Different people, the same return curve through different paths

Written by: ChandlerZ, Foresight News

After massively buying blue-chip projects like Bored Ape Yacht Club (BAYC) and Azuki in the NFT market, Taiwanese musician Huang Licheng (nicknamed "Machi Big Brother") began to shift towards the decentralized contract platform Hyperliquid starting in May 2025, leaving behind a series of eye-catching trading records in just a few months.

In the trading data from Hyperliquid, Huang Licheng's investment trajectory exhibits a distinct rollercoaster characteristic. Overall, his win rate is as high as 92.11%, with 70 profitable trades out of 76, and only 6 losses. From a broader perspective of the return curve, his account reached a peak floating profit of $35 million in early August 2025, but just a few days later, with the market correction, the net value fell below $3 million on August 3, nearly wiping out all previous profits.

Huang Licheng's account curve swings significantly between peaks and troughs, reflecting a typical high-leverage player characteristic, where one can become wealthy in a short time but can also return to the starting point at any moment.

Machi Big Brother's Hyperliquid Contract Trajectory

On May 16, according to monitoring by Lookonchain, Taiwanese singer Huang Licheng's address (Machi Big Brother) deposited 6.04 million USDC into his Hyperliquid account. In the first week, he executed 7 trades, mainly focusing on long positions in ETH and HYPE, resulting in all profitable trades, netting $669,600.

Subsequently, he expanded his funds to $6.7 million, purchasing 218,866 HYPE at an average price of $30.63 and choosing to stake. Within a week, the total amount grew to $8.2 million, achieving over $2.1 million in profits.

By the end of May, he continued to increase his positions, establishing long positions when ETH was around $2,654, while also expanding his HYPE positions. In June and July, as the market rose, his floating profits quickly increased. By late July, the floating profit once reached $22.45 million.

However, the market corrected in early August. On August 3, Huang Licheng's previous long profits in ETH, HYPE, and PUMP of about $22.45 million had nearly all been wiped out. He had started going long on HYPE at $27.5 in mid-May and on ETH at $2,654 by the end of May, with profits peaking at $22.45 million in late July. However, as the market corrected in August, his long positions began to incur losses.

As the market turned around with ETH breaking upward, Huang Licheng closed all long positions on August 13, with total profits exceeding $33.8 million.

Despite this, he chose not to stop. On August 15, he continued to leverage up, opening a 25x leverage position on ETH with 21,900 ETH (worth about $100 million) and a 40x leverage position on BTC with 50 BTC (about $5.9 million).

On August 20, as the market continued to decline, his long positions incurred a floating loss of $13.68 million, with the liquidation price for ETH around $3,115.

In terms of specific assets, ETH is his main source of profit. 22 ETH trades brought him over $7.5 million in profits, with one long position closed on August 13 alone yielding nearly $16 million, marking a significant battle. Bitcoin also provided positive returns, with cumulative profits close to $940,000. In contrast, the contribution from the platform token HYPE was relatively modest, with total profits at the $200,000 level. PUMP, however, became the biggest drag on account performance, with cumulative losses exceeding $5.6 million across 14 trades, nearly offsetting some of the profits from ETH.

From the perspective of holding rhythm, he is not merely a short-term player. The overall average holding duration is close to 55 hours, with some positions held for over 20 days, such as a long HYPE position on June 21, held for over 600 hours, ultimately yielding $820,000. This trading approach indicates that he has both the flexibility for quick trades and the willingness to hold positions long-term while waiting for market reversals. However, this strategy also brings significant risks; if the market trend turns unfavorable, it can lead to sustained massive losses, as seen with PUMP.

In summary, Huang Licheng's investment performance on Hyperliquid is both dazzling and fragile. The substantial profits from ETH support the overall "winner" image, but losses from a single asset can also erode gains in a short time.

From Machi Big Brother to NFT Whale

Huang Licheng, nicknamed "Machi Big Brother," was originally a well-known figure in the Chinese music and entertainment industry, but in recent years he has gradually shifted his focus to the crypto market. As early as 2021, he was active in the NFT market and quickly became a well-known whale investor. He made large-scale purchases of BAYC (Bored Ape Yacht Club) and held them long-term, even gifting NFTs to artist friends like Lin Junjie and Xu Jinglei, bringing these digital collectibles into the public eye.

In 2022 and 2023, he made multiple large entries and exits in blue-chip projects like Azuki, causing significant market fluctuations. In July 2024, he further increased his holdings by purchasing 23 BAYC NFTs in a short period, with total holdings exceeding 60 at one point. The outside world generally believes he hopes to link BAYC NFTs with tokens through the new ERC-404 protocol "APE Fi," seeking arbitrage or liquidity expansion. However, the initial brief surge of the project quickly faded, with token and NFT prices largely remaining stagnant and insufficient liquidity, making it difficult for him to realize the new positions.

Similar high-risk attempts are not uncommon in his investments. In March 2024, the Solana MEME project Bobaoppa, initiated by Huang Licheng, raised 200,000 SOL, equivalent to $38 million at the time. However, months after the project launched, the token price nearly halved, and the liquidity pool shrank to about 5% of the original fundraising amount, causing many supporters to incur losses.

Additionally, Huang Licheng frequently placed bets on emerging tokens, such as spending $15.35 million to buy FRIEND, becoming the largest individual holder, but the token price plummeted, resulting in a paper loss of over 90%; spending $4.65 million to purchase BLAST; and recording about a 50% loss when selling BLUR. In just a few months, his cumulative losses across multiple projects approached $20 million.

Huang Licheng's NFT investments have not always been smooth; he has repeatedly announced exits from the NFT market but often quickly re-enters at lower prices. By 2025, as Hyperliquid gained popularity, his capital focus began to shift towards higher leverage and more volatile derivatives markets.

Few Winners in the Big Casino

In a high-leverage-driven market environment, even traders with large capital volumes find it difficult to maintain positive returns over the long term.

According to data from the on-chain monitoring account @ai_9684xtpa, as of August 19, among the TOP 20 positions on the Hyperliquid platform, only 3 accounts were in a floating profit state, while the remaining 85% were in floating losses. Even when expanding the scope to the TOP 100 positions, only 34 addresses managed to remain profitable. In other words, the outcome for most positions is either floating losses or liquidation, with individual profitable cases often being temporary exceptions.

Huang Licheng is not the only one experiencing severe volatility. According to analyst Yu Jin's summary, as of August 15, three major Hyperliquid high-leverage whale positions had "gone to zero," with cumulative losses exceeding $140 million:

JamesWynnReal: Once peaked at $87 million in profits at the end of May, but ultimately lost $21.77 million on a Bitcoin long position worth $1.23 billion;

"Insider Whale" qwatio: Grew from a $3 million principal to $26 million, then lost everything including principal and interest;

AguilaTrades: Continued to open high-leverage positions after multiple liquidations, currently with cumulative losses of $37.5 million.

This is the norm for Hyperliquid and the entire high-leverage derivatives market. Profits and losses coexist, and risk and return are intertwined. In such an environment, winners are always in the minority, while most people ultimately become floating loss accounts in the data.

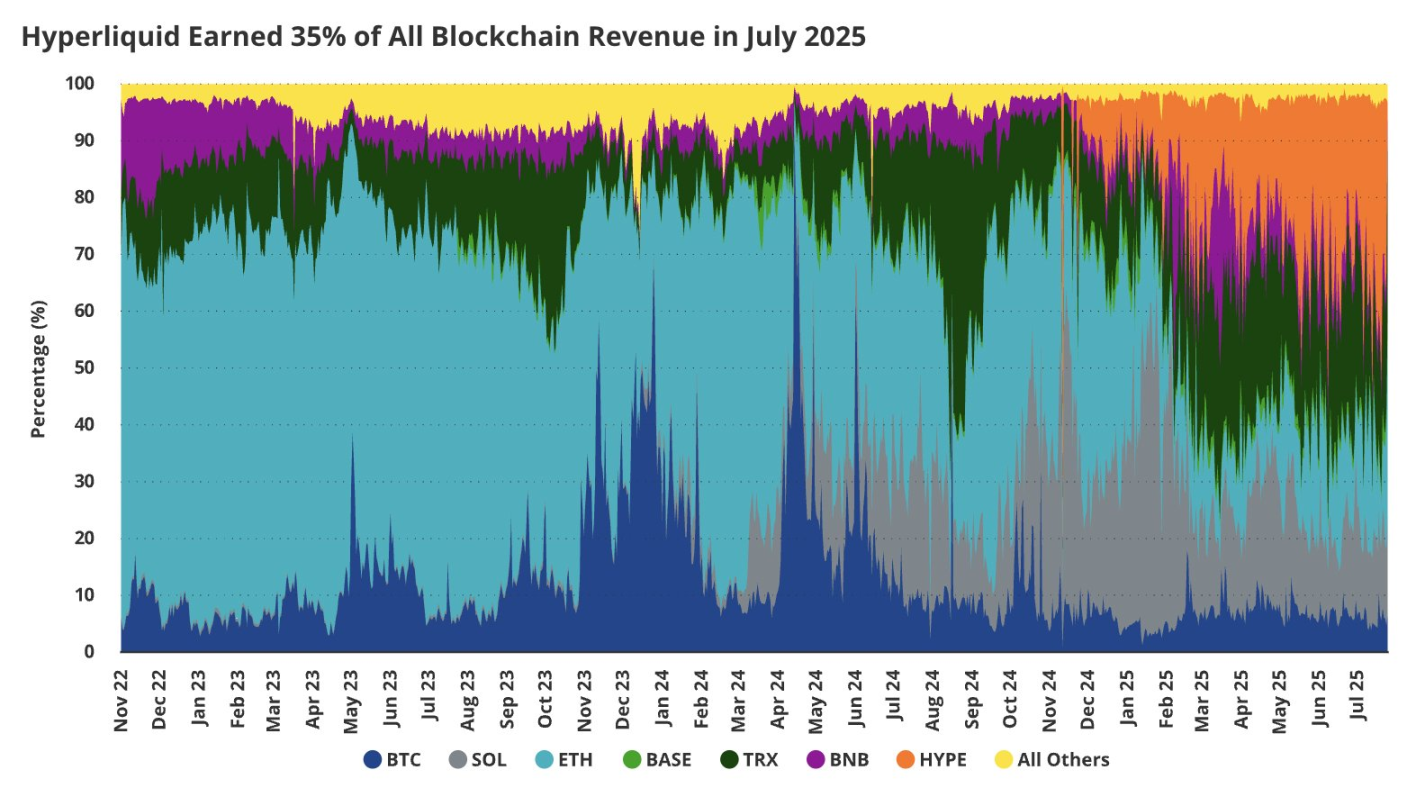

Meanwhile, Hyperliquid has profited immensely in the industry. Matthew Sigel, head of digital asset research at VanEck, stated that in July 2025, Hyperliquid's revenue accounted for 35% of the overall blockchain. This means that while most traders lose on the platform, Hyperliquid itself has become the biggest beneficiary.

At the gambling table, some gamblers become rich overnight, while others lose everything in an instant, but regardless of who wins or loses, the casino always takes a stable cut.

For Hyperliquid, the fluctuations of Huang Licheng, JamesWynnReal, or qwatio are merely part of the capital flow; the true role that always profits without loss is the platform itself.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。