Written by: Yangz, Techub News

Monero, a veteran privacy coin that has gradually been labeled as "marginalized" under the industry's trend towards mainstream acceptance and compliance, attracted significant attention yesterday due to a "peaceful occupation" led by an unknown individual. However, this spotlight felt more like a "humiliation" for it. Yesterday evening, a Layer1 Qubic, led by IOTA's former co-founder Sergey Ivancheglo (nicknamed Come-From-Beyond), retweeted major media posts, stating that "the Monero (XMR) experiment is proceeding smoothly as planned, and everything will be revealed at the appropriate time." The so-called experiment refers to initiating a 51% "attack" on Monero, successfully raising concerns about one of the most destructive network threats to cryptocurrencies. Following the news, the price of XMR dropped sharply, falling by 4.5% within an hour.

Three hours later, Qubic again posted, officially announcing the successful control of 51% of the Monero network's hash power. Surprisingly, this month-long "occupation" was not a deliberate act of destruction: Qubic neither initiated a double-spend attack nor implemented a destructive hard fork. Instead, it resembled a carefully designed proof, demonstrating that in a decentralized world, the robustness of code cannot withstand human greed; as long as sufficiently enticing economic benefits are provided, miners will willingly "turn against" their original networks.

Qubic: An "Unknown Individual" Born for AI

According to Qubic, its original intention was not to become another high-speed public chain or financial infrastructure, but to support a fully on-chain decentralized AI model—AIGarth. To achieve this goal, Qubic adopted a lightweight design, allowing validation nodes to operate in RAM. It employs a Quorum consensus mechanism and utilizes "Useful Proof of Work" (uPoW) to allocate hash power to actual computational tasks rather than meaningless hash collisions.

Additionally, Qubic's core innovation lies in "Outsourced Computations." In simple terms, Qubic's miners can not only maintain network security but also "rent out" their hash power to external tasks (such as training AI or providing hash power for other chains), thereby earning higher returns. However, theory needs practical validation; to showcase its uPoW and outsourced computing capabilities, Qubic chose Monero, known for its privacy and ASIC resistance, as its experimental subject.

Experiment: "Peaceful Occupation" of Monero through Economic Incentives

Qubic's "Monero Mining Plan" can be roughly divided into two phases: in the first phase of exploratory layout, Qubic allocated hash power to two parts. One part continued to train AIGarth, while the other part was used for mining Monero. Due to the high efficiency of uPoW, the mining returns reached up to three times that of pure Monero mining, attracting a large number of miners to join the Qubic network; subsequently, the Qubic community voted to make a critical adjustment to the profit distribution mechanism, changing the original 100% profit used for repurchasing and destroying QUBIC tokens to a new model of 50% for token destruction and 50% directly rewarding validators. This adjustment visibly increased miners' profits, further siphoning hash power from Monero's original mining pools.

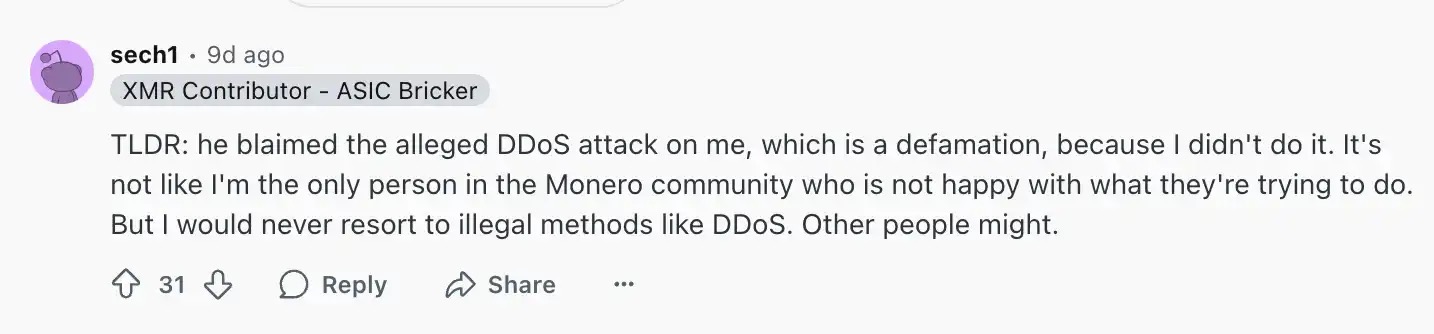

Of course, this "occupation" process was not without challenges. According to Qubic, when it first attempted to seize a 51% hash power advantage on August 2, it faced resistance from the Monero community. Some of Qubic's validation nodes reported experiencing DDoS attacks, which Qubic summarized lasted for a week. Ivancheglo pointed fingers at Sergei Chernykh (nickname sech1), the main developer of the Monero mining software XMRig, suggesting possible involvement, but sech1 promptly issued a statement on Reddit, clearly stating that he was not involved in this incident.

Despite facing resistance, Qubic's experiment continued to advance. On August 11, Qubic deployed a more complex "Selfish Mining" strategy, selectively delaying block broadcasts, artificially creating isolated blocks, and releasing the longest chain at critical moments, ultimately successfully testing the reorganization of the Monero network. Data provided by Qubic's chief developer dkat showed that during the critical testing window of 122 blocks, Qubic mined 63 blocks, accounting for 51.6%, exceeding the set target.

However, surprisingly, upon completing the takeover test, the Qubic team clearly stated that they would not actually take over Monero's consensus mechanism. This decision was partly due to considerations of Monero's price stability, but more fundamentally, this action was always a validation experiment. The Qubic team expressed their hope to ultimately achieve a win-win situation with Monero: Qubic miners would provide security for Monero while rewarding those participating through Qubic's mining pool.

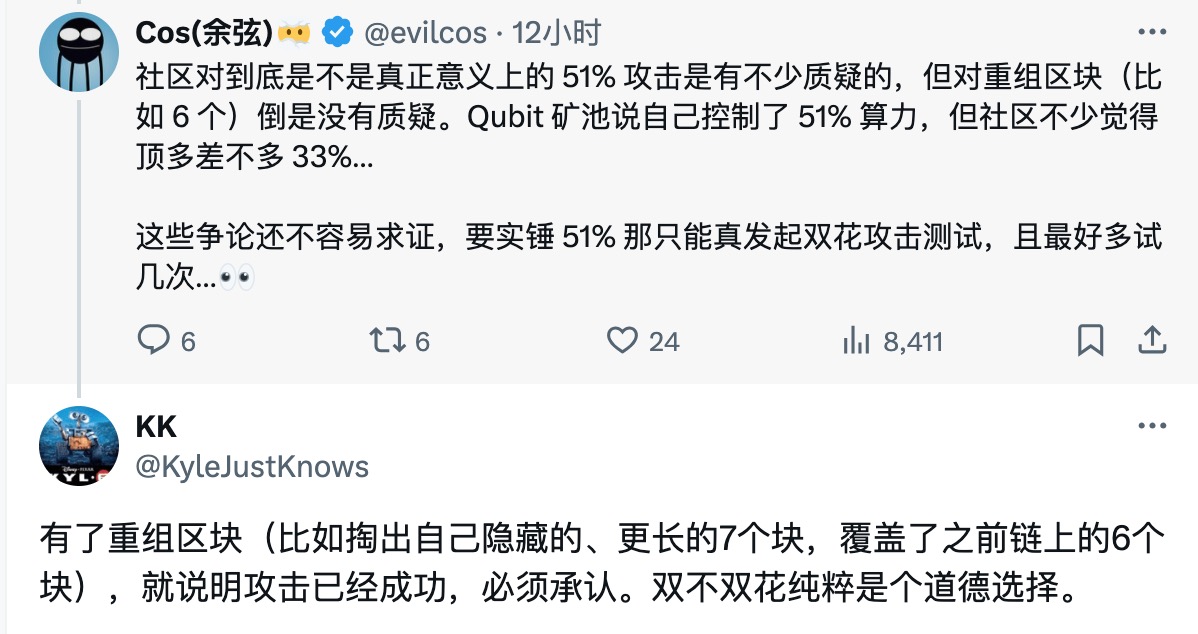

It is worth noting that although Qubic claims to currently control 51% of Monero's network hash power, the community remains skeptical of this assertion. The founder of Slow Mist, Yu Xian, pointed out that the community generally believes Qubic controls only about 33% of Monero's network hash power at most. Of course, some argue that "having reorganized blocks means the attack has succeeded and must be acknowledged. Whether it is a double-spend or not is purely a moral choice."

Summary

Although the debate over hash power distribution remains unresolved, in this "bloodless occupation," Qubic, with a market value of only $300 million, successfully put the privacy coin giant with a market value 20 times greater into crisis. It declares to the industry that economic incentives often hold more decisive power than technical beliefs.

Moreover, the more thought-provoking aspect of this experiment lies in its "non-aggressive" nature. Qubic did not act maliciously; it simply calmly proved a fact: in a decentralized world, value creation is more powerful than coercive control. This resembles classic disruptive cases in business history. It was not better film that defeated Kodak, but digital technology; it was not cheaper taxis that disrupted the taxi industry, but Uber.

As pointed out by Dan Dadybayo, a researcher and strategist at Unstoppable Wallet, [“This is not just the story of Monero. It is a warning to all PoW networks. Having strong mathematical capabilities is not enough. We need resilient infrastructures with aligned incentive mechanisms. Otherwise, the next 'attack' may not look like an attack at all, but just a better deal.”]

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。