「买地吧,他们已经不再制造土地了。」这是 20 世纪被误认为是马克吐温的名言,而被频繁用于房地产销售领域的口号。重力给这句话做了强背书,如果人类无法做到星际旅行的话,土地就跟比特币一样「无法增发」。

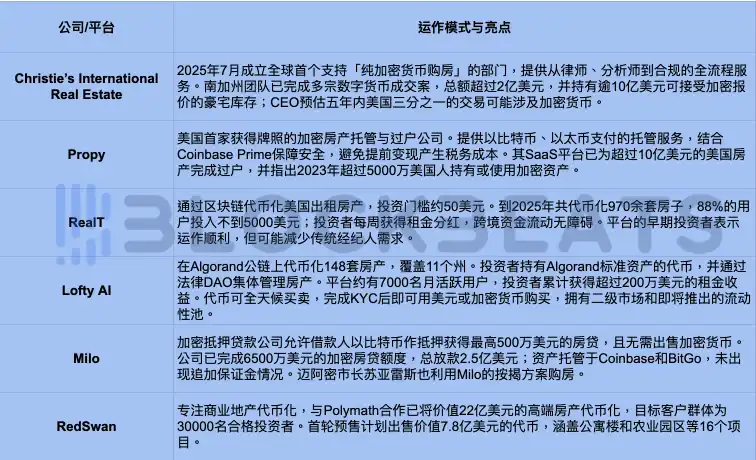

2025 年,加密浪潮从硅谷传导至华尔街最后影响到华盛顿,随着合规的逐步进行,它也开始悄悄改变房地产行业的基本结构。7 月初,佳士得国际地产(Christie』s International Real Estate)正式成立加密房产交易专属部门,成为全球首个以企业名义全流程支持「纯数字货币支付购房」的主流奢侈地产经纪品牌。

而这只是开始,从硅谷创业者到迪拜开发商,从洛杉矶的比弗利山庄豪宅到西班牙的出租公寓,一批以区块链技术和数字资产为核心的房产交易平台正浮出水面,构成了一个新兴的「Crypto Real Estate」赛道。

加密为何能驱动美国房地产的下一波浪潮

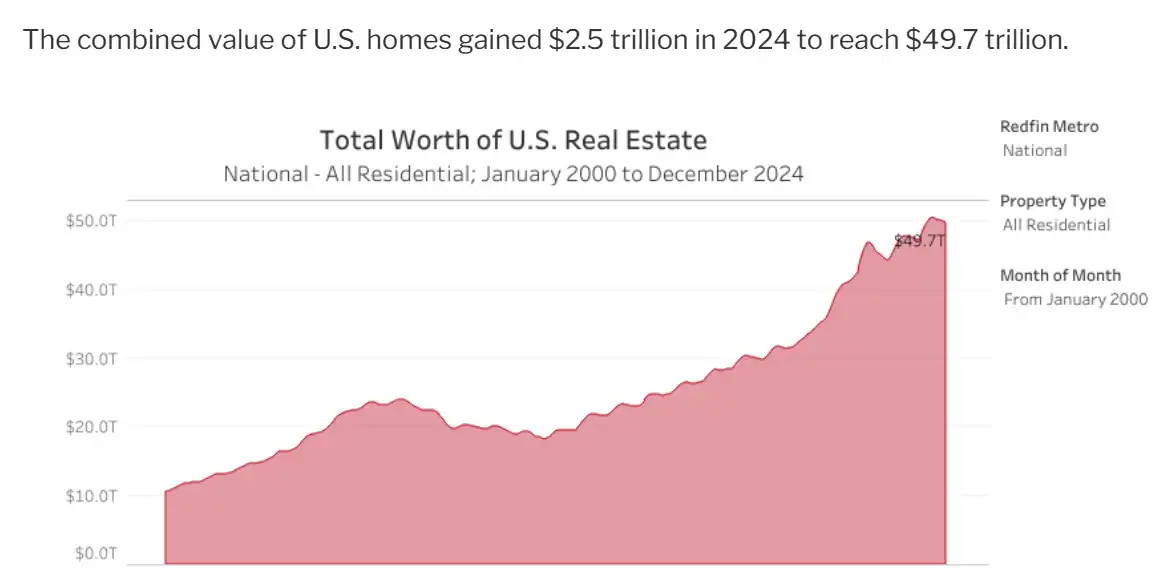

美国房地产价值在 2024 年已接近 50 万亿美元,是全球最具分量的资产市场之一,而这个数字在 10 年前的 2014 年约 23 万亿美元,十年内该领域的资产规模翻倍。

美国房地产总体量,Awealthofcommonsense 分析报告

2025 年 6 月NAR 报告显示,美国房价的中位数达 43.53 万美元,较去年同期上涨 2%。住房库存约 153 万套,供需为 4.7 个月。高房价与长期供应不足拉高了门槛,加上一直维持的高按揭利率(2025 年 7 月 30 年固定利率均值约 6.75%,比特币房贷当前约 9%)始终高于房产每年价值的上涨,这抑制了交易量,低流动性使房产投资者寻求新的流动性来源。

而高利率阻挡的不仅仅是房地产投资者的低流动性问题。在过去五年中,房产的拥有者平均财富增加了 14 万美元。但实际上让许多家庭在持有房地产资产时也不愿意用房产借贷释放流动性,因为他们的变现路径普遍只有两个,一个是贩售整体资产,另一个则是出租,用房产借贷在当下利率来看并不是一个好的选择,在持续上涨的房价的情况下出售似乎也不是更好的投资决策。

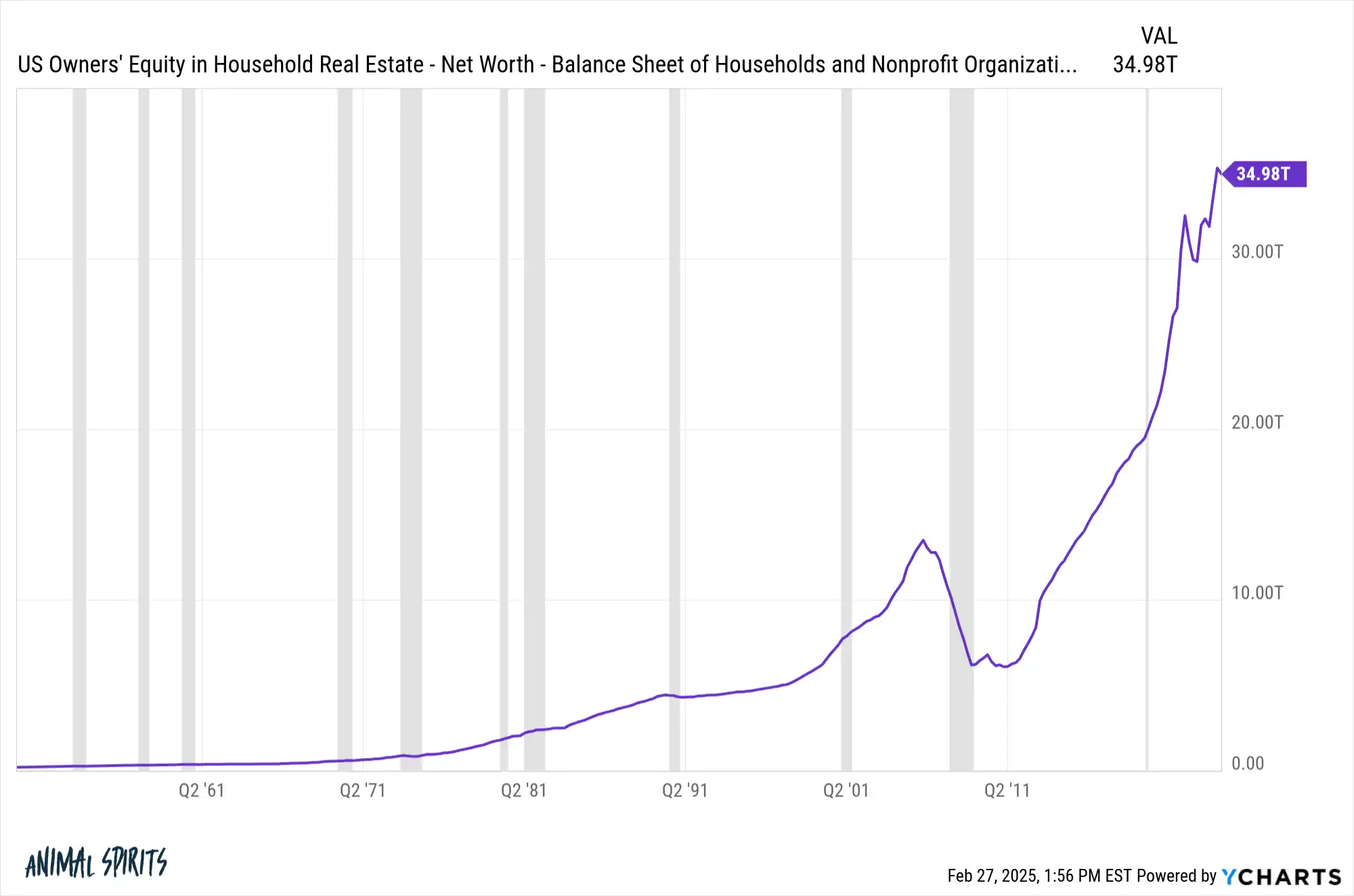

因此在整体 50 万亿美元量级的房地产领域中,当前有 70 % 左右的权益(34.98 万亿美元)是持有人拥有的,这意味着有仅 30% 为借贷资金所支撑,其余皆为购房者自有资金。举例来说,一个家庭拥有 50 万美元的房产,虽然名义上他们拥有这个房产,如果他们想要出售它还需要扣除借贷的份额才是他们实际持有的,按 70% 的权益的情况下他们拥有这个房产中的 35 万美元权益。

美国房地产权益持有量,源:Ycharts

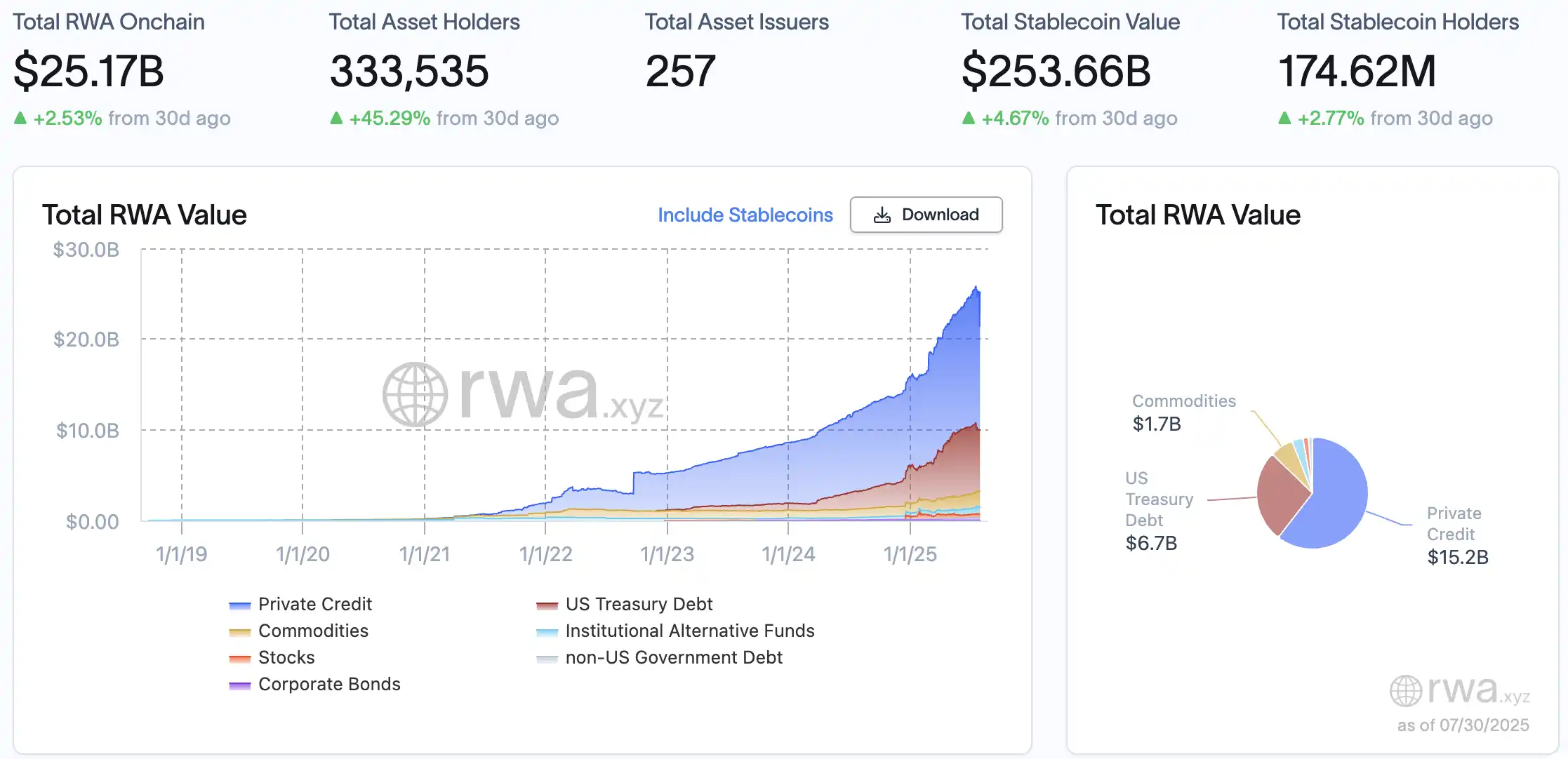

而仅仅有供需关系是远远不够的,RWA 这一概念已经发展了许多年但在近两年才真正开始爆发,尤其是在 2025 年特朗普当选后上涨斜率进一步提高了。

其核心就是合规,尤其是对房地产这样低流动性的资产投资者来说更是如此,FHFA 新任主管威廉‧普尔特在 2025 年 3 月下令房贷巨头房利美(Fannie Mae)和房地美(Freddie Mac)制定方案,允许在评估单户房贷风险时将加密资产纳入储备资产,且无需先转换为美元。这一政策鼓励银行将加密货币视为可计入储蓄的资产,扩大借款人基数。

2025 年 7 月,特朗普签署《GENIUS 法案》并推动《CLARITY 法案》。GENIUS 法案首次承认稳定币为合法的数字货币,要求稳定币按 1:1 以美元或短期国债等安全资产完全储备,并强制进行第三方审计。CLARITY 法案则试图厘清数字代币属于证券还是商品,为从业者提供监管路径。

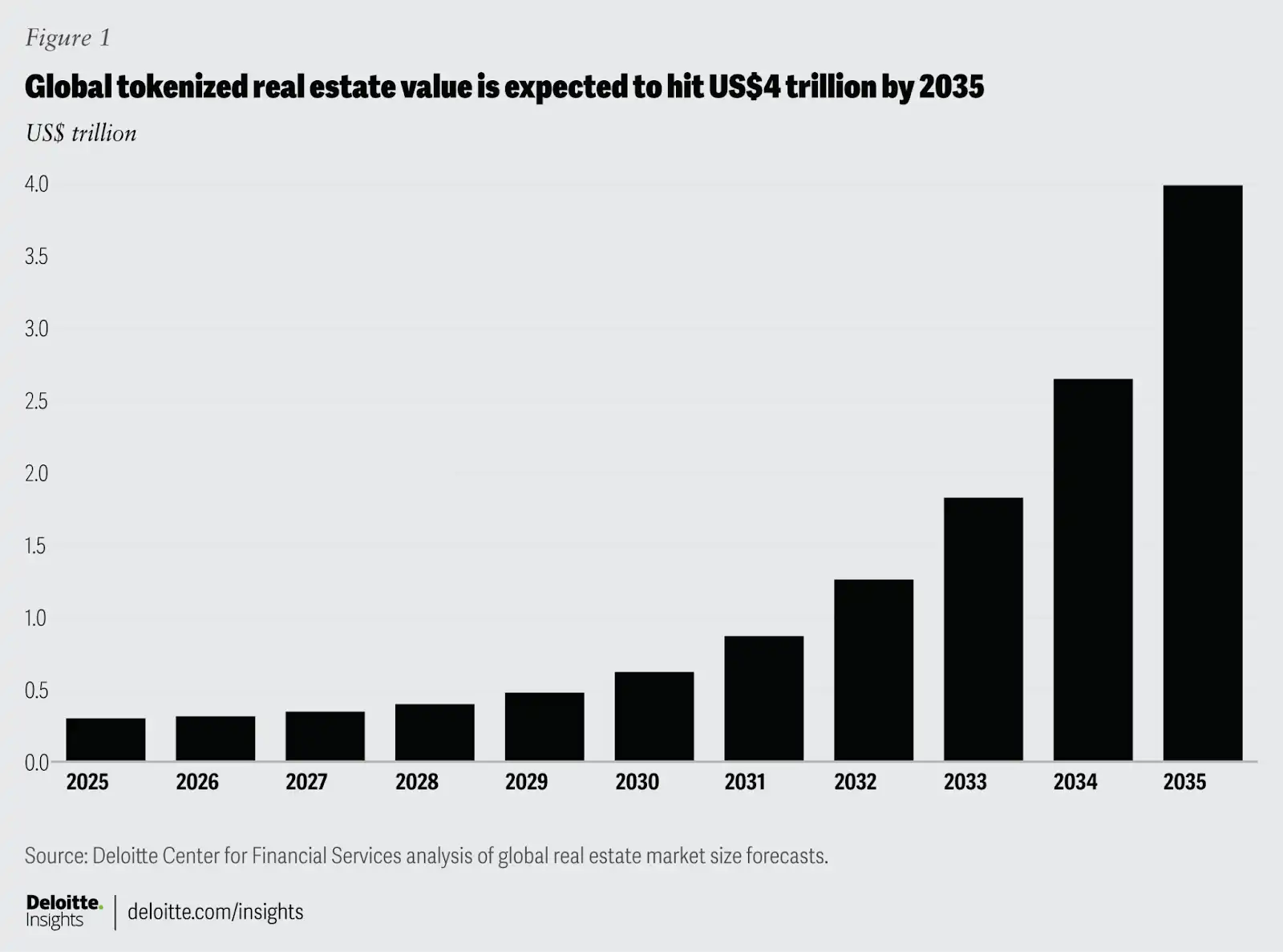

这几套组合拳让该领域拥有更大的安全边际,加之房地产类似比特币「无法增发」的稀缺属性(土地无法变多房产本身可以,建房就像挖矿一样),让两者更容易的结合。数字化有助于打破高门槛。会计四大所之一 Deloitte 在其金融部门报告中预测,到 2035 年约 4 万亿美元的房产可能被代币化,远高于 2024 年的不到 3000 亿美元。

代币化可以将大型不动产拆分成小份额,为全球投资者提供低门槛、高流动性的参与方式,也为原本缺乏资金的卖家和买家创造现金流。话虽如此,4 万亿美元这一数字虽然动听,但如同机构预测 ETH 市值未来将达 85 万亿一样有待商榷,但它到底发展到什么地步了?我们也许能在市场中找到一些 Alpha 。

碎片化?借贷?出租?提供流动性?像玩 DeFi 一样玩房地产

跟黄金、艺术品等低流动性的同类实体不同,房地产自带着一起衍生的金融属性。而在其接上 Crypto 后则更加多元化了。

虽然此前也有人尝试,但 2018 年 Harbor 平台与 RealT 的合作,推出了基于区块链的房地产代币化服务被认为是较早且较具规模的房地产代币化项目之一。

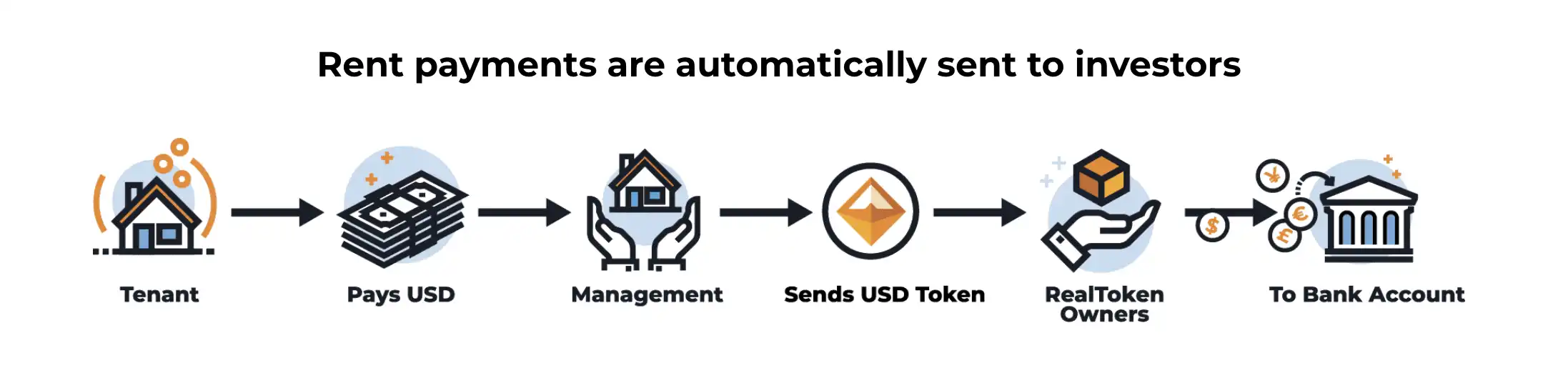

具体来说,RealT 平台通过区块链将房产权益拆分为可交易的 RealToken。每套房产由独立的公司(Inc/LLC)持有,出资人购买 RealToken 就相当于持有该公司的一部分股份,并按比例享有租金收益。平台利用以太坊的授权发行机制,使投资门槛较低(通常 50 美元左右),并且交易和租金发放都在链上完成,投资者无需承担传统房东的日常管理工作。RealT 每周将租金收入以稳定币(USDC 或 xDAI)形式发放给持有者。

而其预期收益来自净资产回报率(RONA),即年度净租金 / 房产总投资。例如,当某物业的预期年租金收入减去费用后为 66,096 美元,总投资 880,075 美元,则 RONA 为 7.51%。这一数值并不包含杠杆或房产增值收益。当前该平台的平均收益为 6%~16% 期间浮动。

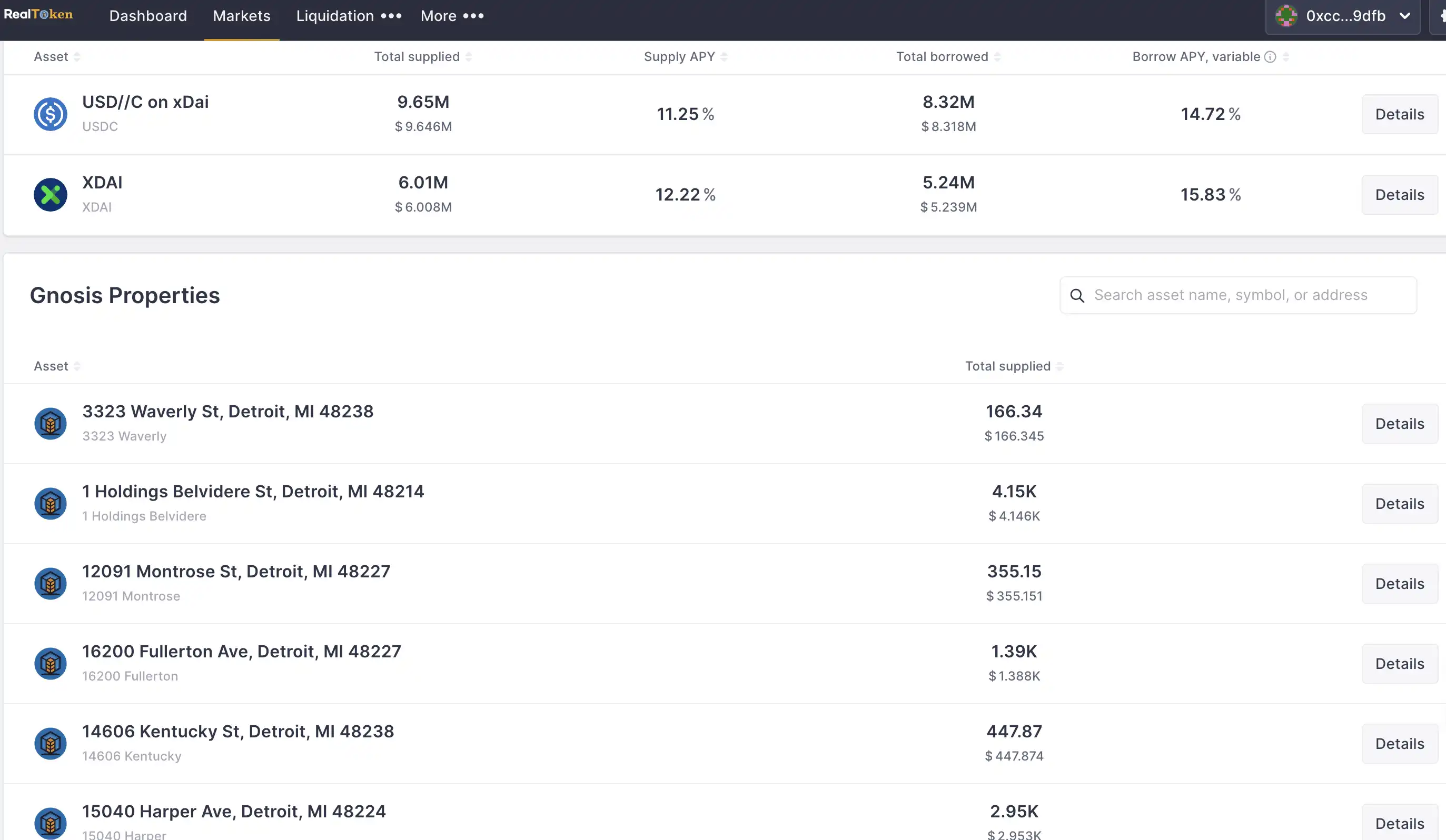

代币化之后下一步自然是应用它了,RealT 自身的房产没有贷款,所有资金都来自于售出 RealToken。但为了让持有人能灵活运用资产,RealT 推出了 RMM(Real Estate Money Market)模块。

RMM 基于 Aave 协议,你可以通过它做两件事,其一就是提供流动性,就像 DeFi 中的 LP 利息一样,投资者可以将 USDC 或 XDAI 存入 RMM,获得对应的 ArmmToken,这些代币实时累计利息。其二就是通过抵押 RealToken 借款,将持有的 RealToken 或稳定币作为抵押,可以借出 XDAI 等资产。借款利率也有两种选择:稳定利率(类似短期固定利率,但当利用率过高或利率过低时会调整)和可变利率(根据市场供需浮动)。

打开借贷这一路径意味着可以进行杠杆,就像十几年前炒房团借钱买房,买房贷款再用贷款再买房一样。抵押 RealToken 借出稳定币再购入 RealToken,如此重复数次以提高整体回报率。需要注意的是,每增加一层杠杆,健康因子会降低,风险上升。

注:健康因子是抵押价值与贷款价值的比率的倒数;健康因子越高,爆仓风险越小。健康因子降至 1 时意味着抵押品价值等于贷款价值,可能触发清算。避免清算的方式包括归还部分贷款或追加抵押。(类似于永续合约的保证金)

而除了房产作为「保证金」借款,最近讨论更多的是加密原生资产抵押借贷买房,金融科技公司 Milo 允许借款人用比特币抵押获取最高 100% 成数的房贷,截至 2025 年初已完成 6,500 万美元的加密按揭业务,累计发放贷款逾 2.5 亿美元。政策层面也在为这一模式「开绿灯」,美国联邦住房金融署(FHFA)要求房贷巨头 Fannie Mae 和 Freddie Mac 在风险评估中考虑合规加密资产。虽然加密按揭的利率普遍接近甚至略高于传统房贷,但其主要吸引点在于不必抛售加密资产即可融资。

延伸阅读:《比特币房贷,一个 6.6 万亿美元的新蓝海》

而 Redfin 的调查则显示在疫情后美国有约 12% 的首次置业者使用加密货币收益支付首付款(出售或抵押借贷),加之政策风向的转变,无疑将吸引「大企业入场」,而「Crypto Real Estate」也首次迎来高端房地产经济公司的加入。

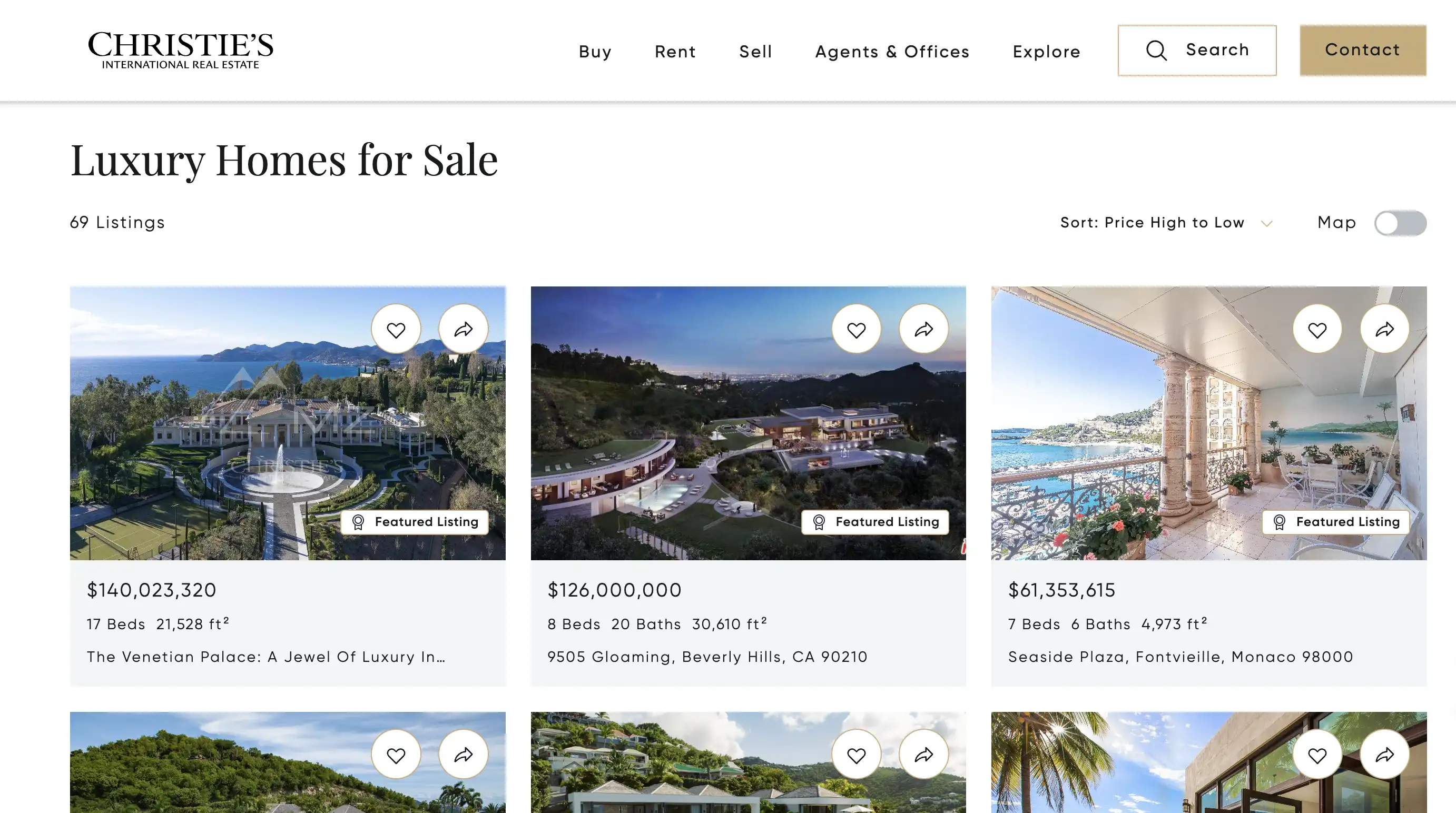

2025 年 7 月,佳士得国际地产(Christie's International Real Estate)率先成立全球首个以加密货币为重点的奢华房地产部门,成为传统高端房产经纪公司与数字资产融合的标志性案例。有意思的是,这一举措并非源于自上而下的战略推动,而是因应高净值客户的真实需求。

佳士得高管表示,「越来越多的富裕买家希望以数字资产直接完成房产交易,这促使公司顺势而为,搭建起支持全流程加密支付的服务架构。」在南加州,佳士得已完成多笔完全以加密货币支付的豪宅交易,总额超过 2 亿美元,全部为「八位数」级别的顶级住宅成交。目前,佳士得持有的加密友好型房源组合价值超过 10 亿美元,涵盖众多愿意接受「纯加密货币报价」的豪宅。

其中一栋接受纯加密货币支付,价值 1.18 亿美元的豪宅「La Fin」位于洛杉矶贝莱尔(Bel-Air),拥有 12 间卧室、17 间浴室,配备 6,000 平方英尺夜总会、私人酒窖、零度以下伏特加品鉴室、雪茄休息室及带攀岩墙的健身中心。此前挂牌价高达 1.39 亿美元,源:realtor

佳士得的加密房地产部门不仅提供基于比特币、以太坊等主流加密资产的支付渠道,还与托管机构及法律团队合作,确保交易在合规框架内完成。包括加密货币支付托管、税务与合规支持、资产匹配(满足高净值客户的特定投资需求的专属加密房产组合)

佳士得房产 CEO Aaron Kirman 预测,「未来五年,美国超过三分之一的住宅房地产交易可能涉及加密货币」。佳士得的转变从侧面印证了加密资产在高净值人群中的渗透率,也预示着传统房产交易模式的结构性变革。

基础设施趋于完善,但似乎「用户」教育还要走很长的路

截止目前,房产代币化的项目已经初具规模,但似乎还达不到与其预期一般的水准。RealT 迄今已代币化 970 余套出租房,已经为用户已经带来了近 3000 万的纯租金收益;而 Lofty 在 11 个州代币化 148 套房产,吸引约 7,000 名月活跃用户,这些用户通过持有代币分享每年约 200 万美元的租金收益。几个项目的体量几乎都在上千万、上亿美元徘徊,迟迟无法突破可能也有多方面的原因。

一方面,区块链确实让交易脱离地域限制,实现跨境即时结算,且交易手续费相较传统房产过户成本更低。然而,投资者需要了解这并非「零成本」生态:代币铸造费、资产管理费、交易佣金、网络手续费及潜在的资本利得税,构成了新的成本结构。相较于传统房地产经纪人和律师的「一站式服务」,加密房产要求投资者主动学习和理解智能合约、链上托管及加密税务规则。

另一方面,流动性虽是卖点,却伴随更高波动性。代币化房产可在二级市场全天候交易,投资者不仅能领取租金,还能随时退出持仓,但流动性不足时,代币价格可能远高于或低于房产本身的真实估值,行情波动甚至快于实体房地产周期,增加了短期交易的投机属性。

此外,许多平台引入 DAO(去中心化自治组织)治理,让投资者投票决定租金、维修等事项。这种参与感类似「玩大富翁」,降低了门槛、增强了互动性,但也对用户提出了新的要求:他们不仅要理解物业管理,还需具备链上治理和合规意识。在缺乏足够教育的情况下,投资者可能误判风险,将数字化房产视作一种短期套利工具,而非长期资产配置。

换言之,加密房产的真正门槛不在于技术,而在于认知。用户需要理解抵押率、清算机制、链上治理、税务申报等知识,而这对习惯传统购房模式的群体而言是一种颠覆式转变。

随着监管逐步明朗、平台体验优化以及主流金融机构的介入,未来加密房产有望缩短这一教育曲线。但在可预见的几年内,行业仍需在用户培训、风控科普和合规引导上投入更多资源,才能真正让「加密房地产」从小众尝鲜走向大众普及。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。