Connectionism, the power-law expansion of on-chain assets.

Written by: Zuoye

Ethereum returns with DeFi once again, with Aave/Pendle/Ethena making circular lending a leverage amplifier. Compared to the on-chain stack based on ETH during DeFi Summer, the leverage ascent curve supported by stablecoins like USDe is much smoother.

We may be entering a warm long cycle, and the examination of on-chain protocols will be divided into two parts: first, involving more asset types, as external capital liquidity will be more abundant under the expectation of the Federal Reserve's interest rate cuts; second, examining the extreme values of leverage multiples, corresponding to the process of safe deleveraging, i.e., how individuals can exit safely and how the bull market will end.

Crypto's Six Protocols: Interaction of Ecosystems and Tokens

There are countless on-chain protocols and assets, but under the 80/20 rule, we only need to focus on parameters like TVL/transaction volume/token price. More specifically, we should focus on the few indispensable individuals in the on-chain ecosystem, and then examine their relationships within the ecological network, balancing individual importance, ecological connectivity, and the highest growth potential of new protocols.

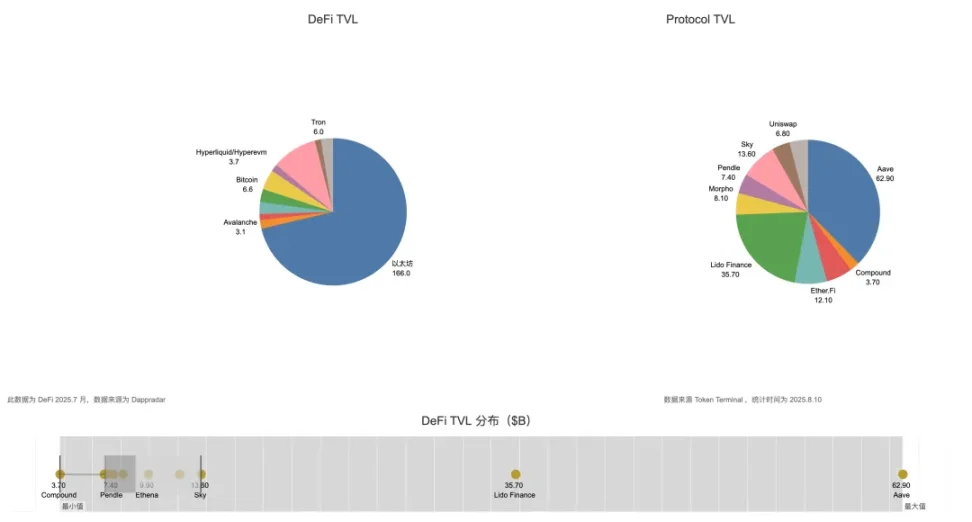

Image description: DeFi TVL Overview, image source: @zuoyeweb3

In the composition of DeFi TVL, Ethereum accounted for over 60% of DeFi TVL in July, while Aave accounted for over 60% of Ethereum's ecosystem TVL. This represents the 20% in the 80/20 rule; the remaining protocols must have a strong connection with the two to be included in the ranks of primary passive beneficiaries.

With the flywheel of the circular lending trio starting, the degree of association among Ethereum, Aave, Pendle, and Ethena goes without saying. Adding Bitcoin to the mix, WBTC, ETH, and USDT/USDC are the de facto foundational assets of DeFi. However, USDT/USDC, similar to Lido, only possess asset attributes and lack ecological value, with Plasma, Stablechain, etc., just beginning to compete.

To make a slight distinction, a protocol can have multiple values. For example, Bitcoin primarily possesses asset value; everyone needs BTC, but no one knows how to utilize the Bitcoin ecosystem. This is not to say that BTCFi is a scam (just a precaution).

On the other hand, ETH/Ethereum possesses dual value; everyone needs ETH and the Ethereum network, including EVM and its extensive DeFi stack and development facilities.

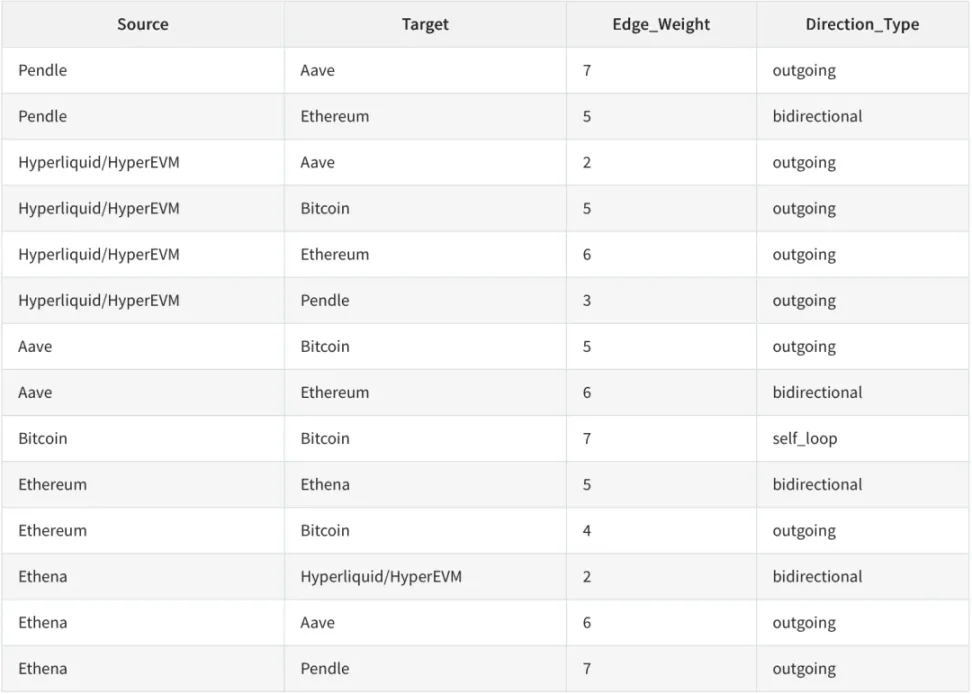

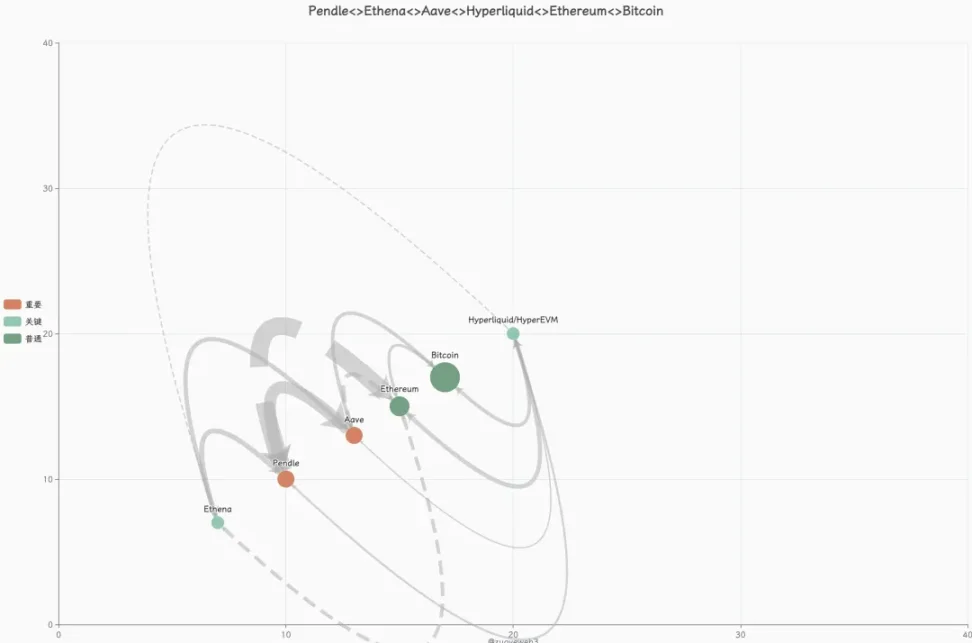

Based on asset and ecological value, we further categorize the "need" level of various leading protocols. Each needed asset attribute scores one point, and each needed ecological value scores another, leading to the following table:

Pendle/Aave/Ethena/Ethereum/HyperEVM/Bitcoin are the six protocols with the strongest links, with any two of them being able to couple with each other, requiring at most one additional protocol or asset link.

Let’s explain a bit:

- Ethena > HyperEVM: USDe has already been deployed to the HyperEVM ecosystem.

- Pendle > HyperEVM: $kHYPE and $hbHYPE rank first and third on the trend list.

- Aave > HyperEVM: Hyperlend's TVL accounts for 25% of HyperEVM ($500M vs. $2B), and it is a friendly fork of Aave, promising to share 10% of profits with Aave.

- BTC/ETH are the two cryptocurrencies with the highest trading volume on Hyperliquid and can be deposited and withdrawn through Unit Protocol.

- Pendle, Aave, and Ethena have already become one, but USDe's asset attributes are recognized, while $ENA's ecological value is slightly inferior.

- Pendle's new product Boros is based on funding rates, with BTC and ETH contracts as the first choices.

- Aave requires WBTC and various ETH, such as staked ETH, especially since Ethereum's ecological value as infrastructure is needed by Aave/Pendle/Ethena, serving as on-chain support for ETH prices.

- The most unique aspect is that the Ethereum ecosystem unidirectionally needs BTC, while the Bitcoin ecosystem does not require any external assets.

- Ethena has no relationship with Bitcoin/BTC.

- HyperEVM/Hyperliquid is the "most proactive" external ecosystem, giving a strong sense of "I am here to join this family."

Based on statistics, these are the six assets with the closest links. Any introduction of other ecosystems and tokens requires more hypothetical steps. For example, Lido, which ranks second in TVL, has a weak relationship with Hyperliquid and Bitcoin, and after Pendle "abandoned" LST assets to invest in YBS, Lido's ecological interactivity within Ethereum will weaken.

Using BTC's highest score of 7 as a base, we categorize the six assets into three nodes based on their influence on other protocols. Please note that this is not a depiction of their asset value but a ranking of their importance within the ecosystem:

BTC/ETH are the strongest infrastructures, with BTC excelling in value attributes and ETH's ecological status being unshakeable. If you include Solana to calculate the degree of connection, you will find it does not compare to Hyperliquid/HyperEVM's connection to Ethereum. The core reason is Hyperliquid's trading attributes, which align better with the EVM ecosystem when combined with HyperEVM.

- Within Ethereum, Lido/Sky have insufficient interaction with the existing six protocols.

- Outside of Ethereum, Solana/Aptos have insufficient interaction with the existing six protocols.

However, Solana needs to support its own DEX to accommodate more external assets, which naturally requires an additional hypothetical step. SVM's compatibility with the EVM ecosystem will also be more challenging. In short, everything in Solana must develop independently.

Image description: Connectionism, image source: @zuoyeweb3

However, within the network of relationships, the synergistic effect of the Ethereum ecosystem is the strongest. The $1 Ethena comes through hedging with ETH, then flows into Pendle and Aave for value transfer, and the Gas Fees generated become the value support for ETH.

Apart from Bitcoin naturally relying on BTC for value self-circulation and self-transfer, ETH is the closest to a value closed loop, but this is the result of proactive actions. The combination of Hyperliquid/HyperEVM is still in progress, and whether it can achieve the linkage of trading (Hyperliquid) + ecology (HyperEVM) and $HYPE remains to be seen.

This is an entropy-increasing process with gradually increasing hypotheses. BTC only needs itself, ETH needs ecology and tokens, and $HYPE needs trading, tokens, and ecology.

Is there an end to the expansion of DeFi?

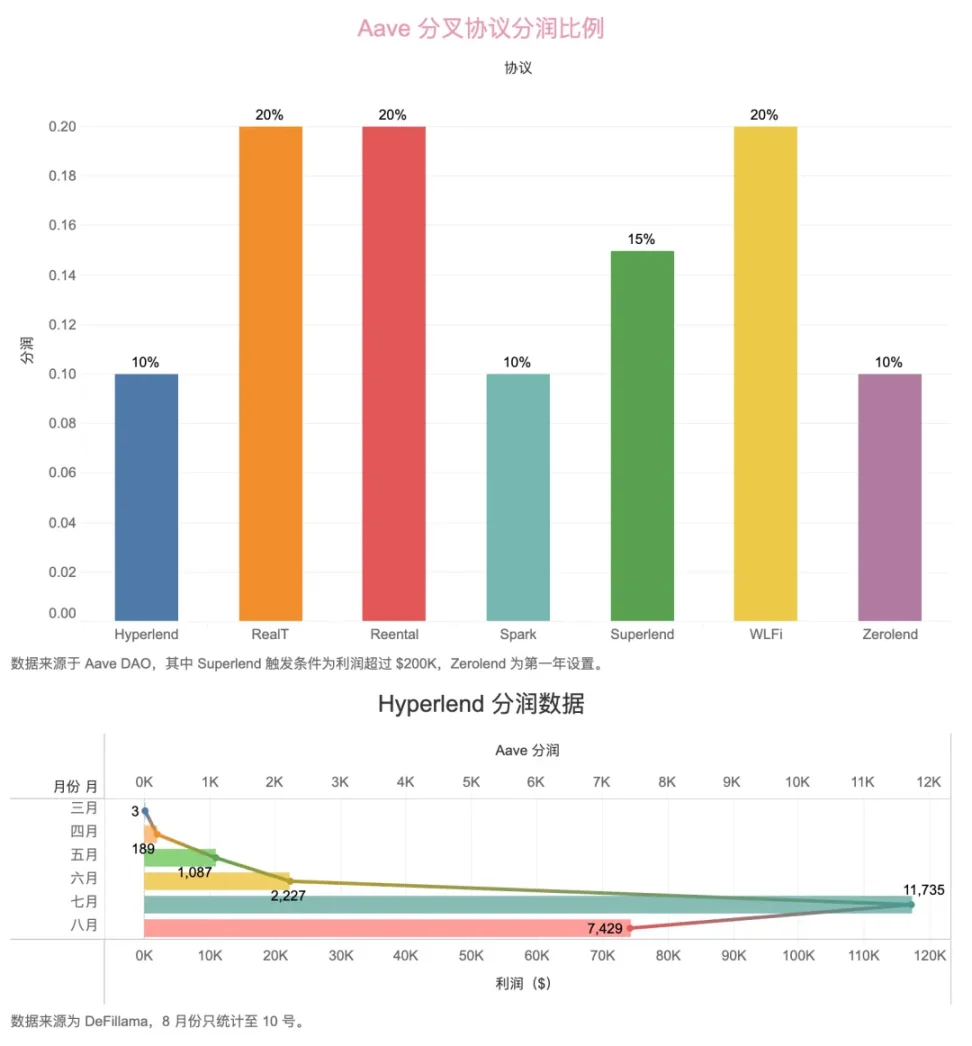

As mentioned earlier, Hyperlend needs to share profits with Aave. Aave's influence is not limited to this; in fact, Aave is the main character in the circular lending initiated by Pendle and Ethena, bearing the leverage role of the entire circular system.

Aave is the closest to becoming the on-chain infrastructure of Ethereum, not because it has the highest TVL, but due to a comprehensive consideration of safety and capital volume. The safest way for any public chain and ecosystem to initiate a lending model is to fork Aave in a compliant manner.

Image description: Aave and Hyperlend profit-sharing setup, image source: @zuoyeweb3

In Hyperlend's fork template, a 10% profit-sharing is the baseline, along with an allocation of 3.5% of its own tokens to Aave DAO and 1% to stAave holders. This means Aave sells itself as a service to various ecosystems, which is where its ecological value and token value are linked.

However, it is not without competitors. Maple has already expanded to HyperEVM, and new forms of lending protocols like Fluid and Morpho are also competing fiercely with new assets like YBS. HyperEVM, as the strongest competitor in the Ethereum EVM ecosystem, may not always remain peaceful.

In terms of proactivity, Bitcoin and HyperEVM are absolute extremes. HyperEVM is siphoning traditional trading types onto the chain through HIP3, connecting the liquidity of HyperCore and Hyperevm through CoreWriter, and supporting its front-end agents through Builder Code.

Additionally, it is utilizing Unit Protocol and Phantom to connect funds from the Solana ecosystem, siphoning all on-chain liquidity, which is also a way to expand infrastructure.

To summarize:

- Pendle is targeting all types of assets that can be split, starting from fixed income and expanding into the derivatives market beyond perpetual contracts, which broadly refers to the interest rate swap market.

- Ethena, leveraging the DeFi circular lending model and treasury strategies, aims to create a third pole for stablecoins starting from $ENA and $USDe, $USDtb. The basic use of USDT/USDC remains trading and payment, while USDe hopes to become a risk-free asset in the DeFi space.

- Aave has already become the de facto lending infrastructure, with its status closely tied to Ethereum.

- Bitcoin and Ethereum represent the limits of the blockchain economic system, and their degree of expansion is the foundation for DeFi growth, specifically how much BTC can be migrated to DeFi and how much growth potential DeFi still has.

- Hyperliquid/HyperEVM has already tightly bound itself to existing DeFi giants in the ecosystem. Although its TVL is far inferior to Solana's, its growth prospects are greater. The story of Solana lies in defeating the EVM system from the perspective of public chains.

Conclusion

The six crypto protocols examine the degree of interconnection among them, not to say that other protocols lack value, but rather that high collaboration density will exponentially increase the freedom and utilization of funds, leading to shared benefits and mutual prosperity.

Of course, a loss will also be a collective loss, which necessitates examining the DeFi anchor shift—from ETH to the subsequent development of YBS. As a high-value asset, ETH is more aggressive in terms of leverage, while YBS, like USDe, is naturally more price-stable (not value-stable). The DeFi Lego built on it is more solid, and excluding extreme decoupling situations, theoretically, it can make the leverage and deleverage curves more gentle.

The seats in the crypto pantheon are limited; new chosen ones can only strive forward, forge connections with existing deities, and build the strongest protocol network to earn their place.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。