Lido, whose share of the Ethereum staking market was once so large it raised concerns the protocol was nearing a level considered a dangerous concentration of power, has dropped to a record low as competition from rivals intensifies and the development of infrastructure tailored for institutional finance opens new avenues into the industry.

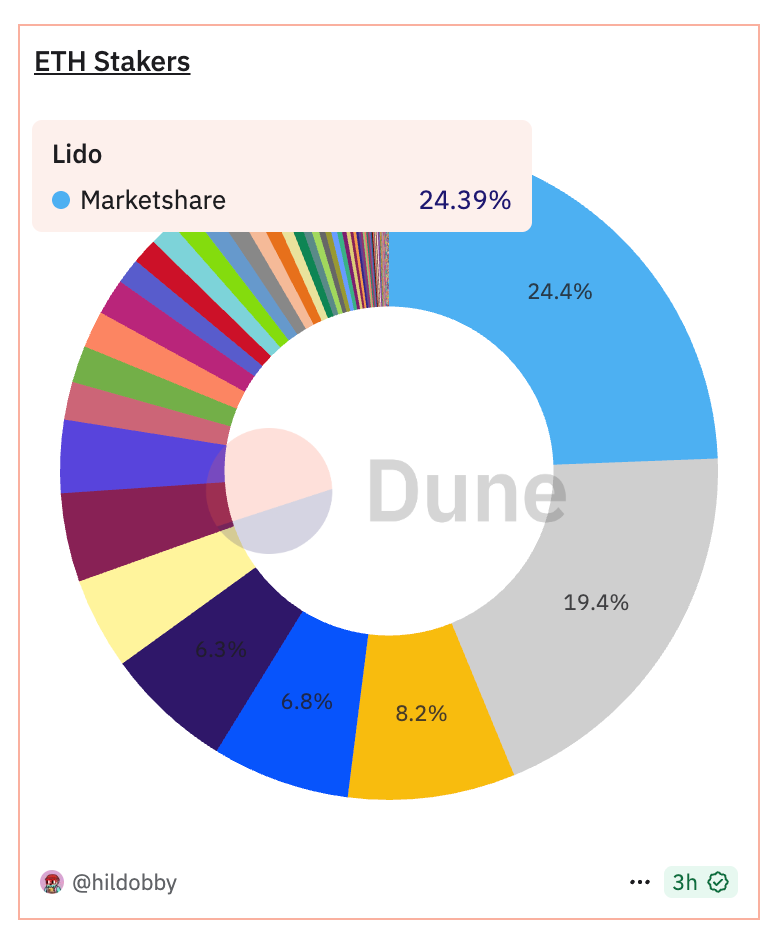

While it's still the dominant force, Lido's market share is now 24.4%, down from its highs in late 2023 when it held 32.3%. That's within striking distance of the 33% level many researchers and Ethereum core developers said would allow a single liquid staking provider to exert disproportionate influence over the blockchain's consensus mechanism.

The shift points to a staking ecosystem that is maturing. Where Lido once seemed unshakable, it now faces a mix of institutional-grade operators, community-run decentralized protocols and exchange-hosted staking products.

For Ethereum, this diversification may be a sign of improved blockchain health. If these trends continue, Ethereum staking in 2025 is likely to be defined less by concerns of single-provider dominance and more by competition among specialized service models.

"Lido’s share decreased considerably due to stake centralization concerns and protocol safety," said Darren Langley, the general manager of Lido-competitor Rocket Pool. "There was a big community effort to ensure that Lido did not reach 1/3 of total stake."

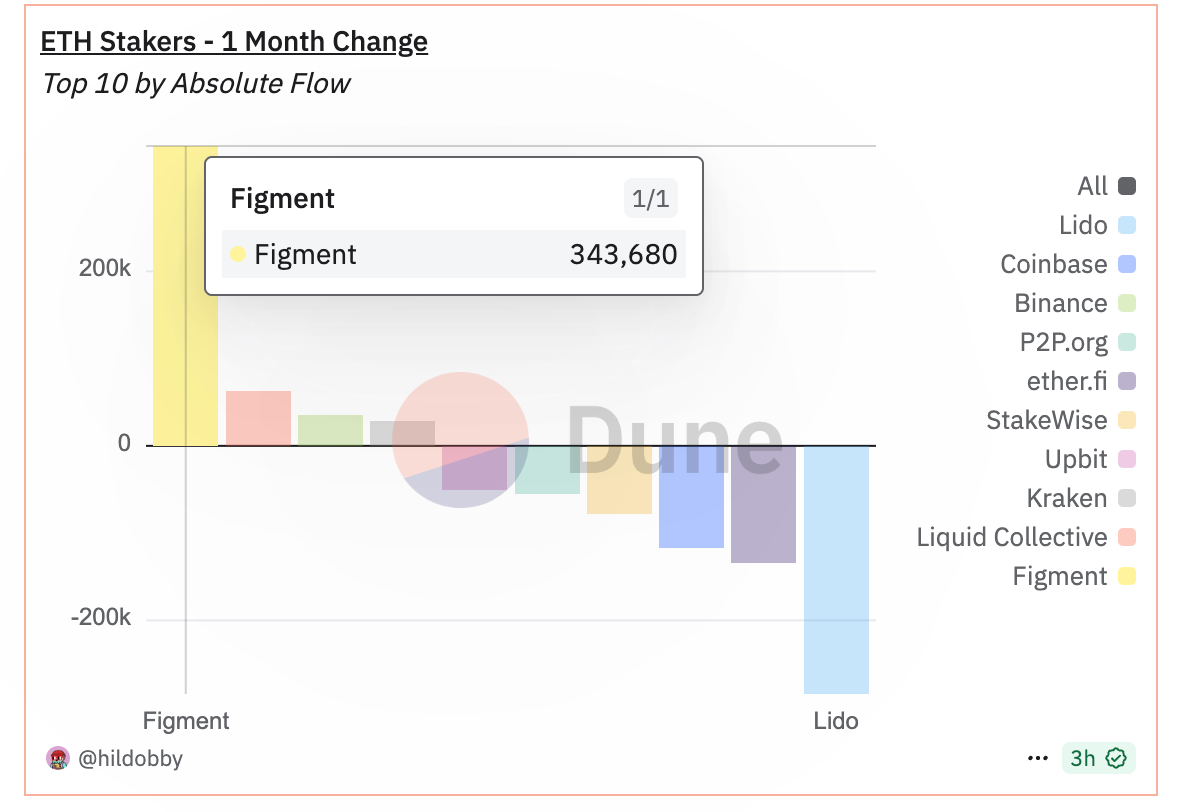

One of the clearest beneficiaries of the rebalancing is Figment, a staking infrastructure provider with a strong institutional client base. While Figment has long ranked among the largest validator operators on Ethereum, the past year has brought a marked acceleration in ETH deposits from funds, custodians and large-scale asset managers.

According to data from Dune Analytics, Figment was the largest gainer of new stakers over the last month, adding roughly 344,000 and now holding 4.5% of all staked ETH. Lido lost the largest number, about 285,000. Ether.fi, Coinbase (COIN) and Binance also figure among the largest holders.

Figment said ETH staking demand from its institutional clients doubled after the U.S. Securities and Exchange Commission (SEC) said in May that staking didn't constitute a securities activity, a surge mirrored in rising validator queue wait times across the network. Last week, the SEC clarified that those participating in liquid staking would also not need to worry about securities laws, a decision that is likely to open the doors to more staked products.

“Now that the largest institutions in the world are embracing digital assets, we’re busier than ever onboarding them," Figment CEO Lorien Gabel said in an interview. "We’ve built our business from day one on compliance, regulation, and risk-adjusted performance, exactly for customers like digital asset treasuries and neobanks. It’s working. If we weren’t winning the majority, I’d fire myself as CEO.”

Read more: SEC Green Light on Liquid Staking Sends ETH Past $4K, Spurs Broad Staking and Layer-2 Rally

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。