⚡️《香港稳定币条例》今日起正式生效,这是全球内首个出台的稳定币监管框架。看看有哪些值得关注的点——

🧾 严格牌照制度上线

持牌发行:凡在香港境内发行或面向本地零售用户提供法币稳定币服务的机构,必须向金管局申请稳定币牌照。首批牌照预计2026年初发放,且“优中选优”。

资本门槛:最低实缴资本2500万港元,基本只对有深厚资源储备的机构开放。

过渡窗口:条例生效后3个月内必须申请,最晚2026年3月底前完成退出或获批。

💰 储备金与赎回机制完善

储备资产:必须 100% 支付支持、隔离托管、禁止再抵押,资产须高质量、高流动性,并通过法定信托机制实现破产隔离保护。

及时赎回机制:稳定币持有者必须可随时按面值兑换对应资产。

🛡 AML/KYC 和监管指引同步上线

KYC强制执行:发行人必须执行5年以上的身份记录和审查机制。

禁止无证宣传:条例生效后,未经许可发行的稳定币,禁止向香港公众营销,否则属违法行为,可能罚款、坐牢。

🧩 OK,综上,可以提炼的几个关键点——

1️⃣ 这轮稳定币监管,其实是面向机构的体系化许可制,我估计只会有极个别财大气粗而且早做准备的人才能拿到牌照,比如京东币链、Nano Labs、蚂蚁、渣打等早期就参与沙盒测试的玩家。

2️⃣强身份绑定,发行者要验证持币者身份并保存五年以上,这基本就宣告:匿名用户请绕道,DeFi式自由发行在香港是不存在的,这倒是很特色了。

3️⃣核心应用场景是提升跨境支付效率和拓展机构代币化资产结算业务,基本利好的是大型企业或者传统银行,跟散户其实没毛太大关系。

怎么说呢,就是感觉是蹭上了利好,但是又感觉作用有限。

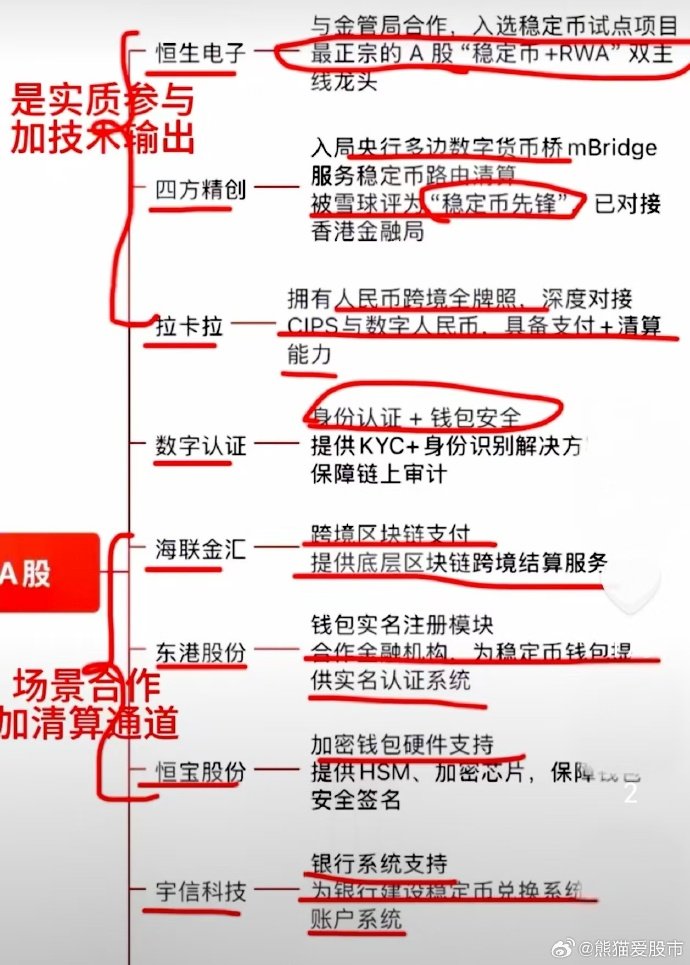

散户在这里面应该是三不沾的,倒是可以看看利好A股哪些标的……👇👇

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。