Source: BitpushNews

On Thursday local time, as Wall Street was nearing the close, U.S. President Trump announced on Truth Social the appointment of Stephen Miran, Chairman of the White House Council of Economic Advisers (CEA), as a Federal Reserve Governor, to replace Adriana Kugler, who recently stepped down. His term is set to last until January 31, 2026.

According to Politico, the White House was not yet prepared to announce a successor to current Fed Chair Jerome Powell, and Miran's move serves both as a "placeholder" and a "political signal."

Will this brief "Fed audition" become an unexpected booster for the crypto industry? And what does Trump's appointment of Miran mean in the context of expectations for Fed rate cuts and the weakening dollar?

Who is Stephen Miran? A Crypto "Ally" from Harvard to the White House

Stephen Miran has an economics background from Harvard University and a career spanning investment and policy fields. Before joining Trump's team, he served as an investment partner at Amherst Peak Advisors and as a senior strategist at Hudson Bay. Notably, Hudson Bay was deeply involved in debt trading following the bankruptcy of FTX—a cryptocurrency exchange that went bankrupt at the end of 2022, with its founder Sam Bankman-Fried sentenced to 25 years in prison in November 2023 for seven charges, including telecommunications fraud.

After joining Trump's camp in 2023, Miran quickly rose to prominence, becoming the Chairman of the White House Council of Economic Advisers (CEA) in March 2025. As a typical conservative economist, he firmly supports Trump's tariff policies and has repeatedly advocated for "lowering interest rates" and "reassessing the strong dollar policy."

In the cryptocurrency field, Miran has shown a rare openness. In December 2024, as the then-chairman of the CEA, he was invited to participate in the renowned financial podcast "Forward Guidance," where he discussed the issues arising from the chaotic regulation of cryptocurrencies with host Joseph Wang (former New York Fed trader Fed Guy). In the latter half of the show, Miran addressed the problems caused by regulatory confusion, stating:

"Perhaps we really should simplify a lot of regulations to allow innovative industries like crypto to truly take off."

At that time, U.S. crypto regulation was in disarray, with the SEC and CFTC locked in disputes over token classification, and cases involving Coinbase and Binance still unresolved. Miran's remarks were seen by many in the industry as the "first friendly signal from the White House." Although his views as CEA Chairman do not have legislative power, they carry "barometer" significance in policy trends and regulatory discussions.

It is important to note that Miran does not blindly support the crypto industry; rather, he opposes the current reality of fragmented regulation, redundant approvals, and legal ambiguity, not regulation itself. He pointed out in the program:

- The current dispute between the SEC and CFTC over the attributes of crypto assets (securities vs. commodities) has severely impacted the compliance operations of innovative companies;

- The White House should promote a more coordinated regulatory framework, "so that entrepreneurs clearly know the compliance roadmap";

- Regulation that truly benefits innovation is not "no regulation," but rather "clear rules and defined responsibilities."

This perspective differs from traditional crypto extremists and is closer to the path advocated by institutional compliance-oriented crypto supporters—such as Coinbase CEO Brian Armstrong.

According to Coindesk, Miran has also privately participated in discussions regarding the ambiguity in token regulatory classification between the SEC and CFTC.

If Miran continues to publicly express a rationalization of crypto regulation during his term at the Fed, even if it does not directly influence policy-making, it could become an important catalyst for market sentiment, potentially accumulating momentum as a "potential candidate for governor" after 2026.

Fed Policy: The "Entry" of a Rate Cut Advocate

"He’s just here to warm the seat," commented Mark Spindel, author of "The Independence of the Federal Reserve," "He’ll be gone after a few meetings."

Indeed, from a timing perspective, Miran will participate in at most three Federal Open Market Committee (FOMC) meetings—September, October, and December—having a very limited structural impact on the annual interest rate path.

However, this does not mean that Miran's voice is meaningless. In the increasingly heated interest rate game in the second half of 2025, a vote on the council could keep the market on edge.

In terms of monetary policy, Miran can be seen as a typical Trump-era economist: supporting "American manufacturing," questioning the strong dollar strategy, and advocating for interest rate cuts to stimulate growth.

Between 2023 and 2024, he has repeatedly pointed out in writings and public speeches that the Fed's sustained high interest rate policy "is extremely detrimental to American manufacturing and exports," calling for "a more aggressive monetary policy to complement industrial policy." He is also one of the few senior officials in the CEA to publicly state that "a strong dollar is not in the national interest."

This resonates with Trump's ongoing criticism of Powell. Trump has repeatedly complained in public, "Powell has messed everything up; high interest rates have made America lose its competitiveness." Miran academically endorses this viewpoint, reinforcing the White House's stance that "interest rates should serve growth objectives."

Although Miran is unlikely to change the Fed's interest rate path in the short term, if he promotes the narrative within the Fed that "inflation is under control, and we should focus on employment and investment," it will undoubtedly provide new policy imagination for the market. Especially against the backdrop of currently high U.S. Treasury yields and a weakening dollar index, "the return of rate cut expectations" is becoming a focal point for capital markets.

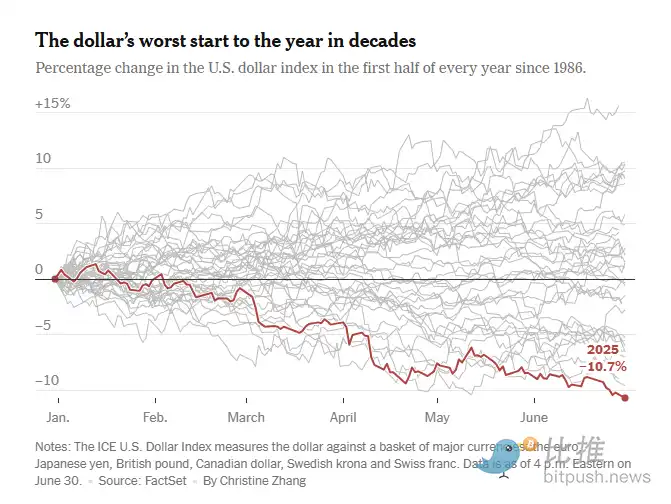

This year, the dollar's safe-haven attributes are facing unprecedented challenges. According to FactSet data, in the first half of 2025, the dollar index (DXY) fell by over 10%, marking the weakest performance for the first half of the year since 1973. The dollar, which typically strengthens during periods of financial market volatility, is now rising alongside long-term U.S. Treasury yields, exhibiting an "anomalous" characteristic typically seen in emerging markets.

Some analysts point out that Miran's challenge to the "strong dollar consensus" is forming a "new consensus in its infancy." In a paper, he questioned, "Is a strong dollar really in the national interest? Should we consider a more flexible exchange rate mechanism for export-oriented manufacturing?" Such views are gradually gaining traction within the Trump administration.

How Should the Crypto Market View Miran's Entry?

For the crypto industry, Miran's temporary ascension may signify:

- A warming policy atmosphere: His stance reinforces the White House's interest in crypto and may promote clearer regulatory integration.

- Increased risk asset sentiment: If he advocates for rate cuts or guides expectations for easing, risk assets like BTC and ETH will directly benefit.

- The dollar's trajectory affecting stablecoins and cross-border payment paths: A weak dollar strategy will enhance the attractiveness of crypto assets in international payments.

Although Miran is not a legislator and cannot single-handedly change the Fed's direction, his views are already shaping the macro sentiment framework for the second half of 2025. This scholar-turned-policy-maker may have a stage that extends far beyond these brief five months.

References:

- MarketWatch: Trump taps Miran for Fed seat

- Politico: Trump picks economic adviser Miran for Fed post

- Forward Guidance Podcast (December 2024)

- FactSet, ICE Dollar Index

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。