On July 30, news emerged that the cryptocurrency exchange Kraken is seeking to raise approximately $500 million at a valuation of $15 billion, attracting significant market attention. This news coincides with a gradually warming regulatory environment in the United States: in March 2025, the U.S. Securities and Exchange Commission (SEC) officially withdrew its securities violation charges against Kraken, and just last week, Fortune magazine revealed that the FBI has also concluded its investigation into Kraken's founders, allowing Kraken to shed multiple regulatory shadows. Meanwhile, Kraken's official social media has frequently hinted at potential listing plans, further igniting market imagination.

Previously, CRCL saw a peak increase of up to 10 times after completing its IPO in June, providing a strong contrast to market expectations. If Kraken successfully goes public, it may trigger another wave of emotional highs—worth noting is which targets will become the "speculative pioneers" in this feast.

Pre-IPO Investment Frenzy, Retail Investors Can Also Jump Ahead of the Listing

As top companies like OpenAI and SpaceX maintain their privatization for a long time, many original employees and early investors hope to cash out their equity before the IPO. Forge serves as a trading market connecting those "wanting to sell" with investors "wanting to buy early." Now that Kraken's IPO expectations are heating up, if its employees or institutions start selling equity, private equity trading platforms like Forge may become an indirect entry point for retail investors.

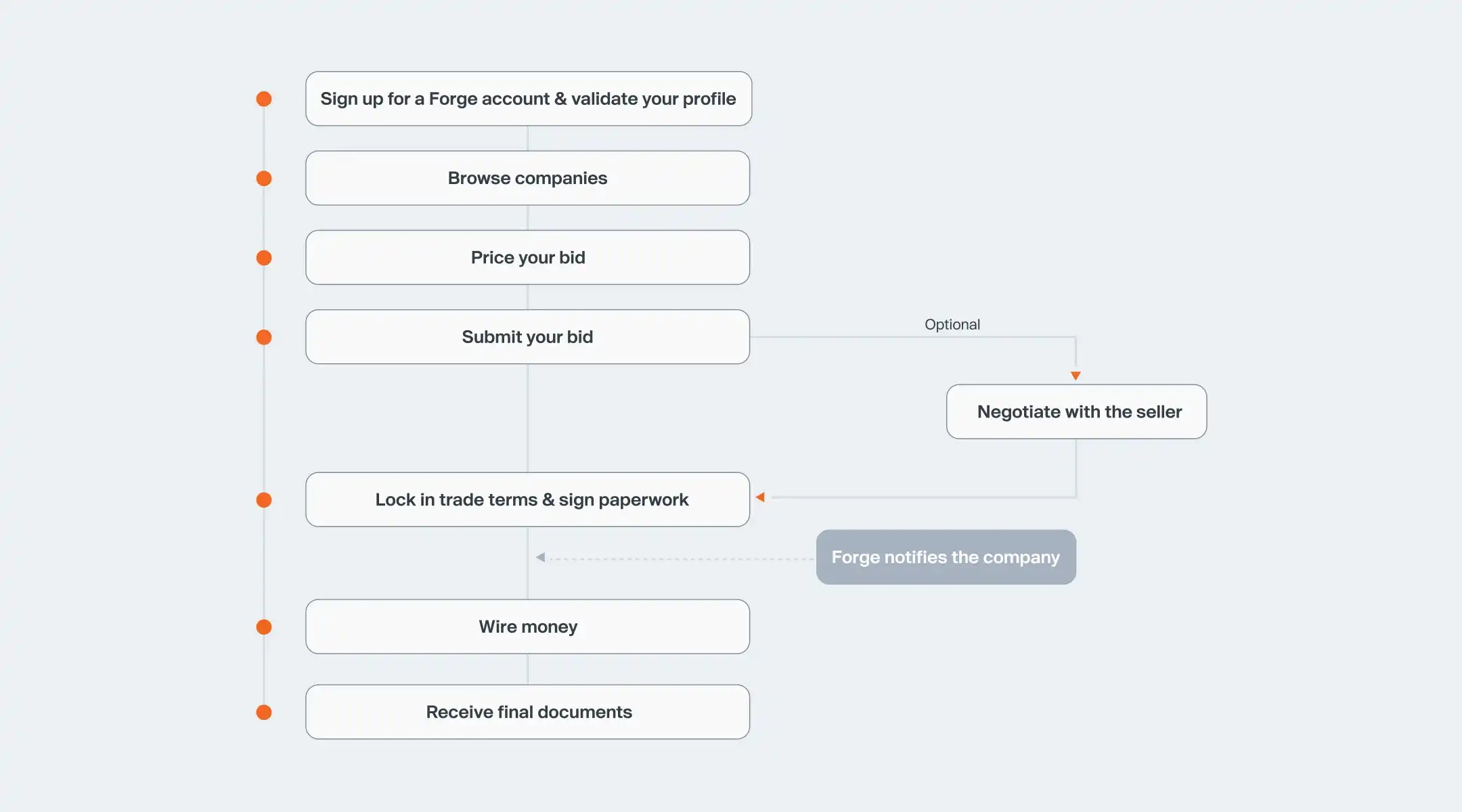

On the Forge platform, investors can typically purchase shares of unlisted companies in two ways: the first is direct trading, where you find a holder willing to sell Kraken equity and negotiate a price. Forge will assist in completing the KYC, due diligence, and contract signing processes. The second is through SPV trading (Forge Funds), where Forge establishes a special purpose vehicle (SPV) to pool buyer funds and collectively purchase equity in the target company. What you hold is a share of the SPV, not the company's stock itself. This method bypasses ROFR and is more suitable for investors looking to enter quickly, potentially completing transactions within days. Once Kraken officially IPOs, the SPV is also expected to gain liquidity for cashing out.

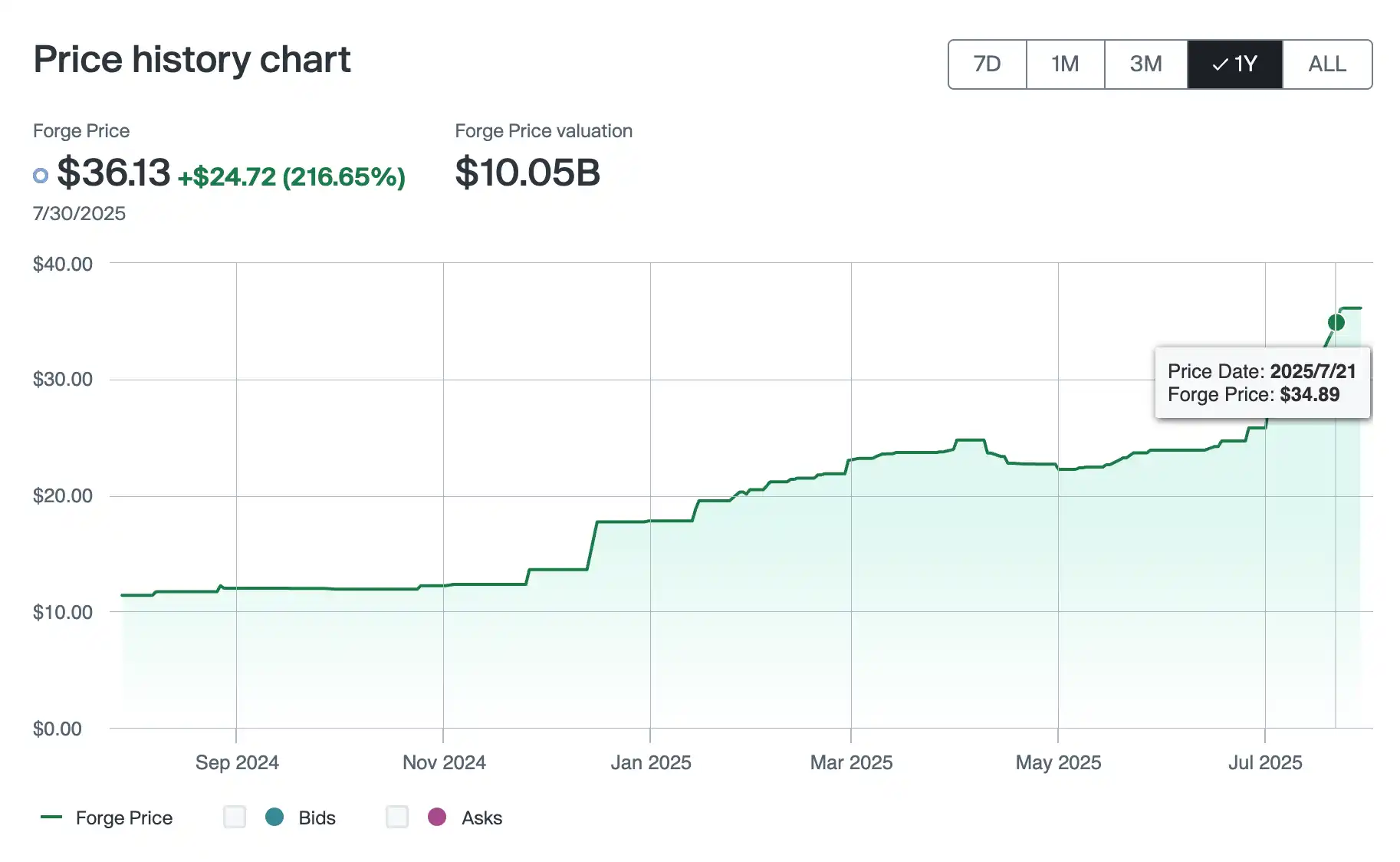

Currently, the price on the Forge platform is $36.13, with an increase of up to 200% within a year, reflecting the market's enthusiasm for Kraken's IPO expectations. With a valuation of approximately $10 billion, if Kraken can successfully go public at a $15 billion valuation, current entrants may achieve over 50% excess returns.

Additionally, the tokenization of private equity is bringing new investment opportunities to retail investors, with platforms like Republic and Robinhood already supporting tech companies like OpenAI and SpaceX. It is also worth continuously monitoring whether they will support Kraken in the future.

Benchmarking Coinbase's Base Chain, Ink Becomes the Core of the Next Round of L2 Narrative

Following the launch of Coinbase's Base chain as the traffic hub of the Layer 2 sector, Kraken has officially entered the fray, launching its Layer 2 strategy with the Ink network. Ink is a Layer 2 blockchain built on the Ethereum OP Stack, focusing on high throughput, low latency, and native compatibility with the Ethereum Virtual Machine (EVM), aiming to become the DeFi hub on the Superchain, providing solid underlying support for future trading, payments, and on-chain financial infrastructure. The network is spearheaded by Kraken, with its native token $INK to be issued by its subsidiary, the Ink Foundation, and distributed to eligible active users and ecosystem participants through an airdrop program on the Kraken trading platform. Although specific distribution standards and timelines have not yet been announced, this news has already become a market focal point.

On June 17, the Ink Foundation announced that the total supply of $INK will be permanently capped at 1 billion tokens, with no additional issuance or governance rights, intended solely for ecosystem incentives and user-level usage, positioning it more as a "fuel" rather than a traditional governance token. The first clear application scenario is a native liquidity protocol powered by Aave, which is a key component of Ink's on-chain capital stack. This protocol will natively integrate lending mechanisms onto the Ink chain, providing users with efficient and convenient on-chain capital scheduling services.

Kraken's co-CEO Arjun Sethi stated that Ink's mission is to deeply integrate "production-grade on-chain systems" into Kraken's product ecosystem, promoting a strategic migration from centralized platforms to on-chain financial systems. The Ink Foundation's board referred to this as "a pivotal moment," believing that the launch of Ink marks the beginning of the convergence of CeFi and DeFi, as well as a substantial step toward a unified global capital market vision.

With the mainnet officially launched, Ink's ecosystem is taking shape. The platform has opened a memecoin launch tool called Inkypump, and the first mascot token $ANITA once surged to a market value of $8 million, currently stabilizing around $4 million. Although the TGE for $INK has not yet been announced, market expectations for Ink's potential have been strongly stimulated by the successful cases of projects like Base and other L2 initiatives.

Referencing the rapid rise in ecological activity, TVL, and project numbers on the Base chain, as well as the performance of ecosystem tokens like $VIRTUAL and $ZORA built around it, Ink, backed directly by the Kraken team and equipped with inherent traffic and resource advantages, undoubtedly has the potential to become the next popular L2 mainline. It can be anticipated that once $INK starts circulating and trading is opened, it will inevitably become one of the "orthodox" representatives under the CeFi speculative narrative, especially against the backdrop of Kraken's intention to deeply bind its trading capabilities with on-chain scenarios. Ink is not just an L2; it may become the on-chain strategic core of Kraken. For investors looking to position themselves ahead of Kraken's IPO and the next round of L2 hotspots, Ink and its ecosystem targets are worth close attention.

Summary

In addition to cryptocurrency trading and Layer 2 network construction, Kraken has also been actively expanding its broader financial landscape. In 2025, Kraken made a significant acquisition of the leading U.S. retail futures trading platform Ninja Trader for $1.5 billion, obtaining the status of a futures commission merchant and officially entering the derivatives market regulated by the CFTC, thereby opening a key channel between CeFi and TradFi. Meanwhile, Kraken has launched a payment application called Krak, supporting real-time reward transfers for over 300 types of crypto and fiat assets, with plans to expand into lending and credit card services in the future, creating a comprehensive crypto payment experience. This series of developments not only lays the foundation for Kraken to build a super financial platform but is also seen as an important prelude to its long-anticipated IPO plan. With product line expansion, revenue growth, and continuous improvement in the regulatory environment, Kraken is increasingly accelerating its pace toward a formal listing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。