According to Foresight News statistics, in July 2025, there were a total of 52 investment and financing events in the cryptocurrency market, including 19 in tools and infrastructure, 5 in the DeFi sector, 16 in asset management, 6 in blockchain gaming and NFTs, and 6 in the Web3 sector. The total disclosed investment amount is approximately $1.523 billion. Additionally, a total of 28 listed companies have disclosed purchases or plans to purchase cryptocurrency assets.

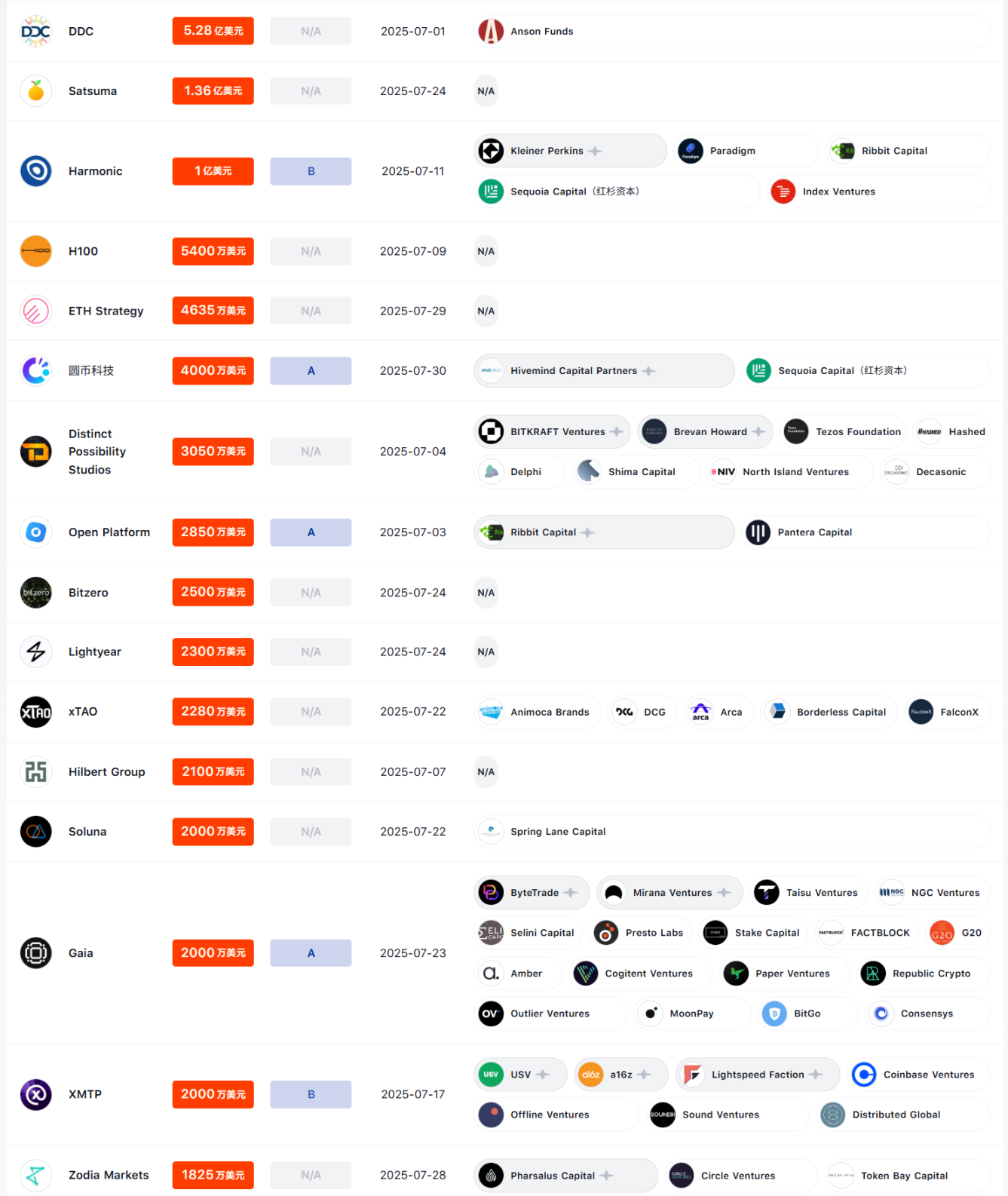

This month's investment and financing projects are sorted by financing amount as shown in the figure below:

This month, there were 2 financing events exceeding $100 million, including Harmonic, an artificial intelligence lab, completing a $100 million Series B financing led by Kleiner Perkins; and Substack, a content subscription platform, completing $100 million in financing led by BOND and others.

There were 21 financing events in the tens of millions of dollars, including Stable completing $28 million in seed round financing led by Bitfinex and Hack VC; Yuan Coin Technology completing $40 million in Series A2 financing led by ZhongAn International and others; the lending platform Salient completing $60 million in Series A financing led by a16z; Gaia Labs obtaining $20 million in financing led by ByteTrade and Mirana; Poseidon completing $15 million in seed round financing led by a16z; Spiko completing $22 million in Series A financing led by Index Ventures; the stablecoin company Agora completing $50 million in Series A financing led by Paradigm; and the game studio Distinct Possibility Studios completing $30.5 million in financing led by Bitkraft Ventures and others.

In the segmented investment and financing tracks, this month saw a hot market in asset management, tools, and infrastructure, while the DeFi, NFT, and blockchain gaming sectors were relatively sluggish.

On the institutional side, active institutions this month included a16z, YZi Labs, and Coinbase Ventures, primarily focusing on asset management, tools, and infrastructure.

This month, the purchase of cryptocurrency assets by listed companies continued to be hot, with a total of 28 companies purchasing or planning to purchase cryptocurrency assets, including XRP reserve company Webus obtaining a $100 million credit line financing from Ripple Strategy; DDC Enterprise completing $528 million in financing, with net proceeds used to purchase Bitcoin; Nano Labs investing in BNB strategic reserve company CEA Industries; and listed company Upexi reaching a $500 million equity financing agreement to support its Solana reserve strategy, among others.

Tools and Infrastructure

Harmonic completes $100 million Series B financing

Harmonic is an artificial intelligence lab.

XerpaAI completes $6 million seed round financing

XerpaAI is a blockchain AI-driven growth platform.

Quack AI completes $3.6 million in financing

Quack AI is an AI-driven governance protocol.

Poseidon completes $15 million seed round financing

Poseidon is built on Story Protocol and aims to unlock high-quality training data for "next-generation entity AI."

DSRV completes approximately 16 billion KRW (about $11.6 million) in initial Series B financing

DSRV is a South Korean blockchain infrastructure provider.

Freename completes $6.5 million Series A financing

Freename is a Swiss Web3 domain registrar.

Cryptocurrency mining company Bitzero completes $25 million in financing

Bitzero is a cryptocurrency mining company supported by Kevin O'Leary.

D-GN completes $5 million seed round financing

D-GN is a decentralized data platform.

Manifold announces completion of $10.5 million Series A financing

Manifold is a decentralized AI infrastructure.

Billy Bets recently completes $1 million in financing

Billy Bets is an AI agent based on Virtuals.

Pri0r1ty Intelligence Group raises $1 million

Pri0r1ty Intelligence Group plans to expand the Bitcoin liquidity of its Lightning Network node from 1 BTC to at least 5 BTC.

European investment app Lightyear completes $23 million in financing

Lightyear will also launch brand new AI features. Additionally, Lightyear plans to launch its own cryptocurrency product within two months, focusing on a "more long-term perspective" investment experience.

Gaia Labs obtains $20 million in financing

Gaia Labs is a decentralized AI agent infrastructure.

Vaulta secures $6 million strategic financing from WLFI

Vaulta (formerly EOS Network) secures $6 million strategic financing from WLFI to advance its Web3 banking business in the U.S., with USD1 to be directly integrated into Vaulta's infrastructure.

YZi Labs strategically invests in blockchain infrastructure platform Aspecta

Aspecta is dedicated to providing smart verification, price discovery, and full lifecycle liquidity for trillion-dollar illiquid assets such as TGE pre-token shares, locked tokens, private equity, and RWA.

Awaken Foundation commits to invest $15 million in Infinity Ground

The AI network Infinity Ground supports more developers and creators in building and launching the next generation of AI-driven DApps.

Castellum.AI completes $8.5 million Series A financing

Castellum.AI is a financial crime compliance platform.

Zypher Network completes $7 million in financing

Zypher Network is a Web3 infrastructure developer.

The Open Platform announces completion of $28.5 million Series A financing

The Open Platform is a Telegram ecosystem development platform.

DeFi

Kuru Labs completes $11.5 million Series A financing

Kuru Labs is a decentralized exchange on Monad Layer 1.

Meme Perp DEX project Superp completes second round of financing

Superp is a Meme Perp DEX project supported by the eighth season BNB Chain MVB and CoinMarketCap incubation.

Pear Protocol completes $4.1 million strategic financing

The protocol has officially launched integration features on the Hyperliquid perpetual contract order book.

Velvet Capital completes $3.7 million in financing

Velvet Capital launches its intent-driven DeFAI trading and portfolio management ecosystem.

Xitadel completes a new round of financing

Xitadel is an on-chain bond layer.

Asset Management

YZi Labs announces investment in Digital Asset

Digital Asset is an enterprise-grade tool platform building compliance solutions for regulated markets.

BridgePort completes $3.2 million seed round financing

BridgePort is a cryptocurrency OTC settlement platform.

KUN completes Series A financing

KUN is a stablecoin payment service platform.

Spiko completes $22 million Series A financing

Spiko is a tokenized money market fund platform.

Zodia Markets completes $18.25 million in financing

Zodia Markets is a cryptocurrency trading platform under Standard Chartered Bank.

Salient completes $60 million Series A financing

Salient is a lending platform.

Stable completes $28 million seed round financing, led by Bitfinex and Hack VC

Stable is a new blockchain project built around Tether's USDT.

Xinglu Technology completes nearly $10 million Series A financing, with participation from the Solana Foundation and others

Xinglu Technology is a wealth technology platform focused on Web5 (Web2 + Web3), providing one-stop solutions for financial institutions. The company has launched the FinRWA Platform (FRP) in Hong Kong, connecting the entire asset tokenization industry chain, and plans to expand into the Singapore and Middle East markets.

Due completes $7.3 million seed round financing

Due is a payment service provider.

Yuan Coin Technology completes $40 million Series A2 financing

Yuan Coin Technology previously participated in the Hong Kong Monetary Authority's stablecoin sandbox pilot and launched the HKDR stablecoin pegged 1:1 to the Hong Kong dollar. ZhongAn Bank has signed a strategic cooperation memorandum with it to explore the application of stablecoins in compliant financial services.

Dakota completes $12.5 million Series A financing, led by CoinFund

Dakota is a stablecoin-driven financial institution co-founded by former Coinbase executives.

Cryptocurrency infrastructure company Function announces completion of $10 million seed round financing

Function (formerly Ignition) is dedicated to introducing institutional-grade yields for Bitcoin, with its flagship product FBTC being a fully reserved, composable representation of Bitcoin, currently with a total locked value (TVL) of $1.5 billion.

NEXPLACE completes $8 million Series A financing

NEXPLACE is a trading platform under NEXBRIDGE.

Stablecoin company Agora completes $50 million Series A financing

Agora has partnered with cryptocurrency companies such as Polygon to help them launch customized stablecoins for decentralized finance projects.

DigitalX completes approximately $13.5 million in financing

DigitalX is an Australian crypto asset management company.

Perena completes oversubscribed Echo round financing

Perena is a decentralized stablecoin infrastructure.

NFT and Blockchain Gaming

Remix completes $5 million seed round financing

Remix is a gaming platform.

Aria completes $5 million in financing

Aria is a Web3 role-playing game.

Delabs Games completes $5.2 million Series A financing

Delabs Games is a blockchain gaming developer.

Circle Games completes $7.25 million seed round financing

Circle Games is a Turkish gaming company.

Distinct Possibility Studios completes $30.5 million in financing

Distinct Possibility Studios is a game studio.

Cold River Games completes $2 million in financing

Cold River Games is a game development studio.

Web3

U.S. listed medical device technology company BioSig merges with Streamex, plans to raise $1.1 billion to advance RWA tokenization development

U.S. listed medical device technology company BioSig Technologies merges with another listed company, Streamex Exchange Corporation, while signing an $1.1 billion financing agreement aimed at advancing RWA tokenization business development, focusing on bringing the $142 trillion commodity market on-chain with an emphasis on gold tokenization.

New York startup Courtyard completes $30 million Series A financing

Founded in 2021, Courtyard primarily sells "blind box" cards and comic books through its website in the form of digital vending machines. Users pay a certain amount, and an algorithm randomly allocates cards or comics, with options to resell at 90% of market price, resell on the platform with no fees, or store for free in Courtyard's warehouse.

Substack completes $100 million in financing

Substack is a content subscription platform.

Blockskye completes $15.8 million Series C financing

Blockskye is building blockchain infrastructure for business travel.

XMTP developer Ephemera completes $20 million Series B financing

XMTP is relaunching in Coinbase's new Base application, transitioning from an optional tool to native infrastructure.

Limitless announces completion of $4 million strategic round financing

Limitless is a prediction market on the Base chain.

Others

Listed company Thumzup Media raises $6.5 million to explore accumulating more cryptocurrency

NASDAQ-listed Thumzup Media Corp announced it raised $6.5 million at a price of $6 per share, intending to use the net proceeds from this proposed issuance for general corporate purposes and to explore accumulating other cryptocurrencies.

XRP reserve company Webus obtains $100 million credit line financing from Ripple Strategy

Chinese customized ride-hailing service platform Webus announced it has signed a conditional securities purchase agreement with Ripple Strategy Holdings to obtain up to $100 million in preferred equity credit.

DDC Enterprise has completed $528 million in financing, with net proceeds used to purchase Bitcoin

NYSE-listed DDC Enterprise Limited announced that the previously announced financing has been completed, totaling $528 million, with investors including Anson Funds and others.

Norwegian mining company Green Minerals signs approximately $25 million financing agreement to increase Bitcoin holdings

Norwegian mining company Green Minerals announced it has signed a structural financing agreement worth 250 million Norwegian kroner (approximately $25 million) to purchase more Bitcoin.

Remixpoint raises approximately $215 million to purchase Bitcoin, plans to increase holdings to 3,000 BTC

Japanese listed company Remixpoint announced it raised approximately 31.5 billion yen (approximately $215 million) through financing, planning to use all funds to purchase Bitcoin. The company currently holds 1,051 BTC, with a recent target to increase holdings to 3,000 BTC.

Swedish listed company H100 Group completes approximately $54 million in financing, funds will be used for investment opportunities within Bitcoin reserve strategy framework

Swedish listed company H100 Group officially disclosed that it has raised an additional 516 million Swedish kronor (approximately $54 million) through the execution of the sixth and seventh rounds of financing, with funds to be used for investment opportunities within the company's Bitcoin reserve strategy. These two rounds of financing were initially announced on June 16.

Libre Capital launches $100 million tokenized yield fund and rebrands as KAIO

Libre Capital announced its rebranding to KAIO and the launch of a $100 million Laser Digital Bitcoin diversified yield fund, managed by Laser Digital Middle East.

Nano Labs invests in BNB strategic reserve company CEA Industries

Nano Labs announced its investment in BNB strategic reserve company CEA Industries, subscribing to 495,050 shares of Class A common stock of CEA INDUSTRIES INC at $10.10 per share, while also receiving an equal number of warrants (exercise price $15.15 per share).

Antelope Enterprises AEHL signs $50 million financing agreement to purchase Bitcoin

NASDAQ-listed Antelope Enterprises Holdings Limited (AEHL) today announced it has signed a securities purchase agreement with U.S. investment firm Streeterville Capital, with a total financing amount of $50 million.

ETH Strategy completes $46.35 million pre-launch financing

Ethereum treasury protocol ETH Strategy announced it has completed pre-launch stage financing, raising 12,342 ETH, approximately $46.35 million at current prices.

Listed company Upexi reaches $500 million equity financing agreement to support its Solana reserve strategy

Upexi (NASDAQ: UPXI) announced it has reached a stock financing agreement of up to $500 million with A.G.P. to accelerate its Solana treasury strategy.

CEA Industries and 10X Capital conduct $500 million private placement financing to establish BNB treasury

CEA Industries and 10X Capital announced a $500 million private placement financing supported by YZi Labs to establish a BNB treasury, issuing common stock PIPE, with total proceeds of $500 million (including $400 million in cash and $100 million in cryptocurrency), plus up to $750 million in cash.

Japanese nail salon chain Convano raises $10.1 million to purchase more Bitcoin

The company purchased approximately 80 BTC last week.

Satsuma completes over $136 million private placement financing to accelerate its Bitcoin funding strategy

UK-listed company Satsuma (formerly Tao Alpha) announced it has completed £100 million ($136 million) in private placement financing to accelerate its Bitcoin funding strategy.

Matador secures $100 million in financing for Bitcoin reserve construction

Canadian listed company Matador has secured $100 million in financing for Bitcoin reserve construction. By 2026, Matador plans to acquire up to 1,000 BTC, and by 2027, up to 6,000 BTC.

Nature's Miracle Holding launches $20 million corporate XRP financial plan

Vertical farming technology company Nature's Miracle Holding Inc. (OTCQB: NMHI) announced it will establish a $20 million corporate XRP financial plan.

Hilbert Group and LDA Capital reach $15.8 million financing agreement to increase Bitcoin holdings

Hilbert Group and LDA Capital have reached a structural financing agreement worth 150 million Swedish kronor (approximately $15.8 million) to support its Bitcoin reserve strategy. This "ATM-style" financing mechanism allows for flexible withdrawals over 36 months to increase Bitcoin holdings.

Soluna Holdings completes $20 million in financing

Soluna Holdings is a NASDAQ-listed company developing green data centers for Bitcoin mining and AI-intensive computing applications.

Listed company Profusa signs $100 million equity credit agreement to initiate Bitcoin treasury strategy

Commercial-stage digital health company Profusa (NASDAQ: PFSA) announced it has reached a securities purchase agreement (equity credit agreement) with Ascent Partners Fund LLC (referred to as "Ascent") to finance up to $100 million through the issuance of common stock, with net proceeds fully allocated to purchasing Bitcoin (which can be used for debt repayment).

Windtree raises $6 million through securities subscription financing, plans to initiate BNB treasury strategy

U.S. listed company Windtree (WINT) announced it has signed a securities purchase agreement worth $6 million with Build and Build Corp, with future subscriptions potentially raising up to $140 million in total proceeds.

Hilbert Group AB receives 300 million Swedish kronor investment in Bitcoin

NASDAQ-listed Hilbert Group AB announced that following last week's announcement of the initial issuance of 200 million Swedish kronor in convertible bond financing, Deus X Capital will invest 300 million Swedish kronor in Bitcoin, totaling 233 BTC, which have now been transferred to Hilbert's balance sheet.

Bitcoin Treasury Capital signs 200 million Swedish kronor ATM-style equity financing agreement with shareholder investors

Bitcoin treasury company Bitcoin Treasury Capital has signed an ATM-style equity financing agreement with three existing shareholder investors, allowing the company to flexibly raise up to 200 million Swedish kronor in funding over the next six months.

Upexi announces completion of $200 million private placement financing to further increase SOL holdings

U.S. listed company Upexi (NASDAQ: UPXI) announced the completion of a total of $200 million in parallel private placement financing, covering both common stock and convertible notes, both priced above market value.

KWM reaches convertible note agreement with Anson, with 80% of the first $15 million in financing used to purchase Bitcoin

NASDAQ-listed Korean media alliance K Wave Media (NASDAQ: KWM) announced it has reached a convertible note agreement with Anson Funds. Anson has agreed to provide up to $500 million in financing, with KWM committing to use at least 80% of the net proceeds to purchase Bitcoin (BTC).

Canadian listed company Digital Commodities completes $2 million private placement financing, part of which will be invested in Bitcoin

Canadian listed company Digital Commodities completed $2 million in financing through a non-brokered private placement, with Mogo making a strategic investment of $1 million in Digital Commodities.

Bitcoin Treasury Capital raises approximately $1.6 million to increase Bitcoin holdings

Canadian listed company Bitcoin Treasury Capital raised 15 million Swedish kronor (approximately $1.6 million) through a directed share issuance to increase its Bitcoin holdings.

Ego Death Capital's second fund completes $100 million fundraising, focusing on supporting the expansion of Bitcoin ecosystem enterprises

Ego Death Capital's second fund has completed $100 million in fundraising, focusing on supporting the expansion of Bitcoin ecosystem enterprises. This new fund will primarily target Series A financing stages to help existing validated companies scale their growth.

Swedish listed company Hilbert Group completes over 200 million Swedish kronor in financing to support its crypto reserve strategy

Swedish listed company Hilbert Group has completed over 200 million Swedish kronor (approximately $20.98 million) in financing to support its crypto reserve strategy. The funds were obtained from a U.S. institutional partner.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。