This is the true institutional-level DeFi in the real sense.

Author: Cheeezzyyyy

Translation: Deep Tide TechFlow

For institutions, the dawn of new DeFi native financial assets is upon us.

The early integration of Pendle and Terminal Finance is not just another "yield opportunity."

This marks the arrival of a new financial era:

TradFi > DeFi native financial asset integration at the most fundamental level.

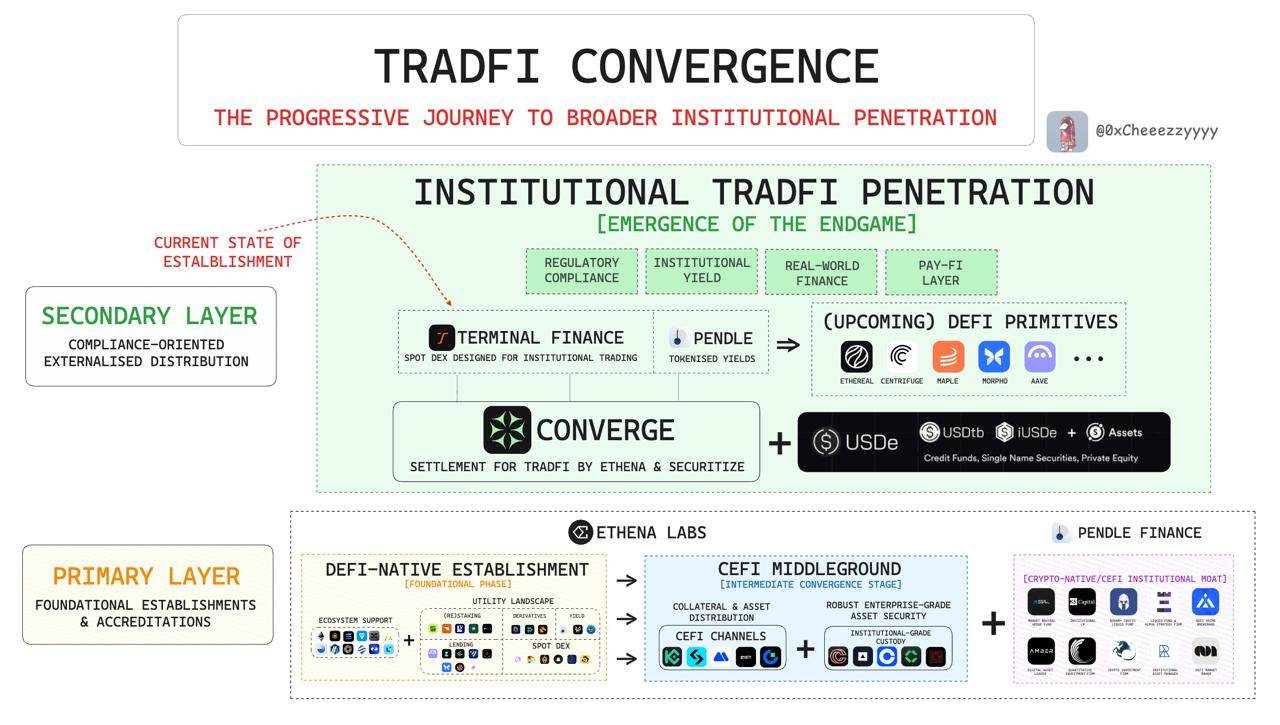

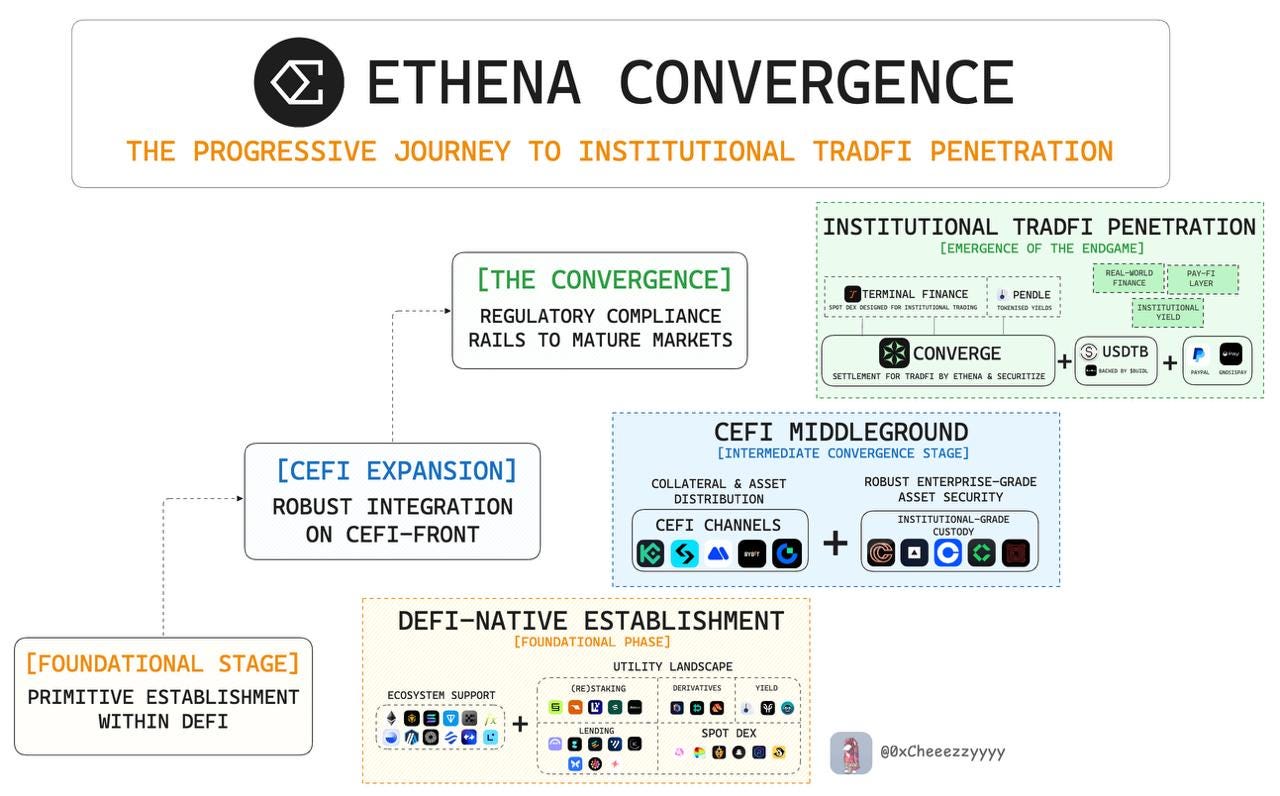

This is the harbinger brought by Converge: establishing strategic partnerships with Ethena and Securitize aimed at TradFi, paving the way for institutional capital entry.

As TradFi begins to recognize the powerful synergies unleashed by DeFi, the driving force behind this transformation stems from a new theory of institutional adoption, propelling this financial revolution.

Led by Terminal Finance, combined with the cutting-edge technologies of Ethena and Pendle, the Converge ecosystem gathers the forces most aligned with institutional needs in the DeFi space.

Its credibility comes not only from the speculative allure of the market but also from a meticulously designed financial architecture:

DeFi native infrastructure, deeply integrated with high composability

Strong CeFi external distribution capabilities

Closed-loop institutional participation model

All of this together forms a solid underlying structure, laying the foundation for broader institutional capital entry into the DeFi space.

Next Phase: Layer Two Formalization

This phase marks the final process of externalizing the Converge ecosystem, aiming to create a system fully aligned with traditional finance (TradFi), with core cornerstones including:

Traditional financial strategic distribution channels

Compliance regulatory framework

Institutional-level liquidity coordination mechanisms

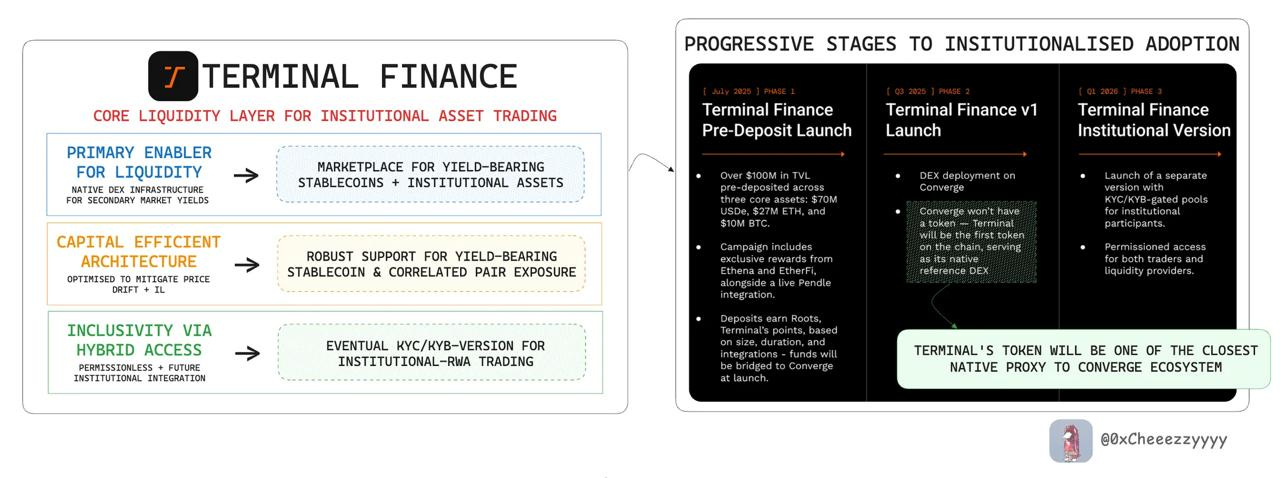

Through a bottom-up design, Terminal Finance becomes the core liquidity hub of Converge aimed at traditional finance, tailoring the entire financial architecture for institutional trading.

The entire spirit defining early DeFi's "Money Legos" is built on one principle: composable liquidity.

However, without deep, reliable, and accessible liquidity, composability is out of the question. This is precisely the critical gap that TerminalFi fills as the cornerstone of the Converge ecosystem.

It is not just an ordinary decentralized exchange (DEX), but an innovative platform designed specifically for institutional needs:

Core ecosystem driver: Building a robust secondary market for institutional-grade assets and yield-bearing stablecoins

Capital efficiency priority: Reducing price slippage and impermanent loss (IL) through optimized design, enhancing liquidity provision returns

Inclusive accessibility: Supporting permissionless trading while gradually rolling out KYC/KYB compliant institutional-grade real-world asset (RWA) trading

Clearly, TerminalFi, as an institutional-grade financial native component, offers a unique and highly attractive value proposition.

However, in the absence of a token roadmap from Converge, TerminalFi effectively serves as the closest native agent to capture the potential growth value of Converge.

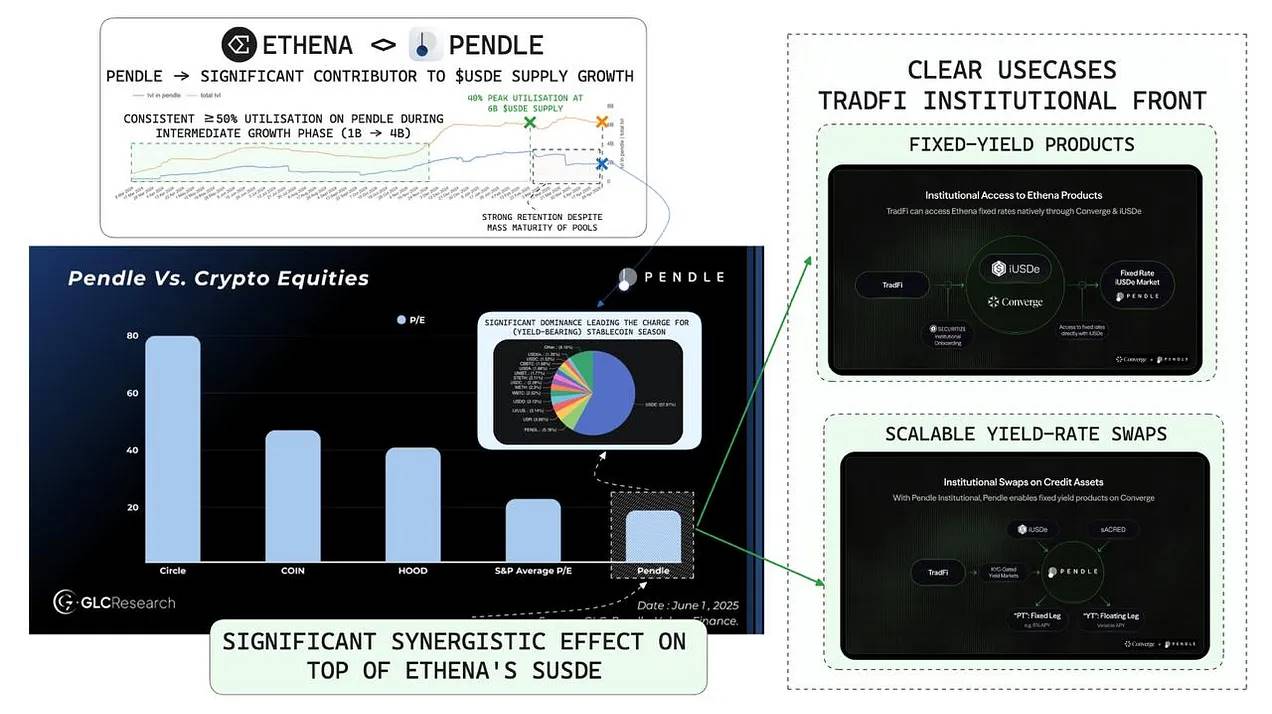

Strategic Dual Synergy: Pendle x Ethena

The YBS (yield-bearing stablecoin) theory of TerminalFi prompted its strategic choice of sUSDe as the core underlying asset, with the simultaneous launch alongside Pendle further solidifying this strategic direction.

This is no coincidence.

@ethena_labs achieved a supply scale of over $6 billion in less than a year, with Pendle Finance playing a significant role in this growth:

During the process of sUSDe supply rising from $1 billion to $4 billion, over 50% of the sUSDe supply was tokenized through Pendle.

When the supply reached $6 billion, peak utilization reached 40%.

The high level of sustained utilization on Pendle demonstrates the market fit of fixed and floating yield tokenization within DeFi native portfolios. More importantly, it further highlights the strong synergy between Ethena and Pendle: both driving each other, forming a lasting compound network effect cycle that brings profound impacts to the entire ecosystem.

But the synergy does not stop there.

Ethena and Pendle's goals extend far beyond DeFi users. They are jointly targeting larger institutional market opportunities:

Fixed income products: A market in traditional finance worth $190 trillion

Interest rate swaps: An even larger market segment, valued at $563 trillion

Through Converge's certified and regulated distribution channels, a key bridge connecting institutional asset allocators has been established. This breakthrough provides institutions with broad access to crypto-native yield sources, characterized by faster, composable, and yield-centric designs.

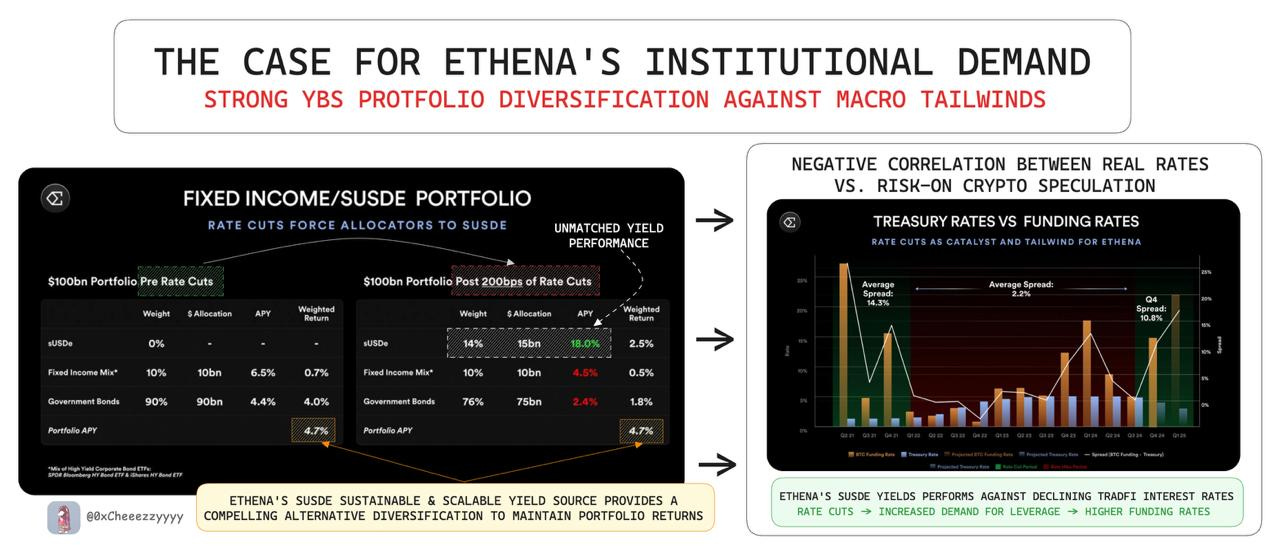

The success of this theory relies on innovative financial native assets, designed appropriately for the upcoming macro tailwinds to be effective, and Ethena's sUSDe perfectly fits this requirement:

The yield of sUSDe is negatively correlated with global real interest rates, which is starkly different from other debt instruments in traditional finance.

This means that sUSDe can not only survive in changing interest rate environments but also benefit and thrive from them.

Current interest rates (around 4.50%) are expected to decline, and institutional portfolios are bound to face challenges of yield compression—further solidifying sUSDe's positioning as a logical alternative for preserving investment returns.

In the 2020/21 period and the fourth quarter of 2024, the BTC financing spread exceeded 15% compared to real interest rates.

What does this mean?

From a risk-adjusted return perspective, sUSDe and its extended version iUSDe (the traditional finance packaged version) have a structural advantage. Coupled with its capital costs being significantly lower than traditional finance (TradFi), this presents a potential 10x return in the yet-to-be-explored traditional finance sector.

Dual Synergistic Growth Effect: The Key Role of Pendle

Next Phase: Integration

Clearly, Ethena and Pendle are strategically aligned and moving towards the same ultimate goal: the integration of traditional finance (TradFi).

Since its establishment in the first quarter of 2024, Ethena has successfully solidified its position in the DeFi native realm + CeFi intermediary space with a robust infrastructure:

USDe and sUSDe assets cover over 10 ecosystems + top DeFi integrations

Multiple CeFi distribution channels achieved through CEX for the adoption of perps + collateral utility

Payment layer integrations, such as PayPal and Gnosis Pay

This solid foundation lays the cornerstone for the final phase of institutional penetration into traditional finance (TradFi), while the birth of Terminal Finance becomes the core anchor of Converge, driving the development of a TradFi liquidity hub aimed at institutional trading.

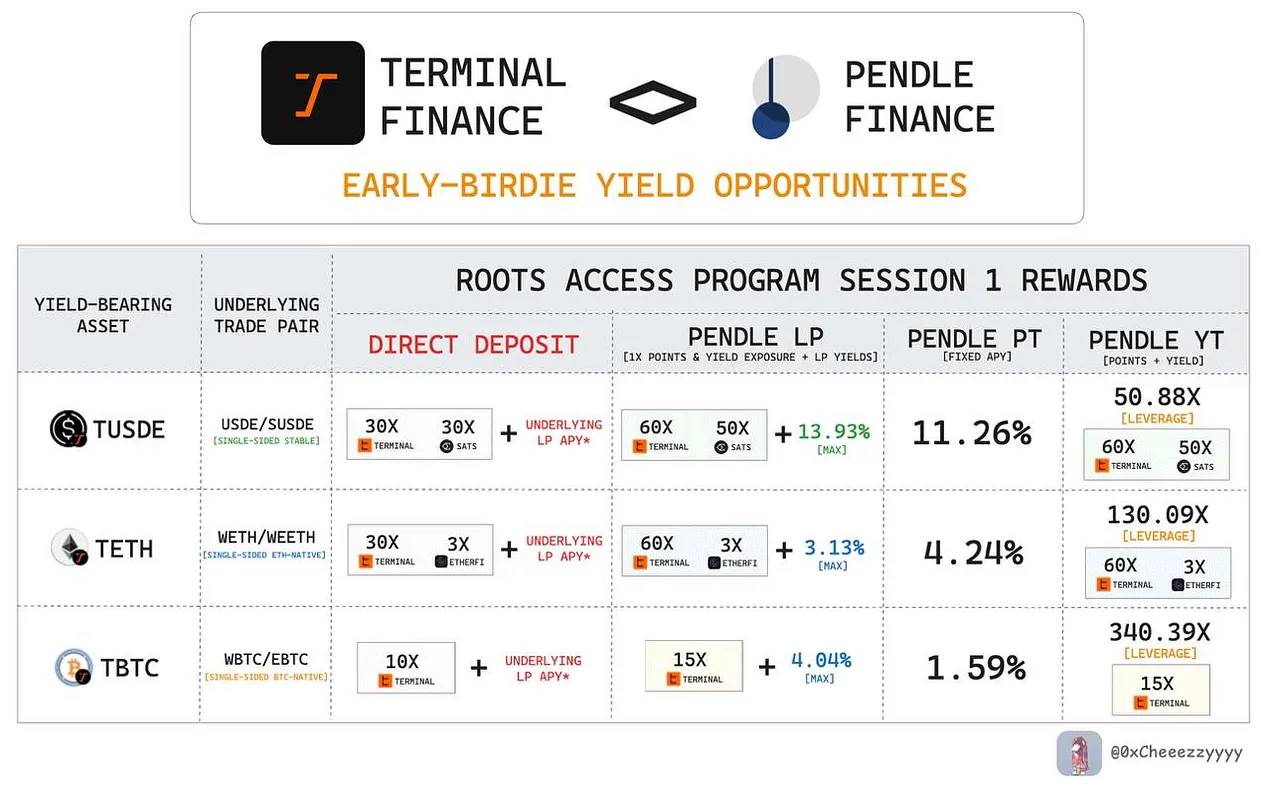

Undoubtedly, Pendle's participation unleashes the financial potential based on YBS native assets. At the same time, Pendle has also launched a pre-staking feature for LP tokens for the initial pools:

tUSDe: sUSDe/USDe pool

tETH: wETH/weETH (provided by EtherFi) pool

tBTC: wBTC/eBTC (provided by EtherFi) pool

*These pools are specifically designed for single-sided beta exposure + simultaneously minimizing impermanent loss (IL) risk to attract committed LPs willing to participate in liquidity provision long-term.

About Early Opportunities: Roots Access Program Phase One

The early guidance phase comes with exclusive multiplier rewards from Pendle, which are time-sensitive:

Terminal Point: 15x to 60x multiplier rewards (compared to 10x to 30x for direct deposits)

tUSDe Rewards: 50x Sats multiplier

tETH Rewards: 3x EtherFi multiplier

LP Annual Percentage Yield (APY): Up to 13.93%, including yield and point rewards, with negligible single-sided exposure and impermanent loss.

Fixed Annual Percentage Yield: tUSDe offers 11.26%

Highly capital-efficient YT exposure: Total yield and points can reach 51% to 340%

Clearly, there are no other avenues that can provide such strategically significant opportunities in the emerging field of institutional native assets.

Final Thoughts:

Looking at the bigger picture, the establishment of Converge marks the birth of the financial operating system for the next generation of economic native assets.

If you have not yet recognized this trend:

Ethena provides yield-bearing dollars

Pendle builds the yield-structured layer

Terminal leads the access to the institutional market

Together, these three form the core framework of a unique on-chain interest rate system that is composable, scalable, and capable of meeting the demand for higher yields from the trillions of dollars in the global fixed income market.

This truly opens the box of institutional-level DeFi.

And this transformation has already begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。