撰文:Daii

最近,朋友们最常问我的问题是:

「比特币的牛市是不是快要结束了?现在是不是该卖出?」

毕竟,现在比特币已经涨到了 12 万美元附近,价格卡在这,好几周都上不去。大家开始不安了:

「是不是顶到了?熊市是不是就在门后等着?」

这是个好问题。但我们不妨反过来问一句:

假设熊市真的就埋伏在 12 万的门后,你准备怎么办?

全仓卖掉,锁住利润?

那么如果这又只是一次「假顶」,下一站直接冲到 20 万,你会不会像 2013、2017、2021 年那一批「太早下车」的人一样,只能在更高的位置追涨补票?

这种事情,不止一次发生过:

-

2013 年 4 月,比特币从 260 美元回落到 70,媒体齐喊熊市,结果七个月后它拉到了 1100 美元;

-

2019 年 6 月,从 14000 回调到 7000,一样被误认为「牛尽熊来」,谁想到转眼就是 2021 年的 64000 美元;

-

2022 年底,FTX 崩盘,比特币砸到 16000,许多人清仓离场,三个月后它直接拉到 25000;

-

2023 年夏天,有人终于等到 31000 出场,却眼睁睁看着它九个月飙到 73000。

真正让人懊悔的,往往不是「踏空熊市」,而是把还在奔跑的行情错当终点,提前下车。

如果你脑海里只有「牛市」和「熊市」这两个按钮,那你每一次决策都像是在掷硬币:猜对了叫高位落袋,猜错了叫错过整轮周期。

可市场不是二元对立的黑白照片——它更像一张调色盘:除了牛市的艳阳和熊市的风暴,还有长时间的闷热横盘,以及几乎不回调的加速上冲。

只有把这四季都看见,你才不必在每一个十字路口都赌命猜天意,而是能让资产配置替你随天气换衣、随风向调帆。

说得更直白一点,传统的「牛熊二分法」,其实太粗糙了。

这不是我先说的,一个叫 Jesse B. Mackey 的投资研究者,早在几年前就给出了更清晰的地图——从黑白的牛熊二元世界,扩展为彩色的四象市场:牛、熊、狼、鹰。

——这场投资世界的「分季革命」,才刚刚开始。

1. 从牛熊到狼鹰:把市场调色板还给投资者

过去,我们大多数人都习惯把市场分成两种颜色——上涨是牛市,下跌是熊市。

涨就是「红光满面」,跌就是「冰天雪地」。

可 Jesse B. Mackey 却提出了一个更贴近现实的市场刻画。他像是拿出了一盒更细腻的调色板,对我们说:

「你看到的,只是黑白世界的一角。真正的市场,是一张彩色地图。」

在牛和熊这两个经典角色之外,他补上了另外两位一直被忽略、但却异常常见的主角——狼市(Wolf)和鹰市(Eagle)。这不是为了玩概念,而是源于他对 1950 年至 2017 年标普 500 每一帧日线图的逐条拆解与分类,得出的统计真相。

接下来,让我们逐个认识这四种「市场天气」:

🐻 1.1 熊市(Bear)

标准定义:从最近高点累计跌幅超过 20%。

气候特征:寒潮突袭,市场像突然断电,成交量暴增,恐慌指数(VIX)飙升。

心理感受:每一根绿 K 线都像是海啸里的泡沫,心跳随账户净值一起掉进谷底。

🐂 1.2 牛市(Bull)

标准定义:不满足熊市定义的上涨区间,通称为牛市。

历史特征:平均持续 2.7 年,期间涨幅中位数约 112%。

气候特征:春风拂面,大盘沿着 200 日均线缓步上扬,信心悄然回归。

投资节奏:定投、长持、什么都不动反而最赚钱。

🐺 1.3 狼市(Wolf)

标准定义:从高点回撤超过 10%,随后反弹至原位;或出现两次 ≥10% 的下跌,中间没有创新高。

历史发生率:约占市场日历的 22%。

视觉画面:K 线像锯齿在来回拉扯,方向感模糊,技术派接连被「扫损」。

投资体验:你不觉得行情在跌,但账户就是不断在流血。趋势系统在这种行情里往往失灵,被反复「千刀万剐」。

🦅 1.4 鹰市(Eagle)

标准定义:过去一年涨幅 ≥30%,且没有出现 ≥10% 的回撤。

历史发生率:高达 34%,比牛市还常见。

气候特征:仿佛被气球牵着一路飞升,价格持续拔高但波动异常平静。

典型场景:你犹豫着等回调,但市场从不回头;一边上涨,一边把观望者留在原地。

于是,当 Mackey 把 70 年的市场日线重新归类统计后,他发现了一个令人瞠目结舌的事实:

狼市 + 鹰市合计占了 56% 的时间,而我们最熟悉的「牛市」,只占 24%;熊市为 17%,其余 3% 无法归类。

这意味着什么?

意味着我们大多数时间,其实活在「牛熊」以外的市场里,却浑然不觉。

我们在鹰市里等回调,在狼市里追趋势,在看似牛市的假象中频繁换仓——最后不是错过,就是被磨光信心。

真正的问题不是「你猜错了牛熊」,而是你用的那张地图,压根没画出狼和鹰的轨迹。

那么这背后的逻辑到底是什么呢?为什么市场会变成这样呢?

2. 我们为什么需要「狼鹰」?

一句话:

牛熊的黑白眼镜,已经看不清这个多彩又反常的市场了。

2.1 相关性:整条街都反着来

牛熊二分法的最大前提,是「涨跌轮流来」:股票跌,债券涨,反之亦然。这是一种「资产负相关」的经典逻辑,也是老派资产配置的压舱石。

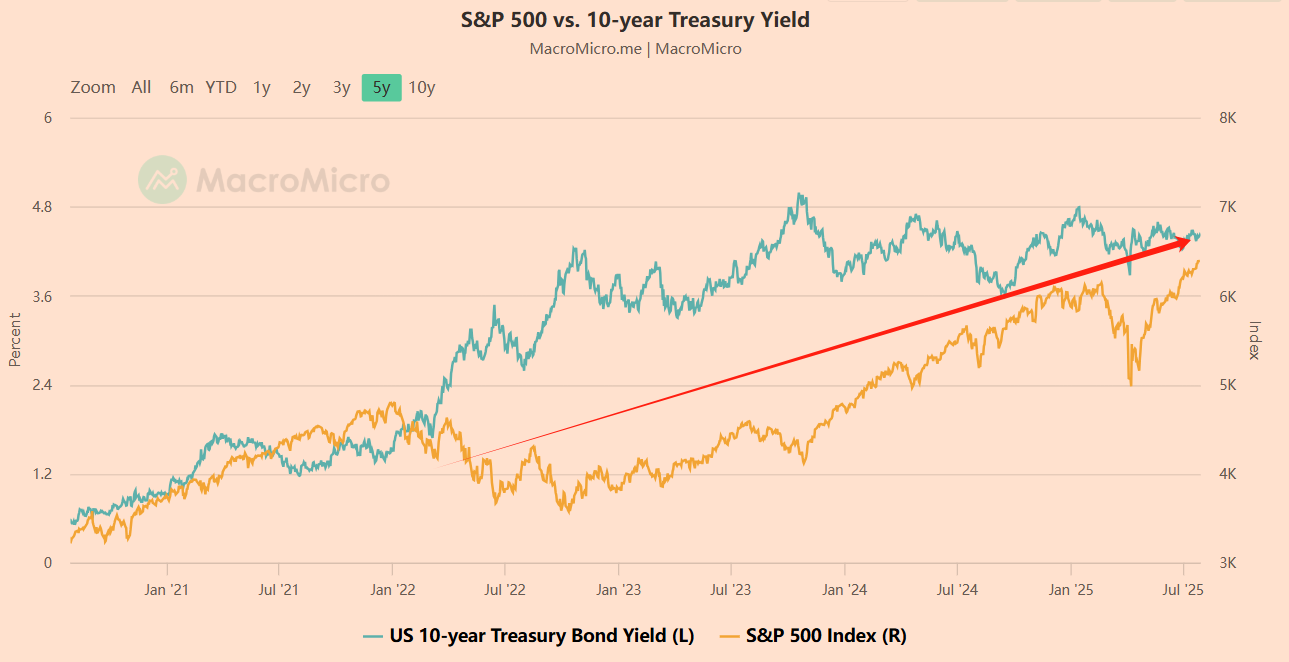

可从 2022 年开始,这条「物理定律」突然像重力消失一样失效了。 根据美银的全球研报,2022 至 2023 年间,美 10 年期国债与标普 500 的 60 日滚动相关性不止一次转正,最高甚至接近 0.6。

这意味着什么? 你以为熊市抄底债券是避险,结果发现股债一起「自由落体」;到了 2023 年底,它们又一起飞了起来。

牛熊模型只适合处理「一涨一跌」的清晰画面,可如今你面对的是「双涨双跌」的乱流,它就哑火了。

2.2 宏观政策:成了八轨道地铁

上一轮超级牛市(2009–2020)有一个「大背景」:

全球央行携手放水,利率一起降,行情一起涨。

而现在,这条高速路已经分裂成 N 条岔道—— 2023 年美联储停下加息脚步,2024 年欧洲央行谨慎降息,中国、印度、澳洲却在一路放水。 国际清算银行在 2025 年年报中直言:货币政策差异化已成为跨境资本流动的最大「震源」【来源:BIS Annual Report 2025, Chapter III】。

你还在用「全球一起宽松是牛市、一起紧缩是熊市」那套逻辑,像是拿着两条地铁线的票,跑进了十八线的换乘站。眼花缭乱,还会上错车。

2.3 熊不够凶,牛却带毒牙

传统牛熊模型还有一个默认设定:

熊市 = 高波动;牛市 = 低波动。

可流动性泡沫打破了这个节奏。

2021 到 2022 年的美股,日内波幅超过 2% 的交易日多达 46 天,比过去的牛市高出一倍还不止。 而到了 2024 年第一季度,比特币在 ETF 推出后连续上涨 70%,却把 30 天波动率压低到 25% 以下——完全是鹰市的「低波快涨」剧本。

2.4 四记闷棍:打在牛熊模型上

过去的牛熊模型,建立在趋势清晰、波动有序、回归可期的前提上。可如今的市场,早已脱轨。

横盘区间变成「狼谷地」:2023 年标普 500 和比特币的价格在 ±10% 的窄幅里反复扫损。J.P. Morgan 数据显示,仅 3–7 月间就出现了 17 次 1.5% 假突破,趋势交易者被磨成「金属屑」。

再平衡策略反成自残:BlackRock 报告显示,被动资金已占美股 54% 的自由流通市值,这些资金按季度机械调仓,实际却因流动性枯竭带来巨额滑点。2023 年底,纳指一次权重调整 单日蒸发 180 亿美元。

事件主导时代,均值回归被打碎:一条推文、一个监管信号足以让行情剧震。2024 年 6 月,SEC 重审以太坊证券属性,仅一句话就让 ETH 日内暴跌 12%,两天后又收复一半。

职业资金用脚投票:据 HFR,全球趋势跟随型基金的 AUM 自 2015 年高点以来缩水三分之一,而多策略与市场中性基金则逆势扩张,说明老派「牛熊信徒」已退场,市场正迎来「狼鹰猎人」的时代。

2.5 小结

牛熊模型不是错了,它只是诞生在一个逻辑更简单的旧时代:当时相关性单一,波动性规律,政策同频。

而今天的市场,像是打翻了调色盘:

央行路径差异、流动性扭曲、消息面碎片化、算法交易引发的非线性反馈……让这片 K 线图呈现出赤橙黄绿青蓝紫全光谱。

你还用黑白滤镜来看这个市场,注定会在关键节点看错风向、踩空节奏。

拥抱「狼」「鹰」不是猎奇,是回到现实。

下次再有人问你:「牛市是不是要结束了?」 或许你该先问一句: 「现在是狼风、鹰流,还是熊潮?」

因为只有你知道答案,策略才有方向。

3. 新模型 × 加密口袋:MMI 的链上实践

我们已经看到了,牛熊模型不够用了,市场需要更细分的「气候学」;但有了更精准的地图,接下来就该考虑:怎么在这四季轮转的链上环境里穿对衣、踩对节奏?

这就是 MMI 策略(Multi-Modal Investing) 的用武之地。

MMI 是一种基于市场状态匹配策略组合的资产配置模型,最初用于传统资产的四象限环境。如今,它被搬上链,核心思想不变,只是装备从股票、债券、波动率基金,换成了稳定币、永续合约、流动性挖矿和高贝塔代币。

我们把它拆解成四个「口袋」,一场行情来临时,你知道该掏出哪一件武器。

3.1 准备好四个链上口袋

3.1.1 熊市口袋:稳定币 + 链上短债

场景特征: BTC/ETH 自高点回撤超 20%,链上清算频发,流动性枯竭。

稳定币就是你的现金仓。 回看 2022 年 FTX 暴雷那一周,USDT/USDC 的交易量一度占全网 81%,比平时高出 15 个百分点(数据来源:Kaiko Research)。那一周,谁手上拿着「稳币」,谁就能满地捡黄金。

链上美债,让你在风暴中心睡得着觉。 Ondo Finance 推出的 OUSG 等代币化短债产品,把 5% 的美债利息搬到了链上,在 BTC 年化波动超过 60% 的日子里,显得异常安静。

对冲型「黄金」代币,真正抗住了恐慌。 比如 PAXG:2020-2024 三次大级别抛售周期中,它和 BTC 的相关性稳定在 -0.3 到 -0.4 之间,是名副其实的链上逆周期资产。

3.1.2 牛市口袋:长期持币 + 质押再投资

场景特征: BTC、ETH 持续走高,链上活跃地址、TVL、Stablecoin 流入多点开花。

BTC 与 ETH 是牛市最稳的「双王 Beta」。 CoinShares 数据显示,2025 年迄今,比特币 alone 就吸走了加密基金 62 亿美元净流入,占全部流入资金的 54%。长牛的果实,仍长在这两棵大树上。

质押是链上牛市的「股息红利再投资」。 LBTC(Lombard),weETH、stETH 不仅享受上涨,还能持续复利增长。你不必高频调仓,也能「睡后盈利」。

3.1.3 狼市口袋:机会主义套利 + 市场中性策略 + 卖波动为王

场景特征: 价格在 ±10% 的箱体里反复震荡,趋势假突破频繁,行情「走不出方向」。

做基差 / 资金费套利,趁波动率「退潮捡贝壳」。 2023 年二季度,BTC 现货与永续合约的年化基差一度达到 8-12%。你只需要做多现货、做空 perp,每个月稳收 2-3% 的无方向收益。

Uniswap v3 提供流动性。 用 BTC-ETH 挂进 10% 的窄区间,用永续合约锁住 Delta,手续费年化可以达到 25-35%(数据:DeFiLlama)。

狼市不是赌方向,而是靠来回收「灰尘里的金币」。

3.1.4 鹰市口袋:集中进攻 + 杠杆永续 + 高贝塔公链

场景特征: 波动率骤降,价格沿 30 日均线上扬,一路飞升、几乎不回头。

杠杆 才是捕捉鹰市的「火箭座舱」。 2025 年第一季度 2 倍杠杆的 BTC 三个月涨幅高达 142%,而同期现货 BTC 只涨了 70%。

高贝塔公链是新周期的「链上 NVIDIA」。 Solana 是继 ETH 之后比较有希望的一个。

注意,鹰市不是撒网捞鱼,是选好火箭、抱紧它飞。

3.2 个人实操:三步把 MMI 装进链上钱包

第一步:把资金装进四个「加密口袋」

-

熊市口袋: USDC/DAI + TBILL 代币 + PAXG

-

牛市口袋: BTC + ETH(长持 + 质押)

-

狼市口袋: perp 基差套利 + AMM delta 中性 LP

-

鹰市口袋: BTC/ETH/SOL 杠杆永续或 2x ETF

每个口袋各占 25%。

第二步:设定「自动驾驶逻辑」

熊口袋、牛口袋配置后尽量不动,行情恐慌时逆向买入。

狼口袋可以半自动执行:如流动性挖矿选 BTC-ETH,在 Base 链做;perp 套利推荐 BTC、ETH,只做低风险品种。

鹰口袋控制两件事:杠杆不超 3 倍,只选具备长期故事支撑的核心资产,例如 BTC、ETH、SOL。

第三步:用「剪刀」调仓而非「大锤」

口袋权重浮动区间建议 15% 至 35%;

每次只微调 5-10%,以减少误判与执行成本。

这套配置就像你链上投资的「衣橱」:

不管是狼风扑面、鹰流冲顶,还是熊潮突袭,你永远有四套适合天气的「防护装备」。

行情变幻莫测,但节奏可以稳定。MMI,不是预测市场,而是陪你穿越它。

上面这些只是粗略的操作逻辑,详细的我会在《阿尔法 Daii》知识星球里面详细拆解。

结语|投资不是预测未来,而是准备好面对一切未来

让我用一个亲身经历,给这个话题画个句点。

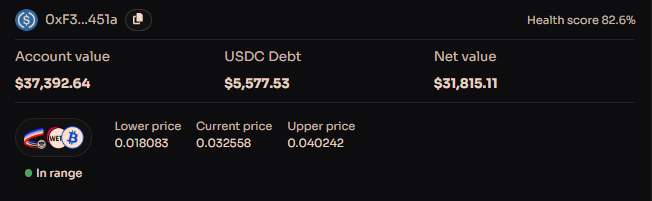

今年 4 月,比特币跌破 8 万美元时,市场一片恐慌。我没有预测底在哪里,也不敢打包票它会马上反弹。 但我动用了「熊口袋」里那笔 10,000 美元的稳定币,开了一个 3 倍杠杆的 BTC-ETH 流动性挖矿仓位。今天,它已经变成了 31,000 美元,收益超过 300%。

具体的细节,我在《阿尔法 Daii》的知识星球里写过一篇实操拆解,有兴趣可以去看看。但我要说的重点不是「我赚了」,而是:

我并没有靠预测赢这一笔,而是靠准备。

市场,不是单行道,而是一座四季轮转的城市。

如果你的脑中只有「牛市」和「熊市」,那你在每一个转角处,都只能靠猜:

赌对了叫「高位落袋」,赌错了就是「悔不当初」。

但如果你早早为自己准备好了四季衣柜——熊来有羽绒,狼来有风衣,鹰来穿助跑鞋,牛来换上短袖——那么,波动再猛烈,也不过是一次换季而已。

MMI 的「四口袋思维」不是玄学,不是花哨的策略拼盘,而是一种生活方式。

它的本质:

是把「我现在该不该卖出」这种高压决策,转化为「我今天该穿什么」的日常节奏。

真正的投资高手,从来不是市场的预言家,而是自己情绪与仓位的管家。

在加密世界,你的「口袋」里可能装着的是稳定币、质押收益、套利机器人和杠杆永续; 在传统市场,它可能是现金、短债、低波策略或动量 ETF。

你需要做的,从来不是预测行情,而是:

定好四个口袋,写好自己的规则表,定期用「剪刀」微调仓位比例。

因为季节会变,太阳会升,但你要确保:

下雨时有伞,起风时有衣,冲顶时有箭,横盘时有盾。

——剩下的,交给市场,交给时间。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。