作者:Biteye 核心贡献者Louis Wang

编辑:Biteye 核心贡献者 Denise

当大多数DeFi项目还在为日活跃用户破万而庆祝时,Hyperliquid已经在每日悄然处理着超过10亿美元的交易量。这个由哈佛物理奥赛金牌得主Jeff Yan领导的10人团队,用拒绝VC资金的方式证明了一个朴素的道理:真正的创新不需要资本的加持,只需要对技术的执着和对用户需求的深度理解。

HYPE 代币价格 $42.5,市值$142 亿,排名所有数字货币第 12 位;累计交易量 2.2 万亿美元,占据 DEX 永续合约市场 70%+份额;用户规模从 2024 年 35 万增长至 2025 年超过 60 万活跃钱包;BTC 永续合约交易量已达到Binance的10%。这些令人瞩目的数字背后,是一个关于技术创新如何重新定义去中心化金融的故事。

1.1 交易量的惊人增长

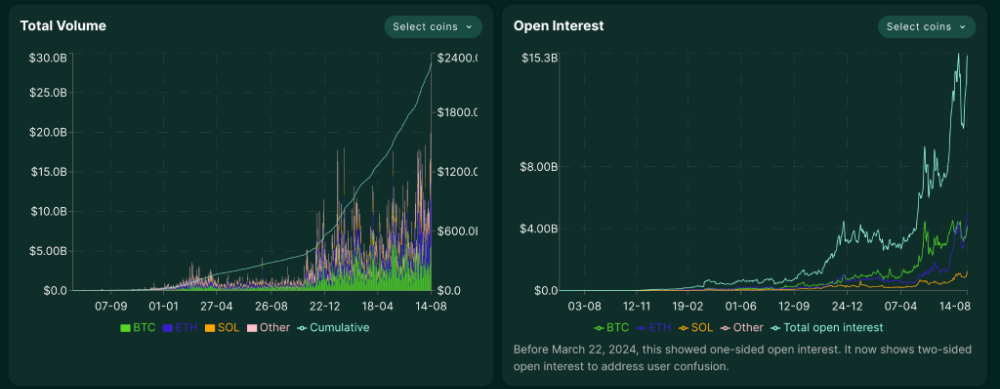

Hyperliquid在短短两年内从零增长到超过60万用户,其增长轨迹堪称现象级。2023年项目无声发布,没有新闻发布会,没有营销预算,Jeff Yan只是简单地"打开了大门,静观其变"。然而结果是爆炸性的:仅用100天时间,日交易量就突破了10亿美元。2025年1月19日,平台创下单日210亿美元的历史交易记录,而7月份更是创下了月交易量新高,达到近3200亿美元,较6月的2160亿美元增长47%。这一交易量使得Hyperliquid与Binance的比例达到11.89%,创下新高,而Binance同期的永续合约交易量约为2.59万亿美元。最新数据显示,累计交易量已经突破$2.3T,未平仓合约达到$15.2B。

HL的交易量和OI,https://stats.hyperliquid.xyz/

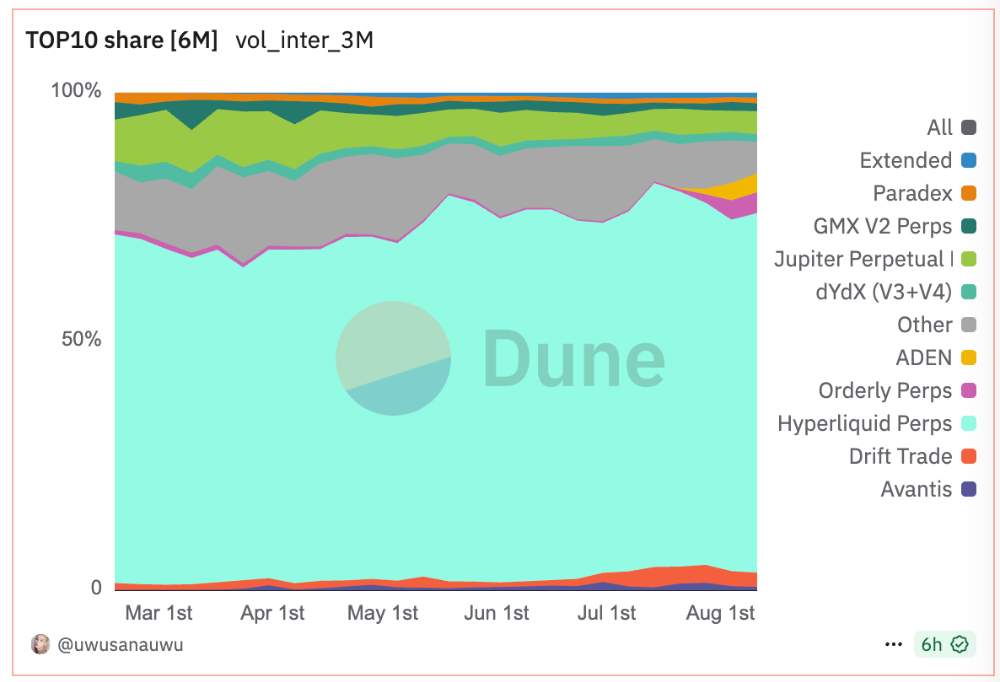

目前HyperLiquid在去中心化永续合约市场交易量份额,已经占到整体的70%以上,达到Binance的十分之一。

Perp dex 市场占比,https://dune.com/uwusanauwu/perps

正如分析师指出:"没有任何DEX曾经如此接近一线CEX的交易量",Hyperliquid已经开始在某些指标上直接挑战传统中心化交易所。

2.1 无KYC的自由交易体验

与传统中心化交易所不同,Hyperliquid提供了真正的无许可交易体验。用户只需连接钱包即可开始交易,无需繁琐的身份验证过程。这种自由度吸引了大量重视隐私和便利性的交易者,特别是那些不愿意或无法完成KYC的用户群体。

2.2 更大的仓位灵活性

传统CEX往往对大额交易和高杠杆操作设置重重限制,而Hyperliquid的去中心化特性允许用户开设更大的仓位。平台支持最高50倍杠杆,且对交易规模的限制更加宽松,这对专业交易者和机构投资者具有很强的吸引力。

2.3 完全透明的链上执行

所有订单、取消、交易和清算都在链上透明执行,用户可以实时验证交易的公平性。这种透明度在FTX等中心化平台接连爆雷后显得尤为珍贵,为用户提供了信任基础。

2.4 技术性能的革命性突破

Hyperliquid通过自建Layer 1区块链解决了DeFi交易的根本性能问题:

交易速度:亚秒级确认,媲美顶级CEX

吞吐量:20万TPS,远超其他DEX的2000TPS

Gas费用:对用户完全免费

订单簿:完全链上,实时匹配

Jeff Yan发现传统区块链的问题:"以太坊太慢。二层解决方案增加了延迟。Solana相对较快,但对严肃的交易来说仍不够快。"因此他决定从零开始构建专为交易设计的区块链。

03 创新的Vault机制:双刃剑的流动性解决方案

3.1 HLP Vault运作原理

Hyperliquid的HLP(Hyperliquid Liquidity Provider)机枪池是平台流动性体系的核心。该机制通过算法自动执行做市策略,为平台提供深度流动性,同时让普通用户也能参与专业级的做市收益。

Vault机制优势:

为平台提供稳定的流动性支撑

让普通用户参与专业做市策略

收益透明,完全链上可查

有效降低交易滑点

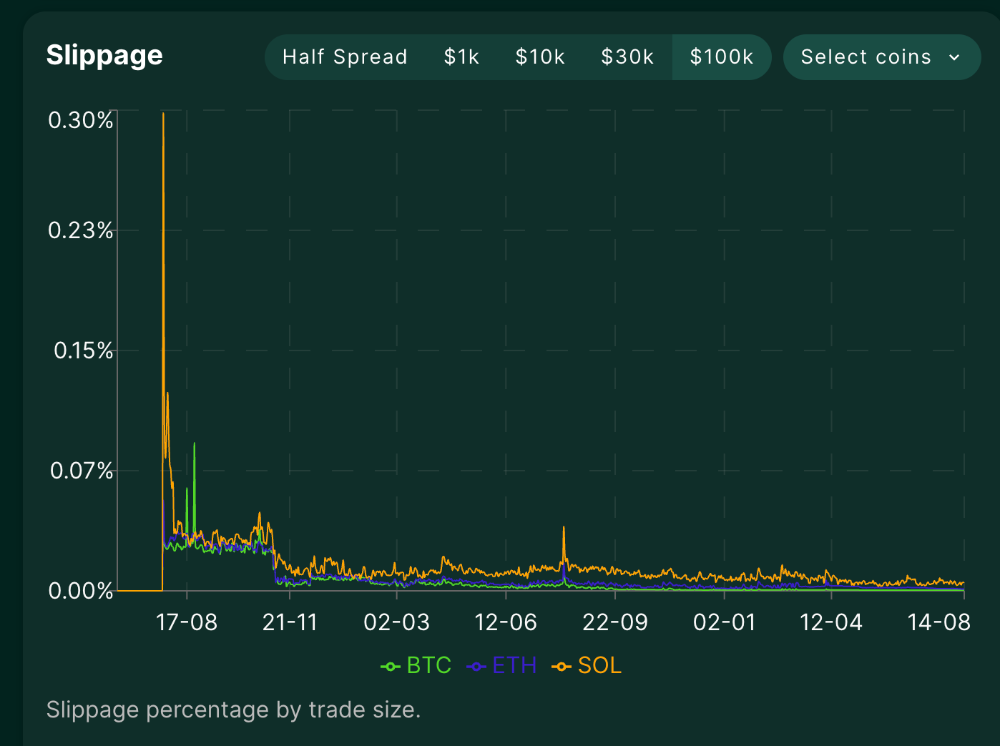

如图所示,在HL上单笔交易十万美金的BTC或ETH可以实现0滑点。

不同金额交易的滑点 https://stats.hyperliquid.xyz/

3.2 对手盘机制的风险暴露

然而,Vault机制也带来了系统性风险,这在2025年3月的JELLY事件中得到了充分暴露。

JELLY攻击事件复盘:

2025年3月26日,攻击者控制1.246亿JELLY代币,先大量抛售推低价格,让HLP被动承接1530万美元空头头寸,随后在去中心化交易所大量买入推高价格,JELLY价格1小时内暴涨400%,HLP未实现亏损一度达到1350万美元。

当时HyperLiquid陷入了前所未有的舆论危机,HYPE代币价格也跌到了历史低点(回头来看是最好的买入机会),不过HyperLiquid面对危机,迅速做出回应:验证者2分钟内达成共识,紧急下线JELLY市场;所有头寸以攻击者开仓价格强制平仓;Hyper Foundation承诺补偿所有正常用户。

HLP的系统机制也在这次危机之后迅速改进:

1. ADL机制优化:不再基于整体资产计算,单独监控清算池损失

2. 仓位限制加强:重新评估低市值代币的风险参数

3. 清算机制强化:降低清算池占比,减少风险暴露

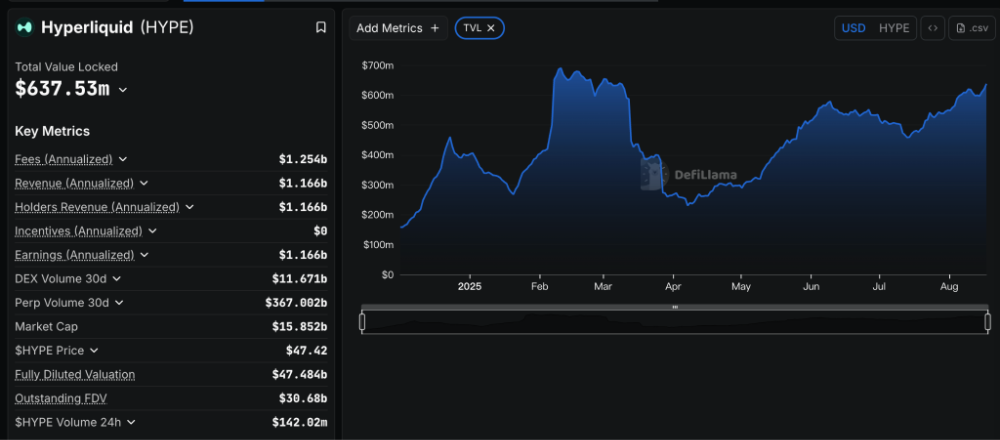

HLP TVL,https://defillama.com/protocol/hyperliquid?tvl=true&events=false

事件后的恢复数据显示:TVL从最低点197亿美元恢复至208亿美元,HLP资产完全恢复至195亿美元,交易量从5000万美元/日恢复至稳定的1.4亿美元/日,展现了平台的强大韧性。

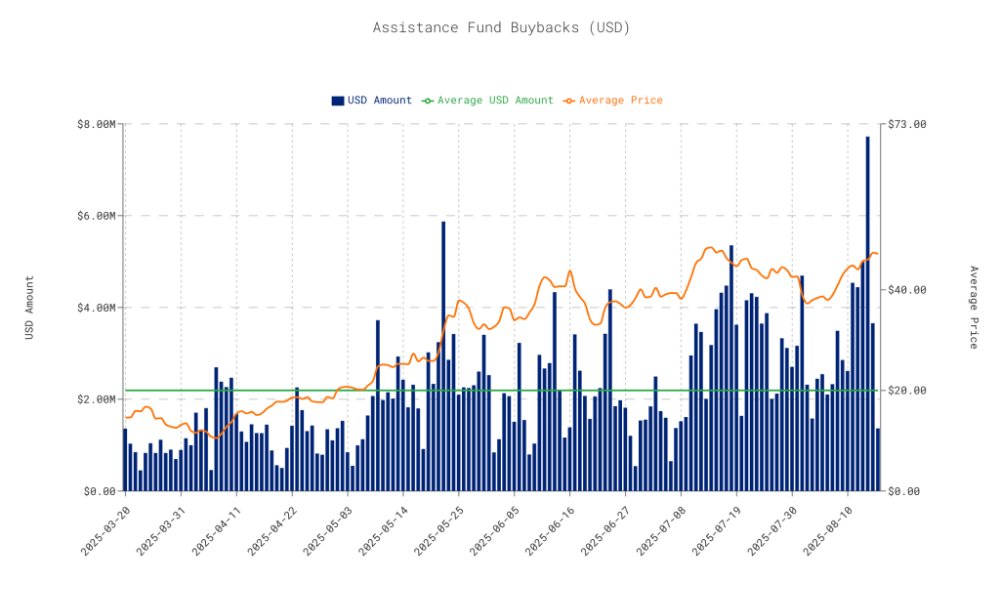

4.1 史无前例的回购承诺

当大多数DeFi项目还在为如何分配协议收入而争论不休时,Hyperliquid做出了一个令人震惊的决定:将97%的协议收入用于HYPE代币回购。

基于平台7日平均交易量计算,Hyperliquid每日回购约76,000枚HYPE代币,年化回购率达到4.7%的流通供应量。累计回购价值已超过9亿美元,而目前有41.85%的总供应量被质押锁定,这创造了强大的供应收缩效应。

Hyperliquid回购记录,https://data.asxn.xyz/dashboard/hl-buybacks

这种设计的精妙之处在于将平台的商业成功直接转化为代币价值的提升。随着交易量的增长,回购力度自动增强,形成了正向的价值循环。这不是简单的通缩机制,而是将协议收入直接回馈给代币持有者的真实分红模式。

4.2 多维度的价值实现

HYPE代币的价值捕获不仅限于回购销毁,作为一条Layer1还有节点质押收益,收益率设计参考了以太坊的PoS共识机制,收益率与质押HYPE数量的平方成反比,目前在2.2%左右。链上数据显示已有超过3200万枚HYPE参与质押,占流通供应量的比例约为42%,其中23%为流动质押(如kHYPE)。

HYPE节点质押收益率,https://app.hyperliquid.xyz/staking

4.3 拒绝VC的勇敢实验

在一个被风险投资主导的行业中,Hyperliquid选择了一条截然不同的道路。该项目将70%的代币分配给用户空投和社区奖励,23.8%分配给团队和核心贡献者,6.2%用于未来发展基金,而VC投资的比例为零。

这种分配模式的革命性在于它完全避免了传统项目的VC抛售压力。在传统模式中,VC往往在代币上线后大量抛售获利,而Hyperliquid的模式确保了代币价格的稳定性,让真正的用户和建设者成为最大的受益者。正如Jeff Yan所说,让风险资本家在去中心化网络中持有大量股份会成为"网络的伤疤"。

05 HYPE代币:被低估的价值洼地

5.1 强劲基本面支撑的投资逻辑

从纯粹的投资角度看,HYPE代币具备了成功投资标的的所有要素。首先是强劲的业务基本面:平台年化收入已达5.77亿美元,且这个数字仅来自交易费用,不包括其他潜在收入来源。用户基数从2024年的35万活跃钱包快速增长至2025年超过60万,用户留存率在行业中名列前茅。

更重要的是,这种增长建立在真实的产品价值基础上,而非投机炒作。Hyperliquid的市场份额持续扩大,已经在某些指标上开始直接挑战传统中心化交易所,这为未来的增长提供了巨大空间。

年初至今HYPE上涨约83%,大幅跑赢比特币和以太坊的表现。与比特币0.703的高相关性表明,HYPE在享受整体加密市场上涨的同时,还有自身基本面驱动的额外收益。

5.2 技术护城河构筑的长期价值

HYPE的投资价值不仅来自短期的业务增长,更重要的是Hyperliquid构筑的技术护城河。自主开发的Layer 1区块链、20万TPS的处理能力、亚秒级的交易确认,这些技术优势不是其他项目短期内可以复制的。

在一个充满同质化竞争的DeFi市场中,Hyperliquid通过技术创新建立了真正的差异化优势。这种护城河的价值会随着时间的推移而不断放大,为HYPE代币的长期价值提供了坚实支撑。

5.3 HIP-3:构建金融创新的新基础设施

HIP-3提案代表了Hyperliquid从交易平台向金融基础设施的战略转型。该机制允许任何人通过质押100万HYPE代币在平台上创建自定义的永续合约市场,包括设置价格预言机和合约规范。

这一创新解决了传统金融市场创造的核心痛点。在传统体系中,新金融产品的推出需要经过漫长的监管审批,耗费巨额成本,且往往局限于大型金融机构。HIP-3则提供了一个无许可的市场创造平台,任何创新者都可以快速验证和部署自己的金融产品想法。

从商业模式角度看,HIP-3创造了一个全新的价值捕获机制。每个新市场的创建都需要大量HYPE代币质押,这为代币创造了持续的刚性需求。同时,市场创造者可以获得所创建市场的部分手续费收入,形成了创新者与平台的利益共享机制。

对HYPE代币价值而言,HIP-3标志着需求驱动因素的多元化。除了交易手续费和质押收益外,市场创造需求将成为代币价值的新增长点,为长期价值增长提供了更加稳固的基础。

5.4 Pre-IPO交易:打破传统投资壁垒

在HIP-3机制的基础上,Hyperliquid生态中涌现出了一个革命性的应用案例:Ventuals平台。这个协议为传统金融中最封闭的领域之一——pre-IPO交易——提供了去中心化的解决方案。

Pre-IPO交易指的是在公司正式上市前对其股份或相关衍生品进行交易的活动。这个价值数万亿美元的资产类别长期以来被机构投资者和风险投资公司垄断,普通投资者几乎无法参与其中。传统的pre-IPO投资不仅门槛极高,流动性也极为有限,投资者往往需要等待数年才能退出。

Ventuals的创新在于将这些私人公司的总估值代币化,创建了基于估值的永续合约市场。以OpenAI为例,如果该公司估值为350亿美元,那么一个vOAI代币的价格就是35美元(估值除以10亿)。投资者可以对OpenAI、Stripe、SpaceX等明星私人公司的估值变化进行最高10倍杠杆的多头或空头交易。

这种模式的意义远超技术创新本身。它为传统上流动性极度匮乏的私人公司股份创造了合成流动性,让价格发现过程变得透明和高效。更重要的是,它真正实现了投资机会的民主化,让普通投资者也能参与到这些顶级公司的价值增长中。

对于Hyperliquid而言,pre-IPO交易代表了平台向传统金融领域渗透的重要一步。当区块链技术开始承载传统金融资产的交易需求时,这不仅验证了技术的成熟度,更预示着更大的市场空间和价值潜力。

Hyperliquid的成功证明了一个朴素的道理:专注于解决真实问题、服务真实用户需求的项目,即使没有巨额融资和营销预算,也能在激烈的竞争中脱颖而出。这个由11人团队打造的去中心化交易所,用两年时间完成了从零到万亿的跨越,重新定义了DeFi交易平台的标准。

正如 Jeff Yan 所说:「我们专注于打造用户喜爱的产品,其他一切都是次要的。」这种看似简单的理念背后,是对技术创新的执着追求和对用户价值的深度理解。Hyperliquid 没有选择在现有区块链上妥协,而是从零开始构建专为交易优化的 Layer 1;没有选择追逐 VC 资金,而是坚持用户优先的价值分配;没有选择营销驱动的增长,而是依靠产品本身的优异体验获得用户认可。

从投资角度看,HYPE代币具备了优质投资标的的所有特征:强劲的基本面、创新的商业模式、深厚的技术护城河,以及健康的代币经济学。在当前42.5美元的价格水平下,考虑到平台的发展速度和市场潜力,HYPE仍然具有很强的投资吸引力。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。