来源:Pantera Capital

原标题:DAT Value Creation

编译及整理:BitpushNews

前言:

加密风投 Pantera Capital 其最新区块链信函中首次透露,迄今为止已向数字资产财务 (DAT) 公司投资超过 3 亿美元,DAT 是一类在资产负债表上持有加密货币储备的上市公司,其数量正在不断增长。

Pantera 表示,其对 DAT 公司的投资理念很简单:“DAT 可以产生收益,从而提高每股净资产价值,随着时间的推移,您将拥有比仅仅持有现货更多的底层代币所有权。因此,与直接持有代币或通过 ETF 持有代币相比,持有 DAT 可以提供更高的回报潜力。”

以下为原文:

DAT VALUE CREATION

我们对数字资产财库公司(Digital Asset Treasury companies,简称DATs)的投资理念基于一个简单的前提:

DATs可以通过产生收益来提升每股净资产价值(NAV),从而随着时间的推移,比单纯持有现货拥有更多的基础代币。

因此,持有DATs相比直接持有代币或通过ETF,可能提供更高的回报潜力。

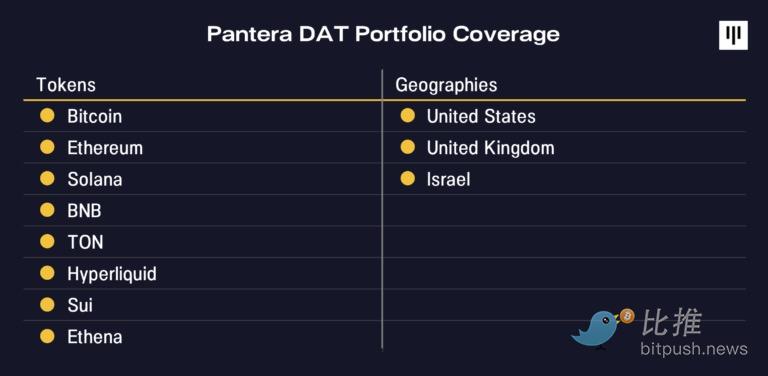

Pantera已在不同代币和资本市场的DATs上部署了超过3亿美元。这些DATs正在利用其独特优势,采用策略以每股增值的方式增加其数字资产持有量。以下是我们的DATs投资组合概览。

BitMine Immersion (BMNR)是Pantera DAT基金的第一笔投资,它体现了一家拥有清晰战略蓝图和执行力的公司。作为董事长,Fundstrat的Tom Lee已经规划了BitMine的长期愿景:收购以太坊总供应量的5%——他们称之为“5%的炼金术”。我们认为,将BMNR作为一家高效执行的DATs的案例研究是很有价值的。

BitMine (BMNR)案例研究

自BitMine启动其财库策略以来,它已成为全球最大的以太坊财库和全球第三大DATs(仅次于Strategy和XXI),共持有1,150,263枚ETH,价值49亿美元(截至2025年8月10日)。BNMR也是美国流动性排名第25位的股票,日交易额达22亿美元(截至2025年8月8日的五日移动平均值)。

以太坊的案例

DATs成功的关键要素是其底层代币的长期投资价值。

BitMine的DATs理念基于一个核心论点:随着华尔街向链上迁移,以太坊将成为未来十年最重要的宏观趋势之一。正如我们在上个月的信件中所写,随着代币化创新和稳定币重要性的日益增长,“链上大迁徙”正在进行中。目前,公共区块链上已存在250亿美元的现实世界资产——这还不包括2600亿美元的稳定币,后者总计已成为美国国债的第17大持有者。

“稳定币已成为加密世界的ChatGPT故事。”

—— Tom Lee,BitMine董事长,Pantera DAT电话会议,2025年7月2日

这些活动大部分都发生在以太坊上,这使得ETH能够从不断增长的区块空间需求中受益。随着金融机构越来越依赖以太坊的安全性来支持其运营,它们将被激励参与其权益证明网络——从而推动对ETH的进一步积累。

Growing ETH Per Share (“EPS”)

在确定了底层代币的投资价值后,DATs的商业模式便是以每股为基础最大化其代币所有权。增长每股代币持有量(ETH per share, “EPS”)有几种主要方式:

- 以高于每股代币净资产价值(NAV)的溢价发行股票。

- 发行可转债和其他股权挂钩证券,以利用股票和底层代币中蕴含的波动性。

- 通过质押奖励、DeFi收益和其他运营收入来获取更多代币。值得注意的是,这是ETH和其他智能合约代币DATs所特有的额外手段,而最初的比特币DATs(包括Strategy)并不具备。

- 收购另一家交易价格接近或低于NAV的DATs。

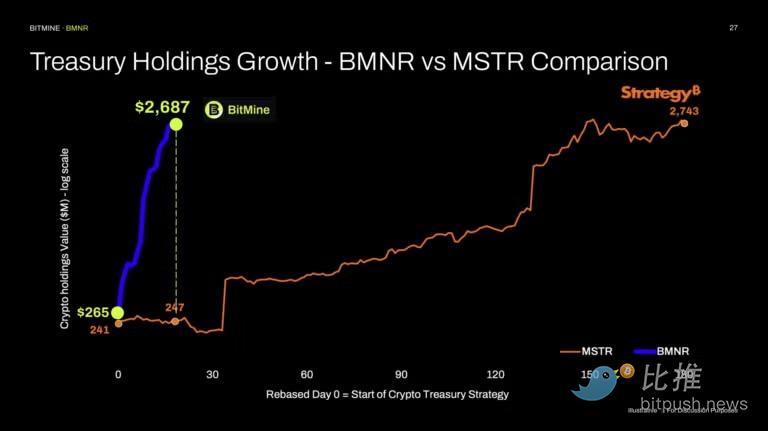

在这一点上,BitMine在其推出ETH财库策略的第一个月里,以惊人的速度增长了其每股ETH(巧合的是,也缩写为“EPS”),远超其他DATs。BitMine在第一个月内积累的ETH比Strategy(前身为MicroStrategy)在其执行该策略的前六个月还要多。

BitMine主要通过发行股票和产生质押奖励来增加EPS,我们相信BitMine很可能很快会扩大其策略,开始发行可转债和其他金融工具。

价值创造实例

DATs的价格可以分解为三个因素的乘积:

(a) 每股代币数量,

(b) 底层代币价格,

和 (c) NAV的倍数(“mNAV”)。

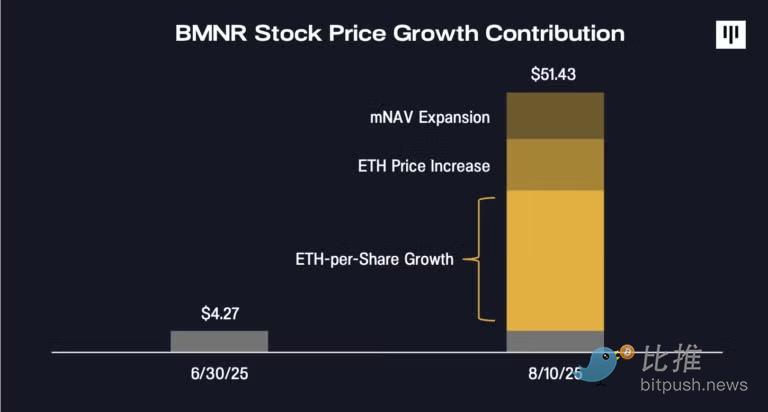

六月底,BMNR的股价为每股4.27美元,大约是其初始DATs融资的每股4美元NAV的1.1倍。仅仅一个多月后,股价收于51美元,约为其估计每股30美元NAV的1.7倍。这在一个多月内实现了1100%的价格增长,其中:

(a) EPS增长约330%贡献了约60%的涨幅;

(b) ETH价格从2.5k美元涨至4.3k美元贡献了约20%的涨幅;

(c) mNAV倍数扩大到1.7倍贡献了约20%的涨幅。

这意味着BMNR股价上涨的绝大部分是由底层每股ETH数量的增长所推动的,这是管理层可控的核心引擎,也正是DATs与单纯持有现货的区别所在。

第三个我们尚未探讨的因素是mNAV。自然,有人会问:为什么有人愿意以NAV溢价购买DATs?

在这里,我发现将它与银行等基于资产负债表的金融企业进行类比是很有用的。

银行试图在其资产上产生收益,而投资者会给予那些他们认为能够持续产生高于其资本成本收益的公司以估值溢价。最高质量的银行,如摩根大通,其交易价格高于NAV(或账面价值)的两倍。

同样,如果投资者相信一个DATs能够持续增长每股NAV,他们也会选择以高于NAV的溢价对其进行估值。我们认为,BMNR在短短一个月内实现了每股NAV约640%的增长,这足以证明其mNAV溢价是合理的。

BitMine能否持续有效地执行其策略将随着时间的推移而显现,在此过程中也必然会面临挑战。

然而,BitMine迄今为止的管理团队和业绩记录,已经吸引了包括Stan Druckenmiller、Bill Miller和ARK Invest等传统金融机构重量级人物的支持。我们预计,最高质量的DATs的增长故事将得到更多机构投资者的认可,就像Strategy所经历的那样。

以太坊十周年

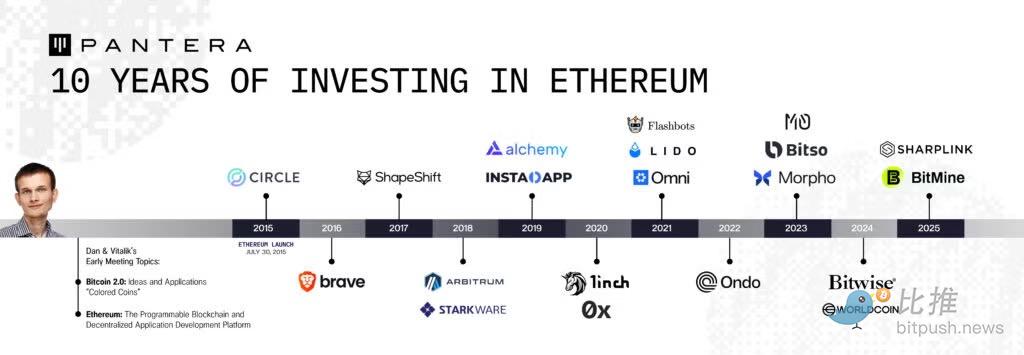

7月30日是以太坊的十周年纪念日。

我第一次见到Vitalik Buterin时,他还是一个17岁的《比特币杂志》记者!

2014年,我们在“彩色币”(Colored Coins)项目上再次相遇——这是当下RWA、NFT和各种资产支持代币的迷人先驱。他于2015年1月提出了以太坊的概念。

它的发展真是令人惊叹。十年如一日的稳定运行和不间断的交易。十年的创新和对全球市场未来的重塑。

我们支持了众多富有远见的团队和开发者,他们构建了推动以太坊使命前进的应用和基础设施。我们对这个生态系统的承诺一如既往地坚定。工作尚未完成。

预测市场复兴:万物皆可市场

预测市场的复兴正在进行中。虽然新的预测市场时有出现,但现在各类市场事件类型、形式(如手机端、类似Tinder的滑动界面、交易终端)和地域的预测交易平台已比比皆是。

这场复兴是由几个事件催化:

- Polymarket和Kalshi的成功: 预测市场持续获得数十亿美元的月交易量。它们的成功——尤其是在2024年美国总统大选后的选举市场——证明了基于事件的市场需求。

- 预测市场事件合约的监管明晰: 2024年10月2日,哥伦比亚特区巡回上诉法院驳回了暂停执行的请求,允许Kalshi推出其选举合约。Robinhood在同一个月也上线了选举市场。监管的明晰对金融市场中的创新公司所能带来的影响是惊人的。

- 投机世代的增长: 首次购房者的中位年龄为38岁,在过去几年中显著上升。散户的零日(zero-day)期权交易即将占到所有每日期权交易量的三分之二,这表明散户投资者在波动市场中渴望快速获胜。金融市场的“TikTok化”仍在继续,随之而来的是对更多市场的押注欲望,直到无处可押。

虽然预测市场的投机诱惑推动了参与度,但这些市场绝非无用。通过将激励与信息对齐,它们可以帮助发现准确的信息和洞察。

市场有助于预测结果,各种新市场正在涌现——包括政治事件、企业财报预测、天气预报和FDA药品审批等。

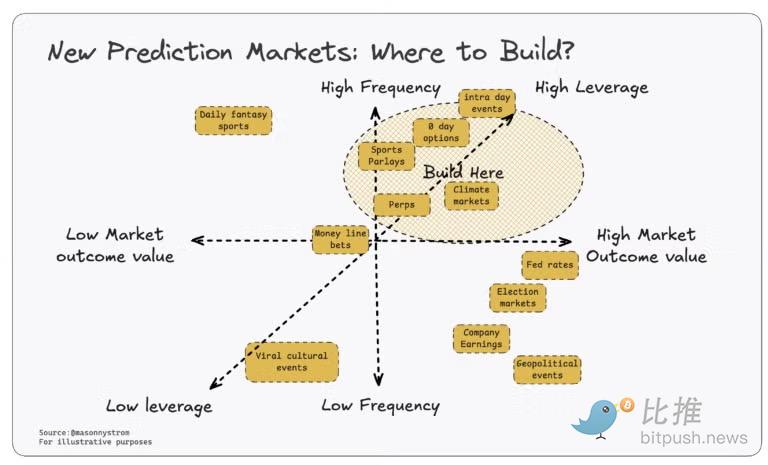

随着预测市场的增长,许多团队采取了不同的产品方向和市场进入策略。从投资角度来看,我相信那些能获得长期成功的新预测市场,将专注于打造服务于具有以下共同特征的市场的优秀产品:

- 事件发生非常频繁的市场

- 具有高杠杆或以少量资本赢得巨额收益能力的市场

- 具有高结果价值的市场——即预测价值本身具有信号意义

让我们更详细地讨论一下:

高杠杆

用户希望获得高杠杆或叠加赔率来增加收益。连赢投注(Parlays)、永续合约(perps)、日内事件市场——所有这些预测市场产品都有潜力增加对预测市场事件的需求。想象一下中期选举,如果有人能对所有结果进行正确的连赢投注。考虑到零日期权的兴起,日内市场(半天、几小时、几分钟)也值得考虑。

高频次的预测市场

预测市场是习惯性的——用户会来投注他们感兴趣的市场。更多的市场有助于保持用户的参与度,但真正重要的是高频市场的存在,这能驱动用户留存。

想要在一次性的高关注事件(总统选举、流行文化事件等)上投注的用户可以在任何平台进行,他们最终很可能会使用他们最常访问的平台。拥有更多经常性市场也将为平台创造更好的经济效益,使它们能够列出更多市场、支付客户获取成本或以其他方式更具竞争力。这种情况在体育博彩中已经发生,DraftKings等平台利用DFS(每日梦幻体育)作为一种宝贵的获客和留存工具,培养用户的习惯性行为。

高市场结果价值

选举并不是频繁事件,但具有很高的信号价值。这会吸引大量资本进入这些市场。

Polymarket最近发布了FDA审批结果,这些决定足以成就或摧毁价值数十亿美元的企业。Kalshi的气候市场具有预测信号价值,而且理论上,还可以基于大量的日常预测信号构建其他类型的衍生品合约。具有高结果价值的市场将驱动更高的交易量和更深的流动性。

相反,许多流行文化市场——真人秀、格莱美奖得主、诺贝尔奖得主——虽然投注有趣,但结果价值较低。有时结果价值低,部分原因在于结果可能被操纵。一个结合了《幸存者》等电视节目的预测市场会很有趣,但如果投注的金额足够大,人们就会找到操纵市场的方法。

预测市场的火爆将利用高效市场来生成有价值的预测洞察,并为那些交易个股或进行体育博彩的同一批客户提供一种杠杆化的娱乐形式。我们即将看到市场类型和人们可以押注的事物大爆发。万物皆可市场(Markets for everything)的时代即将到来。

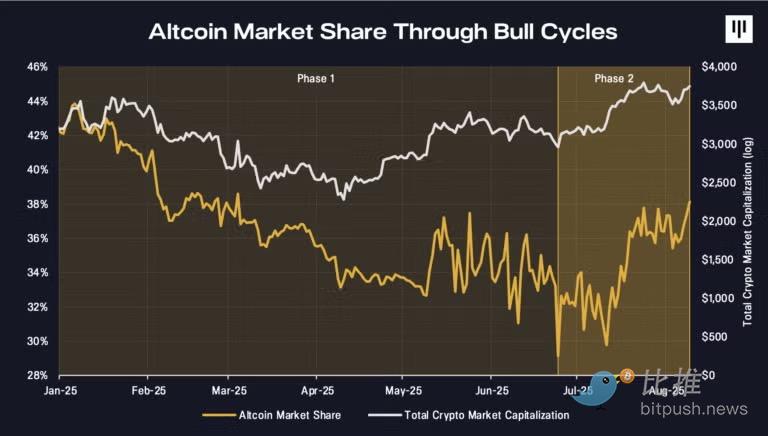

进入牛市第二阶段

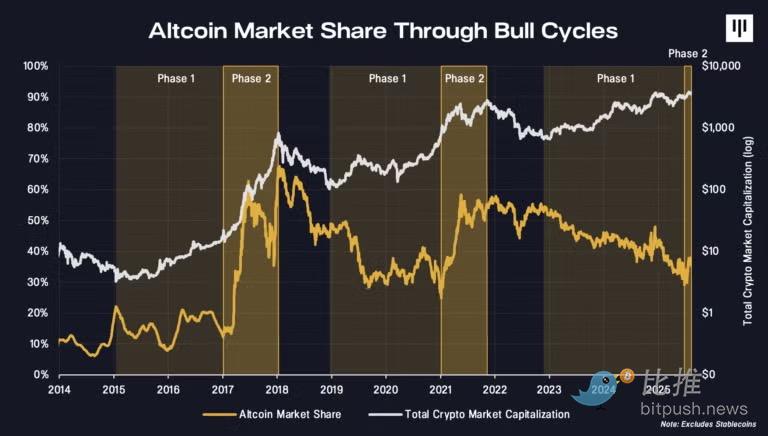

比特币往往会引领牛市周期,而山寨币在早期则会滞后。随着周期的推进,山寨币通常会获得势头,并在周期尾声跑赢比特币。我们将这称为牛市的“第一阶段”和“第二阶段”。

重要的是,在过去的两个周期中,山寨币贡献了大部分的价值创造。在2015-2018年周期中,山寨币占加密总市值增长的66%。在2018-2021年周期中,它们贡献了55%。

而到目前为止,在本轮周期中,山寨币仅占市场总增长的35%。

长期以来,比特币一直受益于监管的明晰——不仅因为它被归类为商品,更因为它作为“数字黄金”的角色被充分理解。这在本轮周期早期是其跑赢山寨币的关键驱动因素,因为山寨币历来面临更大的监管不确定性——直到最近。随着新一届政府上台,这种动态正在发生转变,推动数字资产创新取得了有意义的进展。

历史上偏爱比特币的监管明晰和利好现在正开始延伸到山寨币。市场开始反映出这一点。

随着监管胜利不断累积,势头正在增强。上个月,特朗普总统将《GENIUS法案》签署为法律,为在美国受监管的稳定币的繁荣创造了条件,这可以成为全球金融交易的引擎。已经通过众议院的《CLARITY法案》旨在建立数字商品和数字证券之间更清晰的界限——帮助解决SEC和CFTC之间长期存在的管辖权不确定性。一场转变正在进行中,有理由相信非比特币代币将是最大的受益者之一。

创新和发展已经在加速,特别是在代币化领域。Robinhood最近推出了由Arbitrum支持的股票代币,旨在普及股票投资,创造更高效的市场。美国主要银行如美国银行、摩根士丹利和摩根大通正在探索发行自己的稳定币。贝莱德的BUIDL基金已积累了23亿美元的代币化国债。Figure已处理了超过500亿美元的区块链原生RWA交易。除了其代币化国债基金,Ondo还计划通过Ondo Global Markets在纽交所和纳斯达克提供超过1,000种代币化股票。链上大迁徙正在进行中。

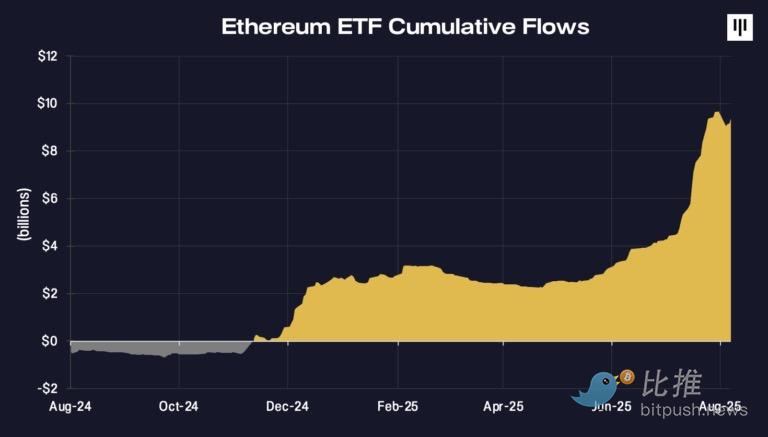

以太坊驱动非比特币市场份额增长

大部分现实世界资产正流入以太坊。

在2600亿美元的稳定币市场中,54%的稳定币是在以太坊上发行的。73%的链上国债资产在以太坊上。DATs正在以前所未有的水平进行积累。华尔街正在意识到这一点,对ETH的需求正在激增。

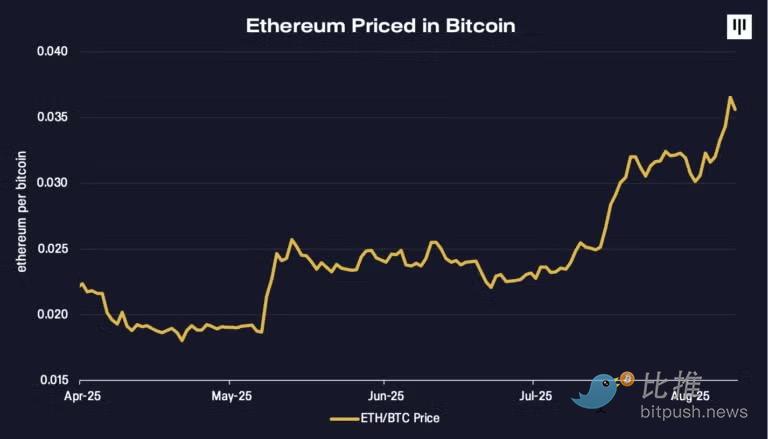

以比特币计价的以太坊价格自2025年4月触底以来,已上涨103%。

比特币减半周期–精准预测

这太疯狂了!

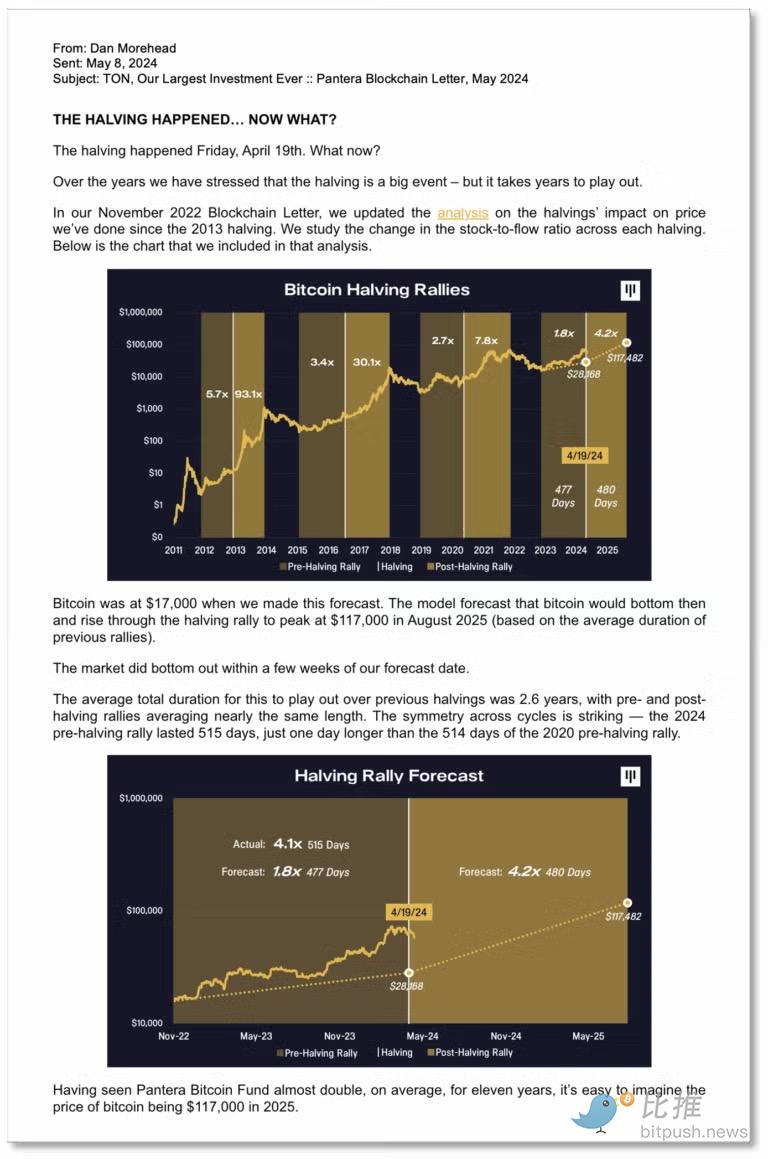

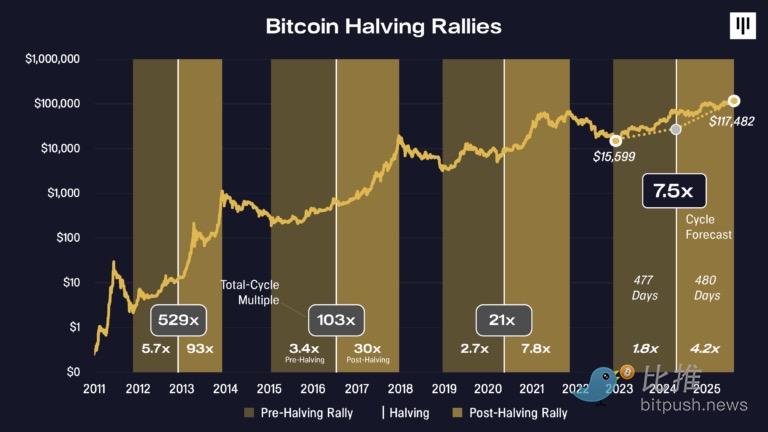

在加密寒冬期间,我们利用之前三次比特币减半的研究,预测比特币将在2025年8月11日达到117,482美元。

它真的达到了!!!

减半发生了……更新版

在我们2022年11月的《区块链信函》中,我们更新了自2013年减半以来我们对减半对价格影响的分析。我们研究了每次减半后存量-流量比的变化。下方图表是我们当时分析的更新版本。

祝你八月愉快,

“让‘另类’(alternative)重回‘山寨币’(Alts)”–Dan Pantera

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。