Crypto News Today: Key Reasons Behind Market Dip and Trader Insights

The global decentralised market is showing red signals today. According to the data of CoinGeckoAs of now the total crypto market stands at $3.94 trillion a 0.4% low recorded in the last 24 hours. While the trading volume of the market is $148 billion.

Why Crypto Market Down Today: Reasons to consider

As per the data of CoinMarketCap, at the time of writing, Bitcoin is trading at $115,014 and running down today by 0.29%, Ethereum is trading at $4,236.32 with a downfall recorded in a day of 0.86%, whereas Solana at $179.93 with a down of 0.55%.

The recent dip in the crypto is not random but is is closely tied to global economic events The following below mentioned reasons could be the possible reasons of system facing downfall these days:

-

Jackson Hole Economic Symposium (Aug 21-23):- Fed Chair Jerome Powell’s upcoming speech has put the traders on edge. If he wants to lower the interest rate, which is 4.25% to 4.5% then the Crypto world will see a high surge in the prices. If he supports cuts then it could bring more liquidity into decentralised world.

-

Recently, Trump and Putin meeting in Alaska was expected to be a discussion for the Russia-Ukraine war, but no outcome like it has been seen. Fear, uncertainty, and global economic ripple effects from the war are pressuring Bitcoin, Ethereum, and altcoins, pushing prices down.

-

Ongoing court reviews of Trump-era tariffs are creating trade uncertainty that is making investors cautious. This fear is pressuring BTC, ETH and other cryptocurrencies adding to the recent drop.

-

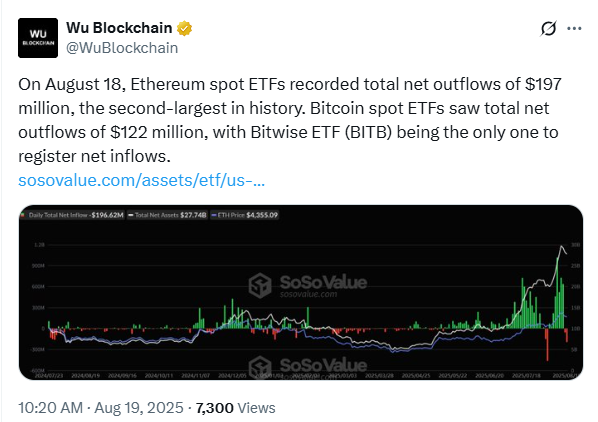

As on August 18, Ethereum ETFs recorded a total net outflows of $197 million and Bitcoin ETFs showed a total outflow of $122 million.

-

September Fed Meeting (Sept 16-17):- The two day FOMC meeting, less jobs could add pressure to ease the rates. Now pricing a 61% chance of a 25bps cut. Since Ethereum and Bitcoin are moving high correlation with US equities, stock market sentiment will directly influence prices.

Source: X

Crypto Liquidations Hit $334M in 24 Hours

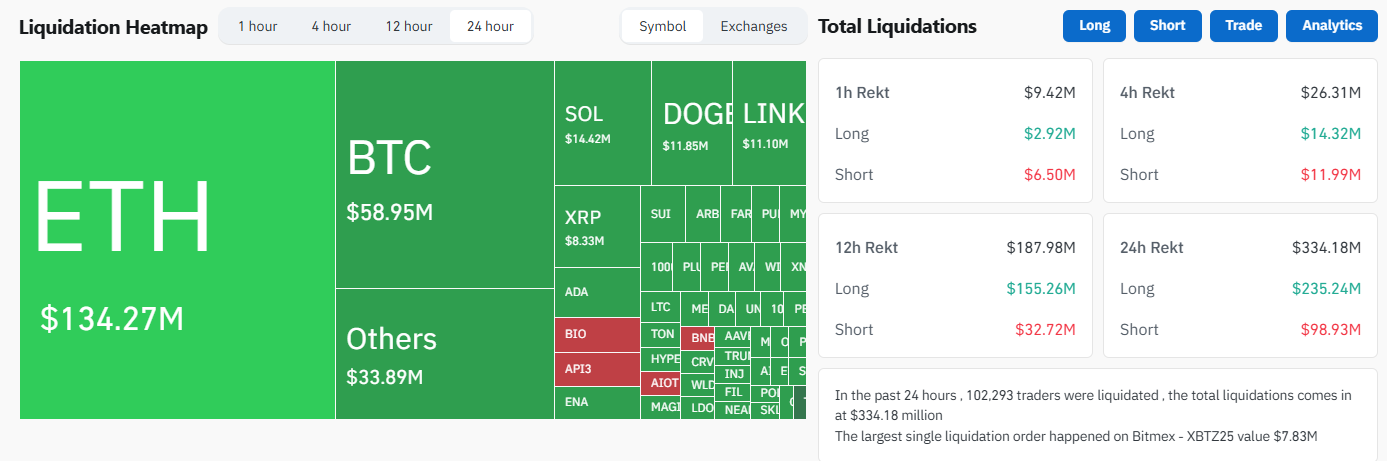

In the past 24 hours the digital asset market saw a total of $334.18 million in liquidations impacting 102,293 traders.

Ethereum suffered the most at $134.27million, followed by Bitcoin at $58.95M, Solana $14.42M, Dogecoin $11.85M and Chainlink $11.10M.

The long positions dominated with $235.24million while shorts accounted for $98.93M. The largest single liquidation was on Bitmex for $7.83M. This shows the high leverage and short-term volatility across major cryptocurrencies.

Source: Coinglass

Will the Crypto Market Rise Again? What to Expect Next

As the Crypto Fear and Greed Index is showing 56 that is indicating mild greed and people are slightly confident in the decentralised world. As compared to the previous data the greed was higher yesterday at 60, last week it was 68 and last month it was 72.

So, while traders are still optimistic the excitement has slightly cooled down over the past month.

Source: Alternativeme

Conclusion

The decentralised world is facing a temporary dip due to global economic uncertainty and ETF outflows. However mild optimism among the traders suggests a potential recovery could be on the horizon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。