引言

过去两年里,Uniswap 一直被困在一个估值悖论里:作为 DeFi 的龙头协议,它坐拥行业最高的成交量与交易费用,却无法为代币持有者带来哪怕一分钱的回报。

但进入 2025 年,Uniswap 的故事,似乎正在进入下一个阶段。协议本身在变化,治理也在变化,唯一没变的,是市场还在用“0 分成”逻辑定价 UNI。

当我们试图回答关于 UNI 的估值问题:

基于当前种种“天时地利人和”,它的合理估值应该是多少钱?

所以,是时候重估 Uniswap 了。

一、协议现状:从不分红的叙事,到被低估的现实

在 2025 年 2 月,Uniswap 终于等来了一个改变叙事的节点——美国证券交易委员会(SEC)宣布,正式结案对 Uniswap Labs 的调查,并“不会采取任何执法行动”。

这不仅为 Uniswap 自身扫清了多年的合规阴影,也为整个 DeFi 市场释放出一个明确信号:协议层的开放式金融基础设施,仍然有空间在监管框架内生存并扩张。

与此同时,Uniswap 的产品迭代也在悄然完成一次代际升级。2025 年初,v 4 正式上线并完成多链部署,借助 Hooks 架构带来的灵活性,Uniswap 的流动性聚合效率进一步提升。Unichain 主网的发布则为其后续扩张提供了更统一的底座和执行环境。实际表现也迅速给出反馈:仅 2025 年 5 月,Uniswap 的单月现货交易量就达到 88.8 亿美元,创下年内新高,近 30 天总交易量,更是高达 1,090 亿美元。

除了交易量回升、v 4 上线等催化因素,Uniswap 在治理层面也迎来了一个潜在的关键改变。Uniswap 基金会(UF)8 月 12 日提议,在怀俄明州注册去中心化非注册非营利协会(DUNA),并以此为基础组建“DUNI”作为 Uniswap 治理的法律实体。

这意味着,未来 Uniswap DAO 将拥有一个法律身份,能够在链下签订合同、雇佣合作伙伴、履行税务合规,同时承认链上治理的合法效力。最关键的是,DUNI 将为治理参与者提供有限责任保护,大幅降低因协议决策可能带来的个人法律或税务风险。这项结构性改进恰好补齐了分红机制落地的最后一环:过去不可触碰的“法律灰区”正在被制度填平。一旦 DUNI 成立,协议收入真正进入 DAO 或 UNI 持有者手中,就不再只是“愿景”,而是有实际执行基础的步骤。

但相比协议本身的扩张节奏,UNI 的估值节奏却仍处在旧轨道上——币价徘徊在 10 美元上下,DefiLlama 显示其持币者收入为 0,协议层产生的年化费用近 几百亿美元,却尚未有一分钱流入 UNI 持有者手中。

这背后当然有理由。Uniswap 的治理从一开始就将协议收入设置为“0 分成”,将全部交易费用让渡给 LP。但现在,故事正在改变。

DAO 已启动针对 v 3 全池统一收取 0.05% 协议费的试验讨论,技术上也早已部署好 “质押 + 委托 → 分成” 的 UniStaker 模块,监管风险的清除使这一分配逻辑具备更现实的执行空间。

问题是:协议的结构变了,市场的定价逻辑却还没变。

Uniswap 正在从一个“不分红的基础设施”,向一个“具备潜在现金流分配能力”的协议演化。但目前市场对于这一演化路径的定价,仍停留在过去“只讲故事、不讲收益”的估值体系中。

而这,恰恰是我们认为——现在的 Uniswap,值得被重估的起点。

二、估值口径:用分红预期看待未来估值

在现有的定价逻辑中,UNI 更多被视为单纯的一种加密币。没有分红、没有费用回流,市场自然不会按照“能产生现金流”的逻辑来给它定价。

而一旦这个协议分成前提成立,UNI 的估值逻辑就不再是「市场情绪 × 流动性博弈」,而是「可分配协议收入 × 分成比例 × PE 倍数 」。

在这种情况下,最直接的估值方法就是:

预期估值 = 当年预期分红 × PE 倍数

- 分红:用协议年化收入 × 分成比例计算。

- PE 倍数:在多数 DeFi 协议中,40–60 倍是常见区间,但 Uniswap 的体量与收入结构,足以支撑它拿到更高的溢价。

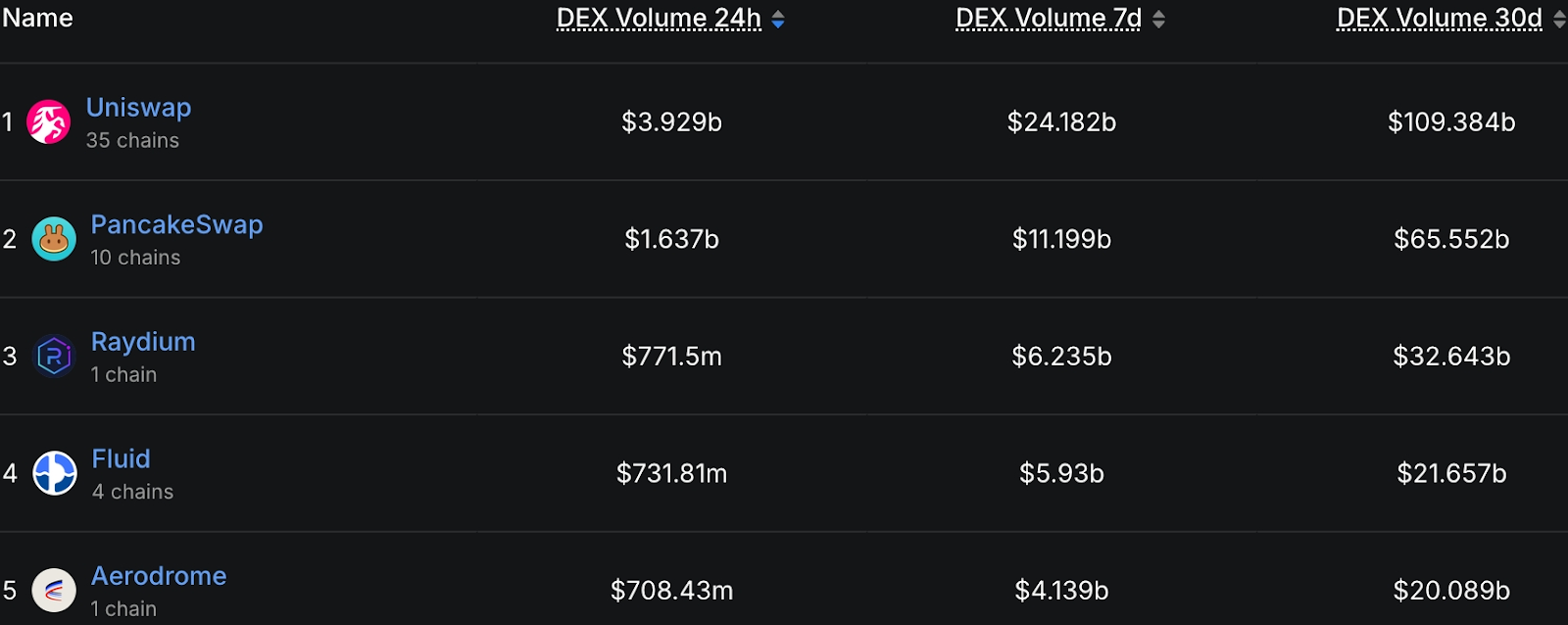

首先看规模。根据 DefiLlama 数据,Uniswap 过去 30 天的交易量达 1090 亿美元,不仅大幅领先 PancakeSwap 的 655 亿美元,还远超 Raydium 的 326 亿美元。换句话说,它一个月的交易量,就接近市场前五 DEX 的总和。

对比其他 DEX 相关数据,显然 Uniswap 这样已经验证了跨周期能力、收入占据行业绝对份额的协议,早已形成“断层式”领先的格局。这种优势并不仅是规模大,更体现在收入的可持续性与分布广度——它覆盖了以太坊、Polygon、Arbitrum、Optimism 等多条链,流动性与用户基数具备极强的稳定性,因此可以用接近传统金融市场对蓝筹现金流资产的定价方式,在这种量级下,UNI 作为龙头的竞争壁垒和议价能力,足以享受比普通协议 40-60 倍 PE 更高的溢价。

其次,对比当前其他 DEX 的 P/Fees/TVL 区间,龙头估值普遍会比二三线项目高出 30%~100%。在全球合规化叙事、fee switch 落地预期,以及机构更倾向配置头部协议的背景下,给 UNI 的 PE 合理偏保守预期计算为:

以业内偏低均值 40 倍 PE 为基数 * (1+30%~100%) =UNI PE =52 倍-80 倍

⬇️

取中位数 PE 值为 66 倍

最后,PE 不是一个死数,它会随着市场利率、行业景气度、协议竞争格局变化而波动。如果要横向对比其他协议的收入和估值,可以直接去 DeFiLlama 查一查数据,把 UNI 放在同类榜单里去看,66 PE 是不是高估,你心里会有一个直观答案。

四、估值推演:Uniswap,凭什么未来值 $26?

所以如果用传统金融的视角来看 Uniswap,最直接的估值方法就是现金流折现法(DCF)的简化版本看待:以未来一年可分配的现金流为基准,乘以潜在的市盈率(PE),得到合理市值区间。

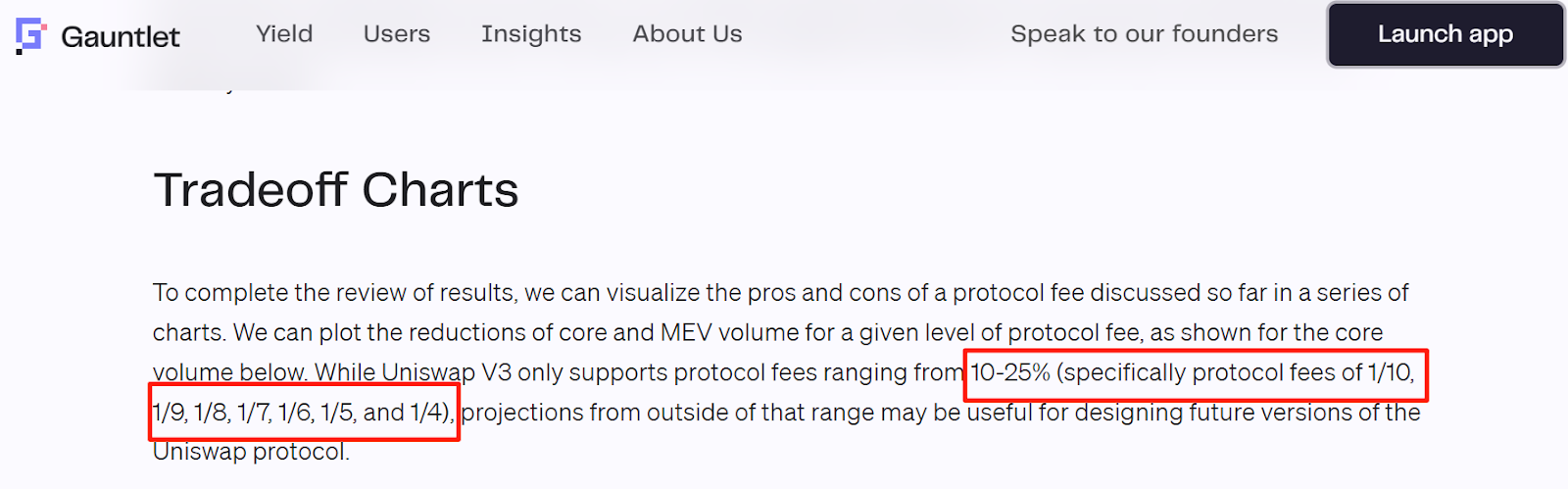

过去 30 天,Uniswap 的总交易量约为$109 B。按平均 0.3%手续费率计算,协议在这一期间产生的总手续费约为$327 M。由于 fee switch 尚未开启,这部分收入目前全部流向 LP;但一旦分红机制落地,协议可按一定比例(假设 10%~25%)分配给 UNI 持有人。

将 30 天的交易数据年化,得到年度可分配现金流区间:

- 分成比例 10%:$109 B × 0.003 × 0.10 × 12 ≈$392.4 M

- 分成比例 25%:$109 B × 0.003 × 0.25 × 12 ≈$981 M

(据 Gauntlet 报告,Uniswap v 3 的 fee switch 机制支持按 10%-25% 多档切分 LP 收入,目前 DAO 治理也已开启试验池统一收取 0.05% 协议费用,代表协议正在尝试在不伤害 LP 的前提下,激活分红可能性)

在当前市场环境下,在上一节中我们合理推断的 PE 水平约为 66 倍。代入计算公式:

- 低分成场景(10%):$392.4 M × 66 ≈$25.9 B

- 高分成场景(25%):$981 M × 66 ≈$64.8 B

考虑到当前 UNI 总市值仅$10.5 B,币价约 $10.6(截止 2025 年 8 月 8 日晚 22 点),这意味着在不同分红比例下,重估后的理论币价区间为:

- 低分成场景:约$26.2

- 高分成场景:约$65.4

从估值结果来看,即便是保守的 10% 分成比例,对应的合理价格也较当前水平有超过 2.5 倍的上升空间。更激进的假设下,潜在重估幅度则可能超过 5 倍。

换句话说,市场对 UNI 的定价,正卡在 fee switch 启动前的“低估”时期。一旦分红落地,现金流逻辑将取代单纯的交易量情绪,成为驱动估值中枢上移的核心力量。

当然,一个项目的合理估值还受到多重因素综合评判,UNI 一下冲到估值天花板也不太符合市场逻辑,所以取最低数$26 左右还是值得期待。

五、分红的现实与想象之间:机会、路径与风险

看到这里你可能会问:协议分成听起来很好,但真能兑现吗?

其实这个问题,在过去几年一直是悬在 DeFi 龙头项目头上的未解命题。现在的 Uniswap,除了上述讲过的监管、治理、技术问题正在被妥善解决外, 其实并不是行业第一个吃螃蟹的人:

- SushiSwap 从诞生起就以“手续费分给持币者”作为代币激励;

- GMX、dYdX 等协议也早已形成了“质押 = 收入权”的市场心智;

- 新一代交易协议如 Ambient、Maverick、Pancake v 4,纷纷在上线阶段就内置“分成逻辑”。

但不代表风险已消失。

fee switch 仍未正式开启,一切估值预期仍建立在“合理”的假设上;

- 2% 的永续通胀机制已于今年启动,在分红尚未兑现之前,每一枚新增 UNI 其实都在稀释现有持币者的价值;

- 此外,fee switch 的开启并不等于所有人都能“坐享其成”,分红或许需要门槛,真正能够享有现金流分成的比例也仍未知。

- 而最核心的风险在于——一切仍取决于 DAO 的决议。

但这一次,至少我们已经看到了壮志前行的 Uniswap。

结语:估值之外,是对方向的下注

至此,可以确定的是,Uniswap 它的估值逻辑,确实已经迎来了转折点。

唯一滞后的,是市场情绪与定价模型。

从当前的数据看,Uniswap 的交易量已经重回高位,分成机制也开始具备落地可能,现金流模型也正在重塑市场对 UNI 的理解。相比于泡沫时期的模糊叙事,如今的 Uniswap,反而更具备“价值回归”的基础。

当然,估值模型只能告诉我们:“如果一切顺利,UNI 可以值多少钱?”

但最终,UNI 的价值,不止在于它能不能分红,而在于它是否能在 DeFi 叙事最不被看好的时刻,重新拿回话语权。

因为,市场未必总是理性定价,但总会迟到地补课。而这一次,或许是时候重新上课了。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。