Trump's expected announcement of a new chair nomination by the end of 2025 may extend the bull market into the transition period, while the probability of significant volatility during the transition in May to June 2026 is high—potentially aligning with the peak time window.

- Changes in Market Structure

Concerns About Currency Devaluation: This factor is creating new demand drivers, no longer limited to traditional risk appetite cycles.

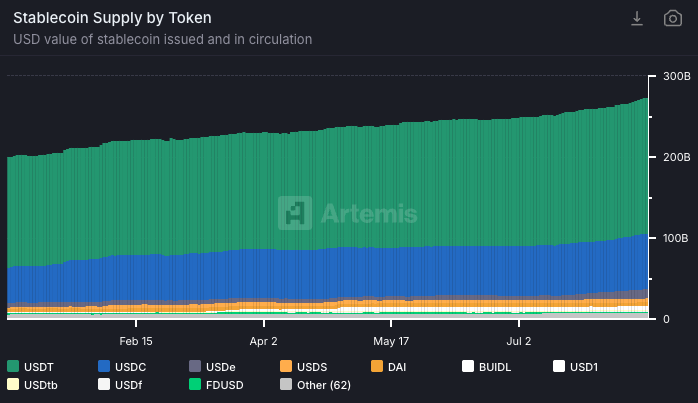

Stablecoin Market Cap as a Leading Indicator: Stable growth, becoming a key metric for measuring market "gunpowder" (potential purchasing power).

- Diverse Sources of Bitcoin Demand: Including ETFs, DATs (Digital Asset Treasuries), pension funds, etc., broader than in previous cycles.

What Could End the Cycle Early and Lead to the Return of the Four-Year Cycle?

DAT Leverage Risk: I believe the strongest bearish factor is that digital asset treasury companies may liquidate leverage faster than expected. Major forced sellers could overwhelm buyers, changing the market structure. However, losing purchasing demand (mNAV close to 1) and becoming a forced seller that triggers a "violent drop" are different.

Nonetheless, losing the purchasing power of major DATs is clearly a significant impact. Many speculate that this situation has already occurred, especially as the mNAV of Strategy and major ETH DAT companies has significantly declined. I am not blind to this, and you shouldn't ignore it either, so it is worth keeping a close watch.

Macroeconomic Risks: A resurgence of inflation would be a major macro risk, but I have not yet seen relevant evidence. The crypto market is now highly correlated with the macro environment, and we are still in a "Goldilocks" state (economic stability and moderate interest rates).

Missing Elements of the Cycle Peak

Euphoria Has Not Yet Emerged:

The market has not yet shaken off its worries, with every 5% pullback triggering predictions of cycle peaks (which have lasted for 18 months).

There is a lack of sustained market euphoria or consistent market consensus on the rise.

There has been no "explosive peak" behavior (though this is not a necessary condition).

Potential Signals: If the crypto market experiences a significant rise later this year and significantly outperforms the stock market, this "explosive peak" signal may indicate that the crypto market's cycle peak will occur earlier than expected, extending into the 2026 business cycle.

Stablecoin Leading Indicators

A particularly noteworthy indicator: Growth in Stablecoin Market Cap.

In traditional finance (TradFi), the growth of M2 money supply typically precedes the formation of asset bubbles. In the crypto space, stablecoin market cap plays a similar role, representing the total "dollar" supply available within the crypto ecosystem.

Past major cycle peaks have often coincided with stagnation in stablecoin supply 3-6 months before the cycle peak. As long as stablecoin supply continues to grow significantly, the crypto market may still have the "fuel" to drive further increases.

My Current Viewpoint

To be honest, I currently believe based on existing observations that I think a significant cycle peak will not occur until 2026 (this is a vague viewpoint that could change rapidly).

Regarding the four-year cycle, we have limited data points (only three instances), and institutional participation has brought fundamental changes to market structure. The dynamics of the Fed chair transition itself may extend the "Goldilocks" environment into 2025, which I believe is particularly important, especially as the correlation between the crypto market and the macro economy reaches unprecedented heights.

In this cycle, crypto market participants have a broader awareness of the "four-year cycle" pattern, which leads me to believe the outcome may be different. After all, when can the market at large accurately predict the trend? Will everyone sell assets according to the four-year cycle pattern and then collectively welcome a bountiful outcome? This is clearly worth pondering.

Nevertheless, I acknowledge that the four-year cycle pattern has been very consistent, and market patterns typically persist until they are broken. The widespread recognition of this cycle among market participants could indeed lead to a self-fulfilling prophecy, thereby ending this pattern.

As Bitcoin's dominance (BTC.D) declines, I will continue to take profits in the overbought altcoin market, but I still hold Bitcoin and believe it will reach new highs in 2026. It is important to note that regardless of how the broader cycle evolves, your altcoins could reach their cycle peaks at any time.

Final Thoughts

The four-year cycle pattern is the strongest argument supporting a peak in 2025—this pattern has successfully operated three times, and simple logic is often more persuasive. However, changes in institutional market structure, the dynamics of the Fed chair transition, and the lack of signals of market euphoria all suggest that this cycle may extend into 2026.

Many changes may occur in the coming months, so there is no need to be overly dogmatic or stubborn.

In any case, one must accept the fact that you cannot sell precisely at the absolute peak of the market; it is wise to develop a systematic exit strategy.

The appropriate investment exposure is one that allows you to sleep peacefully at night. If you have already made a decent profit, selling "too early" is perfectly acceptable.

I welcome a variety of viewpoints, including those that differ from my own. The purpose of this article is not only to help me make decisions but also to learn and grow in a public environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。