Who Will Benefit the Most?

Written by: mattdotfi

Translated by: AididiaoJP, Foresight News

Currently, only a few people are paying attention to @LayerZero_Core's acquisition of @StargateFinance, but since such mergers are extremely rare, I believe it is worth exploring in depth.

Proposal Summary

LayerZero plans to acquire the tokens and treasury of Stargate (currently, each $STG is supported by $0.1444 in funds) and terminate the Stargate DAO, integrating it into the $ZRO-led economic system.

Acquisition price: $0.1675 per $STG, or 0.08634 $STG for each $ZRO.

The proposal will follow the standard process of the Stargate DAO, requiring at least 1.2 million votes and a 70% approval rate to pass.

Future excess revenue generated by Stargate will be used to reduce the circulation of $ZRO through buybacks.

Pros and Cons Analysis

This raises a key question: "Who will benefit the most?"

In the current situation, LayerZero and $ZRO holders seem to be the biggest beneficiaries, as this is a liquidity acquisition conducted through its tokens, specifically manifested as:

Acquiring $STG supported by the Stargate treasury at a moderate premium of 16%, while increasing the number of $ZRO holders.

Earning fees generated by the protocol (approximately $1.74 million annually according to @DefiLlama data), which will be used to buy back $ZRO on the open market.

Vertically integrating the $ZRO token economy with cross-chain operations through buybacks (LayerZero is in a leading position) and enhancing its utility.

What do $STG and $veSTG (locked STG) holders get? Not much:

Due to the recent price increase of $ZRO, the exchange discount is low; $STG has only a slight premium due to market fluctuations, but the price floor is clear.

After an initial 24-hour discussion, LayerZero decided to pay $veSTG holders six months of Stargate revenue, as they cannot unlock their tokens before the end of the lock-up period.

Drawbacks and Concerns

The issues here are complex, but ultimately boil down to one word: compromise.

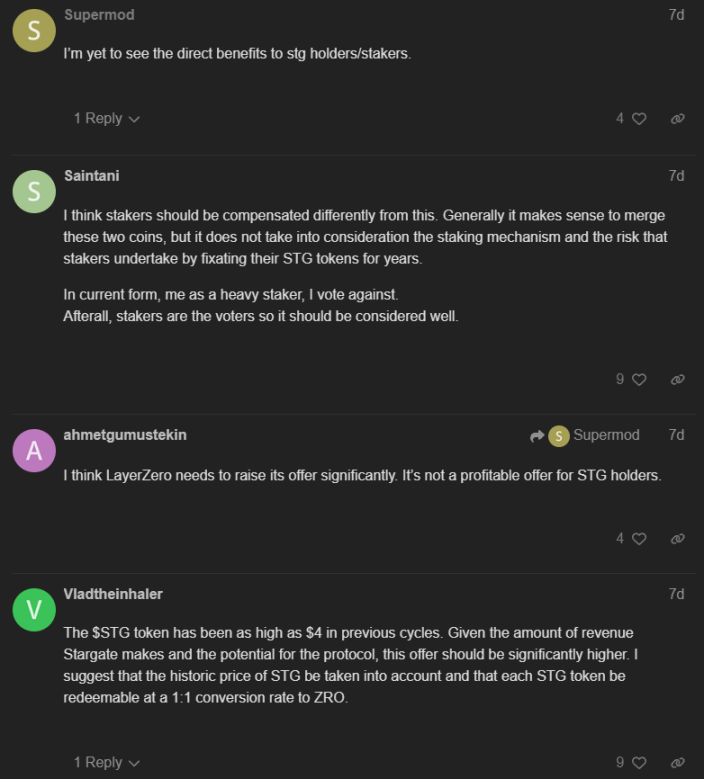

LayerZero profits more in the current situation, while Stargate token holders find it hard to be satisfied. Here are three major questions and uncertainties:

How should a reasonable premium for LayerZero's acquisition of $STG be calculated?

For $STG holders, how to choose between "the lesser of two evils"? Should they continue to endure ongoing selling pressure on the token, or opt for a safe but limited upside solution?

The average lock-up period for $veSTG holders is about a year; if the proposal passes, what incentive do they have to only receive six months of compensation?

Currently, the fully diluted valuation (FDV) of $STG is less than 10% of $ZRO, while $STG worth $8.1 million is locked in the form of $veSTG.

Many holders demand a 1:1 exchange of $ZRO for $STG, but this is unreasonable, as it would mean they instantly gain 12 times the profit, while LayerZero would need to use the entire FDV to acquire a stable but limited-income business.

Personal Opinion

Although I believe the LayerZero team should reassess the premium paid to $STG holders and design a more reasonable revenue-sharing plan for stakers, this acquisition may not necessarily be a disaster for the project itself.

DAOs primarily rely on revenue and token issuance to maintain operations, and $STG has plummeted over 95% from its historical high, with Stargate's annual revenue of only $2 million making it difficult to expand. Additionally, Stargate already relies on LayerZero's infrastructure, and integration will make it easier to achieve growth through its tech stack and funding.

That said, I think the proposal is meaningful for Stargate, but there is no need to rush to conclusions. The retention and loyalty of $STG holders to LayerZero will largely depend on how the team handles this matter. Otherwise, they may lose a group of potential new loyal $ZRO holders and participants who have supported Stargate since the project's inception.

Update:

The proposal has gone live on Stargate DAO, with the minimum threshold met; currently, 2.3 million circulating $veSTG (out of a total of 17 million) have voted "in favor" (98% to 2% "against").

I do not believe this is a hostile acquisition, but at this stage, LayerZero's benefits are clearly far greater than those of $STG and $veSTG holders.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。