⚡Not long ago, I invited you to participate in the pre-deposit activity of @Terminal_fi, and today I looked through the data and was a bit surprised—

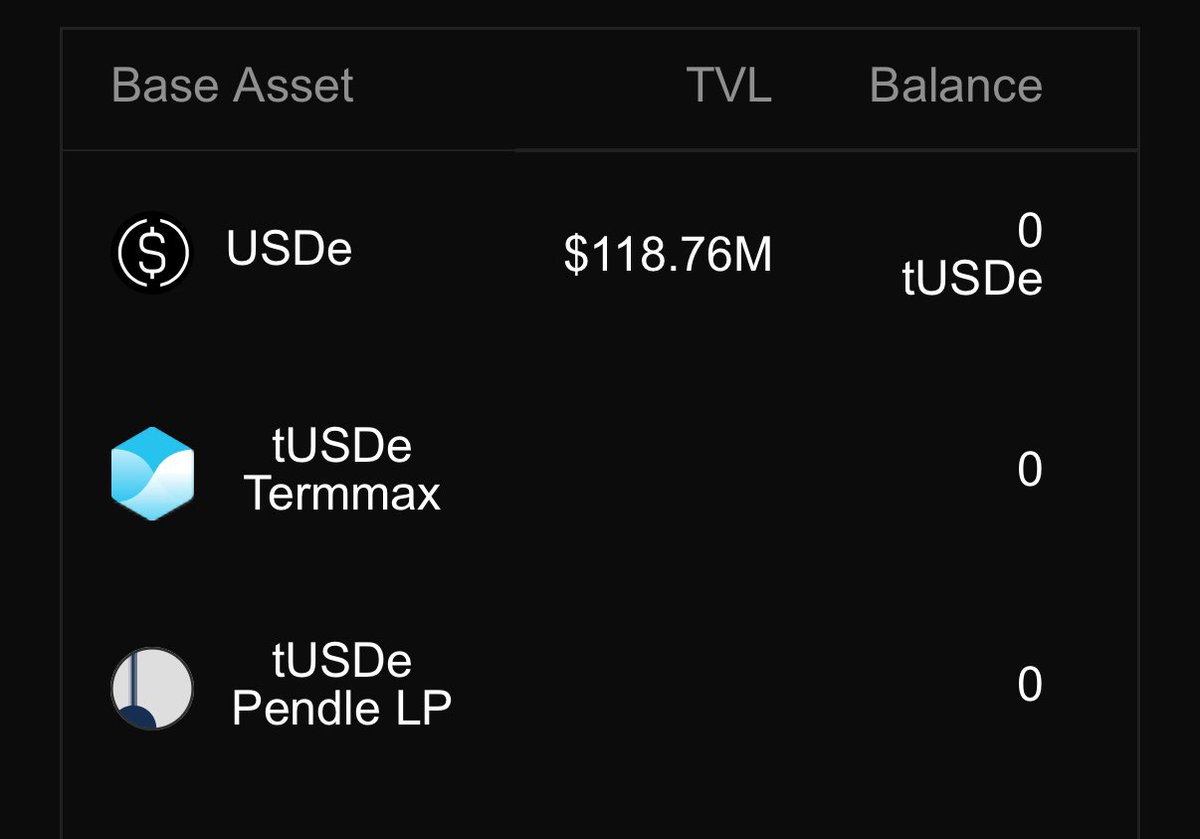

In just 21 days, the TVL of tUSDe reached 117 million USD, with @pendle_fi contributing 64 million.

The APY of PT has stabilized at 14%, and the point multipliers for YP and LP are also maxed out: 60x Roots + 50x Sats, a truly luxurious configuration.

This cold start has indeed been successful; I anticipated rapid growth, but not this fast. I need to add more PT and LP!

There’s also good news—Euler and TermMax have officially announced support for PT-tUSDe as collateral.

For those who like Loop strategies, it’s comfortable again: collateralize PT to borrow eUSDe (interest rate 7.3%), and then go to Pendle to buy PT for circular lending.

I see that leveraged positions are still growing, and it’s clear that many DeFi veterans and large holders have come in for risk-free arbitrage.

Well, this aligns with my previous expectations—Terminal has basically completed the integration of TradFi RWA and the DeFi lending market.

In the future, the model of Ethena × Pendle × Terminal will become a standardized approach.

Institutions looking to enter can directly replicate the process of filling in assets and earning points, quickly completing the cold start.

Of course, this is just my personal speculation, but Terminal has achieved a 9-digit TVL in just three weeks, fully proving: this path is viable!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。