Author: miya

Compiled by: Felix, PANews

First of all, this article is not an attack on LetsBonk. The Bonk team, led by Tom, has done an excellent job of capturing market share in the Memecoin space, making it not worth retaliating against PumpFun. LetsBonk has already won the memecoin battle and will continue to dominate in this field.

PumpFun is winning. You might initially think the author is an idiot. Let's look at some data that reflects the opposite of PumpFun's winning situation.

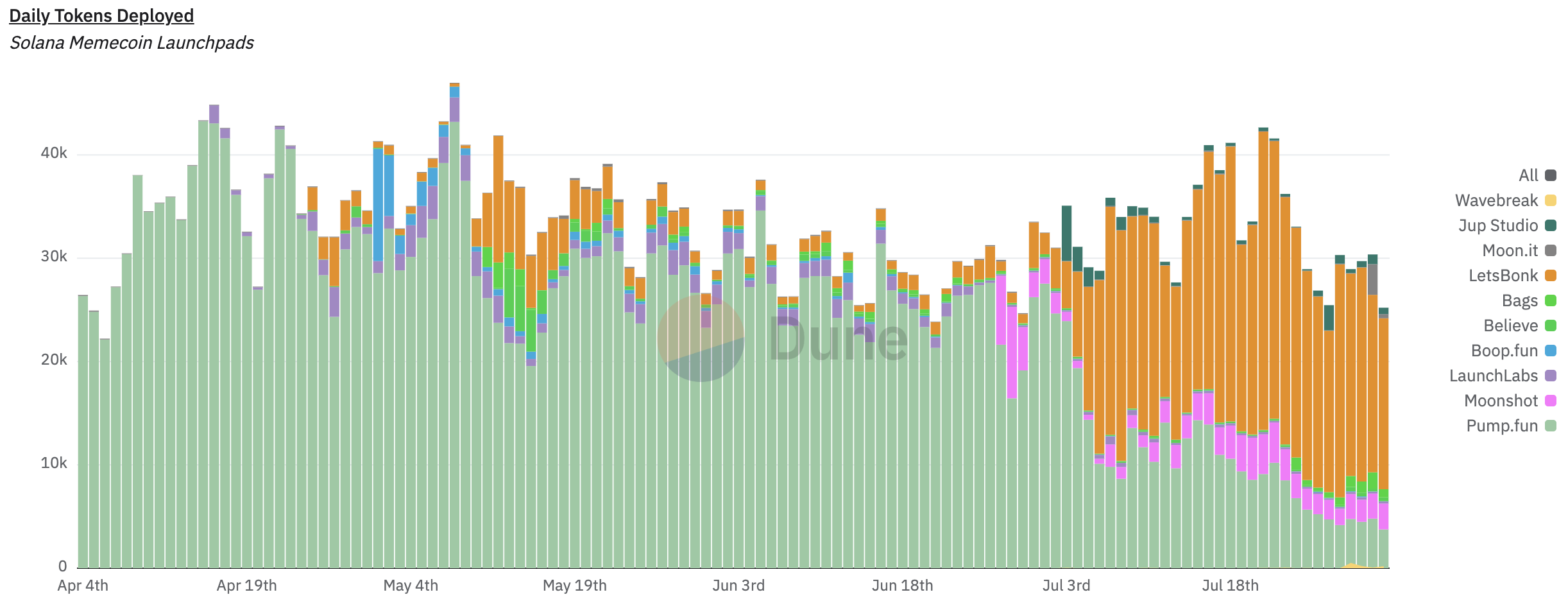

LetsBonk has not only captured a certain share in daily token deployments but has also become the "leader" in the token deployment field.

Currently, Let'sBonk is leading in token deployments by about 3.7 times. It has gained 65.1% market share in just one month. The number of graduation projects from Let'sBonk is approximately 7.8 times that of PumpFun. The number of tokens issued per graduation project by PumpFun is also far greater than that of Let'sBonk, making Let'sBonk a more profitable trading platform.

All indicators and charts seem to show a difference. So why is PumpFun winning? Let's understand from a more macro perspective why PumpFun's strategy has been executed so perfectly so far.

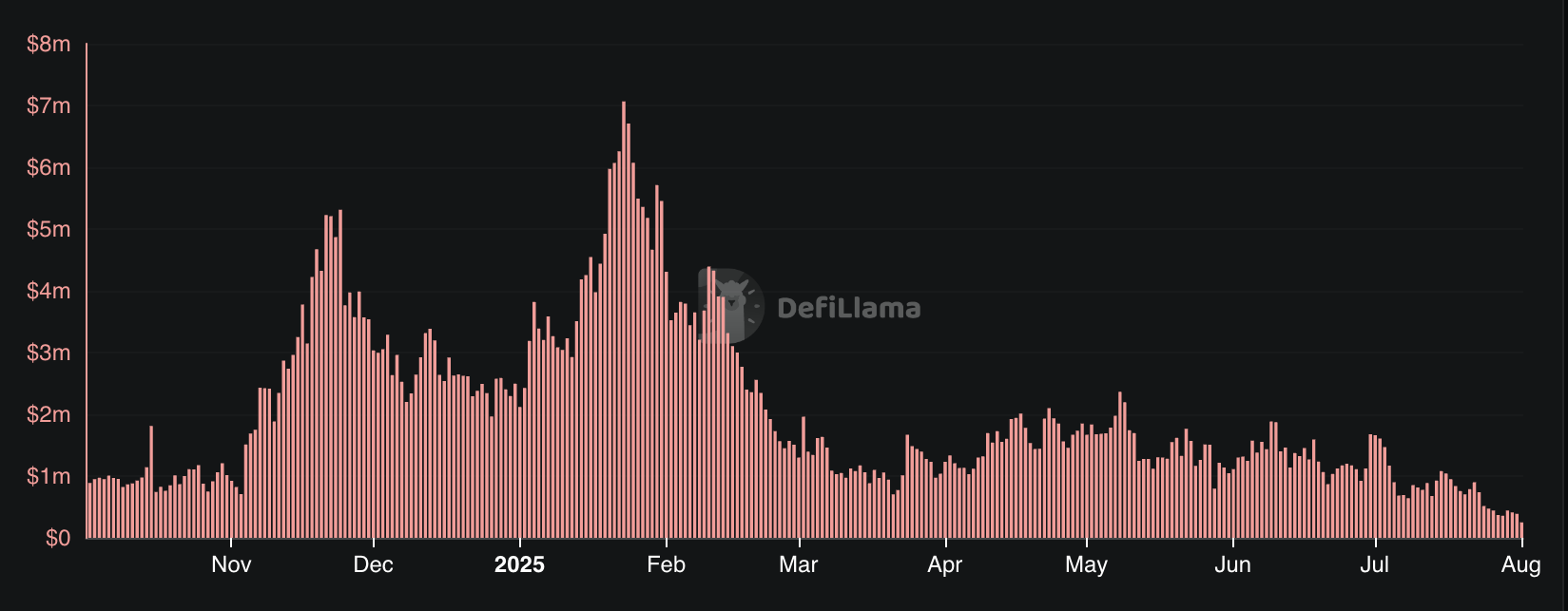

PumpFun's revenue has dropped from $7.07 million to $469,000, a decrease of $6.601 million, with a 93.4% drop in peak revenue over 24 hours.

Memecoins are dying. They have been on a continuous decline since February 2025. Not only has PumpFun's daily revenue dropped by 93.4%, but the overall market size of Let'sBonk is also shrinking.

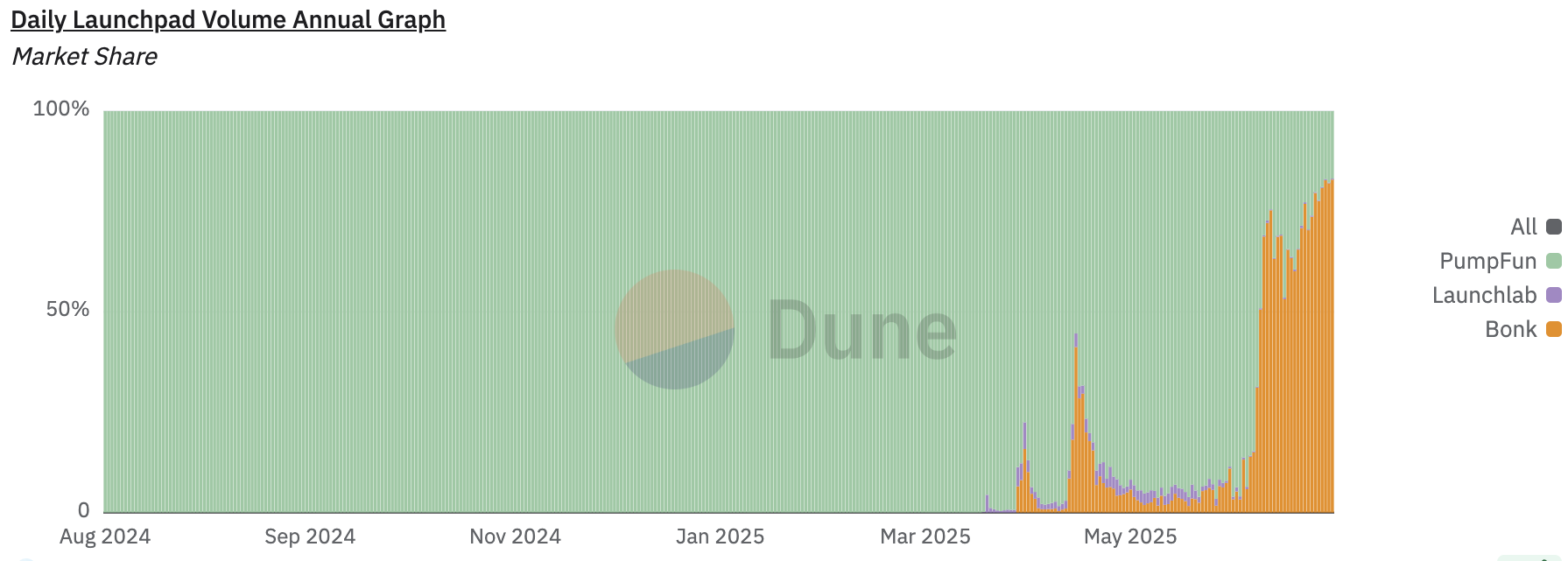

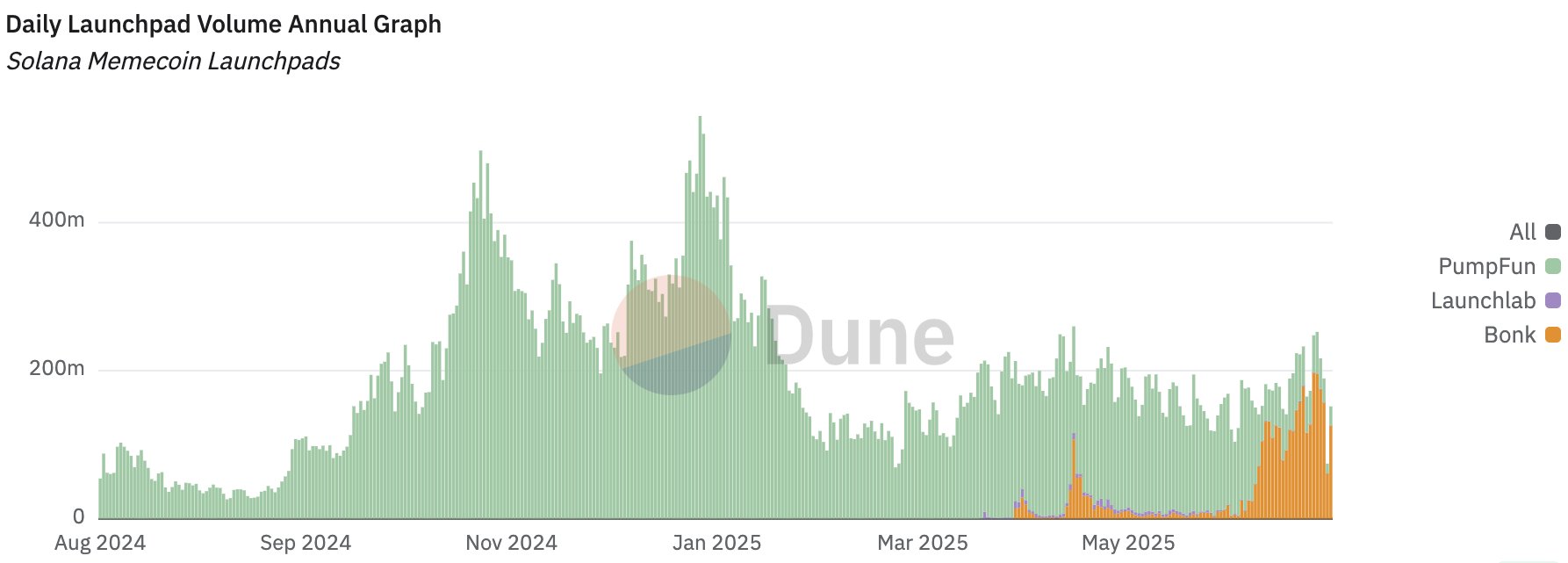

While the trading volume share may look like this:

The actual market size in which these two companies compete is as follows:

This chart does not account for the significant increase in bot activity, and the decline in actual user numbers is even more pronounced.

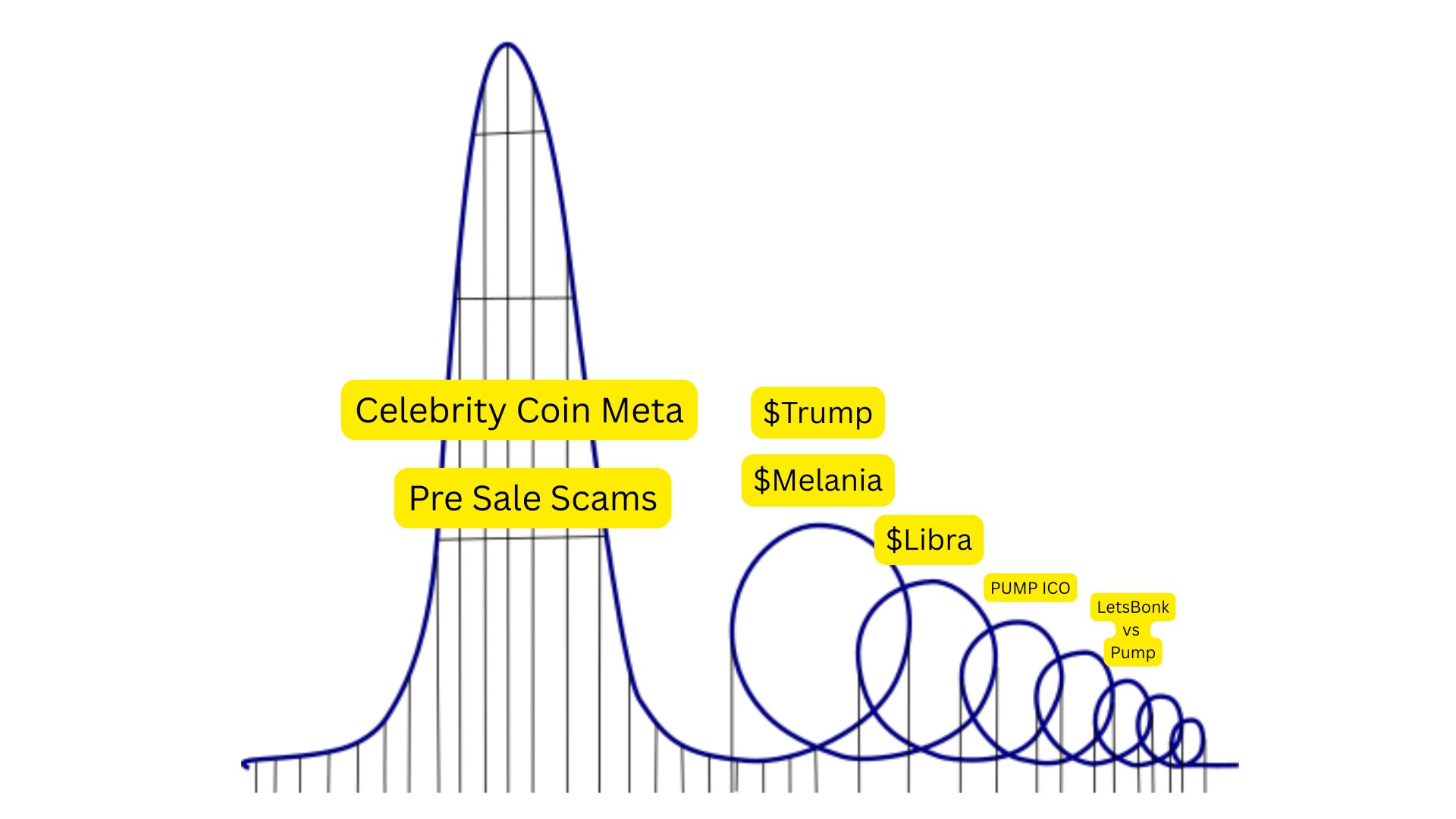

Since the emergence of celebrity coins, the risk appetite for Solana's Memecoins has been continuously declining. Large-scale sell-off events like "MELANIA" and "LIBRA" have accelerated this trend.

Retail investors' risk appetite

It is safe to say that Memecoin trading is no longer what it used to be. To analyze in detail why it is actually worse than it appears on the surface, you can refer to the previously published series of articles.

The Memecoin supercycle has entered its final phase.

For those companies hoping to survive long-term, Memecoins are not an ideal investment choice. Memecoin trading has evolved into a high-risk place that devalues your money rather than just being an ordinary casino.

"Oh, but they are already addicted, so let's squeeze more money from the traders."

Even the most foolish gamblers have abandoned Memecoins because they know they will ultimately lose. Savvy market participants have developed very advanced tools and have such a well-established information flow (FNF, insider coins) that ordinary market participants will be left further behind in the future. This situation is irretrievable; the insider advantage will gradually increase, and the capital available to ordinary traders will gradually decrease.

So why is PumpFun still winning?

Let me ask you a question: If you were Alon (CEO of PumpFun), what would you do?

Option 1) Use your strong capital reserves to buy back $PUMP.

Well, let's assume he takes out $200 million now and gradually buys PUMP over the next 31 days, using the generated fees for a 100% buyback. Is everything solved now? No, not at all. Memecoins are still on a downward trend. PumpFun still bears the heavy brand image of being a "Memecoin launch platform." Buying back PUMP will not restore risk appetite to previous highs, nor will it provide the liquidity that "investors" need. In the short term, it might boost market sentiment, but it still cannot revive Memecoins. This is a massive cash injection in a declining market that cannot be sustained long-term.

Option 2) Airdrop $PUMP to users and create new liquidity.

Again, the only effect of this is to inject funds into a shrinking market and declining market share. PumpFun might risk giving away some money they can never get back, and even worse, this money could flow into the hands of competitors.

Alon has executed the established strategy almost perfectly so far.

PumpFun must develop, but spending on a dying horse like Memecoin is of no value.

Now let's look at the current situation.

Let'sBonk has invested most of its fees into BONK and GP, and does not have a large capital reserve. Insiders hold significant shares in projects like BONK and USELESS, which they have cashed out through the launchpad to make money. Regardless of what happens next, they may attract attention, but they are financially constrained.

PumpFun may be losing this Memecoin battle, but the market's expectations for the future of this field are so low that winning this war is actually worse than losing it.

Crypto researcher rasmr has shared some insights on how PumpFun should develop, with a key point being to build a $200 million project on PumpFun (like ChillHouse). This is actually a completely unnecessary investment, further confirming that PumpFun is competing for a continuously shrinking market. PumpFun may have already given up on the idea of making Memecoins great again; otherwise, they wouldn't go a week without tweeting or give up competing with Let'sBonk.

While individuals may not understand the specific internal situation of PumpFun, it is clear what Solana Labs is preparing: ICM. In the upcoming bear market cycle, utility will return to its chain.

Whatever happens next, PumpFun is financially well-prepared to stay ahead of any other participants.

While the idea that Alon would give up on PumpFun seems ridiculous.

PumpFun has such a mature brand, excellent resource connections within Solana, and a clear company structure. You wouldn't just give up a well-functioning company because you cashed out a certain amount; no one would do that. This idea is so untenable in terms of business development and is merely propagated by those degenerate gamblers accustomed to cash-out events. While Alon may not reinvest all profits back into the business, he will attempt to successfully conquer the next Solana market in the upcoming bear market cycle.

In the upcoming bear market, $PUMP may be one of the coins worth holding long-term. If you believe this cycle can last another year, buying at the current price is also a good investment choice. The author holds PUMP spot as a hedge in case the judgment that this cycle is about to end is wrong, and personally believes that there is hardly any other liquid altcoin more suitable for this bet than it.

Related reading: “Is the ‘Green Pill’ finished? Airdrop failure exacerbates PUMP's decline, three post-00s collect over $700 million

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。