Falcon Finance’s USDf is an overcollateralized synthetic stablecoin designed to hold its peg to the U.S. dollar through diversified crypto reserves and institutional-grade decentralized finance (DeFi) strategies.

Unlike conventional fiat-backed tokens, USDf relies on crypto assets—including stablecoins such as USDT and USDC alongside volatile tokens like BTC and ETH—as collateral.

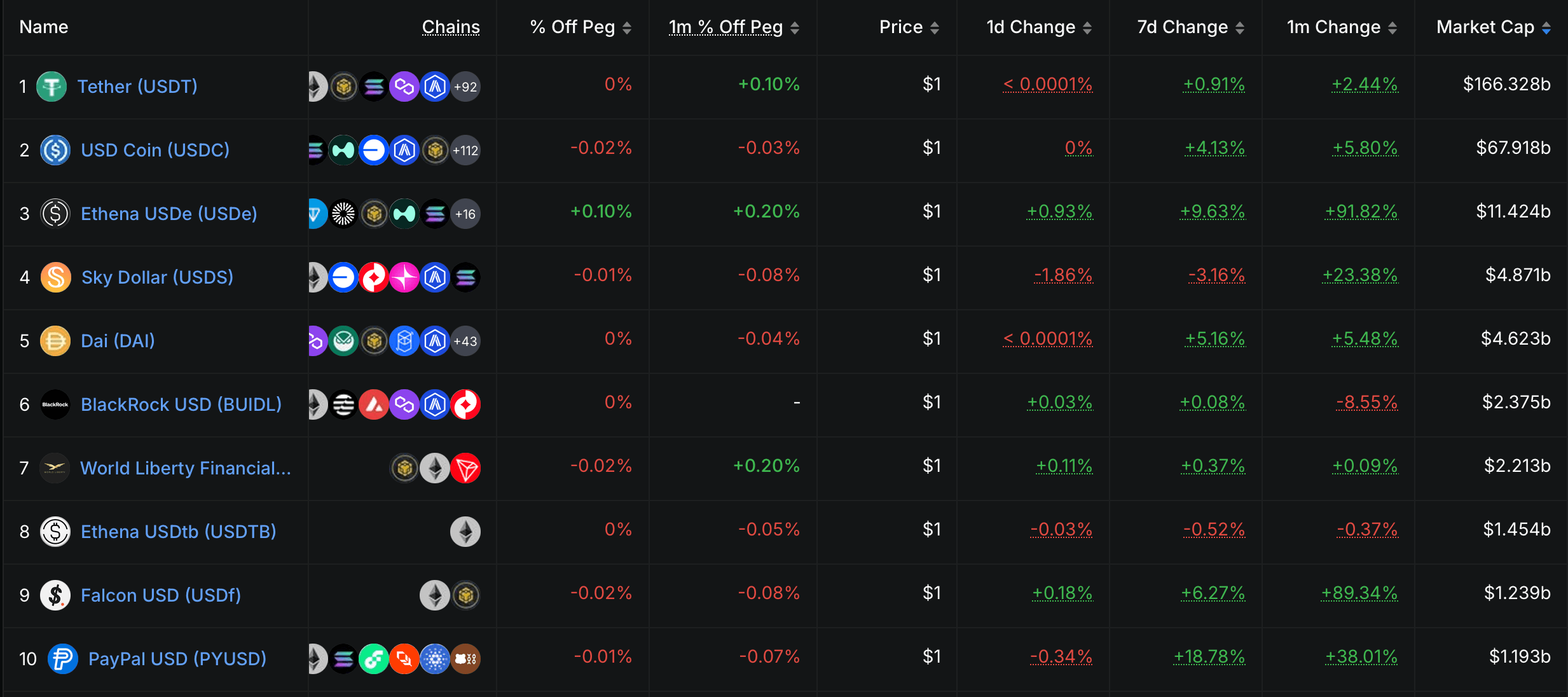

Top ten stablecoins by market cap according to defillama.com stats on Aug. 19, 2025.

USDf minting requires overcollateralization: stablecoins are accepted at a 1:1 ratio, while volatile tokens demand higher deposits (for example, $150 in ETH to create 100 USDf) to absorb market price swings.

To maintain its $1 peg, falcon usd (USDf) also deploys arbitrage and delta-neutral trading. When the token dips below $1, buyers are incentivized; when it climbs above, users are motivated to mint and sell—automated mechanisms that restore balance.

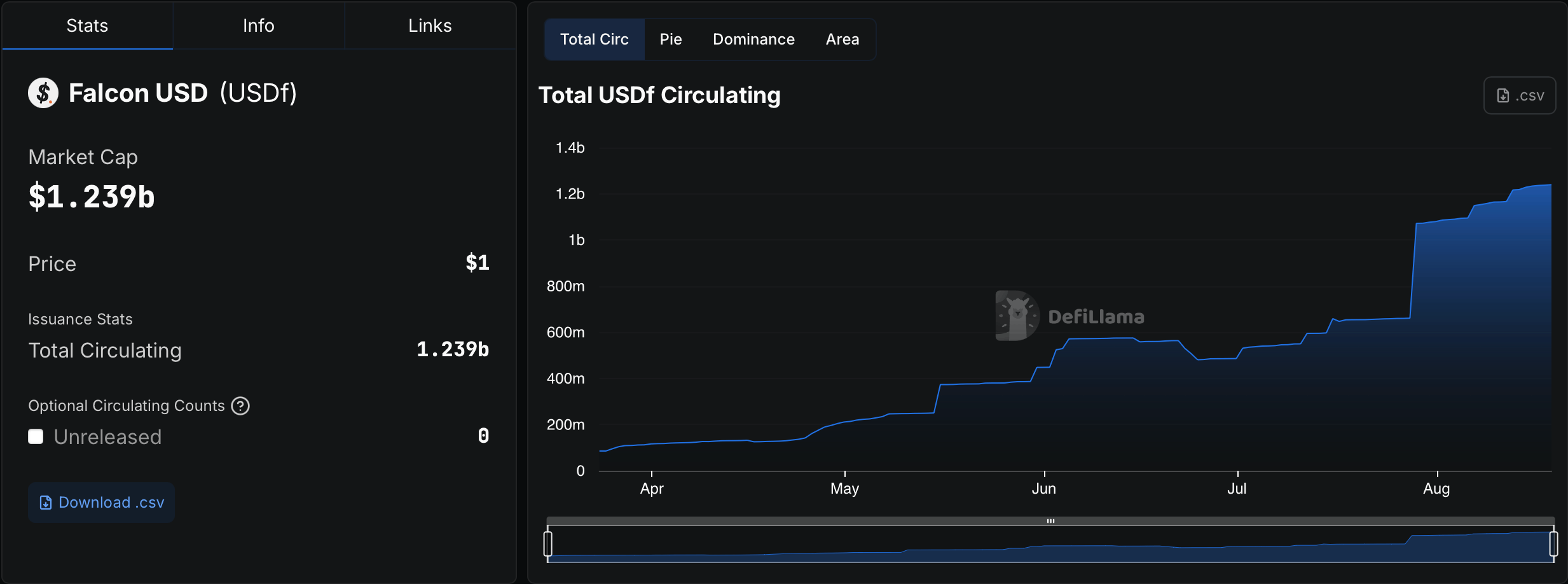

At the close of March, USDf’s market capitalization was $85 million. Over the past 146 days, its supply has expanded by 1,355.29%. Roughly 91% of USDf circulates on the Ethereum blockchain, with the remaining share issued on Binance Smart Chain.

Documentation explains that holders can stake USDf to receive sUSDf, an appreciating ERC-4626 token. Yields are generated from market-neutral strategies such as funding-rate arbitrage (44% of returns) and cross-exchange arbitrage (34%), offering up to 11.8% APY.

Locking sUSDf for three to twelve months can raise returns to 15%. The protocol enforces a collateral ratio between 115% and 116%, with reserves audited quarterly and monitored in real time using Chainlink Proof of Reserve. As of Aug. 18, 2025, USDf’s market capitalization stood at $1.24 billion.

Growth drivers include partnerships such as Bitgo, integration with tokenized treasuries, and deployment on trading platforms like Uniswap and Curve. Supply exceeded $1 billion just three months after its April 2025 debut. USDf sits among a wave of fresh contenders climbing into the top ten stablecoin ranks, alongside Sky’s USDS, Blackrock’s BUIDL, World Liberty Financial’s USD1, and Ethena’s USDtb.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。