Ethereum ETFs Outflow With Bitcoin Moves Are Reshaping Crypto Market

Crypto markets are facing continuous outflows from the past 4-5 days. On August 15, Bitcoin and Ethereum ETFs showed outflows together with $14.13 million and $59.34 million and followed it till today, as per the data recorded by SoSo Value . Let’s take a deep dive, knowing market moves and the reasons behind it.

Ethereum ETFs Hit Record Outflows, Crossing $422.30M

As per the data from above mentioned site, Ethereum ETFs recorded a daily net outflow of $422.30M which surpassed the previous one of $197M and attained the second highest position in ETH Exchange Traded Funds history.

Despite this dip the product still holds its Total net asset value of $25.94B which is 5.17% of Ethereum market cap and in Cumulative total net inflow of $12.05 billion.

Source: X

Whereas the weekly trend shows a reduction with $196.62M and if you see the data of last week then Ethereum ETFs has reached its all time high of $2.85B.

As per the record of August 19, Blackrock (ETHA) is showing a daily reduction of $6.27M with a Cumulative inflow of $12.07B, Grayscale (ETHE) with a reduction of $122.05m and Fidelity(FETH) with $156.32 million.

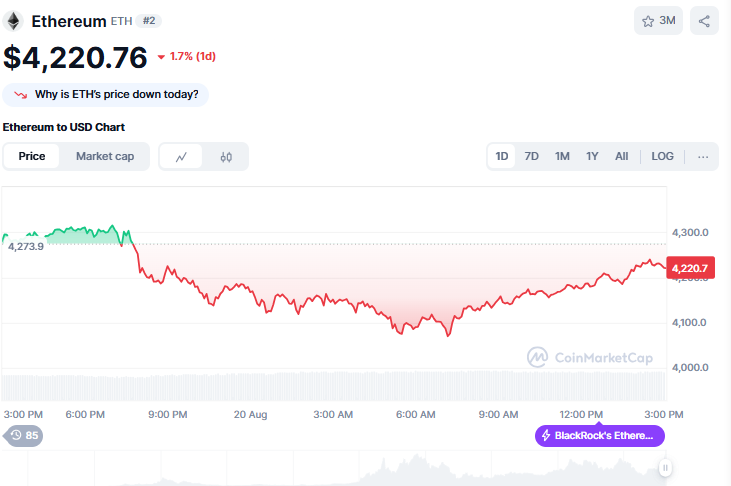

As per the data from CoinMarketCap the Ethereum market is running down today by 1.7% and trading at $4,220.76 at the time of writing, it might be due to investors taking profits and turning cautious ahead of Powell’s Jackson Hole speech which is on August 22.

Source: X

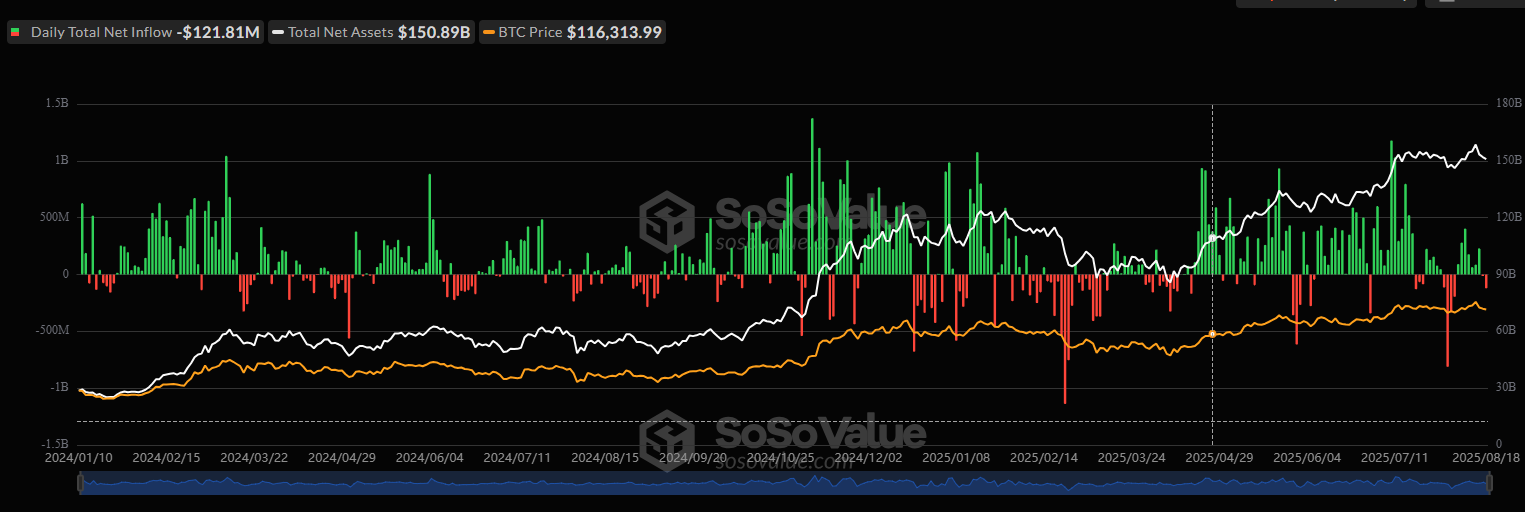

Bitcoin ETFs records $523.31M

As per the data, updated data of today on SoSo Value, Bitcoin Exchange Traded Funds are also showing outflows from the past 4-5 days. After August 14, it shows continuous red signals with a daily total net inflow of $121.82. The total net asset value of Bitcoin ETFs is $146.20B which is 6.47% of Bitcoin market cap and the total value traded is $4.75B with a cumulative sum inflow of $54.33B.

Source: SoSo Value

Fidelity (FBTC) has shown a reduction of $246.89million with a cumulative sum inflow of $58.60B, Grayscale (GBTC) with $115.53million and Bitwise (BITB) with $86.76million. That shows that investors are aggressively swelling their shares which directly gives a huge impact on the Exchange Traded Funds.

Today Bitcoin prices are running down by 1.71% and currently trading at $113,581.55, and showed today’s lowest dip by reaching $112,600.64. This nature of the market that big firms are selling their shares, Fed rate cuts are not decreasing still stands up to 4.25%-4.5%.

And Exchange Traded Funds outflows directly impact asset prices as the users are selling BTC to meet redemptions.

Source: CMC

Who leads in the weekly flows?

If you see the monthly data of inflows then the huge difference would be noticed as the total monthly inflow of Bitcoin Exchange Traded Funds of July was $6.02 Billion whereas this month it shows a sudden huge dip of $139.48 million which affects the crypto market and staggers investors confidence.

On the other hand Ethereum ETFs hasn’t shown outflows as compared to the monthly data, last month the total net inflow was recorded at $5.43 billion which is the highest monthly inflow of the Ethereum ETFs history but this month it showed a dip and is at $2.83B.

Ethereum ETFs are leading the market by showing green signals in monthly inflows whereas daily inflows are showing red signals of both assets. It can now be maintained by if big firms like Strategy , Blackrock, Coinbase, MARA holdings, Sharplink and Bitmine purchase assets it will boost market and investors confidence.

There are still 10 days left in this month, and all eyes are on Powell’s speech on August 22. His words could decide the market’s next move. Until then, investors should stay hopeful and wait for a possible recovery.

Conclusion

Crypto markets are under pressure with heavy Exchange Traded Funds outflows, but investors are still looking toward Powell’s speech for a possible turnaround. Staying patient and positive could be the key as the month isn’t over yet.

Also read: ARI Wallet Daily Quiz Answer 20 August 2025: Earn 10 Coin免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。