撰文:Trendverse Lab

2024 年以来,稳定币市场正经历一场由结构创新驱动的新变局。在 USDT、USDC 等法币托底稳定币占据主导多年后,Ethena Labs 推出的 USDe 凭借 「无需法币支持」 的 合成稳定币设计迅速崛起,市值一度突破 80 亿美元,成为 DeFi 世界中的 「高收益美元」 。

近期,Ethena 联合 Aave 推出的 Liquid Leverage 质押活动更是引发市场热议:年化回报接近 50%,表面看似是一次惯常的激励策略,或许也透露出另一个值得关注的信号——USDe 模型在 ETH 牛市期间所承受的结构性流动性压力。

本文将围绕该激励活动展开,简要解释 USDe/sUSDe 及相关平台后,从收益结构、用户行为、资金流动等角度剖析其背后隐藏的系统性挑战,并对比 GHO 等历史案例,探讨未来机制是否具备足够韧性应对极端市场情境。

一、USDe 与 sUSDe 简介:基于加密原生机制的合成稳定币

USDe 是由 Ethena Labs 于 2024 年推出的合成型稳定币,其设计目标是规避对传统银行体系及发币的依赖。截至目前,其流通规模已超过 80 亿美元。不同于 USDT 或 USDC 等以法币储备支持的稳定币,USDe 的锚定机制依赖于链上加密资产,尤其是 ETH 及其衍生的质押资产(如 stETH、WBETH 等)。

图片来源:Coingecko

其核心机制为「delta 中性」结构:协议一方面持有 ETH 等资产头寸,另一方面在中心化衍生品交易平台开设等值的 ETH 永续空头仓位。通过现货与衍生品的对冲组合,USDe 实现资产净敞口接近于零,从而使其价格稳定在 1 美元附近。

sUSDe 则是用户将 USDe 质押至协议后获得的代表型代币,具备自动累积收益的特性。其收益来源主要包括:ETH 永续合约中的资金费率(funding rate)回报,以及底层质押资产带来的衍生性收益。该模式旨在为稳定币引入持续性的收益模型,同时维持其价格锚定机制。

二、Aave 与 Merkl 简介:借贷协议与激励分发机制的协作体系

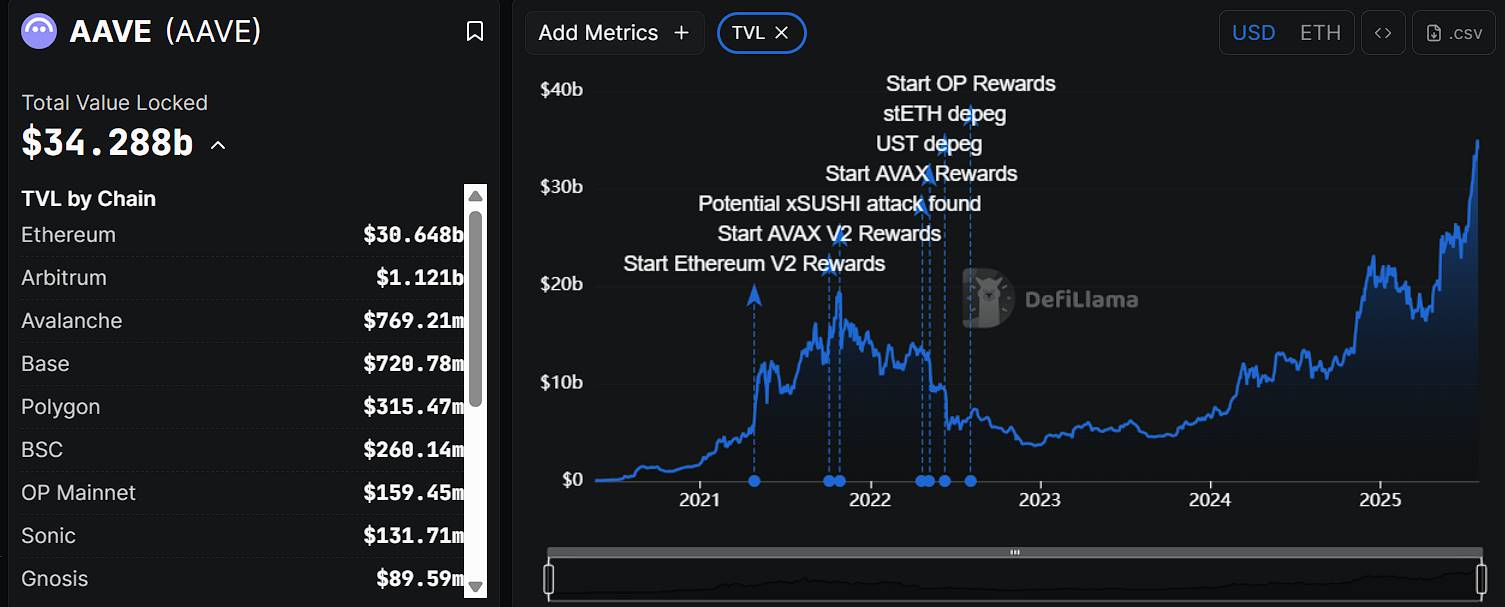

Aave 是以太坊生态中历史最悠久、使用最广泛的去中心化借贷协议之一,最早可追溯至 2017 年。其通过 「闪电贷」 机制和灵活的利率模型,在早期推动了 DeFi 借贷系统的普及。用户可将加密资产存入 Aave 协议中获得利息,或通过抵押资产借出其他代币,全流程无需中介。目前,Aave 协议总锁仓量(TVL)约为 340 亿美元,其中近 90% 部署于以太坊主网,平台原生代币 AAVE 总市值约 42 亿美元,在 CoinMarketCap 上排名第 31 位。

数据来源:DeFiLlama

而 Merkl 是由 Angle Protocol 团队推出的链上激励分发平台,专为 DeFi 协议提供可编程、条件化的激励工具。通过预设参数如资产类型、持仓时长、流动性贡献等,协议方可精准设定奖励策略并高效完成发放流程。截至目前,Merkl 已服务超过 150 个项目与链上协议,累计分发激励总额超过 2 亿美元,支持包括以太坊、Arbitrum、Optimism 在内的多条公链网络。

在本次 Ethena 与 Aave 联合发起的 USDe 激励活动中,Aave 负责组织借贷市场、配置参数及匹配质押资产,而 Merkl 则承担奖励逻辑设定与链上发放操作。

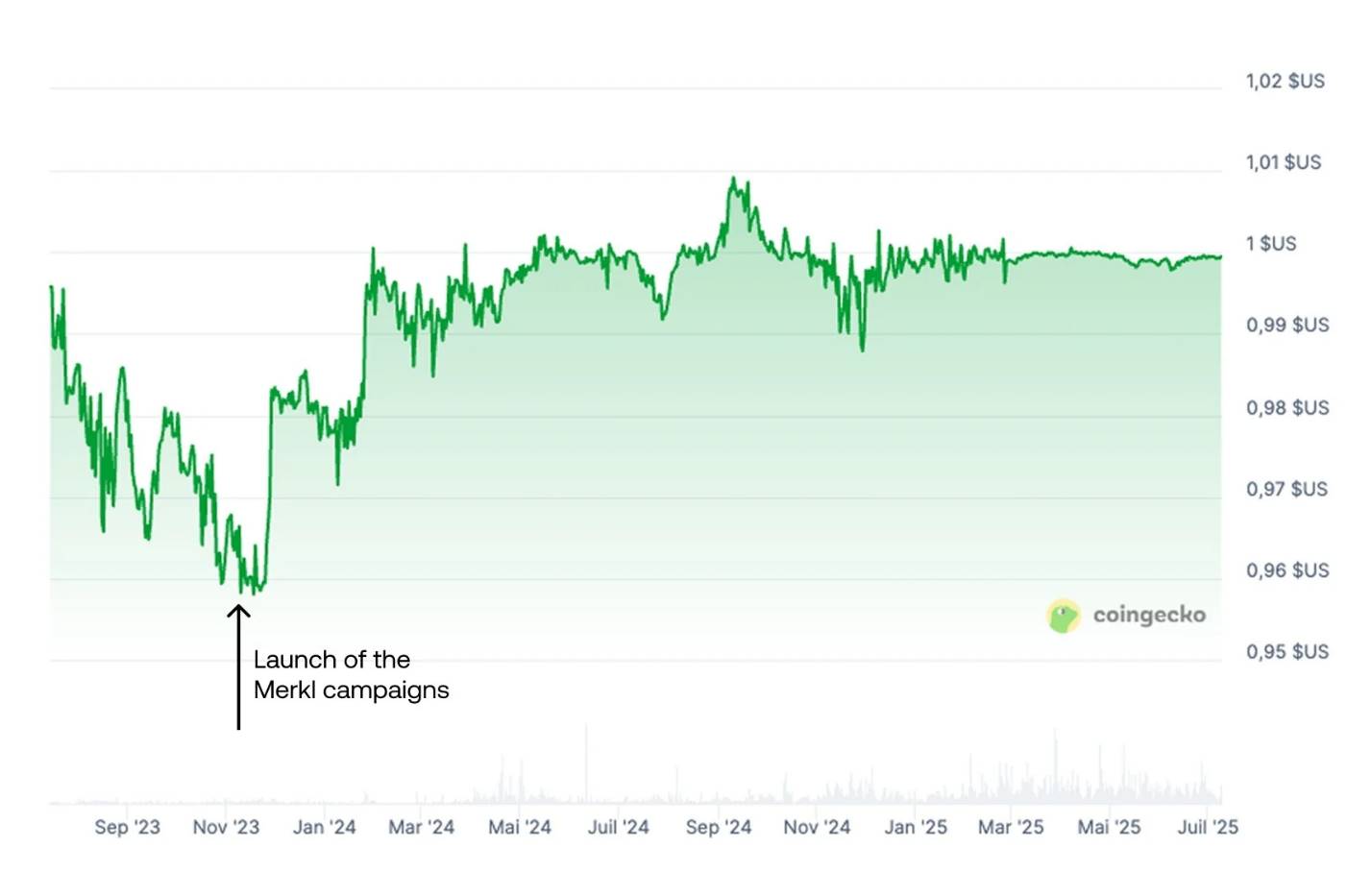

除了当前的 USDe 激励合作外,Aave 与 Merkl 此前已在多个项目中形成稳定协作关系,最具代表性的案例之一是对 GHO 稳定币脱锚问题的联合干预。

GHO 是由 Aave 推出的原生超额抵押稳定币,可通过抵押 ETH、AAVE 等资产进行铸造。该币种在推出初期因市场接受度有限、流动性不足,价格迅速跌破锚定值,长期徘徊于 $0.94~$0.99 区间,失去与美元的价格锚定。

为应对这一偏离,Aave 联合 Merkl 在 Uniswap V3 上设立了 GHO/USDC 与 GHO/USDT 交易对的流动性激励机制。激励规则以「靠近 $1 为目标」,对在 $1 附近提供集中流动性的做市者发放更高奖励,借此引导买卖深度集中于目标区间,从而在链上形成一堵价格稳定墙。这一机制在实际运行中效果显著,成功推动 GHO 价格逐步回升至接近 $1 水平。

这一案例揭示出 Merkl 在维稳机制中的角色本质:通过可编程激励策略,维持链上关键交易区间的流动性密度,就如同在市场价格锚点上安排「补贴摊贩」,只有持续给予收益,才可能维持稳定的市场结构。但是这也引出相关问题:一旦激励中断或摊贩撤离,价格机制的支撑亦可能失效。

三、50% 年化收益的来源机制解析

2025 年 7 月 29 日,Ethena Labs 正式宣布在 Aave 平台上线名为 「Liquid Leverage」 的功能模块。该机制要求用户按照 1:1 的比例,将 sUSDe 与 USDe 同时存入 Aave 协议,形成复合质押结构,并借此获得额外激励回报。

具体而言,合格用户可获得三重收益来源:

1. Merkl 自动分发的激励性 USDe 奖励(当前约为年化 12%);

2. sUSDe 所代表的协议收益,即来自 USDe 背后 delta-neutral 策略的资金费与质押收益;

3. Aave 的基础存款利息,取决于当前市场资金利用率和池子需求。

该活动的具体参与流程如下:

1. 用户可通过 Ethena 官网(ethena.fi)或去中心化交易所(如 Uniswap)获取 USDe;

2. 将持有的 USDe 在 Ethena 平台质押,兑换为 sUSDe;

3. 将等额的 USDe 与 sUSDe 按 1:1 比例一同转入 Aave;

4. 在 Aave 页面中启用「Use as Collateral」(用作抵押)选项;

5. 系统监测到合规操作后,由 Merkl 平台自动识别地址并定期发放奖励;

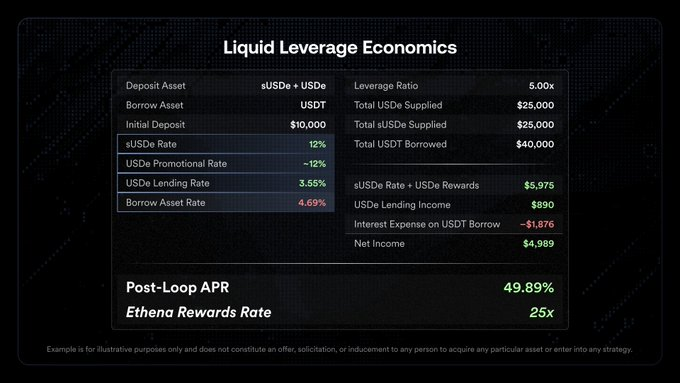

图片来源:官方 Twitter

官方数据,底层计算逻辑拆解:

假设:1 万美金本金,杠杆 5 倍,总借出 4 万美金,分别用 2.5 万美金抵押给 USDe 与 sUSDe

杠杆结构说明:

该收益的前提依赖于「借贷 – 存入 – 继续借贷」循环建立的复合结构,即初始本金被用作第一轮质押后,借出资金后再进行下一轮 USDe 与 sUSDe 的双向存入。通过 5 倍杠杆放大质押头寸,总投入达到 50,000 美元,从而放大奖励与基础收益。

四、激励计划背后是否揭示 USDe 与 GHO 面临同样的结构性困境?

尽管同为基于加密资产质押发行的稳定币,USDe 与 GHO 在机制上存在显著差异。USDe 借助 delta-neutral(中性对冲)结构维持锚定,历史价格基本围绕 $1 稳定波动,未出现 GHO 脱锚至 $0.94 的严重偏离,也未遭遇类似依赖流动性激励恢复价格的流动性危机。然而,这并不意味着 USDe 完全免疫风险,其对冲模型本身存在潜在脆弱性,尤其在市场剧烈波动或外部激励撤出时,可能面临与 GHO 相似的稳定性冲击。

具体风险体现在以下两个方面:

1. 资金费率为负,协议收益下滑甚至倒挂:

sUSDe 的主要收益来自于将 ETH 等质押资产所获得的 LST 收益,与中心化衍生品平台上建立的 ETH 空头永续合约资金费用(funding rate)正值。当前市场情绪积极,多头付空头利息,维持正向收益。然而一旦市场转为疲软,空头增多,资金费率转负,协议需支付额外费用维持对冲头寸,收益即告削减,甚至变为负值。尽管 Ethena 设有保险基金缓冲,但能否长期覆盖负向收益仍存不确定性。

2. 激励终止 → Promotional Rate 12% 收益直接消失

当前在 Aave 平台上执行的 Liquid Leverage 活动,仅限时提供额外 USDe 奖励(年化约 12%)。一旦激励结束,用户实际持有的收益将回落至 sUSDe 原生收益(资金费 + LST 收益)与 Aave 平台存款利率,合计可能下降至 15~20% 区间。而若在高杠杆(如 5 倍)结构下,USDT 借款利率(当前为 4.69%)叠加后,收益空间明显压缩。更严重者,在 funding 为负、利率上行的极端环境中,用户净收益可能被完全侵蚀甚至转负。

若激励终止、ETH 下跌、资金费率转负三者叠加,USDe 模型所依赖的 delta-neutral 收益机制将受到实质性冲击,sUSDe 收益可能归零甚至倒挂,若伴随大量赎回和抛压,USDe 的价格锚定机制亦将面临挑战。这种「多重负面叠加」 构成 Ethena 当前架构中最核心的系统性风险,也可能是其近期高强度激励活动背后的深层动因。

五、以太坊价格上涨,结构就会稳定?

由于 USDe 的稳定机制依赖于以太坊资产的现货质押与衍生品对冲,其资金池结构在 ETH 价格快速上涨期间面临系统性抽水压力。具体而言,当 ETH 价格接近市场预期高位,用户往往倾向于提前赎回质押资产以实现收益,或转向其他具备更高回报的资产。这种行为催生了典型的「ETH 牛市 → LST 流出 → USDe 收缩」 链式反应。

从 DeFiLlama 数据可以观察到:USDe 与 sUSDe 的 TVL 在 2025 年 6 月 ETH 价格冲高期间同步下降,且并未出现伴随价格上涨而增加的年化收益(APY)。这一现象与上一轮牛市(2024 年底)形成对比:彼时 ETH 达高点后,TVL 虽逐步回落,但过程相对缓慢,用户并未集体提早赎回质押资产。

当前周期中,TVL 与 APY 同步下行,反映出市场参与者对 sUSDe 收益可持续性的担忧上升。当价格波动与资金成本变动带来 delta-neutral 模型潜在负收益风险时,用户行为表现出更高的敏感性与反应速度,提前退出成为主流选择。这种资金抽离现象不仅削弱了 USDe 的扩展能力,也进一步放大了其在 ETH 上涨周期中的被动紧缩特征。

小结:

总结来看,当前高达 50% 的年化收益并非协议常态,而是多个外部激励(Merkl 空投 + Aave 联动)的阶段性推动结果。一旦 ETH 价格高位震荡、激励终止、资金费率转负等风险因素集中释放,USDe 模型所依赖的 delta-neutral 收益结构将面临压力,sUSDe 收益可能迅速收敛至 0 或转负,进而对稳定锚定机制构成冲击。

从近期数据来看,USDe 与 sUSDe 的 TVL 在 ETH 上涨阶段出现同步下滑,且 APY 并未同步走高,这种「涨中抽水」现象显示市场信心开始提前计价风险。与 GHO 曾面临的 「锚定危机」 相似,USDe 当前的流动性稳固,很大程度上依赖于持续补贴维稳的策略。

这场激励游戏何时终结,以及能否为协议争取足够的结构性韧性调整窗口,或将成为 USDe 是否真正具备「稳定币第三极」潜力的关键检验。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。