Original Author: Lacie Zhang, Bitget Wallet Researcher

Introduction: On August 7, 2025, Eastern Time, an executive order from the White House may become another historic turning point that ignites the cryptocurrency market, following the Bitcoin spot ETF. U.S. President Trump signed an executive order directing the Department of Labor to revise rules to formally include alternative assets such as cryptocurrencies, real estate, and private equity in the investment options of 401(k) pension plans.

This not only concerns the $8.7 trillion of American "national lifeline funds," but it may also pave an unprecedented compliance highway for a second large-scale entry of institutional capital. When tens of millions of Americans' retirement accounts are directly linked to crypto assets, a profound transformation is brewing.

Next, let’s explore this transformation with the Bitget Wallet Research Institute.

I. The $8.7 Trillion "Golden Key": Why is 401(k) the Key Variable?

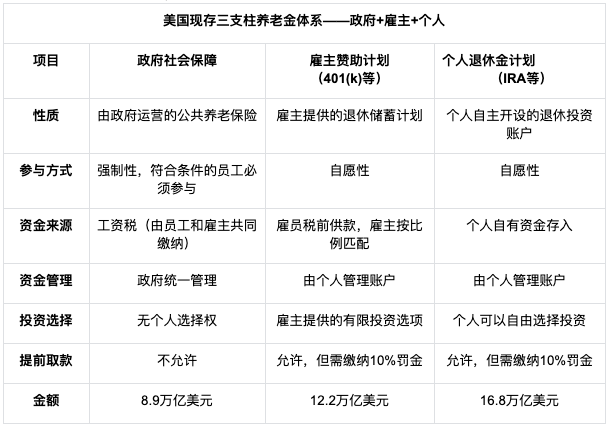

To understand the power of this transformation, we first need to grasp the "C position" role of 401(k) in the U.S. pension system. The U.S. pension system is like a tripod, jointly supporting the retirement life of its citizens:

Source: Fintax, not considering the corporate annuity reserves of insurance companies or private sector fixed-income guarantees.

Source: Fintax, not considering the corporate annuity reserves of insurance companies or private sector fixed-income guarantees.

- First Pillar: Government-led Social Security, similar to China's basic pension insurance, is mandatory, but individuals have no investment choice.

- Second Pillar: Employer-sponsored retirement plans, with 401(k) being the absolute mainstay. It is funded jointly by employees and employers, and while the investment options are preset by employers, it has a wide coverage and stable cash flow, making it the core tool for the American middle class to accumulate retirement wealth.

- Third Pillar: Individual Retirement Accounts (IRA), which are entirely voluntarily established and managed by individuals, granting them significant investment freedom, resembling an "open professional market" where participants must actively research and make decisions.

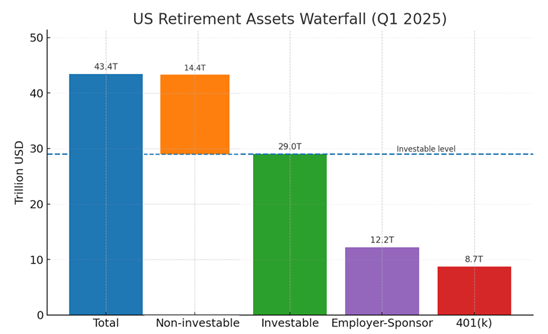

According to data from the Investment Company Institute (ICI) in the first quarter of 2025, the total size of the U.S. pension market reached $43.4 trillion. In this vast ocean of funds, the portion that individuals can make investment decisions on is about $29 trillion. Among this $29 trillion, the 401(k) plan alone accounts for $8.7 trillion, making up 30%. This massive amount of money is the "gold mine" targeted by this new policy.

U.S. 401(k) account balance by age group (as of 2024)

Source: Vanguard "How America Saves 2024"

Source: Vanguard "How America Saves 2024"

Vanguard's 2024 report depicts the national profile of 401(k): the average account balance for all participants has reached $148,153. Notably, as age increases, account balances rise exponentially, with the average balance for those over 65 approaching $300,000. This means that 401(k) not only has a large amount of funds, but its holders also include the most purchasing power-rich middle-aged and elderly groups in American society.

Previously, this large sum of money had been strictly limited to traditional stocks, bonds, and mutual funds. Now, the Trump administration intends to equip it with a "golden key" that can unlock the door to the crypto world.

II. The Triple Waves of the Future: How Will the New Policy Reshape the Crypto Market Landscape?

Incorporating cryptocurrencies into the 401(k) investment category will have impacts that go beyond simple capital inflow; it represents a structural transformation that links users, institutions, and regulators at three levels.

1. First Wave: "National-Level" Icebreaking of User Mindsets

For the crypto industry, one of the biggest challenges has always been "breaking out"—how to get the mainstream public, especially those conservative older investors with substantial capital, to accept and allocate crypto assets. This reform can be seen as a top-down "national-level" market education.

Imagine a 55-year-old American corporate employee seeing "crypto asset allocation fund" listed alongside "S&P 500 index fund" and "U.S. Treasury fund" on the 401(k) investment menu provided by Fidelity or Vanguard; their psychological perception will undergo a revolutionary change. This is no longer a distant and high-risk speculative code on social media, but a compliant retirement investment product approved by the U.S. Department of Labor, packaged by top asset management institutions, and accepted by their employer. The dual endorsement of national sovereign credit and top financial institutions will greatly alleviate ordinary people's doubts and resistance towards crypto assets, completing a user cultivation process that is cost-effective and widely covered.

2. Second Wave: The "Living Water" of Institutional Capital

If the approval of the Bitcoin spot ETF opened a door for institutional capital to engage in active investment, then the entry of 401(k) opens a continuous "automated water pipeline." The fund flow of ETFs largely depends on investors' active decisions and market sentiment, sometimes surging and sometimes calming. In contrast, the funding injection model of 401(k) is fundamentally different: it is directly tied to the vast U.S. national payroll system. This means that every payday, a portion of millions of paychecks will be automatically allocated to the selected crypto asset investment portfolio with almost no awareness from the holders. This stable and massive incremental funding will provide unprecedented depth and resilience to the market.

This certain prospect will ignite a new round of product "arms race" among Wall Street giants. Institutions like Vanguard and Fidelity will not be satisfied with merely offering single crypto products; they will shift towards more diversified, structured, and risk-controlled "401(k) customized" crypto funds. For example, a potential "basket" index fund that includes Bitcoin, Ethereum, and some blue-chip DeFi tokens, or a "mixed allocation fund" that combines crypto assets with traditional stocks and bonds to smooth out volatility. This not only enriches the channels for capital entry but also strongly promotes the entire crypto asset management industry towards maturity and standardization.

3. Third Wave: The "Political Moat" Across Party Lines

However, the most profound step of this new policy may be hidden beneath the clamor of financial markets—it aims to forge a "political moat" that can transcend partisan disputes for the turbulent crypto world.

The policy uncertainty brought by the alternation of the two parties in the U.S. has always been a "Damocles' sword" hanging over the crypto industry, making any long-term capital cautious. The oscillation in regulatory attitudes between the Democratic and Republican parties, and even policy differences among leaders of the same party, have filled the industry's long-term development with variables. The brilliance of the 401(k) new policy lies in the fact that it deeply binds crypto assets with the "lifeline funds" of tens of millions of American voters. This fundamentally changes the nature of the game: crypto assets are no longer an exclusive topic for Wall Street and tech geeks, but have become "national cheese" that every ordinary family cannot ignore.

Imagine the implementation of the new policy: any future government attempting to impose strict crackdowns or even overturn existing crypto policies will face immense political pressure because any attempt to weaken the crypto market could be directly interpreted by voters as "messing with my retirement funds," leading to severe political backlash. This blatant binding of interests elevates the protection of the crypto market from Trump's personal or partisan actions to a "forced choice" for candidates to woo voters and for incumbents to protect national wealth. Thus, a solid moat has already formed, compelling both parties to seek a more stable consensus on crypto regulation, allowing the entire industry to escape the fate of severe fluctuations due to party alternation and truly cementing "crypto-friendly" into America's long-term financial agenda.

III. Vision and Reflection: Opportunities and Challenges on the Path to a Trillion-Dollar Blue Ocean

Regarding this new policy, we have reason to remain optimistic. Just as the approval of the Bitcoin spot ETF propelled Bitcoin to break the $100,000 mark within a year: the massive development of compliant products will inevitably trigger a revaluation of the underlying assets. Even assuming that only 5% of 401(k) funds (about $400 billion) flow into the crypto market initially, this would still be a substantial amount for the current crypto industry, not to mention the significant multiplier effect it would have on user cultivation and regulatory icebreaking.

Looking ahead, if personal-managed pensions can invest in crypto assets, could the much larger social security funds held by the government also potentially open a door in the future? That would be a reconstruction of the entire social wealth and financial system.

However, optimism cannot replace critical thinking; we must remain cautious, as core challenges still exist:

- Will investors buy in? Currently, over 60% of 401(k) assets are still concentrated in traditional mutual funds. It will take time and market validation to get Americans, who have been accustomed to decades of investment models, to allocate their retirement funds to a high-volatility emerging market.

- How to control risks? The severe cyclical volatility of crypto assets is the nemesis of retirement savings. How the Department of Labor, asset management institutions, and employers will delineate investment ratios and provide risk warnings to protect investors' interests—these details will determine the success or failure of the policy.

- What will the product forms be? The scope of investment determines the breadth of risk—will it stick to Bitcoin and Ethereum, or open up to a broader token market? Product design determines the depth of risk—how to smooth out volatility to protect investors is a key unresolved issue.

IV. Conclusion

The Trump administration's executive order is less of a final answer and more of a starting gun. It attempts to leverage the $8.7 trillion 401(k) as a fulcrum to not only pry open the vast U.S. pension system but also reshape the future landscape of global crypto finance. The road ahead is filled with opportunities and unknown reefs and shoals. But regardless, when the most traditional and conservative capital of retirement funds begins to seriously examine the crypto world, a new era's door is slowly being opened.

This article was written by Lacie Zhang, a researcher at Bitget Wallet. If you have any questions or opinions about the content, feel free to connect on X @Laaaaacieee.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。