以太坊今日新闻:Fundamental Global的2亿美元以太坊投资分析

Fundamental Global Inc.(FG Nexus)进行了迄今为止最雄心勃勃的企业加密货币举措之一。该公司已将通过最近的私募融资筹集的2亿美元全部投资于以太坊,使其成为第二大加密货币的最大企业持有者之一。

这一举动反映了对以太坊在全球数字金融未来中的角色的深刻信念。

来源:WuBlockchain

以太坊持有量的目标

FG Nexus于2025年7月30日启动了以太坊的购买计划,这个日期意义重大。正好是以太坊最初的“创世区块”在2015年挖掘6400个ETH的十周年。为了纪念这一周年,该公司购买了同样数量的6400个ETH,作为其进入市场的标志。

自那时以来,Fundamental Global Nexus继续增加其持股。截至2025年8月10日,其持有的以太坊价值为47,331个ETH,每个币的价值为4,228.40美元。该公司有宏大的计划:希望创建全球最大的代币国库之一,并最终拥有所有以太坊币的10%。

以收益生成为核心

这并不是简单的买入并持有策略。Fundamental Global Nexus计划对其ETH持有进行质押和再质押,以从区块链驱动的金融中获得收益,包括代币化的现实资产和稳定币收益计划。Anchorage Digital将提供保管服务,而Galaxy将担任资产管理人。

“这枚币正在迅速成为全球数字金融的基础,”Fundamental Global Nexus数字资产首席执行官Maja Vujinovic表示。“我们旨在将ETH推广为国库储备资产,并成为其网络中的重要参与者。”

Fundamental Global通过50亿美元的发行扩展融资

为了进一步增加其持有量,该公司已向美国证券交易委员会提交了一个货架注册。该注册使公司能够出售高达50亿美元的证券,其中预计通过与ThinkEquity的市场销售协议筹集40亿美元。

价格动向

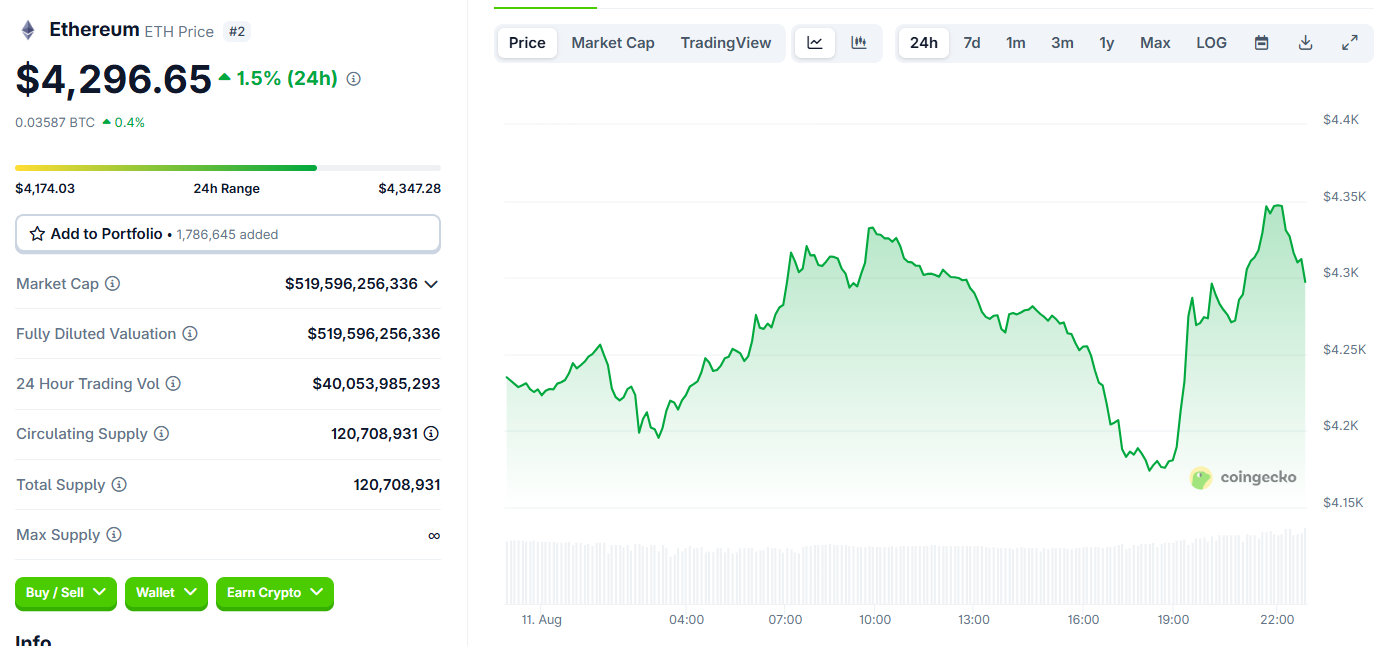

Fundamental Global Nexus的大胆举动发生在以太坊交易价格为4,296.65美元,市值为5190亿美元的背景下。由于企业和机构需求增加,ETH在过去24小时内上涨了1.5%。

比特币仍然控制着58.6%的加密市场,以太坊占12.8%,一些分析师认为,如果ETH像比特币的历史性上涨那样突破,这一比例可能会增加。

市场反应

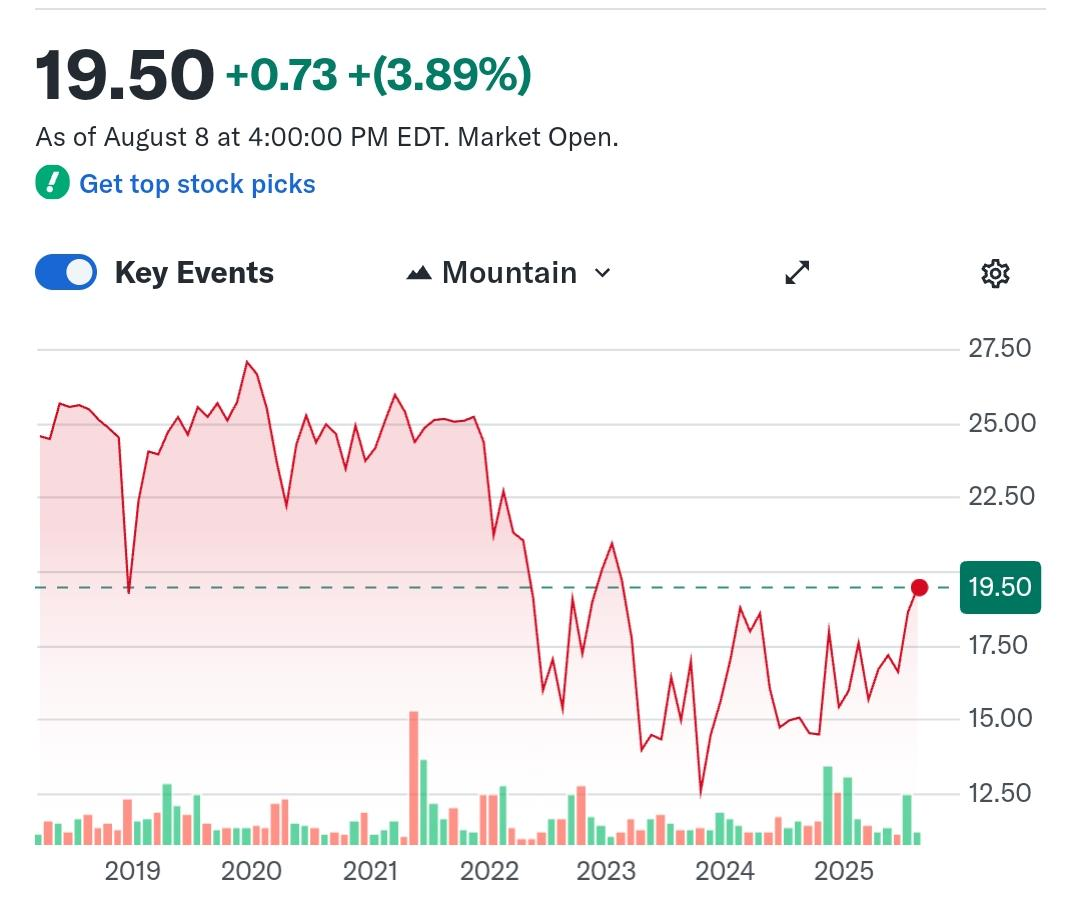

市场反应迅速。在公告发布后,Fundamental Global Nexus的股票上涨至40美元以上,随后回落。该股票在前一天收盘时为18.78美元,下跌了17.39%,显示出突发性波动并非加密市场所独有。

来源:Yahoo Finance

最后思考:聪明还是冒险?

FG Nexus的2亿美元以太坊购买是一项冒险的赌注。一方面,DeFi、质押和代币化资产的重要性日益增加,可能会带来巨大的长期收益。另一方面,加密货币市场的波动性使得下跌可能会严重影响公司的财务状况。

如果它像比特币在之前的牛市中那样上涨,FG Nexus可能会被誉为有远见的公司。另一方面,如果这一举动未能成功,可能会被视为对单一加密货币下注过多的例子。目前,市场将密切关注,以确定这一激进举动的走向。

另请阅读: Monad主网日期预告:为什么有60%的机会在八月上线?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。