原创 | Odaily 星球日报(@OdailyChina)

作者 | Ethan(@ethanzhang_web 3)

8 月 4 日,在一场并不喧哗却格外重要的链上投票中,Cardano 社区通过了名为“IOE 路线图”的核心提案:将动用高达96,817,080 枚 ADA(按当时市价约合7100 万美元)的财库资金,用于资助 Cardano 核心协议的技术升级。此次提案的最终支持率为74.01%,这意味着,在一个以治理缓慢著称的公链体系中,Charles Hoskinson 发起的一项激进改革计划,获得了超出预期的支持。

根据提案文件,拨款将主要用于三个方面:可扩展性改进、开发者体验优化以及跨链互操作性的升级。背后目标很明确:为 Cardano 铺设通往“Voltaire 时代”最后阶段的技术跑道。换句话说,这是一场围绕“链上治理、DeFi 生态和基础协议迭代”展开的全局性战役。

这不是一笔小数目。放在 DeFi 项目中,它足以支撑一个完整 Layer 1 的一年开发预算;放在 Cardano 自身语境里,它甚至是迄今为止最重要的一笔协议层资金调配。尤其值得注意的是:这并非由基金会、IOG 或 EMURGO 三大实体直接拨付,而是通过链上社区提案发起、治理机制投票通过——这标志着 Cardano 正在以行动走向它长期宣称的去中心化目标。

但围绕这场拨款投票的,不只是共识,还有不少疑问。为什么要在市场注意力不在其身时花出这笔钱?谁来监督这笔资金的使用?拨款本身是否会引发 ADA 的流动性变动?而所有问题,指向那个熟悉的名字:Charles Hoskinson(Cardano 创始人)。

从 2023 年起,Hoskinson 的行事风格似乎发生了某种根本性的转向:从“哲学化的技术理想主义者”变成了一个“主动推动治理改革的实用主义者”。而这笔 7100 万美元的拨款,也许正是其身份转型的注脚。

这一切,是偶然的路径依赖,还是早有铺垫?我们先回到提案发起的起点。

提案回溯:从批评以太坊到自建治理之路

如果说以太坊定义了“智能合约的通用计算逻辑”,那么 Cardano 的 ambition,从一开始就不止于代码层的“智能”。在 Hoskinson 的长期表述中,Cardano 承载的是一种更完整的“制度实验”——它不只是去中心化的执行工具,更是一套能自我更新、自我管理的链上公共治理系统。而为了这个目标,他押上的,是一次次从零搭建“制度组件”的耐心,以及对“慢就是快”的执拗信仰。

拨款提案的通过并非突发之举,而是 Cardano 一整套治理推进路径的自然延伸。早在 2024 年 4 月,Cardano 就正式公布了名为Chang的硬分叉升级计划,分两个阶段推进网络治理自主化——其中最核心的,正是围绕链上投票机制、宪法框架与国库分配权限进行重构,最终迈向其路线图最后一阶段,即所谓的“Voltaire 时代”。

在技术层面,Chang 升级配套 CIP-1694 提案,重构了治理参与者之间的权力配置。ADA 持有者将能够将自己的治理权利委托给 “DReps”(代表投票人)、SPO(质押池运营方)以及临时宪法委员会 ICC,从而形成一个三权协商与链上执行结合的治理格局。这一切都将在链上通过智能合约和 CIP 路线图自动化运行,不依赖基金会或 Hoskinson 本人。

图片源引自 《What to Know About the Chang Hard Fork (Cardano)》

这种设计听起来复杂,但核心逻辑其实很简单:治理权的分布应该与经济权益分布相匹配。这也是 Hoskinson 多年来一直强调的“真正去中心化”,一种不再依赖领袖人物,而由代币持有者主导决策的结构。

但要真正从理想到落地,仅靠机制设计是不够的,执行能力、技术架构和治理基础设施必须跟上。于是,“拨款 7100 万美元”这件事,不再只是财政调配问题,它几乎是对整套制度设计的一次“大考”。

更关键的点在于这项拨款并非 Charles Hoskinson 个人的发号施令,而是由社区提案、链上投票实现的。至少执行层角度,也在佐证 Cardano 正在从“创始人统治”走向“制度驱动”,哪怕过程漫长、节奏缓慢,也在以某种形式兑现 Hoskinson 当年的承诺。

早在 2025 年 4 月的一次 AMA 中,Hoskinson 再度抨击以太坊的三大结构性缺陷:错误的经济模型、VM 的设计冗余,以及 L 2“寄生化”对主链价值的掏空。并指出:“它们的治理模型,未能解决核心扩容问题反而抽离主链价值”。而 Cardano 的回应,就是其本身——打造一整套属于自己的公共治理栈。在这套结构中,资金不是创始团队控制的武器,而是 ADA 持有者治理意志的具体体现。7100 万美元只是第一步,真正的终局,是 Cardano 能否成为加密世界第一个“真正可自治”的金融协议生态。

只是,这场自治的路线并非没有质疑与分裂。

观点争议:他链炮轰、社区不信与创始人信誉的重塑

对于 Cardano 社区来说,这并不是一场单纯的升级投票,更像是一场对 Charles Hoskinson 本人的信任测试——而它之所以紧张,正是因为 Hoskinson 一直是这个项目的全部光芒,也是一切争议的中心。

时间拨回到 2025 年 6 月,Hoskinson 在一次直播中提出一项激进建议:将价值 1 亿美元的 ADA 兑换为比特币与生态内稳定币,以改善 Cardano 的稳定币流动性,并推动比特币 DeFi 生态 Cardinal 的发展。他表示,Cardano 当前 TVL 与稳定币规模严重滞后,该转化将“带来非通胀性收入”,并构建一个更健康的资产基础。

该提案一出,立刻引爆争议。Solana 联合创始人 Anatoly Yakovenko 公开炮轰此提议“太愚蠢”,质疑为何项目方要替用户持有比特币,而不是选择“更理性的短债资产”。而社区内部也陷入对 ADA 潜在抛压的恐慌,有用户在论坛直言:“你让我们把 ADA 委托投票,是为了把它换成别的币?”

尽管 Hoskinson 辩称市场深度足以吸收该抛压,但这并不能完全平息担忧。这事还没完,另一边更火上浇油的是,关于 Hoskinson 的旧指控被再度翻出——一笔来自 2021 年 Allegra 硬分叉期间的3.18 亿枚 ADA的转账记录被重新审查,有人质疑 Hoskinson 是否曾滥用创世密钥,暗中调配资金,累计金额接近 6 亿美元。NFT 艺术家 Masato Alexander 指出这笔转账“极不寻常”,并在社交平台上直指“链上记录不会说谎”。

面对指控,Hoskinson 在 5 月中旬表示“深感受伤”,称这些 ADA 中大部分早已被原始买家赎回,剩余部分已捐赠给 Cardano 治理组织 Intersect。他表示:“我们会在 8 月中旬公布完整的审计报告。”并补充称,将考虑将自己的社交媒体交由专业团队代管,以避免情绪化回应造成误伤。

Charles Hoskinson 本人此前直播画面

实际上,这并非 Hoskinson 第一次面对公众质疑。早在 2022 年,《The Cryptopians》作者 Laura Shin 就曾指控 Hoskinson夸大学历和履历背景,称其并无博士学历,并曾在早期向他人宣称与 CIA 或 DARPA 有合作关系。“这本书是不错的虚构作品,”Hoskinson 回应道,“但还不够格超越托尔金。”

这些信任危机,让这次拨款事件蒙上了“创始人干预”的阴影——尽管拨款本身是通过链上治理完成的,但在许多旁观者眼中,Cardano 的一切决策仍然绕不开 Charles 的意志。

这种“人格与协议的绑定”,既是 Cardano 能在长期建设中保持统一性的原因,也可能成为其走向真正自治的障碍。如今,当 Hoskinson 开始尝试将更多权限交由 Intersect 与链上投票机制管理时,他本人也正走在从“统治者”向“精神象征”的转型路上。

而这场转型是否足够彻底,Cardano 是否能承受住从“领袖魅力”到“制度自治”的阵痛考验,将在接下来的市场反馈与生态演化中逐步揭晓。

市场后续:链上生态重构与务实主义路线的形成

相比争议与情绪,链上的数据始终冷静,甚至冷酷。它们不讲情怀,只记录行为。从近期的一系列治理事件与财库拨款动作中,我们或许能看到一个明确的趋势信号:Cardano 正在从理念落地走向务实执行。

这一信号首先体现在资产结构的变化上。Cardano 基金会披露,截至 7 月,其持有的加密资产总价值增至6.591 亿美元,其中比特币占比提升至 15%,而 ADA 占比则下降至 77%。换句话说,基金会自身已开始降低对本币的单一依赖,转向更稳健的资产配置结构。

这在某种程度上呼应了 Hoskinson 提出的“非通胀性收入来源”理念,也从侧面反驳了社区对于“换币提案将损害 ADA 价格”的担忧:现实是,他们早就开始这么做了。

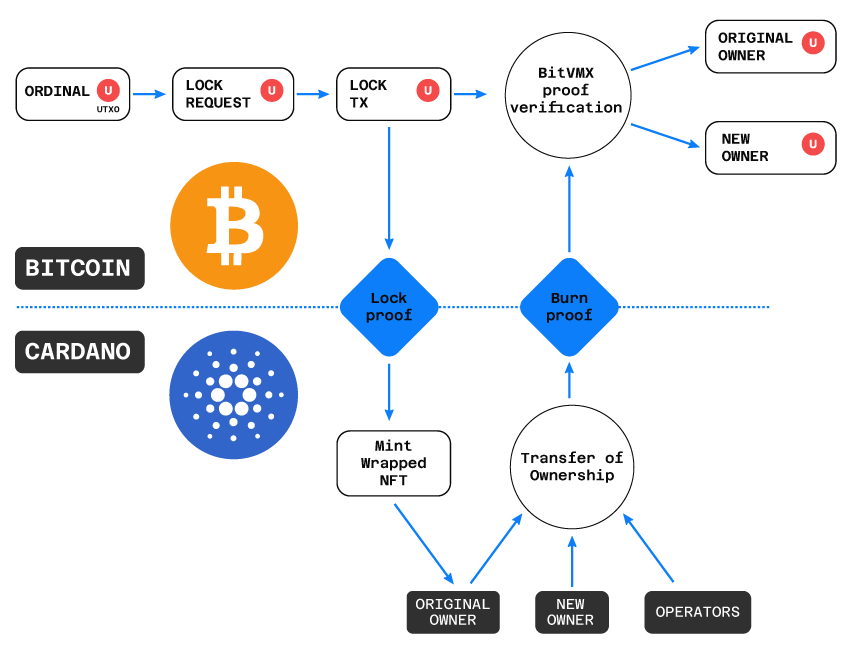

与此同时,Cardano 在 DeFi 层也正在悄然发生变化。2025 年 6 月,Hoskinson 宣布推出比特币 DeFi 协议Cardinal,基于 MuSig 2 多签实现跨链非托管支持,使 BTC 可参与 Cardano 链上的质押、借贷与交易操作,并兼容 Ordinals 铭文作为抵押资产。该协议还将集成零知识证明系统,以提高流动性与互操作性。

这标志着 Cardano首次在技术层打通比特币资产流动性入口,也意味着其生态策略已从“打造封闭式学术公链”转为“拥抱主流资产的跨链兼容”。换句话说,Cardano 不再试图单独开辟赛道,而是试图参与到比特币与稳定币主导的 DeFi 世界。

治理结构方面,Chang 硬分叉第一阶段已基本完成,DRep 代表注册通道开启、SanchoNet 测试网稳定运行、Intersect 实施成员制开发协作机制,代表 Cardano 的链上治理从框架设计进入落地执行阶段。治理权限也正在逐步从 IOG 等核心开发团队,过渡到社区治理与财库提案体系。

在多项指标上,Cardano 都展现出由上至下的一致性调整:资产结构更稳健、技术生态更开放、治理机制更自治。这一切的底层逻辑,是其试图构建一套制度驱动的长期激励模型,让链上治理真正脱离“创始人意志”,朝着制度化、可持续的方向运转。

最终,这场转型的成效,仍需观察两个关键指标:一是稳定币 TVL 能否从当前的10% 提升至 30%-40%;二是社区能否持续产出具备共识与质量的DRep 治理决策。

结语:Cardano 的第二次“定义自我”机会

从某种意义上说,这并不是 Cardano 第一次“自我定义”,但或许是最关键的一次。

早在 2017 年,Charles Hoskinson 创立 Cardano,选择了绕开硅谷、拒绝风投、从学术规范起步,构建共识模型 Ouroboros。他希望 Cardano 成为一个不依赖人设、不追逐周期的理性系统——那是第一次自我定义:不走 ETH 路线,不迎合 DeFi 热潮,而是以慢致稳。

而如今,在治理权限转移、财库资金调配、生态规划更新之后,Cardano 进入了它的第二次自我定义阶段:不再是“由 Hoskinson 主导的项目”,而是作为治理结构自身的存在,开始脱离个人意志运转。

从资产结构调整、DeFi 对接主流资产,到 CIP-1694 的推进与 Intersect 的自治机制,Cardano 正通过一系列技术与制度落地,摆脱“符号链”“僵尸链”等外部标签。它不再强调加密理想,而是选择一条缓慢但清晰的路径——用制度替代情绪,用实践回应批评。

Charles Hoskinson 本人也在逐步退居幕后:从 CEO 到制度设计者,如今转向牧场、医疗、外星探索。他留下的,是一个能被代表投票驱动、能通过财库治理运转的自治系统。

拨款不是终点,而是制度自转的一次验证。当某天 Cardano 能在无人主导下持续演进,Hoskinson 的名字也将从“执行者”退场,留存在制度本身的逻辑中。

这,或许才是他真正等待的“Voltaire 时刻”。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。