Ripple Banking License Rejection: 42 Banks Spark XRP Price Volatility?

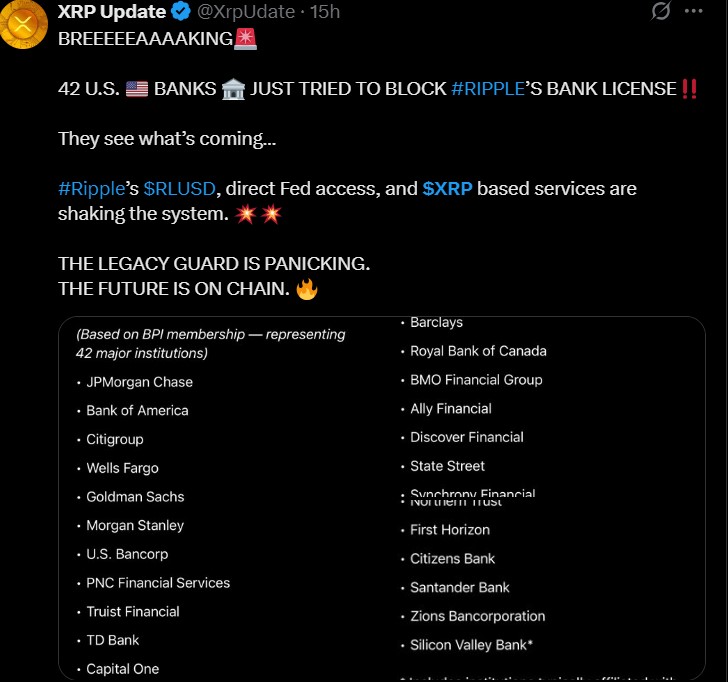

Ripple has once again found itself in the pendulum of traditional finance, and this time, the attack is more coordinated than ever. A total of 42 U.S. banks, including JPMorgan, Bank of America, and Citi, have filed objections against Ripple banking licenses.

This aggressive stance by the Bank Policy Institute (BPI) has raised serious questions about XRP price volatility, which I feel has already started.

Why 42 Banks Objected to Ripple US Banking License

The Bank Policy Institute, representing giants like Wells Fargo, Goldman Sachs, and Morgan Stanley, has officially pushed back against this Layer 1 protocol application to become a licensed U.S. bank.

Source: XRP Update

The group claims “risk to the banking system,” but many in the crypto community see it differently. Could the real reason be fear?

Well, the blockchain's efforts to offer stablecoin services through $RLUSD, direct Fed access, and seamless asset-based cross-border payments could dramatically reduce banks’ control over settlement layers. The latest Ripple news suggests the firm is moving closer to disrupting key areas of institutional finance—hence the resistance.

XRP Ripple US Banking License Under Fire: Bad News or Hidden Signal?

“From the outside, this objection looks like bad XRP crypto news . But zoom in, and the picture shifts.” Many analysts argue that this resistance is actually a sign of how disruptive this blockchain ecosystem is becoming.

When 42 banks band together to block a license, you have to wonder—what are they afraid of? It introduces two interpretations:

-

Bad News? → The scrutiny delays their U.S. financial ambitions triggering price volatility in the coming weeks.

-

Hidden Signal? → This means its U.S. banking license is getting closer to being officially recognized as a banking entity, which could be bullish in the long term.

And more importantly—could this be the trigger that fuels further price prediction surges?

XRP Price Volatility Analysis : Market Reaction To This News?

Let’s talk numbers. At the time of writing, token is trading at $2.95, down 2.81% over the past 24 hours, with a 24h volume of $5.45B. While short-term sentiment appears shaky, a closer look at the technicals offers clarity.

TradingView Daily Chart:

-

RSI: 49.52 (neutral zone)

-

MACD Histogram: MACD is still below the signal line, but the shrinking red bars suggest bearish momentum is cooling.

-

Support: $2.50

-

Resistance: $3.10–$3.12

If the coin breaks $3.10 with volume, it could run toward $3.50, even $4. If not, expect a pullback to $2.60–$2.50. But one thing is certain—the price crash is far from over.

Conclusion: Ripple XRP Price Prediction $7 Possible After Regulator Setback?

Let’s tie it all together now. Yes, banking license objection is a major event. But instead of being a death sentence, it might actually be the best hidden bullish signal.

Combine that with the assets historical resilience shared by Crypto King :

-

From July to November 2024, it was in a downtrend.

-

Then came a 585% rally.

-

2025 started slow, but post-July breakout, the native asset already gave a 70% return.

However, the XRP price volatility seen in recent days reflects more than just fear; it reflects uncertainty mixed with expectation to hit the $7 target.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。