Fake guardrails, real traps.

Written by: Daii

But this time, the warning comes from Simon Johnson—a scholar who just won the Nobel Prize in Economic Sciences in 2024. This means that his views carry significant weight in both academic and policy circles and cannot be ignored.

Simon Johnson previously served as the Chief Economist at the International Monetary Fund (IMF) and has long focused on global financial stability, crisis prevention, and institutional reform. In the fields of macro-finance and institutional economics, he is one of the few voices that can influence academic consensus and shape policy design.

In early August this year, he published an article titled "The Crypto Crises Are Coming" on the globally renowned commentary platform Project Syndicate. This platform is known as a "column for global thought leaders" and has long provided articles for over 500 media outlets in more than 150 countries, with authors including political leaders, central bank governors, Nobel laureates, and top scholars. In other words, the views expressed here often reach the global decision-making level.

In the article, Johnson pointed his finger at a series of recent U.S. crypto legislations, particularly the recently passed GENIUS Act and the advancing CLARITY Act. In his view, these bills ostensibly aim to establish a regulatory framework for digital assets like stablecoins, but in reality, they are loosening key constraints under the guise of legislation. (Project Syndicate)

He stated:

Unfortunately, the crypto industry has acquired so much political power – primarily through political donations – that the GENIUS Act and the CLARITY Act have been designed to prevent reasonable regulation. The result will most likely be a boom-bust cycle of epic proportions.

Translation: Unfortunately, the cryptocurrency industry has gained significant political influence through substantial political donations, to the extent that the design of the GENIUS Act and the CLARITY Act is intended to prevent reasonable regulation. The result is likely to be an unprecedented boom-bust cycle.

At the end of the article, he provided a cautionary conclusion:

The US may well become the crypto capital of the world and, under its emerging legislative framework, a few rich people will surely get richer. But in its eagerness to do the crypto industry’s bidding, Congress has exposed Americans and the world to the real possibility of the return of financial panics and severe economic damage, implying massive job losses and wealth destruction.

Translation: The United States is likely to become the "crypto capital" of the world, and under this emerging legislative framework, a few wealthy individuals will undoubtedly become richer. However, in its eagerness to serve the cryptocurrency industry, Congress has exposed both Americans and the world to the real possibility of a return of financial panics and severe economic losses, which implies massive unemployment and wealth evaporation.

So, how did Johnson construct his arguments and logical chain? Why did he arrive at such a judgment? This is what we will analyze next.

1. Is Johnson's warning justified?

Johnson first set the overall context: The GENIUS Act was officially signed into law on July 18, 2025, while the CLARITY Act passed the House on July 17 and is awaiting Senate review.

These two bills clarify for the first time at the federal level "what stablecoins are, who can issue them, who regulates them, and within what scope they operate," effectively opening institutional pathways for "larger and more pervasive" crypto activities. (Congress.gov)

Johnson's subsequent risk assessment is based on this "institutional combination."

1.1 Interest Rate Spread: The Profit Engine for Stablecoin Issuers

His first step is to grasp the main thread of "where the money comes from"—stablecoins are zero-interest liabilities for holders (holding 1 USDC does not generate interest); meanwhile, issuers invest reserves into income-generating asset pools to profit from the interest rate spread. This is not speculation but a fact clearly stated in terms and financial reports:

The terms for USDC specify: "Circle may allocate reserves to interest-bearing or other income-generating instruments; these earnings do not belong to the holders." (Circle)

Media and financial disclosures further confirm: Circle's revenue almost entirely relies on reserve interest (with nearly all revenue in 2024 coming from this source), and changes in interest rates can significantly impact profitability. This means that as long as regulation allows and does not harm redemption expectations, issuers naturally have the incentive to maximize asset-side returns. (Reuters, The Wall Street Journal)

In Johnson's view, this "interest rate spread-driven" model is structural and normalized—when the core of profits comes from term and risk compensation, and earnings are not shared with holders, the impulse to "chase higher-yielding assets" must rely on rules to pin down the boundaries.

The problem is that these rules' boundaries themselves are elastic.

1.2 Rules: The Devil is in the Details

He then analyzed the micro provisions of the GENIUS Act, pointing out several seemingly technical details that could rewrite system dynamics in times of stress:

Whitelist-style reserves: Article 4 requires 1:1 reserves, limited to cash/central bank deposits, insured deposits, U.S. Treasury securities with a maturity of ≤ 93 days, (reverse) repos, and government money market funds that only invest in the aforementioned assets. On the surface, this is robust, but it still allows for certain maturities and repo structures—during times of stress, this could mean having to "sell securities for redemption." (Congress.gov)

"Shall not exceed" regulatory limits: The bill authorizes regulators to set capital, liquidity, and risk management standards but explicitly requires that these standards "shall not exceed the level necessary to ensure the ongoing operations of the issuer" (do not exceed… sufficient to ensure the ongoing operations). In Johnson's view, this effectively compresses the safety cushion to "just enough," rather than reserving redundancy for extreme situations. (Congress.gov)

He pointed out that normally, the whitelist + minimum requirements make the system more efficient; however, in extreme cases, the maturity and repo chains can amplify the time lag and price shocks of "redemption—liquidation."

1.3 Speed: Bankruptcy Measured in Minutes

In the third step, he brought "time" to the forefront.

Although the GENIUS Act enshrines the priority of stablecoin holders in bankruptcy and requires courts to strive to issue distribution orders within 14 days, which seems investor-friendly; compared to the minute-level redemption speed on-chain, this is still too slow. (CoinDesk)

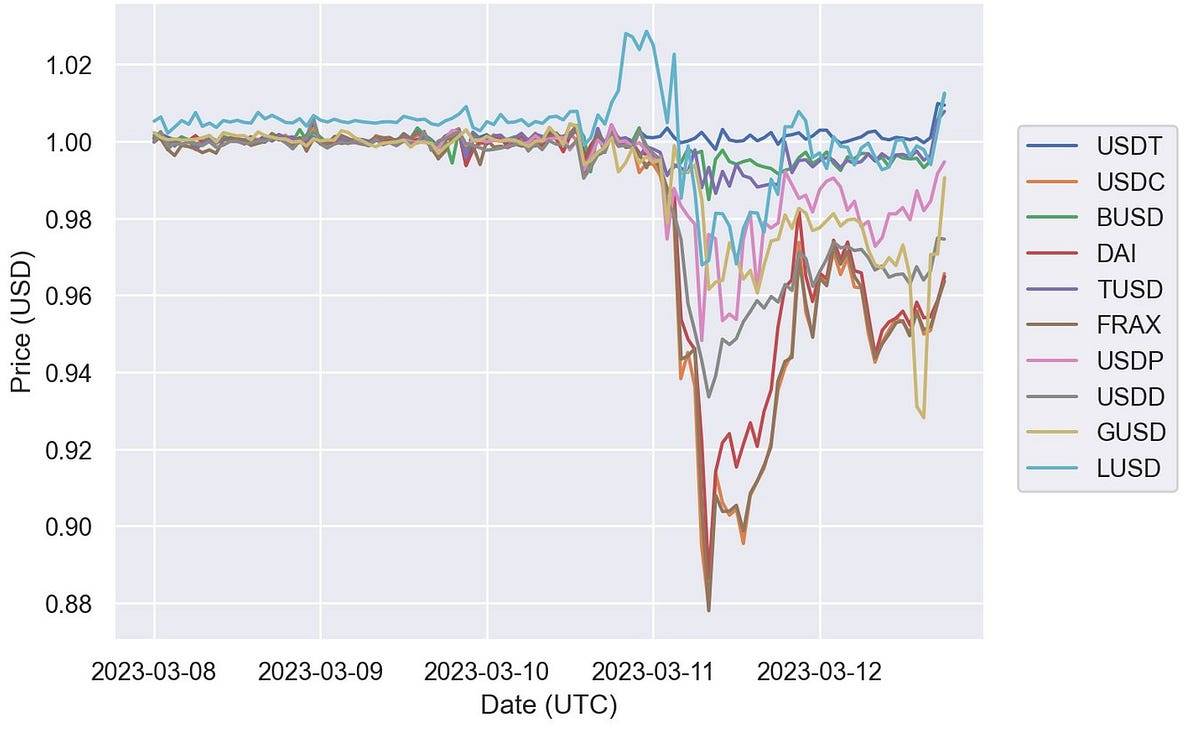

Real-world cases confirm this speed mismatch: During the March 2023 SVB (Silicon Valley Bank) incident, USDC briefly fell to $0.87–0.88, stabilizing only after filling the gap and restoring redemptions; research from the New York Fed documented the "collective run" and "flight to safety" patterns of stablecoins in May 2022. In other words, panic and redemption occur on an hourly basis, while legal and court processes take days. (CoinDesk, New York Federal Reserve Bank, Liberty Street Economics)

This is precisely what Johnson refers to as the system's "leverage point": when the asset side must respond to minute-level liability flight through "selling securities for redemption," any procedural delay could amplify individual risks into systemic shocks.

1.4 Backdoors: The Boundaries Loved by Profits

He then discussed the cross-border dimension:

The GENIUS Act allows foreign issuers to sell in the U.S. under "comparable regulation" and requires maintaining liquidity in the U.S., but the Treasury can exempt certain requirements through mutual recognition arrangements. Although the provisions do not explicitly state that non-U.S. sovereign debt can be invested, Johnson worries that "comparable" does not equal "identical," and the relaxation of mutual recognition and reserve requirements could lead some reserves to decouple from the dollar, thereby amplifying exchange rate mismatch risks when the dollar appreciates significantly. (Congress.gov, Gibson Dunn, Sidley Austin)

At the same time, the bill leaves ample space for state-qualified issuers, and federal intervention requires meeting conditions, which provides fertile ground for regulatory arbitrage—issuers will naturally migrate to the jurisdictions with the loosest regulations. (Congress.gov)

The conclusion is that the regulatory puzzle of cross-border and interstate activities, once combined with profit motives, often pushes risks to the softest boundaries.

1.5 Fatal: No "Lender of Last Resort" and Loose Political Constraints

In terms of institutional design, the GENIUS Act does not establish a "lender of last resort" or insurance safety net for stablecoins. The bill excludes stablecoins from the definition of commodities but does not categorize them as insured deposits—issuers must qualify as insured deposit institutions to achieve this. As early as 2021, the President's Working Group on Financial Markets (PWG) suggested that only insured deposit institutions should be allowed to issue stablecoins to mitigate the risk of runs, but this recommendation was not adopted in the bill. This means that stablecoin issuers lack FDIC (Federal Deposit Insurance Corporation) insurance protection and cannot receive discount window support during a crisis, creating a significant gap compared to traditional "bank-like prudential frameworks." (Congress.gov, U.S. Department of the Treasury)

What worries Johnson even more is the potential entrenchment of this institutional gap due to the political and economic backdrop. In recent years, the influence of the crypto industry in Washington has rapidly increased—just the Fairshake and other related super PACs raised over $260 million during the 2023-24 election cycle, becoming one of the most vocal financial backers; the entire industry’s external fundraising for congressional elections has surpassed the billion-dollar mark. In this context, the "flexible choices" in the legislation and political motivations may reinforce each other, making the "minimum sufficient" safety cushion not only a real choice but potentially evolve into a long-term norm. (OpenSecrets, Reuters)

1.6 Logic: From Legislation to Depression

Connecting the above points, we arrive at Johnson's reasoning path:

A. Legislation legitimizes larger-scale stablecoin activities

→ B. Issuers rely on a profit model of zero-interest liabilities—interest-bearing assets

→ C. The legislation opts for "minimum sufficient" in reserves and regulatory standards, retaining flexibility for arbitrage and mutual recognition

→ D. During a run, minute-level redemptions encounter day-level processing, forcing the sale of securities for redemption, impacting short-term interest rates and the repo market

→ E. If combined with foreign currency exposure or the loosest regulatory boundaries, risks are further amplified

→ F. The lack of a lender of last resort and insurance safety net makes individual imbalances easily evolve into industry volatility

This logic is persuasive because it combines a close reading of the legislation (e.g., "do not exceed… ongoing operations," "14-day distribution order") with empirical facts (USDC dropping to 0.87–0.88, collective redemptions of stablecoins in 2022), and it resonates strongly with the Financial Stability Board (FSB), Bank for International Settlements (BIS), and PWG's focus on "runs and fire-sale dynamics" since 2021. (Congress.gov, CoinDesk, Liberty Street Economics, Financial Stability Board)

1.7 Summary

Johnson does not assert that "stablecoins will inevitably trigger a systemic crisis," but rather warns: when "interest rate incentives + minimum safety cushion + regulatory arbitrage/mutual recognition flexibility + processing speed lag + no LLR/insurance" combine, the elasticity of the system can inversely become a risk amplifier.

In his view, some institutional choices in the GENIUS/CLARITY acts make it easier for these conditions to occur simultaneously, hence the warning of a "boom-bust" cycle.

Historically, two crises related to stablecoins seem to provide indirect validation for his concerns.

2. The "Truth Moment" of Risk

If Johnson's analysis above represents "institutional concerns," the true test of the system occurs at the moment of a run—markets do not provide warnings or ample reaction time.

Two historically distinct events have allowed us to see the "underbelly" of stablecoins under pressure.

2.1 Mechanics of a Run

First, consider the UST during the "barbaric era."

In May 2022, the algorithmic stablecoin UST rapidly lost its peg within days, and the related token LUNA entered a death spiral, forcing the Terra chain to shut down temporarily, with exchanges delisting it one after another. The entire system evaporated approximately $40–45 billion in market value within a week, triggering a broader wave of crypto sell-offs. This was not just ordinary price volatility but a classic bank-like run: when the promise of "stability" relies on internal minting and confidence cycles rather than quickly redeemable external high-liquidity assets, once confidence is shattered, selling pressure self-amplifies until the system completely collapses. (Reuters, The Guardian, Wikipedia)

Next, consider the USDC de-pegging event "before the era of compliance," which revealed how off-chain banking risks can instantaneously transmit to on-chain.

In March 2023, Circle disclosed that approximately $3.3 billion of its reserves were held at Silicon Valley Bank (SVB), which faced a sudden liquidity crisis. Within 48 hours of this news, USDC's price in the secondary market dropped to $0.88 until regulators announced full protection for SVB deposits and launched the Bank Term Funding Program (BTFP) emergency tool, quickly reversing market expectations and restoring the peg.

That week, Circle reported net redemptions of $3.8 billion; third-party statistics showed that on-chain burn and redemptions continued to amplify over several days, with a single-day redemption peak approaching $740 million. This indicates that even if reserves are primarily invested in high-liquidity assets, as long as the "redemption path" or "bank custody" is questioned, a run can ferment within minutes/hours until a clear liquidity backstop appears. (Reuters, Investopedia, Circle, Bloomberg.com)

When comparing the two events, you will find that the same set of "run mechanics" has two triggering methods:

UST: Endogenous mechanisms are weak—there are no verifiable, quickly liquidatable external assets to support the peg, relying entirely on expectations and arbitrage cycles;

USDC: External support exists, but the off-chain anchor becomes unstable—single points of failure on the banking side are instantaneously amplified into price and liquidity shocks on-chain.

2.2 Actions and Feedback

The New York Fed team characterized this behavioral pattern using the framework of money market funds: stablecoins have a clear "breaking the $1" threshold, and once it falls below, redemptions and asset swaps accelerate, leading to a flight to safety from "riskier stablecoins" to "perceived safer stablecoins." This explains why, during the USDC de-pegging, some funds simultaneously flowed into "Treasury-type" or perceived safer alternatives—migration is rapid, directionally clear, and self-reinforcing. (New York Federal Reserve Bank, Liberty Street Economics)

More importantly, consider the feedback loop: as on-chain redemptions accelerate and issuers need to "sell securities for redemption," the selling pressure directly transmits to short-term Treasuries and the repo market. The latest BIS working paper, using daily data from 2021 to 2025, found that significant inflows of stablecoin funds can lower the yield on 3-month U.S. Treasuries by 2–2.5 basis points within 10 days; conversely, the yield increase from equivalent outflows is even stronger, being 2–3 times that of the former. In other words, the pro-cyclical and counter-cyclical fluctuations of stablecoins have already left statistically identifiable "fingerprints" on traditional safe assets; once a USDC-level short-term large redemption occurs, the "passive selling—price shock" transmission path is indeed present. (Bank for International Settlements)

2.3 Lessons

The cases of UST and USDC are not coincidental but rather structured warnings:

"Stability" without redeemable external asset support is essentially a race against collective behavior;

Even with high-quality reserves, the single-point fragility of the redemption path can be instantaneously amplified on-chain;

The "time gap" between the speed of a run and the speed of resolution determines whether it evolves from localized risk to systemic disturbance.

This is also why Johnson discusses "stablecoin legislation" alongside "run mechanics"—if legislation only provides a minimum sufficient safety cushion without incorporating intraday liquidity, redemption SLA (Service Level Agreement), stress scenarios, and orderly resolution into executable mechanisms, then the next "truth moment" may come even faster.

So the question is not whether "the legislation is wrong," but rather to acknowledge:

Proactive legislation is clearly better than no legislation, but passive legislation may be the true coming-of-age for stablecoins.

3. The Coming-of-Age of Stablecoins—Passive Legislation

If we compare the financial system to a highway, proactive legislation is like drawing guardrails, speed limit signs, and emergency escape routes before driving; passive legislation often appears after an accident, using thicker concrete barriers to fill in the gaps that once existed.

To explain the "coming-of-age of stablecoins," the best reference is the history of the stock market.

3.1 The Coming-of-Age of Stocks

The U.S. securities market did not initially have disclosure systems, exchange rules, information symmetry, and investor protection. These "guardrails" were almost all put in place after accidents occurred.

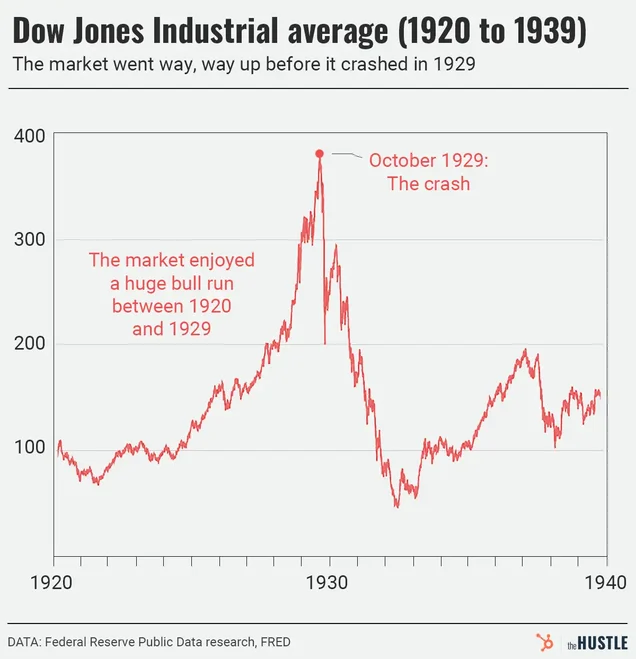

The 1929 stock market crash dragged the Dow Jones index into a deep abyss, leading to a series of bank failures that peaked in 1933. After this disaster, the United States enacted the Securities Act of 1933 and the Securities Exchange Act of 1934, embedding information disclosure and ongoing regulation into law, and establishing the SEC as a permanent regulatory body. In other words, the maturity of stocks was not achieved through ideological persuasion but was shaped by crises—its "coming-of-age" was the passive legislation that followed the crisis. (federalreservehistory.org, Securities and Exchange Commission, guides.loc.gov)

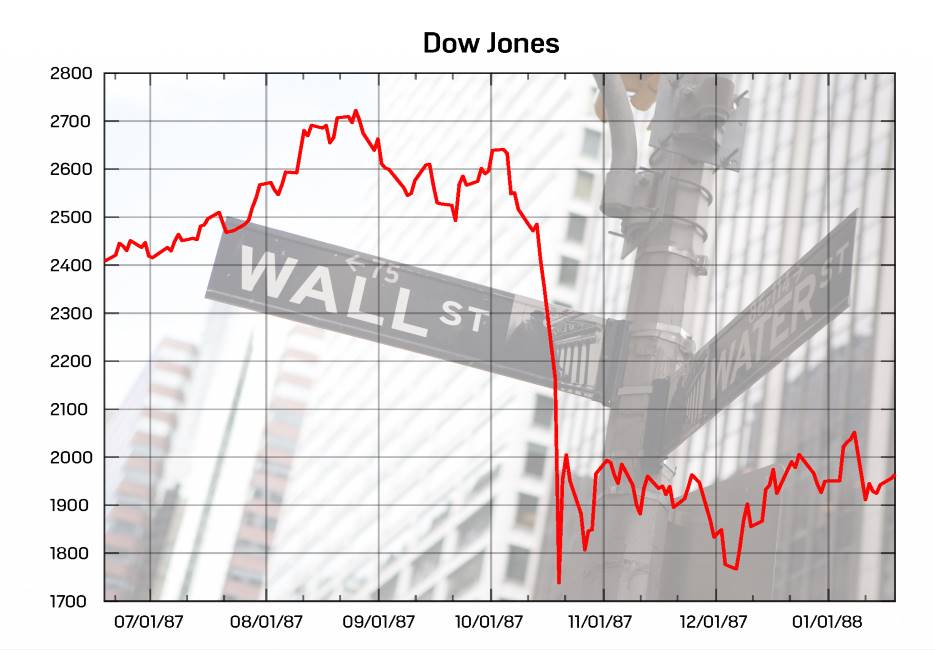

The "Black Monday" of 1987 is another collective memory: the Dow plunged 22.6% in a single day, after which U.S. exchanges institutionalized "circuit breakers," providing the market with brakes and emergency escape routes. During extreme moments such as 2001, 2008, and 2020, "circuit breakers" became standard tools to curb panic selling. This is a typical case of passive rule-making—first there is severe pain, then there is institutionalization. (federalreservehistory.org, Schwab Brokerage)

3.2 Stablecoins

Stablecoins are not "subordinate innovations," but rather, like stocks, they belong to infrastructure-type innovations: stocks transform "ownership" into tradable certificates, reshaping capital formation; stablecoins transform the "fiat cash leg" into programmable, globally available 24/7 settlement digital objects, reshaping payments and clearing. The latest BIS report explicitly states that stablecoins have been designed as gateways into the crypto ecosystem, serving as transaction mediums on public chains and gradually becoming deeply coupled with traditional finance—this is a reality, not a concept. (Bank for International Settlements)

This "reality-virtual" integration is taking shape.

This year, Stripe announced that Shopify merchants can accept USDC payments and choose to automatically settle into their local currency accounts or retain them as USDC—on-chain cash legs directly connect to merchant ledgers. Visa also clearly positions stablecoins on its stablecoin page as a payment vehicle of "fiat currency stability × crypto speed," incorporating tokenization and on-chain finance into the payment network. This means stablecoins have penetrated real-world cash flows; when cash legs go on-chain, risks are no longer confined to the crypto circle. (Stripe, Visa Corporate)

3.3 Inevitable Coming-of-Age

From a policy perspective, why is the "passive legislation" of stablecoins almost inevitable? Because it possesses typical "gray rhino" characteristics:

Significant scale: On-chain stablecoin settlements and activity have become a side chain of global payments, capable of causing spillover effects when failures occur;

Enhanced coupling: BIS metrics show that significant outflows of stablecoin funds can significantly raise the yield on 3-month U.S. Treasuries, with the magnitude being 2–3 times that of equivalent inflows, indicating that it has affected the short-end pricing of public safety assets;

Existing samples: The two "run samples" of UST and USDC demonstrate that minute-level panic can penetrate both on-chain and off-chain.

This is not a coincidence of black swans but a repeatable mechanics. Once the first large-scale spillover occurs, policies will inevitably thicken the guardrails—just as in 1933/1934 for stocks and in 1987 for circuit breakers. (Bank for International Settlements)

Therefore, "passive legislation" is not a denial of innovation; on the contrary, it is a sign of innovation being socially accepted.

When stablecoins truly integrate the speed of the internet with the accounting units of central bank currencies, they upgrade from "in-circle tools" to "candidates for public settlement layers." Once they enter the public layer, society will demand, after an incident, that they possess liquidity organization and orderly resolution capabilities equivalent to, or even exceeding, those of money market funds:

Circuit breaker mechanisms (swing pricing/liquidity fees)

Intraday liquidity red lines

Redemption SLA

Cross-border equivalence regulation

Minute-level triggers for bankruptcy priority

These paths mirror the journey taken by the stock market: first allowing efficiency to fully manifest, then using crises to firmly establish the guardrails.

This is not regression but the coming-of-age of stablecoins.

Conclusion

If the coming-of-age of stocks was about embedding the "disclosure-regulation-enforcement" trio into the system amidst the bloodshed of 1929, then the coming-of-age of stablecoins is about truly writing the "transparency-redemption-resolution" trio into code and law.

None of us wish to see a brutal replay of the crypto crisis, but the greatest irony of history is that humanity has never truly learned its lessons.

Innovation is never crowned by slogans but is fulfilled through constraints—verifiable transparency, executable redemption promises, and predictable orderly resolutions are the tickets for stablecoins to enter the public settlement layer.

If a crisis is unavoidable, let it come sooner, let the weaknesses be exposed first, and let the system be timely repaired. This way, prosperity will not end in collapse, nor will innovation be buried in ruins.

Terminology Overview

Redemption: The process by which holders redeem stablecoins for fiat currency or equivalent assets at face value. The speed and path of redemption determine whether one can "survive" during a run.

Reserves: The asset pool (cash, central bank/commercial bank deposits, short-term U.S. Treasuries, (reverse) repos, government money market funds, etc.) held by issuers to ensure redemption. The composition and duration determine liquidity resilience.

Spread: Stablecoins represent zero-interest liabilities for holders; issuers invest reserves in interest-bearing assets to earn the spread. The spread drives a natural incentive for "higher yield, longer duration" allocations.

Repo/Reverse Repo: Short-term financing/investment arrangements secured by bonds.

Government MMF: Money market funds that only hold high liquidity government assets. Often viewed as part of "cash equivalents," but may also face redemption pressure during extreme times.

Insured Deposits: Bank deposits covered by deposit insurance (e.g., FDIC). Deposits from non-bank stablecoin issuers typically do not enjoy the same level of protection.

LLR (Lender of Last Resort): A public backstop providing liquidity during crises (e.g., central bank discount window/special tools). In its absence, individual liquidity shocks are more likely to evolve into systemic sell-offs.

Fire Sale: A chain reaction of forced rapid asset sales leading to price overshooting, commonly seen in runs and margin call scenarios.

Breaking the Buck: A nominally fixed $1 instrument (e.g., MMF/stablecoin) experiencing a price deviation below par, triggering a chain of redemptions and flight to safety.

Intraday Liquidity: The ability to access/monetize cash and equivalents within the same trading day. It determines whether "minute-level liabilities" can be matched by "minute-level assets."

SLA (Service Level Agreement): Explicit commitments regarding redemption speed, limits, and responses (e.g., "T+0 redeemable limit," "queue processing mechanism"), which help stabilize expectations.

Orderly Resolution: In the event of default/bankruptcy, assets and liabilities are allocated and settled according to a pre-established plan, avoiding disorderly runs.

Equivalence/Recognition: The acknowledgment of "equivalence" of regulatory frameworks between different jurisdictions. If "equivalence ≠ equality," regulatory arbitrage is likely to occur.

Buffer: Redundancies in capital, liquidity, and duration to absorb pressure and uncertainty. An excessively low "minimum sufficient" may fail during extreme times.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。