Article Author: Prathik Desai

Article Translation: Block unicorn

In the past few months, I have been tracking ARK Invest's daily trades in cryptocurrency companies. This American fund company manages assets from exchange-traded funds (ETFs) and venture capital funds. Their buying and selling strategies reveal an interesting story about how they time their trades in an industry that seems extremely challenging.

One trade might be a coincidence, two might be intuition. ARK's cryptocurrency trading shows an extraordinary sense of timing that is thoughtful rather than passive. This is evident from their profits of over $265 million from trading shares of Coinbase and Circle in June and July.

If you look closely, you'll find that ARK has been systematically shifting funds from exchanges and trading platforms to infrastructure, vaults, and token exposure.

Their recent trades give us a glimpse into how this highly watched institutional investor optimizes returns for its retail cryptocurrency stakeholders by moving funds quickly at the right moments. This is more complex and sophisticated compared to the "diamond hands" rhetoric often found in the cryptocurrency space.

Cathie Wood, CEO and Chief Investment Officer of ARK Invest

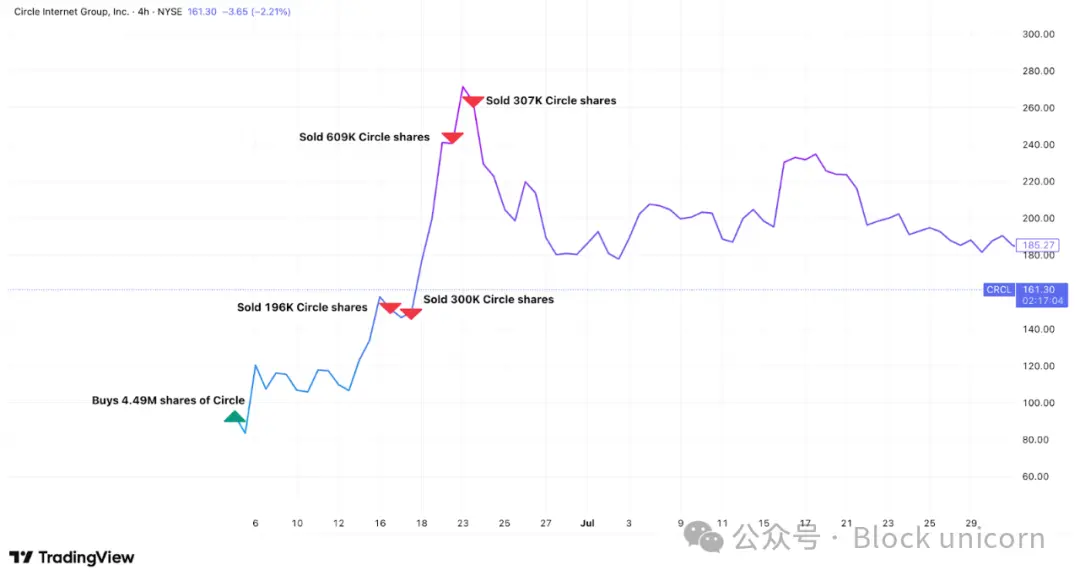

On June 5, 2025, Circle Internet Financial—the issuer of the largest regulated stablecoin in the U.S., USDC—went public on the New York Stock Exchange at a price of $69 per share. As a major investor, ARK purchased 4.49 million shares through its various funds, valued at approximately $373 million.

On June 23, Circle's stock peaked at $263.45 per share. This meant the market valued Circle at about $60 billion, roughly 100% of its assets under management at that time. This may be due to the market's optimistic outlook on the future of stablecoins, attempting to price Circle based on expected revenues ten times its current asset management scale. However, compared to traditional asset management companies' valuations, this still seemed excessive. In contrast, BlackRock manages $12.5 trillion in assets, with a market cap of only $180 billion, about 1.4% of its managed assets. This was a signal for ARK.

Daily trading documents show that as Circle's stock price premium expanded, ARK methodically sold off Circle shares across its various funds.

Image Source: TradingView

ARK began selling shares a week before the stock price peaked. In total, ARK sold about 1.5 million shares, representing 33% of its total holdings, worth approximately $333 million in Circle shares during the stock price surge. This means that in less than three weeks since Circle's Wall Street debut, ARK recorded over $200 million in paper profits on these shares, with a return of 160%.

ARK's interest in hot IPOs did not stop there.

Last week, they purchased 60,000 shares on Figma's first day of trading. This San Francisco-based design software company disclosed in SEC filings that it holds a Bitcoin ETF valued at $70 million and has been approved to purchase an additional $30 million.

Figma's stock soared over 200% on its debut, closing at $115.50, a gain of 250%. The next day, Figma's stock rose another 5.8%.

ARK's recent trades in Coinbase have provided us with more insight into its systematic profit-taking pattern.

As of April 30, 2025, ARK held 2.88 million shares of Coinbase, the largest cryptocurrency exchange in the U.S. After that, until the end of July, ARK systematically took profits.

This period coincided with Bitcoin breaking through $112,000 to set a new all-time high, with Coinbase's stock also reaching historical highs of over $440 per share. On July 1, ARK sold shares worth $43.8 million. On July 21, the day Coinbase peaked, ARK sold shares worth $93.1 million across three funds. In total, ARK sold 528,779 shares between June 27 and July 31, representing about 20% of its total Coinbase holdings, worth over $200 million, with an average selling price of $385 per share. In contrast, ARK Invest's weighted average cost of accumulating Coinbase shares over four years was about $260, meaning these trades generated profits exceeding $66 million.

In the past two months, Coinbase lost its position as the top-weighted stock in ARK's fund portfolio.

After the market close on July 31, Coinbase reported disappointing second-quarter results. The next day, the stock price fell 17%, from about $379 to $314. On August 1, the day the stock price plummeted, ARK bought $30.7 million worth of Coinbase shares.

These trades are not isolated events. They are part of ARK's strategic shift to move funds from the overheated cryptocurrency exchange ecosystem to emerging areas.

While selling Coinbase shares, ARK also sold shares of its competitor Robinhood. These divestments coincided with ARK shifting most of its funds to BitMine Immersion Technologies (known as "MicroStrategy for Ethereum"). Led by Wall Street veteran Tom Lee, BitMine is building an Ethereum vault with the goal of holding and staking 5% of the total Ethereum supply.

On July 22, ARK invested $182 million in BitMine through a block trade. But they did not neglect the investment after the initial purchase. ARK systematically bought into BitMine every time there was a significant drop in stock price, accumulating over $235 million in shares within just two weeks.

Image Source: TradingView

These trades show that ARK is shifting from cryptocurrency exchanges and payment companies to so-called cryptocurrency infrastructure. Coinbase and Robinhood profit when people trade cryptocurrencies, while BitMine profits by directly holding cryptocurrencies. This represents different approaches to acquiring cryptocurrency adoption, but with different risk characteristics.

Exchanges benefit from volatility and speculation. When cryptocurrency prices fluctuate wildly, people trade more, and exchanges earn more. But this is cyclical. Vault companies like BitMine directly benefit from rising cryptocurrency prices. If Ethereum's price rises by 50%, BitMine's asset value also increases by 50%. This does not depend on trading volume or user behavior. Even without significant capital appreciation, staking Ethereum on the network can generate stable income.

However, the higher the returns, the greater the risks. Vault companies also face direct downside risks. When Ethereum's price falls, BitMine's asset value will correspondingly shrink. This makes the vault strategy have a higher beta value.

ARK's trades reflect its belief that cryptocurrency is maturing from a speculative trading market to a market that resembles more permanent financial infrastructure. In such a world, holding the underlying assets may be more valuable than the platforms on which people trade those assets.

What is interesting about these trades is the precision of their timing. They sold during Circle's dream surge, just as the stock price peaked. They seized the opportunity of a 250% surge on Figma's first day of trading. They also sold at Coinbase's peak and doubled down on buying after disappointing earnings reports led to a stock price crash. They bought into BitMine at multiple market lows.

Their methodology combines traditional value investing principles with precise timing. When Circle's trading price reached 100% of its managed assets, its valuation might have been high. When Coinbase dropped 17% within a day of its earnings report, it might have indicated that its price was cheap. ARK also seems to trade based on predictable events—such as earnings reports, regulatory decisions, and market volatility.

There is a larger question here: why do these stocks trade at prices higher than their underlying assets? Circle's trading price once equaled the total value of its managed assets. BitMine's trading price is several times its Ethereum holdings. The existence of these premiums is because most investors cannot easily purchase cryptocurrencies directly. Even if they could, the experience of entering and exiting trading platforms is not smooth for retail investors. If you want to invest in Ethereum through a pension fund, buying Ethereum is certainly not as easy as buying shares of a company that holds Ethereum.

This creates a structural advantage for companies holding crypto assets. ARK's trades indicate that they are very aware of this dynamic. They buy when the premium is reasonable and sell when the premium becomes extreme.

ARK's strategy proves that investing in cryptocurrency stocks is not just a simple buy-and-hold, especially when you want to optimize returns. For anyone looking to follow ARK's cryptocurrency trades, merely knowing what they are buying is not enough. You need to understand why they are buying, when they might sell, and where their next positions might be.

Currently, ARK's cryptocurrency trades provide us with a useful window into how professional funds manage cryptocurrency exposure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。