David Bailey’s Nakamoto Merger Turns KindlyMD Into BTC Whale

KindlyMD acquires 5,743.91 Bitcoin for $679 million

A healthcare company that became a bitcoin treasury organization following its merger with David Bailey's Nakamoto Holdings is creating new headlines in the crypto market. Firm started its ambitious bitcoin accumulation goal by purchasing 5,744 BTC to expand its reserves.

Source : Website

What Role Does David Bailey Play in KindlyMD Strategy?

KindlyMD Bitcoin purchase now holds a total of 5,764.91 coins. The company acquired at an average price of $118,204 per coin for approximately $679M. This is the first purchase that firm has made yet. The buying was done by mainly using PIPE proceeds reflecting its long-term goal and belief in the BTC treasury trend.

Source : X

By combining funds from a concurrent $200 million convertible note offering and an expanded $540 million PIPE financing, the company and Nakamoto successfully concluded their merger on 15 August. The newly combined company, trading under the symbol NAKA. The KindlyMD merger with Nakamoto and funds raised are purely for the purpose of growing their newly formed Digital asset reserve firm.

Is KindlyMD’s Goal of 1 Million Bitcoin Realistic?

“Our long-term mission of accumulating one million coin reflects our belief that BTC will anchor the next era of global finance,” said David Bailey.

The CEO of BitcoinMagazine, David Bailey, co-founded the holding company Nakamoto with the goal of buying digital gold . During the Republican candidate's campaign last year, Bailey gave advice to President Donald Trump on crypto policy.

By buying more than 1M tokens, Nakamoto hopes to eventually amass up to 5% of the 21 million hard-capped supply of the digital gold. This aggressive accumulation strategy shows increasing institutional hunger for exposure to the coin and the growth of digital asset reserves as a new asset class.

742% Stock Growth, 11% Dip: Market Reacts to KindlyMD’s BTC Bet

KindlyMD Bitcoin 's widespread acceptance and recent ATH have sparked curiosity about its largest holders. The distribution of token reveals a complex story of wealth, power, and belief in the world's most valuable digital asset. Some are transparent public entities, while others hide behind anonymity and blockchain addresses. All are key players in shaping coin's present and future.

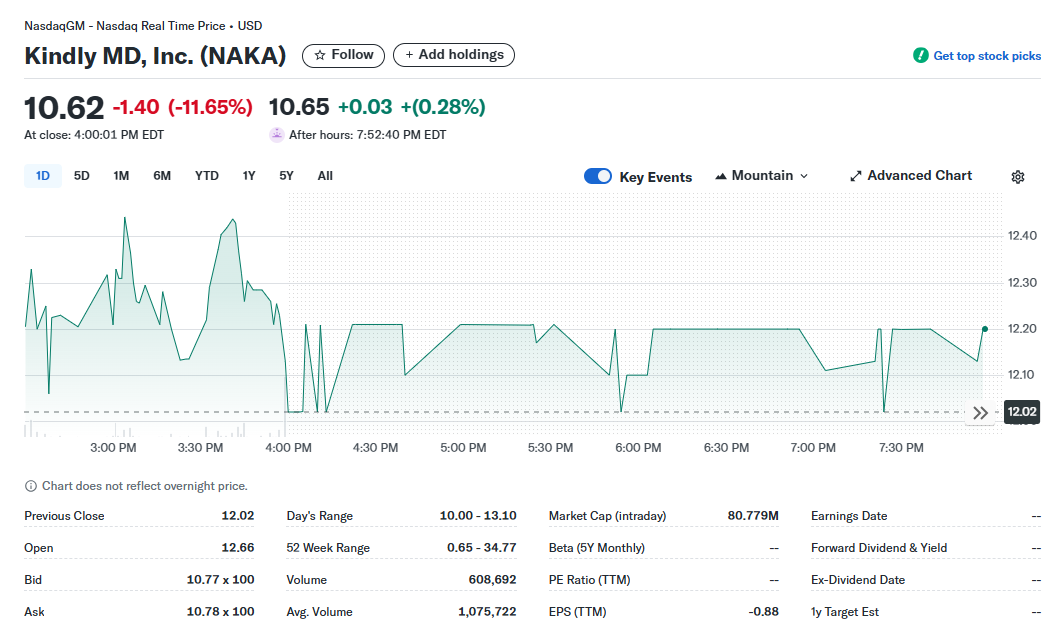

Source Yahoo Finance

The healthcare company’s shares have surged an impressive 742% in the year to date at a market cap of $80 million. As the KindlyMD Bitcoin acquisition news spreads in market the shares a dip of 11% closing at 10.62

Are Corporations Competing to Become the Biggest Bitcoin Whales?

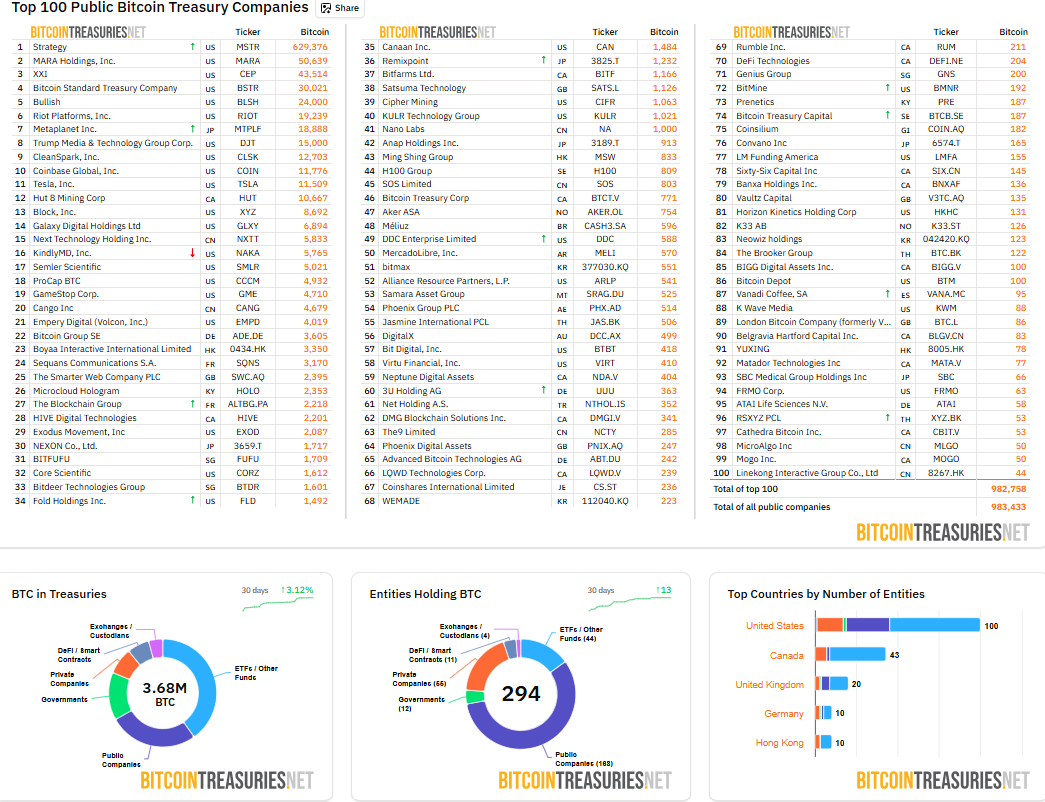

In 2020, Strategy changed its focus from developing software to accumulating coins, and now holds 629,376 BTC, valued at over $71 billion, making it the greatest corporate holder of the commodity.

Source : Bitcointreauriesnet

According to bitcointreasuries.net, there are already 168 publicly traded corporations with Digital gold treasuries, holding about 983,000 tokens in total. Companies are still starting up and accumulating digital assets worth billions of dollars, even if some experts warn of the dangers and the possibility that failed enterprises may fail.

Also read: Hamster Kombat GameDev Heroes Daily Cipher August 20 2025: Play免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。