今天加密市场发生了什么?关键更新和新闻

加密市场经历了大幅回调

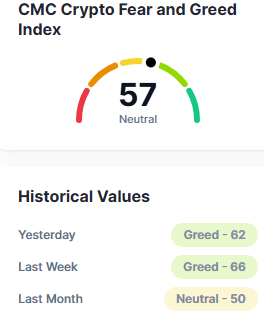

今天,加密市场遭受重创。总市值下降了7.9%,降至3.81万亿美元。24小时交易量为1800亿美元。比特币仍然是市场领导者,市场份额为60.1%,紧随其后的是以太坊,市场份额为11.5%。恐惧与贪婪指数从昨天的62降至57,显示出今天投资者信心减弱。

今天加密市场的主要亮点

特朗普的关税冲击震撼全球市场

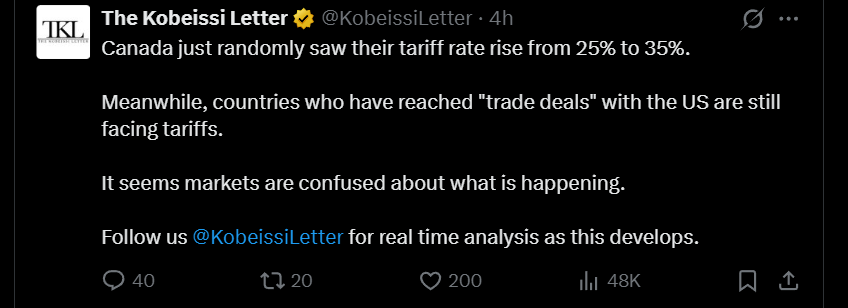

美国总统唐纳德·特朗普对11个国家实施了新的关税,将于2025年8月1日生效。加拿大受到的冲击最大,关税提高至35%——这是前所未有的10个百分点的上涨。

尽管公告已发布,加密市场并未受到太大影响,这表明全球投资者可能已经习惯了特朗普的关税策略。然而,长期影响仍可能通过供应链和贸易协议产生涟漪效应,并可能在跨境投资放缓的情况下影响加密市场。

受新制度影响的国家名单广泛:

- 加拿大:从25%提高到35%

- 瑞士:39%

- 南非:30%

- 台湾:20%

- 越南:20%

- 柬埔寨:19%

- 泰国:19%

- 马来西亚:19%

- 印度尼西亚:19%

- 土耳其:15%

- 委内瑞拉:15%

来源:X

加密市场:SEC的项目加密货币改变美国语调

SEC主席保罗·阿特金斯启动了项目加密货币,这是一个动态的新努力,旨在将美国确立为全球数字资产的领导者。SEC现在的目标是促进创新,而不仅仅是关闭。

该项目建议一个许可证涵盖交易、借贷、质押,甚至代币化股票——为开发者和公司简化流程。如果获得批准,美国可能成为Web3建设者的首选之地。

该提案还旨在吸引因过去的执法行动而离开的开发者,包括Tornado Cash和GitHub的案例。

全球代币化趋势上升

- 代币化资产是一个快速发展的趋势。

- 瑞士的SIX交易所代币化股票。

- 新加坡的DBS提供代币化国债。

香港在区块链上测试绿色债券。

与此同时,在美国,类似的公司如黑石、富达和KKR也在测试代币化基金。如果项目获得监管确定性,也许这是加密市场工具在传统金融中走向主流的时刻。

来源:X

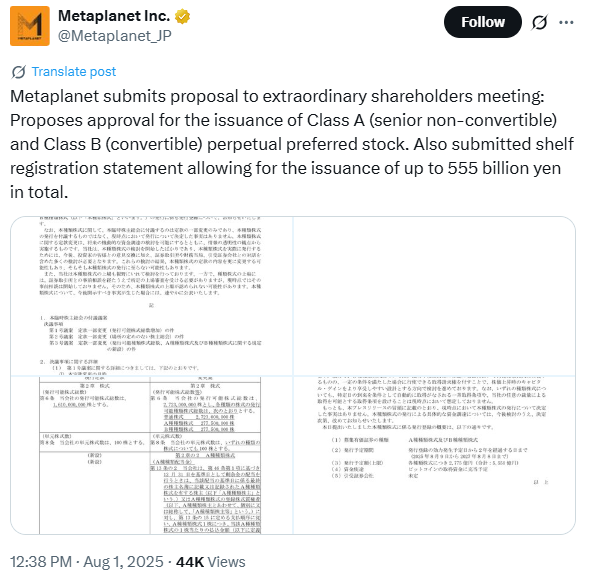

Metaplanet设立35亿美元融资计划

日本公司Metaplanet即将进行一次巨大的融资。它将通过双重股份形式筹集高达35亿美元。将有两种类型的股份:A类:长期资本,优先且不可转换。B类:可转换,留有空间以适应未来的股权调整。

计划于2025年9月1日召开特别股东大会以批准该计划。如果获得授权,这笔资金可能为Metaplanet的数字货币和技术项目提供资金。

来源:X

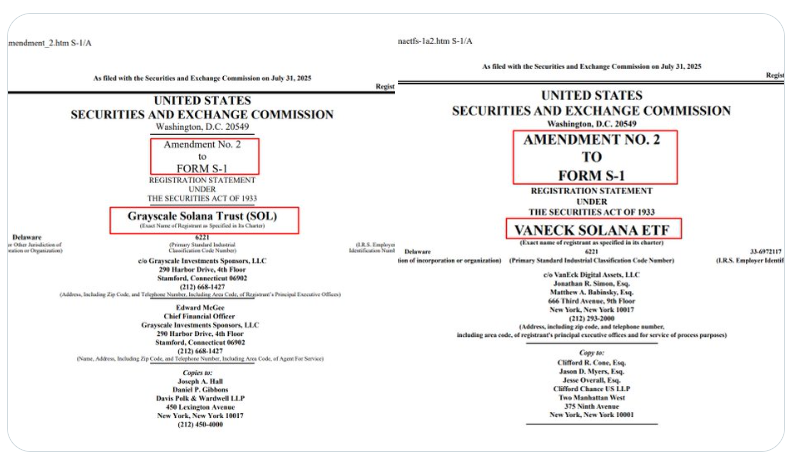

美国Solana ETF竞争加剧

在美国,上市基于Solana的ETF的竞争愈发激烈。主要参与者如Grayscale、VanEck、富达和富兰克林·坦普顿向SEC提交了新的S-1表格。

Grayscale的ETF目标为2.5%的费用,以SOL代币支付。VanEck则推出了一款质押产品VSOL,费用降低至1.5%。这些举措表明对Solana作为长期投资的乐观情绪正在上升,并将机构需求带回加密市场。

来源:官方网站

Tether在2025年创下57亿美元的利润记录

稳定币巨头Tether宣布,在2025年上半年其产生了57亿美元的利润。其中,26亿美元来自比特币和黄金的投资——这表明该公司在加密市场的商业策略正在取得成效。

Tether还从其核心活动——储备和USDT印刷中产生了31亿美元的额外收入。该公司拥有超过1270亿美元的美国国债,使其成为全球最大的政府债券持有者之一。

其资产负债表依然强劲,总资产为1625亿美元,股东资本为54.7亿美元。首席执行官Paolo Ardoino表示:“我们不仅仅是在跟上——我们正在塑造未来。”

USDT需求旺盛:仅在2025年第二季度,Tether就铸造了134亿美元的新USDT,使其总供应量超过1570亿美元。

Tether的信心非常高,因为该稳定币仍然牢牢与美元挂钩。Tether现在将其利润投资于未来,资助地方项目和工具,如Rumble Wallet。

来源:网站

最终思考

今天的头条揭示了一个快速变化的数字格局。从SEC改革和ETF申请到巨额利润和新的融资倡议,数字金融领域开始开放。美国可能终于向加密货币友好转变,而亚洲和欧洲在代币化资产方面引领潮流。

投资者和开发者需要保持警惕。这可能是全球数字货币采用下一个阶段的开始。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。