The fluctuations in the cryptocurrency market are like the waves in a turbulent sea, making people feel anxious. However, its charm lies in the fact that it never looks at your past report card. Stop saying "I'll enter the market when it stabilizes"; opportunities in the crypto world never lie in "stability." The real dividends always belong to those who dare to position themselves amid uncertainty. Market volatility is not a risk; failing to understand trends is the biggest risk.

On August 19, Bitcoin encountered a "Black Tuesday," with its price plummeting from a historical high of $125,000 to below $113,000, a single-day drop of over 3%. As of 3 PM on August 20, the price was around $113,600, rebounding from the previous day's low but still down about 8.4% from last week's peak. This drop was mainly influenced by the decline in U.S. stocks and the uncertainty in the international macro situation.

From the daily chart, Bitcoin has continued to decline after breaking new highs, lacking buffer space. $111,000 is a very important support level. If the closing situation this week is not good, a larger "double top" pattern may form on the weekly chart, which could mean at least a month of consolidation to digest.

Single trading operation suggestion: If the price rebounds to the range of $114,300-$114,600, consider shorting, with a stop loss set at $115,300 and a target looking towards the $112,600-$112,900 range.

Multiple trading operation suggestion: If the price drops to around $112,000 and can find support, consider lightly going long, with a stop loss set near $111,500.

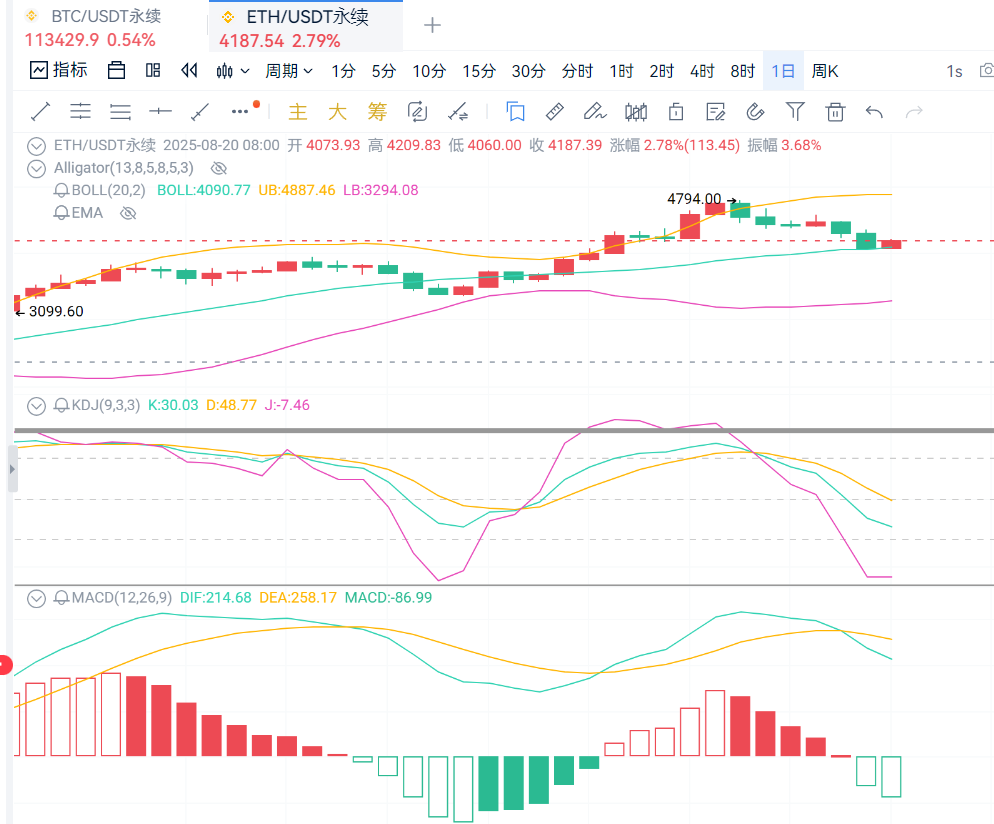

Ethereum mirrored Bitcoin's plunge, with the price dropping to $4,100 on August 19, a single-day drop of over 6%, before rebounding to around $4,230. On August 20, it fell again to around $4,060. After stabilizing at $4,100, it rose back to around $4,200, showing a "sharp drop and slow rise" characteristic.

From a technical indicator perspective, the $4,000 level is an important psychological and technical support level, where the 30-day moving average is located. Currently, the first resistance level below is at $4,150, with strong support at $4,000. If it breaks below $4,000, it may trigger accelerated selling, potentially dropping to $3,800 or even $3,500. The strong resistance above remains at $4,350; if a breakthrough occurs, it may test around $4,600.

Single trading operation suggestion: If it rebounds to $4,260-$4,280 and meets resistance, consider lightly shorting, with a stop loss at $4,300 and a target of $4,180.

Multiple trading operation suggestion: If the price retraces to around $4,130-$4,160, consider entering a long position, with a stop loss at $4,100 and a target of $4,230-$4,260.

Due to the timeliness of price points, there may be delays in post review; specific operations should still be based on real-time market conditions. The above trading range analysis is for reference only. The cryptocurrency market is highly risky, so please manage your risk well and make cautious decisions when investing. If you are interested in specific indicator analysis or the impact of new market dynamics on prices, feel free to scan the QR code for the public account in the article below. You are welcome to visit.

Warm reminder: The content of the above article is original by the author. The advertisements at the end of the article and in the comments section are unrelated to the author; please be cautious!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。