In the past few years, the blockchain industry has experienced ups and downs, with countless projects either shining brightly for a time or disappearing without a trace. When it comes to prominence and controversy, EOS undoubtedly holds a place in the rankings. This public chain, once dubbed a "king project" for raising as much as $4.2 billion in a single year, attracted global attention and expectations.

However, the blockchain industry is not static. As the market evolves and preferences shift, EOS's development gradually lost momentum, exposing numerous issues, with community governance and ecological construction lagging behind. In this new development cycle, EOS has become more of a subject of ridicule in casual conversations rather than the innovative representative that once led the trend.

To shed its past burdens and reshape its image, the EOS team announced a rebranding to Vaulta. This name change is not merely to escape negative impressions and rebuild market confidence; it is also a proactive breakthrough against the development bottlenecks of the past. Vaulta will no longer be positioned as a high-performance public chain but will focus on building a "Web3 banking operating system" aimed at financial institutions and compliant users.

Reconstructing the New Generation of Financial Infrastructure: Vaulta

Behind the rebranding of EOS is a precise grasp of industry trends. In the past, competition in blockchain often centered on technical dimensions such as TPS and consensus mechanism optimization. However, with the proliferation of stablecoins, the application of RWA, explosive growth in cross-border payment demands, and improved regulations, the industry is destined to reach a new inflection point, gradually yielding to the construction of financial infrastructure with more practical value. Blockchain infrastructure will also be used to support the ecosystem brought about by the spillover of the financial system.

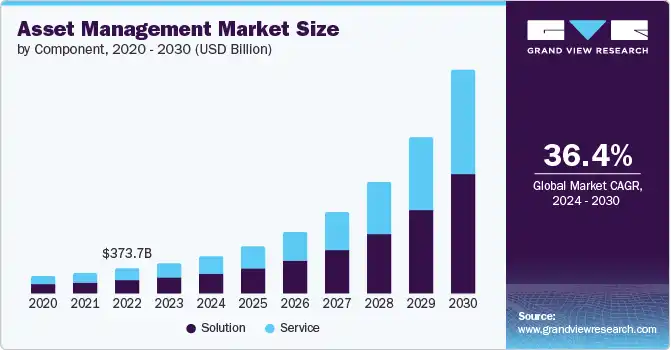

According to a report by Grand View Research, since 2020, the global cryptocurrency user base has seen a compound annual growth rate of 34%, with the 18-34 age group being the main force. This generation of users is far more accepting of financial digitization than traditional groups. Additionally, it is expected that by 2028, cross-border stablecoin payments will account for nearly 73% of the total global stablecoin transaction value. Along with this trend, the disadvantages of traditional payment systems are becoming increasingly apparent, with the global average remittance fee rate at about 6.65%, while blockchain technology reduces this figure to less than 0.1%, compressing settlement times from days to seconds, greatly releasing the efficiency dividend of global capital flow.

Vaulta was born against this backdrop of industry evolution, inheriting EOS's deep accumulation in high-performance blockchain technology while incorporating systematic thinking on financial compliance, system sustainability, and real-world application scenarios. Vaulta derives its name from the English word "Vault," symbolizing security and trust in the DeFi world. The emergence of Vaulta is not just a brand refresh but a systematic reconstruction starting from the underlying architecture.

First, Vaulta has launched a brand new token system, introducing a halving mechanism and multiple project funds to enhance the platform's long-term sustainability and governance capabilities. Secondly, while using a high-performance DPoS architecture, Vaulta has rewritten and expanded key modules, strengthening support for zero downtime and instant transaction certainty.

By optimizing the consensus mechanism and node synchronization strategies, Vaulta can ensure stable system operation even during peak network loads or node failures, allowing transaction confirmations to be completed without waiting for multiple blocks, ensuring efficient execution in financial-grade applications such as payments and settlements. Its banking operating system introduces a modular account system, multi-chain interoperability standards (IBC), and a multi-environment compatible operating layer, supporting developers in building on-chain banking applications for both EVM and non-EVM chains. To ensure asset security and enterprise-level custody needs, Vaulta has also partnered with compliant custody institutions such as Ceffu and Tetra Trust.

Moreover, Vaulta's banking operating system includes essential account management, permission control, and auditing functions required by traditional financial systems, ensuring the efficient operation of the entire network and the traceability of on-chain assets.

The rebranding of EOS is not merely a continuation of a "higher performance blockchain" but a deep reflection on "how to build a new generation of financial infrastructure."

Globalization and Ecological Implementation

Perhaps learning from the lessons of the EOS era, since the launch of the Vaulta brand, the project team has been accelerating its global layout and promoting rapid business implementation through partnerships with various institutions.

As a key component of the Vaulta ecosystem, the Bitcoin-centric digital banking platform exSat Bank has also launched alongside Vaulta's rebranding. exSat Bank aims to break down the barriers between traditional finance and crypto finance by integrating asset management, payments, trading, and risk control functions through a unified on-chain banking operating system. Users do not need to switch between different platforms; they can perform operations such as storing assets, earning yields, transferring, and making payments with just one account.

Among a series of collaborations, the most noteworthy is the strategic agreement reached with World Liberty Financial (WLFI), supported by the Trump family. In May 2025, WLFI purchased Vaulta tokens for $6 million and announced a long-term partnership with Vaulta. WLFI will integrate its USD stablecoin USD1 into the Vaulta network, and both parties will jointly promote the compliant development of Web3 finance globally.

At the same time, Vaulta announced a strategic partnership with Fosun Wealth Holdings, a subsidiary of China's Fosun Group, to jointly provide blockchain financial infrastructure for the Hong Kong financial market. Vaulta will provide a complete Web3 banking operating system technology suite, including exSat, to support asset issuance, yield generation, and crypto payments for Fosun's virtual asset business "FinChain." Fosun will leverage its global licenses and RWA issuance capabilities on this platform to achieve compliant business expansion. Yves La Rose, founder and CEO of the Vaulta Foundation, stated that this collaboration will be a key validation of Vaulta's global Web3 banking vision.

In the crypto-native ecosystem, Vaulta has also partnered with several leading platforms. For example, Vaulta has reached an agreement with the decentralized gaming platform Ultra built on EOS technology, where Vaulta will provide underlying payment and digital asset custody services. By combining Vaulta's high throughput and low latency network capabilities with Ultra's large user base, both parties will co-create a new gaming platform that supports cross-game asset circulation, NFT financialization, and on-chain reward systems.

In the payment sector, Vaulta has launched a cross-border payment solution called VirgoPay in collaboration with the Canadian digital asset platform VirgoCX. VirgoPay is a proof of concept (POC) for cross-border payments within the Vaulta banking operating system. The Vaulta network will serve as the default settlement layer for VirgoPay, granting this payment network transaction speed and stability that surpass traditional channels. By combining stablecoins with traditional banking systems, VirgoPay can achieve near-zero latency and extremely low-cost global remittance services. It is reported that VirgoCX has processed over CAD 2.5 billion in various business transactions, with an expected record transaction volume of CAD 3.5 billion by 2025. The first phase of VirgoPay will cover major financial markets such as the United States, Hong Kong, Canada, Brazil, and Australia, with plans to expand to Southeast Asia, the Middle East, and other emerging regions, targeting the global cross-border remittance market, which exceeds one trillion dollars.

Substantial Progress in Web3 Banking

Since the narrative of brand rebranding began, the ecosystem has welcomed significant capital inflows, as evidenced by the strong performance of the tokens in April. Since rebranding to $A, while the token price has entered a consolidation phase, the ecosystem continues to expand.

Currently, Vaulta's TVL stands at $196 million, peaking at $384 million on May 17. exSat, as a Bitcoin-based digital bank and service provider, is the "killer dApp" of this network. exSat is built on the Vaulta mainnet and forked from Vaulta's EVM architecture. If we combine exSat's current TVL of over $489 million with Vaulta's TVL, the total network TVL would reach $685 million, placing Vaulta among the top twenty in the global public chain TVL rankings.

Within the exSat ecosystem, exSat Bank serves as its core financial service platform, providing a range of banking-level services including digital asset deposits and loans, cross-chain settlements, stablecoin issuance, and asset custody for institutional and individual users. The Vaulta banking operating system can provide modular functions such as on-chain asset management, cross-border clearing, and compliance auditing for existing banking infrastructure.

In addition, the developer activity on the Vaulta network has also significantly increased, reaching a new high for the year.

The Eve of Blockchain Application Infrastructure Explosion

In summary, Vaulta has evolved from EOS, no longer content to exist merely as a high-performance public chain, but has clearly positioned itself as a builder of the next generation of Web3 financial infrastructure. This transformation is a re-understanding and proactive response to the operational logic of the global financial system.

The "Web3 Bank" model proposed by Vaulta is not a simple on-chain version of traditional banking services, but rather a structural reconstruction that attempts to integrate the openness of on-chain finance with the compliance, account systems, and trust mechanisms of traditional finance into a globally deployable infrastructure. This integration not only challenges the monopoly of traditional banks in areas such as cross-border payments and asset management but also provides the blockchain industry with a new path to break out of closed ecosystems and integrate into mainstream markets.

More importantly, Vaulta is not just theoretical; it is actively promoting the practical implementation of its concepts based on lessons learned from past failures. It has already engaged in deep cooperation with financial institutions, including Fosun Wealth and WLFI. The involvement of the former signifies traditional financial institutions' recognition of the blockchain solutions represented by Vaulta, particularly in terms of reducing cross-border payment costs and expanding asset management boundaries. WLFI's strategic investment in Vaulta reflects its bet on this new model of financial infrastructure. These collaborations not only broaden Vaulta's practical application scenarios but also provide important support for its global compliance efforts.

Of course, Vaulta also faces significant challenges. Although the brand has been successfully restructured, the market's historical memory of EOS has not completely faded, and it remains uncertain whether users can truly move beyond their old sentiments. At the same time, how to seek a balance between innovation and regulation in the increasingly complex global compliance environment is a long-term issue that Vaulta will need to confront.

The emergence of Vaulta does not mean that the blockchain industry has found a final answer. On the contrary, if Vaulta can succeed, it may become a key signal for the blockchain infrastructure entering an explosive growth phase. Regardless of the ultimate outcome, Vaulta has already become an important case study for observing how blockchain can penetrate and reshape the global financial system, and its progress is worthy of ongoing attention from the entire industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。