原创 | Odaily 星球日报(@OdailyChina)

作者 | Ethan(@ethanzhang_web 3)

过去两天,加密市场再次回调,主流币种接连跌破关键支撑,ETH 领跌。

OKX 行情显示,BTC 最低跌至 112500 美元,现报 113580 美元,24 小时内最大跌幅超 3%;ETH 跌势更为剧烈,日内最低触及 4062 美元,最大跌幅达 5%,现暂报 4180 美元;过去 48 小时,ETH 累计回调幅度已超过 8%,几乎吞没上周全部涨幅。

其他资产方面,SOL 曾短时跌破 176 美元关口,现报 180.51 美元;DOGE、PEPE、TRUMP 等高 Beta 山寨币同步回调,跌幅集中在 7% – 10%区间。

板块方面,根据 SoSoValue 数据,截至 8 月 20 日,昨日表现相对坚挺的 PayFi 板块今日下跌 5.65%,其中XRP 跌 5.52%、TEL 跌 7.17%;Layer 1 板块下跌 3.35%,Cardano(ADA)跌幅高达8.83%;Layer 2 板块下跌 3.75%,Mantle(MNT)盘中逆势上涨5.51%;DeFi 板块下跌 4.25%,Lido DAO(LDO)小幅上涨1.01%;Meme 板块整体下跌 5.25%,其中 MemeCore(M)逆势上涨 6.91%。

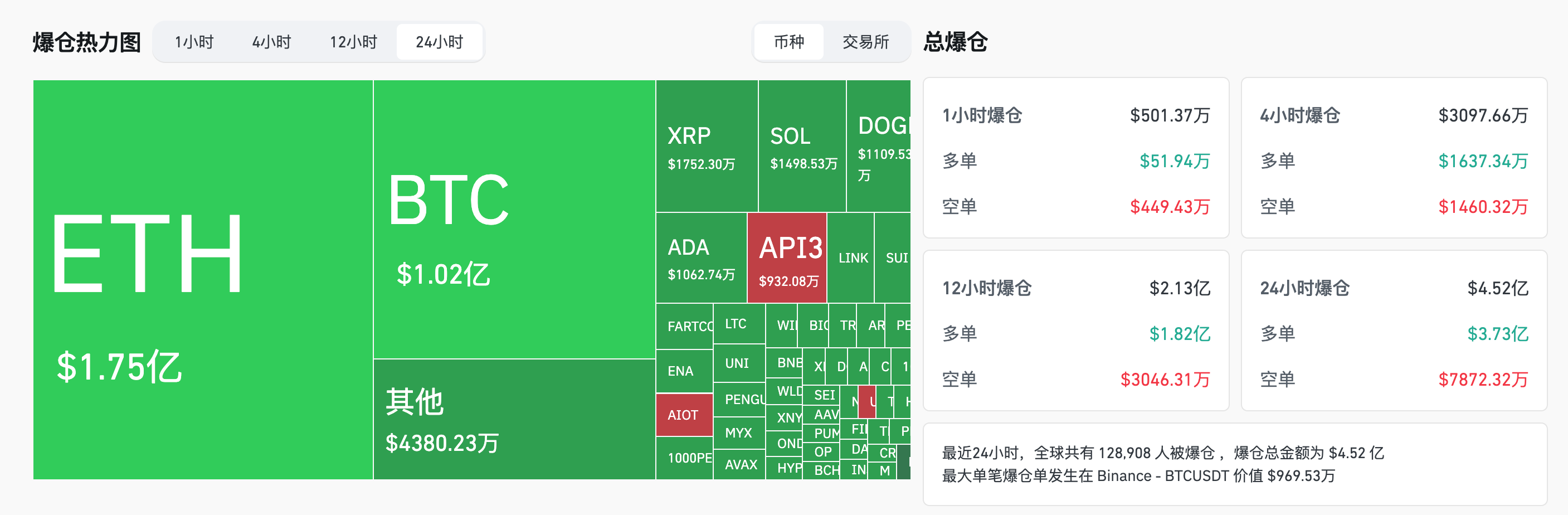

衍生品市场方面,据 Coinglass 数据,过去 24 小时内全网爆仓金额高达4.52 亿美元,其中多单爆仓 3.73 亿美元。BTC 爆仓金额约为 1.02 亿美元,而 ETH 爆仓则高达 1.75 亿美元,成为当前爆仓“重灾区”。

Lookonchain 监测显示,仅过去 12 小时,多个巨鲸地址累计向中心化交易所转入逾 3.4 万枚 ETH,总价值约 1.4 亿美元,巨鲸的集中性减仓正在加剧市场恐慌情绪。

资金层面也未见明显支撑。据 SoSoValue 数据,昨日(8 月 19 日)以太坊现货 ETF 单日净流出高达 1.97 亿美元,为历史第二高。其中,贝莱德和富达两大 ETF 产品分别录得超 8000 万美元流出。

比特币与以太坊连续两日下探关键支撑,市场情绪急转悲观,资金外流、巨鲸减仓与 ETF 净流出形成共振。在投资者分歧加剧的当下,行情究竟是阶段性调整,还是更深层次回调的前奏?

Odaily 星球日报将梳理来自链上数据平台、机构投研以及交易员的最新观点,供读者参考。

比特币止跌未稳,以太坊后市如何演绎?

Santiment:散户情绪转向极度看空,或为市场反转信号

链上数据平台 Santiment 表示,在 BTC 跌破 113000 美元后,散户交易者的情绪在过去 24 小时内急剧转向悲观,创下自 6 月 22 日地缘冲突引发抛售潮以来的最低水平。

历史经验显示,极度悲观情绪往往是潜在反弹的重要信号之一,这可能为长期投资者提供布局机会。

尽管 ETH 领跌,但加密市场的主线依旧在比特币。在 BTC 跌破 113000 美元之际,机构也开始给出自己的预期判断。

Delphi Digital:TGA 回补预计抽走 5000 至 6000 亿美元市场流动性

Delphi Digital 发文表示,美国财政部将在未来数周启动财政部一般账户(TGA)回补,计划在两个月内从市场抽走约 5000 亿至 6000 亿美元流动性。与以往不同,本轮回补缺乏缓冲:美联储仍在通过量化紧缩(QT)抽水,逆回购工具(RRP)几近耗尽,银行受资本规则和账面损失限制,来自中日等海外买盘也明显退潮。换言之,本次筹资将直接从市场流动性中抽取资金。

这一变化对加密市场尤为敏感。历史数据显示:2021 年流动性宽松时,稳定币供应仍随 TGA 回升而扩张;而在 2023 年,稳定币供应缩减逾 50 亿美元,加密市场陷入停滞。2025 年的流动性环境更为紧绷,稳定币供应若再度收缩,ETH 等高 Beta 资产可能面临相对 BTC 更大的跌幅,除非获得 ETF 或企业资金流入对冲。

Greeks.Live:BTC 走势存在分歧,关注 11.2 万–13 万美元区间

期权分析平台 Greeks.Live 在社区简报中指出,当前市场对 BTC 的走势存在明显分歧:一部分交易者认为短期偏弱,仍有进一步下探空间;另一部分则认为多头清算已近尾声,反弹即将启动。

技术面来看,BTC 仍运行于震荡区间,关键观察位为 11.2 万至 13 万美元。在期权策略上,交易者普遍在 11.2 万–12 万美元区间采用“双卖”策略,静待市场突破信号。

BMO 资深策略师:鲍威尔或“浇灭”市场对 9 月降息的乐观预期

BMO 资本市场美国利率策略主管 Ian Lyngen 表示,尽管当前市场押注 9 月会议降息 25 个基点的概率高达 80%,甚至有 32.5 万份期权押注降息 50 个基点,但真正的风险在于本周五鲍威尔讲话“泼冷水”,打击市场对激进宽松的预期。

若美联储坚持鹰派立场,可能引发更广泛的风险资产波动,包括 BTC 在内的加密市场或将继续承压。

Arthur Hayes:对鲍威尔讲话“无法判断”,选择暂避锋芒

BitMEX 联合创始人 Arthur Hayes 表示,对于即将召开的杰克逊霍尔全球央行年会,他“完全无法判断市场将作何反应”,因此选择“享受夏末时光”,暂不参与过度预测。

这一表态虽显轻松,却也反映出当前市场对宏观变量的不确定性极高,投资者预期分化。

Tom Lee:讲话或被“鸽派解读”,美股与加密市场有望迎来修复

BitMine 董事会主席 Tom Lee 表示,多数机构投资者预计鲍威尔在杰克逊霍尔将维持鹰派基调,但因市场已将此作为预设条件,讲话反而可能被“鸽派解读”,从而在讲话结束后推动美股与风险资产阶段性反弹。

对于 BTC 来说,这意味着短线下行后存在技术性修复的窗口。

伯恩斯坦:牛市或延续至 2027 年,比特币目标上看 20 万美元

伯恩斯坦分析师发布研报称,当前周期的加密牛市受到美国政策支持与机构参与度提升的推动,有望延续至 2027 年。

其中,比特币未来一年的价格目标被上调至15–20 万美元区间,成为中长期投资者的重要定价参考。

小结:短期承压未解,反弹信号待确认

美联储偏鹰基调扰动市场情绪,加密资产在资金流出、巨鲸减仓等多重因素影响下出现集中回调。ETH 跌破 4100 美元,BTC 下探 11.3 万美元,衍生品市场爆仓规模扩大。

尽管短期承压明显,但 Santiment 数据显示散户情绪已触及极度悲观区域,历史上往往对应市场阶段性反弹起点。随着鲍威尔即将发表关键讲话,BTC 走势能否止跌企稳,或将成为判断行情方向的关键信号。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。