韩国金融服务委员会(FSC)已命令交易所暂停新的加密货币借贷产品,直到正式指南出台,理由是用户和市场稳定性面临日益增加的风险。

监管机构提到了最近在Bithumb发生的事件,在6月份超过27,000名客户使用了借贷服务,其中13%因抵押品价值波动而被迫清算。

FSC的这一举措是在Galaxy Digital的分析师发布一份报告后几天做出的,报告中指出加密市场中杠杆的增加令人担忧。

FSC的行政指导允许现有贷款继续进行,但禁止推出新的借贷服务。官员表示,如果平台无视该指令,将会进行现场检查和其他监督措施。正式的借贷指南预计将在未来几个月内出台。

韩国的打击行动正值全球加密杠杆回升至牛市水平之际。Galaxy的报告显示,加密抵押贷款在第二季度跃升27%,达到531亿美元,为2022年初以来的最高水平。

上周$10亿美元的清算潮,是由比特币从124,000美元回落至118,000美元引发的,突显了过度押注如何迅速解体。

分析师警告说,系统中已经出现了压力点:去中心化金融(DeFi)流动性紧缩、以太坊质押退出排队,以及链上与场外美元借贷利率之间的利差扩大。

然而,并非所有人都同意韩国当局的做法。DNTV Research的Bradley Park认为需要更好的保障,而不是关闭。

“合理的做法是升级用户界面/用户体验、风险披露和贷款价值比(LTV)控制,以安全管理风险敞口,”Park在给CoinDesk的说明中表示,并指出大多数交易所的借贷是以稳定币进行的,用于建立空头头寸。

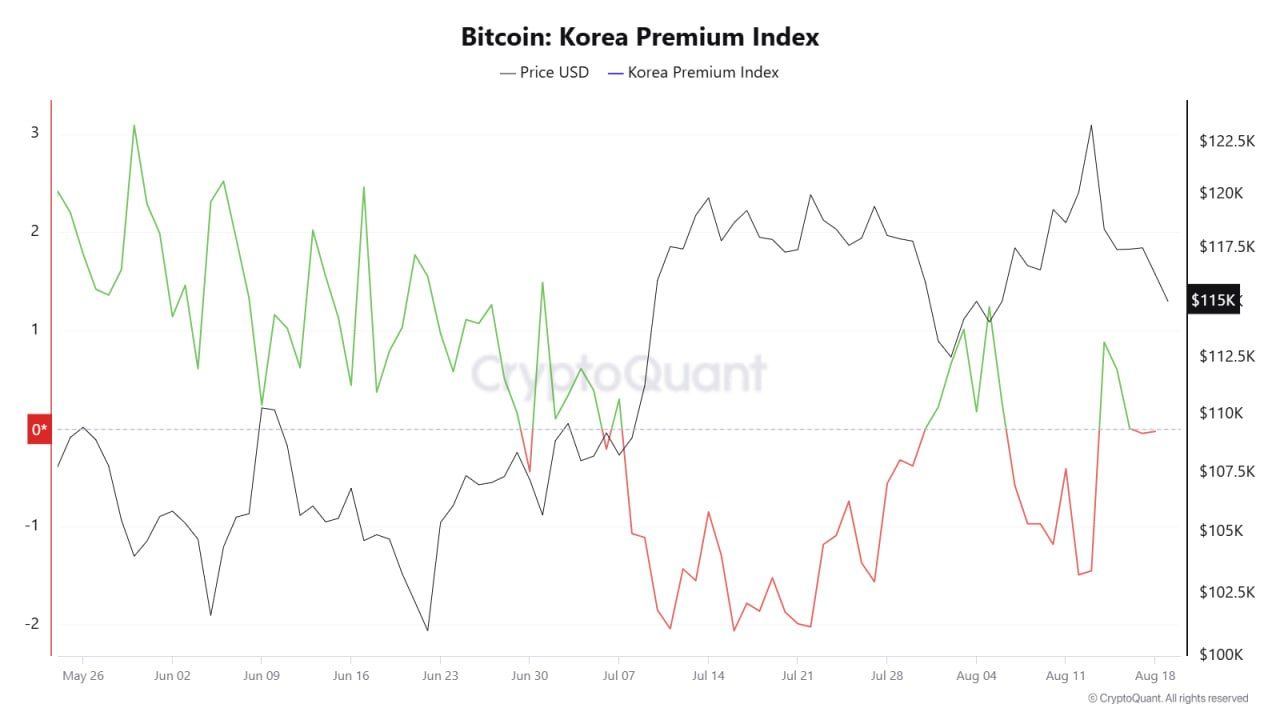

他补充说,监管机构真正关心的可能是市场结构扭曲,例如负的泡菜溢价,而不是服务本身。

Park表示,透明度缺口也使监督变得复杂:Bithumb披露了其借贷活动的规模,但该国最大的交易所Upbit并未披露。这种不透明性可能使监管机构更难判断系统性风险,并可能是全面暂停的关键因素。

“在解决这些结构性问题之前,重新开放可能需要时间;优先考虑应是理解机制并采用数据驱动的设计,而不是全面限制,”他总结道。

阅读更多:顾问的加密货币:亚洲稳定币的采用

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。